88E - what’s next?

Yesterday we put out a detailed note on our US oil Investment 88 Energy (ASX: 88E | LSE: 88E | OTC: EEENF).

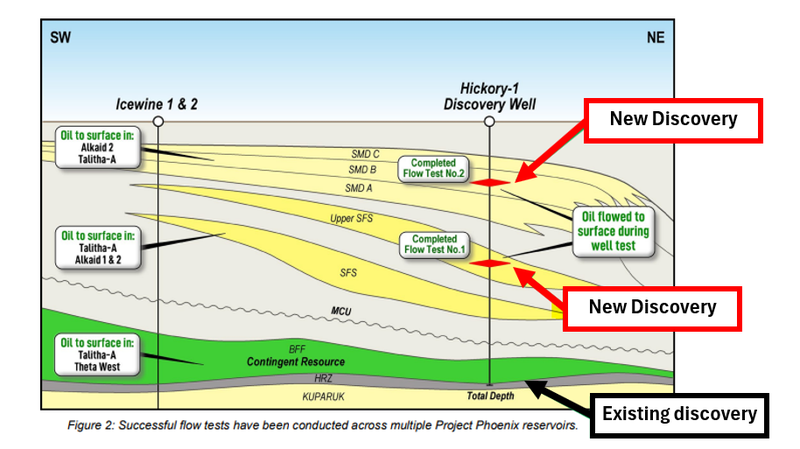

Earlier that morning 88E released results from its second flow test on the North Slope of Alaska, announcing a second oil discovery in 2 weeks.

Over the last 2 weeks 88E has delivered:

- A peak flow rate of ~70 barrels of oil per day from the Upper SFS reservoir

- A peak flow rate of ~50 barrels of oil per day from the SMD-B reservoir

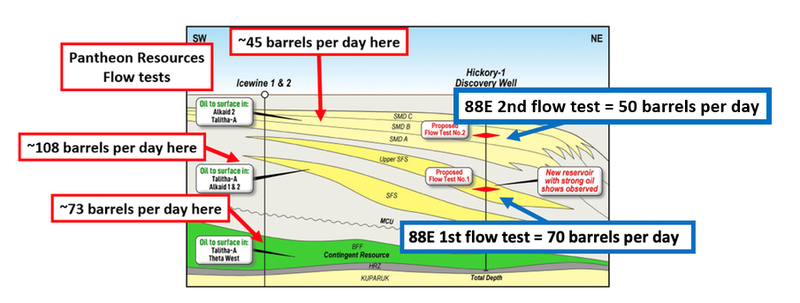

These results are in line with 88E’s much higher valued neighbour, the $650M capped, UK listed Pantheon Resources - 88E is capped at ~ $100M.

The ASX didn't really react to the news yesterday - 88E shares ended the day neutral.

We then thought perhaps the UK market would respond favourably overnight. This is what we saw on the first flow test results a few weeks back - the UK sent 88E up ~62% after the first set of results were released, and the ASX had a day of trading to assess the news.

However the opposite happened - overnight the UK market didn't give us the reaction we were hoping for, sending 88E down 20%.

88E’s first discovery last week was from a reservoir (Upper SFS) that Pantheon has never tested - here 88E got ~70 barrels of oil per day.

Yesterday 88E announced a peak flow rate of ~50 barrels of oil per day from the SMD-B reservoir - where Pantheon had flowed ~45 barrels of oil per day.

Pantheon’s flow rates across three different wells ranged between 45 and 108 BOPD.

Despite the results, there is a big gap between 88E and Pantheon's market caps - 88E is capped at ~$100M and Pantheon is capped at $640M.

Pantheon is more advanced than 88E, and its bigger valuation might be because they have drilled horizontal wells and recently upgraded its contingent resource number to ~1.2bn barrels of marketable liquids.

Pantheon’s share price is up ~300%+ over the last 12 months off the back of resource estimates and upgrades on the ground next door to 88E:

We think the valuation gap between 88E and Pantheon could narrow down as 88E works through its contingent resource estimates which it expects to deliver in Q2 2024.

88E already has an existing ~250M barrel contingent resource from just the BFF reservoir - now 88E can add to that number with resource estimates from the SMD-B and Upper SFS reservoirs.

We are hoping 88E can deliver a pretty material upgrade on the overall project's resource considering the current numbers are from only one (BFF) of the three reservoirs.

What’s next for 88E on the North Slope of Alaska?

Contingent resource estimates for SFS and SMD reservoirs 🔄

Now that 88E has discoveries across the SFS and SMD reservoirs we want to see the company define a maiden contingent resource across the two structures.

88E expects the contingent resource estimates to be ready in Q2 2024.

Commercialisation discussions 🔄

88E mentioned in yesterday’s announcement that it would now start advancing commercialisation work for Project Phoenix.

88E specifically mentioned a “farm-out to a strategic development partner and/or early, capital-lite production”.

We think commercialisation news is an important catalyst for 88E.

Maiden prospective resource estimate for Project Leonis, USA 🔄

88E is also looking to put out a maiden prospective resource estimate for another one of its projects on the North Slope.

Leonis sits on ~25,600 contiguous acres immediately south of Prudhoe Bay - the USA’s biggest-ever oil discovery.

We think Project Leonis will be the next asset 88E drills, but to do that, we suspect it will need to bring in a farm-in partner to fund part of the drilling costs.

We hope to see a maiden prospective resource estimate inside H1 2024, which would give potential farm-in partners a better idea of the asset's potential.

See our latest deep dive on 88E’s Project Leonis here: Will 88E drill Project Leonis next? Watch for a farm-out