88E makes 2nd light oil discovery in 2 weeks - how will the UK react?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 17,464,590 88E shares and 6,296,297 options at the time of publishing this article. The Company has been engaged by 88E to share our commentary on the progress of our Investment in 88E over time.

Good morning London...

88 Energy (ASX:88E | LSE: 88E) just made a second discovery at its Hickory-1 well on the North Slope of Alaska, USA.

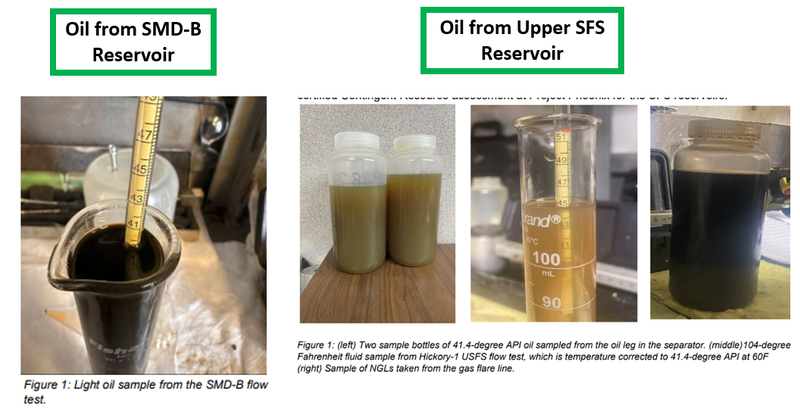

Today, 88E announced a peak flow rate of ~50 barrels of light oil per day from the shallow SMD-B reservoir.

This means that 88E has flowed light oil to the surface for the second time in 2 weeks, from 2 different reservoirs.

88E is capped at A$150M (~ £78M), whereas its direct neighbour to the north, the UK listed Pantheon’s market cap is ~A$650M (~ £338M).

Both companies now have flow rates from multiple reservoirs.

News of the second flow rate was released on the ASX this morning - there were decent volumes being traded, but by the end of the day 88E’s share price ended the day even.

The UK market is about to open - you can watch the 88E UK share price here.

Last week we also saw a relatively muted reaction to the first flow rate news on the ASX, and then the UK market opened and took 88E’s share price up ~62%.

The Australian market typically follows the sentiment of the UK market for 88E, so it will be interesting to see how the UK reacts to today’s news - and then what impact that has on the Australian market tomorrow morning.

The first discovery last week was from the Upper SFS reservoir where 88E flowed ~70 barrels of oil per day.

Today, 88E announced a peak flow rate of ~50 barrels of oil per day from the SMD-B reservoir.

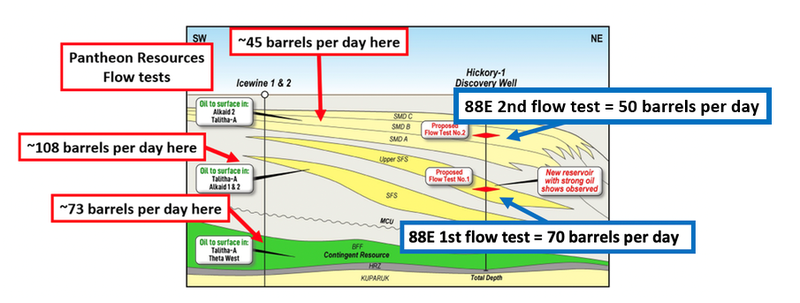

The results were in line with our expectations considering 88E’s neighbour ~$650M Pantheon Resources flowed ~45 barrels of oil per day from that same reservoir.

At market close today Pantheon’s market cap is ~A$650M, whereas 88E trades at a market cap of ~A$150M.

We will be watching out to see if 88E’s valuation can start to move closer toward Pantheon’s over the coming months.

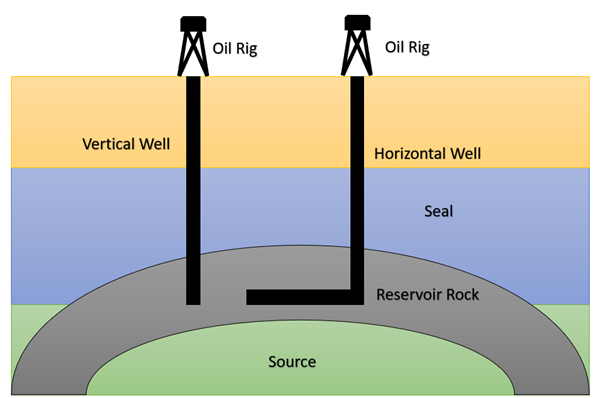

It is anticipated that these reservoirs will be developed from long horizontal production wells, which typically produce at multiples of between 6 to 12 times higher than vertical wells like Hickory-1.

