Cash in on the east coast gas crisis

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Australian Competition and Consumer Commission (ACCC) has confirmed that domestic wholesale gas prices have risen two to three times higher than historical prices (the 2020 average of expected LNG netback gas price is around $9 per gigajoule.)

This has put many trade-exposed Australian manufacturers under extreme pressure.

There is also continuing uncertainty about the longer-term supply outlook.

In its latest Gas Statement of Opportunities (GSOO), the Australian Energy Market Operator (AEMO) warned about potential supply shortages emerging on the east coast within five years, particularly in the southern states.

Are unconventional gas developments the answer?

The worsening supply/demand situation was recently well documented by RISC, an independent consultancy group who made some disturbing observations regarding the east coast gas market.

These were the key issues highlighted by the group.

“A shortage of gas is being experienced already - LNG export projects are not running to capacity, and peak domestic gas supply is not being met.

‘’The current infrastructure and commercial arrangements do not support domestic development that would supply sufficient gas where it is needed.

‘’LNG imports are likely the only source of gas in the short term given the current moratoria in place on exploration and development.

‘’In the longer term, with the right support and development, unconventional plays could radically alter the current views of the East Coast market.’’

This doesn’t bode well for personal or industrial demand, but with energy being a critical need there is no doubt that investment by governments or private enterprise will occur to address those issues.

It could be argued that this will work in favour of emerging oil and gas developers, particularly those with resources close to infrastructure such as pipelines, as well as proximity to major hubs where there is strong demand from the residential and/or industrial sectors.

Finfeed examines two companies that are well-positioned to progress to development stage.

Importantly, the locations of the resources they are exploring and/or in the throes of considering development are close to major markets.

PEP-11 provides BPH with exposure to Sydney Basin

While BPH Energy (ASX:BPH) has some interests outside the energy sector, the company’s key focus and major investment is in Advent Energy Ltd, an unlisted oil and gas exploration and development company with onshore and offshore exploration and near-term development assets around Australia.

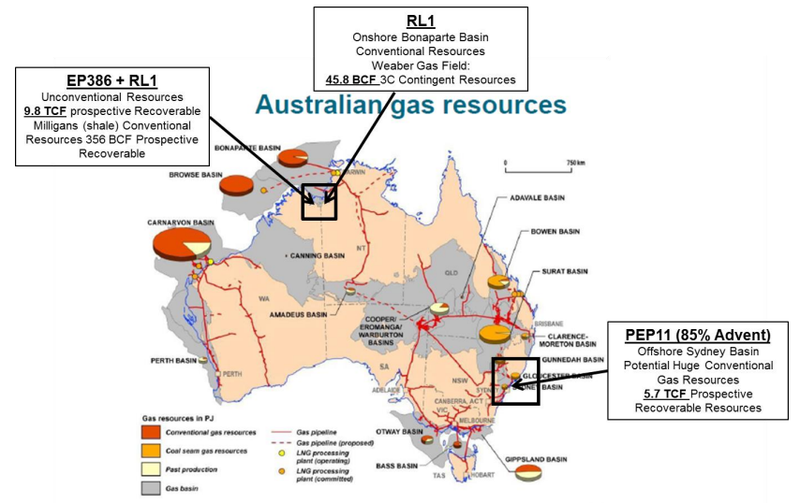

The group’s 22.6% direct interest in Advent has provided the company with exposure to high profile assets in the onshore Bonaparte Basin area north of Western Australia and Northern Territory, as well as PEP 11 (85%) in the offshore Sydney Basin.

Regards the latter, through its wholly owned subsidiary Asset Energy Pty Ltd, Advent holds 85% of Petroleum Exploration Permit PEP 11 – an exploration permit prospective for natural gas located in the Offshore Sydney Basin.

PEP 11 is a significant offshore exploration area with large scale structuring and potentially multi-trillion cubic feet (Tcf) gas charged Permo-Triassic reservoirs.

Mapped prospects and leads within the Offshore Sydney Basin are generally located less than 50 kilometres from the Sydney-Wollongong-Newcastle greater metropolitan area and gas pipeline network.

High probability of success at Baleen

Advent had previously interpreted significant seismically indicating gas features indicating hydrocarbon accumulation following a review in 2004.