88E’s project benefits from potentially being able to produce from multiple reservoirs in a single development scenario.

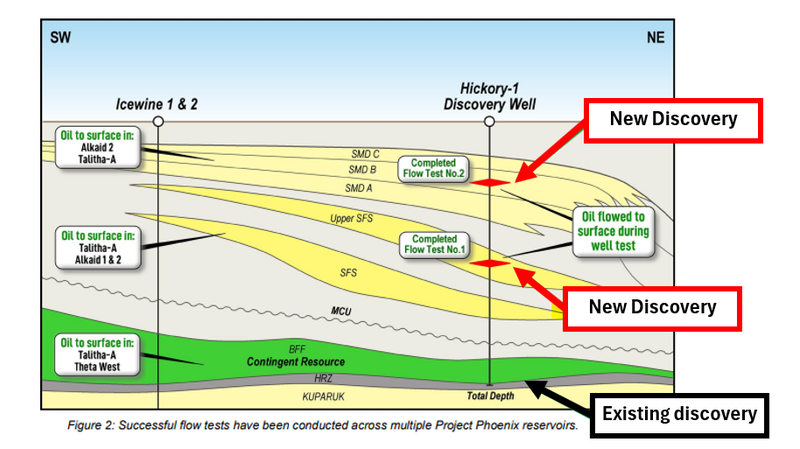

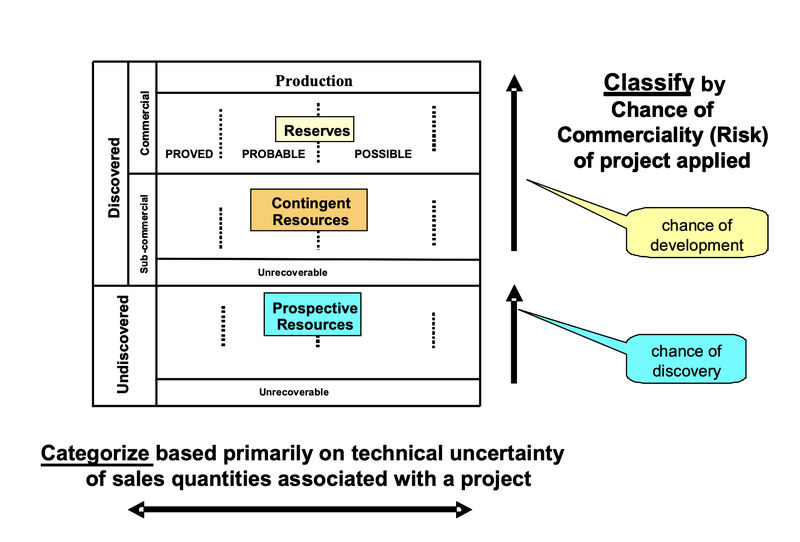

Flowing oil to the surface means 88E has confirmed discoveries in three different reservoirs (SMD-B, Upper SFS, BFF).

88E has an existing ~250M barrel contingent resource from just the BFF reservoir - now 88E can add to that number with resource estimates from the SMD-B and Upper SFS reservoirs.

We are hoping 88E can deliver a pretty material upgrade on the overall project's resource considering the current numbers are from only one (BFF) of the three reservoirs.

88E expects to have the resource estimates for SMD-B and the Upper SFS locked away by the end of Q2-2024.

🎓To learn more about oil & gas resources check out our educational article here: How to Read Oil & Gas Resources

How do 88E’s results compare to ~A$650M Pantheon Resources?

We went into this flow test to see 88E at least replicate the numbers that the much higher capped Pantheon Resources had from its own wells immediately to 88E’s north.

Across its three flow tests, Pantheon produced between 45 and 108 barrels of oil per day.

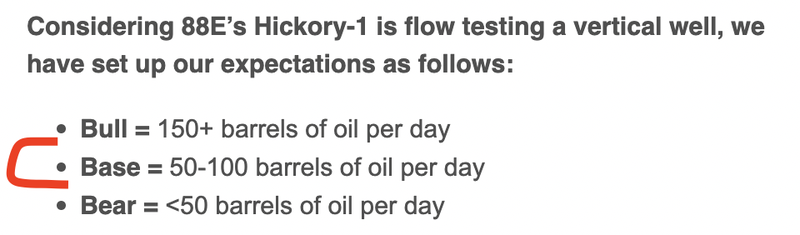

Based on this, we set up our expectations for 88E’s flow test as follows:

(Source)

88E’s results for sit right inside our base case expectation at 50-70 BOPD.