This data was reprocessed in 2010 and a geochemical report supported the potential for an exploration well within that area.

The 2010 geochemical investigation utilised a proprietary commercial hydrocarbon adsorption and laboratory analysis technique to assess the levels of naturally occurring hydrocarbons in the seabed sediment samples.

The report supports that the area surrounding the proposed drilling site on the Baleen prospect appears best for hydrocarbon influence relative to background samples.

In addition, the report found that the Baleen prospect appears to hold a higher probability of success than other prospects.

Leading Edge supports prospect of commercial discovery

Importantly, an independent research article published in The Leading Edge on surface geochemical exploration for oil and gas was extremely positive in terms of backing up management’s confidence regarding a commercial discovery.

BPH chairman, David Breeze referred to this report in saying “A recent review of more than 850 wildcat wells – all drilled after geochemical surveys – finds that 79% of wells drilled in positive anomalies resulted in commercial oil and gas discoveries.”

Advent has demonstrated considerable gas generation and migration within PEP11, with the mapped prospects and leads highly prospective for the discovery of gas.

Further, the group has conducted a focused seismic campaign around a key drilling prospect in PEP11 at Baleen, in the offshore Sydney Basin.

The high resolution 2D seismic survey covering approximately 200-line kilometres was performed to assist in the drilling of the Baleen target approximately 30 kilometres south-east of Newcastle, New South Wales.

A drilling target on the Baleen prospect at a depth of 2150 metres subsea has been identified in a review of previous seismic data.

Intersecting 2D lines suggest an extrapolated 6000 acre (24.3 square kilometres) seismic amplitude anomaly area at that drilling target.

The report on this drilling target noted previous 2D seismic data showed that the Permian aged section of the Bowen Basin has producing conventional gas fields at a similar time and depth to PEP11 at the Triassic/Permian age boundary.

Best estimate 356 bcf of gas in EP386

Advent Energy through wholly owned subsidiary Onshore Energy Pty Ltd, holds 100% of each of EP 386 and RL 1 in the onshore Bonaparte Basin in northern Australia.

The Bonaparte Basin is a highly prospective petroliferous basin, with significant reserves of oil and gas.

Most of the basin is located offshore, covering 250,000 square kilometres, compared to just over 20,000 square kilometres onshore.

Within EP386, recoverable resource estimates range from 53.3 Bcf (Low) to 1,326.3 Bcf (High) of Prospective Resources, with a Best Estimate of 355.9 Bcf of gas.

Management also highlighted that there was prospectivity in both the onshore and offshore areas of the Bonaparte Basin for unconventional resources.

Advent has identified significant shale areas in EP386 and RL1, calculating a prospective resource best estimate of 9.8 trillion cubic feet.

EverBlu Capital research analyst Russell Wright released a report in November, outlining Advent Energy’s promising prospects.

This flows through to BPH which he values that 0.4 cents per share, implying upside of 300% relative to Wednesday’s closing price.

Real Energy the real deal

Real Energy Corporation Limited (ASX:RLE) put the icing on the cake after producing a stellar September quarter in which the group delivered a material upgrade to its Windorah gas resource in the Cooper basin, a prominent gas producing region of Queensland

The estimates of Contingent Gas Resources in ATP927P have been significantly upgraded following the drilling, stimulation and testing of the Tamarama 2 and 3 wells.

But more good news was on the way as Real Energy along with Strata X Energy Ltd (ASX:SXA;TSX-V:SXE) was appointed by the Queensland government as a preferred bidder for a valuable coal seam gas interest in the prolific Surat Basin in Queensland.

With regards to the Windorah Project, the contingent gas resource of the Tamarama area have been independently certified by Aeon Petroleum Consultants, a well-respected petroleum engineering firm.

The estimates of Contingent Resources are based on the area surrounding the four successful gas wells, Queenscliff 1 and Tamarama 1, 2 and 3, located within the exploration permit ATP927P.

Windorah just getting started says management

Real Energy is exploring various options in order to achieve further increases in Windorah gas reserves.

Managing director Scott Brown said, ‘’The company is committed to delivering more reserves for this project through various operational initiatives which are being evaluated.