What happens next for 88E’s Project Phoenix? Development? Farm-out?

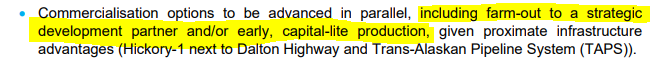

88E announced today that it would start working on “Commercialisation options” alongside potential farm-out discussions for the project.

(Source)

With the results of the flow tests, 88E has gone a long way to de-risking the project - it's shown there is oil and gas in its acreage AND it has managed to flow oil to surface.

From a technical perspective, 88E has shown to anyone who might be interested in the project what the project has - and what it needs to be taken forward.

The reality now is that the project needs multiple big horizontal wells across the discovered reservoirs, before the project can be tied to existing processing infrastructure in the region.

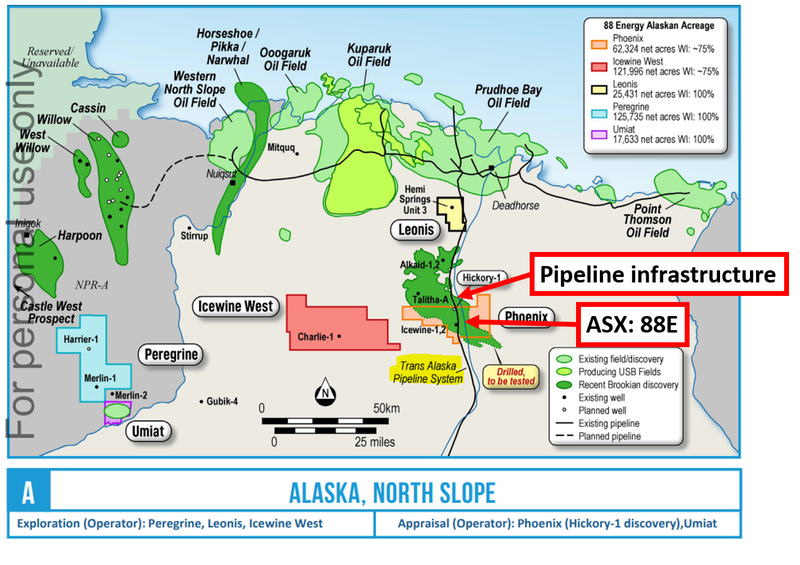

88E’s project sits right next to the Dalton Highway and the Trans Alaska Pipeline, which sends oil down to the lower 48 states of the USA and to the Valdez port where most of the oil and gas is shipped out of on the North Slope.

(Source)

The proximity to infrastructure means 88E can tie into infrastructure without all of the CAPEX that would have come with pipeline infrastructure and roads

The video below is a good watch to get a quick overview of the project and how it could be commercialised:

Instead of focusing on infrastructure CAPEX, 88E can allocate its capital into large scale horizontal wells on its ground, to try and get its flow rates as high as possible.

Higher flow rates will mean project economics are stronger.

That’s where the big horizontal wells come into play.

As we noted above, horizontal wells have the potential to increase flow rates by ~6-12x.

So in theory, 88E’s Upper SFS could flow ~420 to 840 barrels of oil per day & the SMD-B could flow ~300 to 600 barrels of oil per day from horizontal wells.

This kind of scale could be of interest to larger oil and gas producers.

The basic schematic below shows why horizontal wells have stronger flow rates than vertical wells - primarily because they capture a bigger area of a reservoir:

What’s next for 88E on the North Slope of Alaska?

Contingent resource estimates for SFS and SMD reservoirs 🔄

Now that 88E has discoveries across the SFS and SMD reservoirs we want to see the company define a maiden contingent resource across the two structures.

88E expects the contingent resource estimates to be ready in Q2 2024.

Commercialisation discussions 🔄

88E mentioned in today’s announcement that it would now start advancing commercialisation work for Project Phoenix.

88E specifically mentioned a “farm-out to a strategic development partner and/or early, capital-lite production”.

We think commercialisation news is an important catalyst for 88E.

Maiden prospective resource estimate for Project Leonis, USA 🔄

88E is also looking to put out a maiden prospective resource estimate for another one of its projects on the North Slope.

Leonis sits on ~25,600 contiguous acres immediately south of Prudhoe Bay - the USA’s biggest-ever oil discovery.

We think Project Leonis will be the next asset 88E drills, but to do that, we suspect it will need to bring in a farm-in partner to fund part of the drilling costs.

We hope to see a maiden prospective resource estimate inside H1 2024, which would give potential farm-in partners a better idea of the asset's potential.