‘’These initiatives are expected to result in improved flow rates and well performance on Tamarama 2 and 3 and, in due course, allow the company to book reserves.

‘’While the increase in Contingent Resources is indeed a positive, we believe both reserves and resources will increase as we develop the field and deliver better flow rates.

‘’Real Energy is only just getting started with Windorah’s development.

‘’The technical team has been considering horizontal well designs and is now reviewing proposals with interested third parties to drill the first horizontal well in 2020.’’

The directors of Real Energy believe the best way to advance the Windorah Gas Project is to farm down its interest in the asset.

Currently, Real Energy owns 100% of ATP927 but a data room has been established and a number of companies have reviewed the relevant data.

Venus is its name

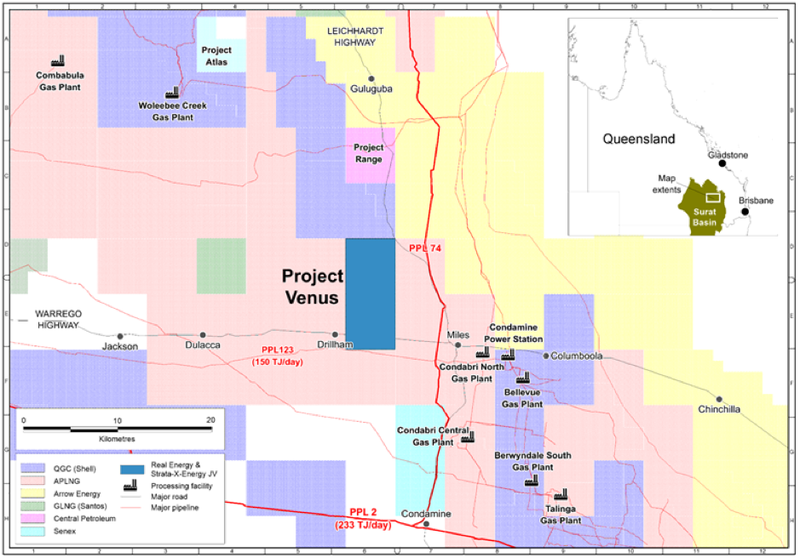

The Surat Basin acreage has been attributed the name Project Venus by the joint venture partners.

In terms of prospectivity, Venus contains high quality and very prospective acreage covering 153 square kilometres which is within the main Walloon Fairway and close to gas infrastructure.

Its location within the prolific coal seam gas producing Surat Basin, as well as its proximity to other power stations and gas plants can be seen in the following map.

Bringing Venus into production

The joint venture partners aim to bring Project Venus into production in the next few years.

Executive chairman Strata X, Ron Prefontaine’s experience is likely to be vital in terms of commercialising such a project.

He was previously executive director of Arrow Energy during its formative years and the founding managing director of Bow Energy Limited.

Arrow is now jointly owned by Shell and PetroChina in a 50-50 joint venture, operating from five fields in Queensland’s Surat and Bowen basins.

Drawing on his past experience in the region, Prefontaine appeared confident regarding the joint ventures’ prospects in the Surat Basin (PR2019-1-11) in saying, “Having run successful exploration and reserves programs in the Walloon Fairway previously, I know exactly what is required to convert the vast prospective resources in PR2019-1-11 to reserves.

‘’Once material reserves are proven, given the nearby pipeline and infrastructure, our goal is to fast track field development to create early cash flows.

‘’We are planning to commence field work early in the second quarter of 2020 and our immediate focus will be to prove commercial gas flows, a required precursor to predictable reserves certifications.”

High-quality gas acreage says Brown

Of course, Real Energy already has substantial acreage in the Cooper Basin, and it brings extensive exploration experience to the table.

Commenting on today’s developments, managing director Scott Brown said, “We are delighted that the Queensland Government has selected our Joint Venture as the preferred bidders for this block.

‘’It illustrates the quality of our tender and the confidence that the government has in recognising the collective expertise we bring to developing this asset into another successful Queensland CSG field.

‘’This is high quality gas acreage and we see the tremendous potential of this significant gas resource.

‘’We look forward to working collaboratively with Strata X to develop Project Venus.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.