See our latest deep dive on 88E’s Project Leonis here: Will 88E drill Project Leonis next? Watch for a farm-out

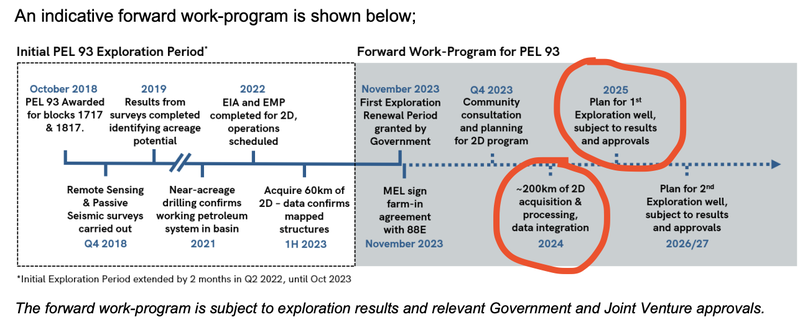

88E’s Namibian asset - watch for bigger neighbour drilling soon

88E’s focus for much of the last few years has been its assets on the North Slope of Alaska.

BUT 88E also has an onshore asset in Namibia that we think will become a big part of the company’s story over the coming ~18 months.

88E is farming into a huge onshore block in Namibia, next door to ~$205M TSX-listed ReconAfrica.

ReconAfrica holds ground to the east of 88E and is planning a well for later this year.

(Source)

We think that in the lead up to AND during Recon’s drill program interest in 88E’s projects could increase especially considering 88E’s current market cap relative to Recon’s.

Recon is currently capped at ~$205M and had previously gone on a big share price run when it drilled its last well at its Namibian asset.

At the time, Recon rallied from a COVID low of ~CAD$0.30 to a share price >CAD$12.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

So the big run up in Recon’s share price started when its licence was renewed in early 2020 through to its first well in April 2021.

88E just recently got its licence renewed and is preparing to start its seismic program in the middle of this year.

88E expects to drill its first well next year.

88E is currently capped at $150M - multiples less than ReconAfrica.

We think the Namibian asset could continue to drive positive momentum for 88E, because:

- Huge block with potential to host a huge resource

- Namibia’s fast developing oil and gas industry

- Assets were picked up before the big offshore Namibian discoveries

- Namibian onshore peer re-rated by over 40x

- Project vendors linked to Invictus Energy (ASX: IVZ)

- Early stage with plenty of upside

- Strategically located

See our deep dive on the Namibian asset here: 88E heading to Africa on frontier oil hunt - following Shell and Totals 11 billion barrel lead

Ultimately, we are Invested in 88E to see it declare discoveries and eventually attract corporate interest in its assets, whether that be on the North Slope or in Namibia - this forms the basis for our 88E Big Bet which is as follows:

Our 88E Big Bet

“88E makes a large oil discovery that is acquired by a major for over A$1BN”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our 88E Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What are the risks?

Even with flow test results now coming out, the primary risk is still around “commercialisation risk”.

88E has now confirmed two discoveries with Hickory-1 by flowing oil to surface BUT it still needs to show the market it can produce commercially viable flow rates from bigger more expensive horizontal wells.

Typically projects require certain flow rates for it to make sense developing a project otherwise the revenues from a well are unlikely to outweigh its development/operating costs.

There is always a risk that 88E’s flow rates are not enough to warrant full scale project development.

Another key risk post flow test will be “Funding risk”.

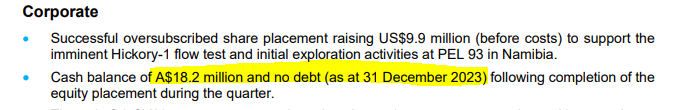

88E went into the flow test with a cash balance of ~A$18.2M (at 31 December 2023).

In today’s announcement, 88E confirmed the flow test cost a total of US$14.5M which would be a total cost of ~A$21.75M on a 100% basis. 88E has a 75% working interest in Project Phoenix and would technically be up for ~75% of the costs of the program, which is ~ A$16.3M.

88E does generate some revenue from its Texan oil producing assets, so 88E should have enough cash in the bank to fund its share of the flow test BUT we don't think that leaves much buffer after that.

This means that 88E may require a capital injection at some point in the near term either via a placement OR via some sort of funding deal with any parties that may be interested in getting exposure to its portfolio of projects.

We are also conscious of 88E having ~24BN shares on issue which will mean that at some point 88E may look to do a consolidation.

We don't see the consolidation as a risk to our Investment Thesis but more of a corporate administrative task to bring down 88E’s shares on issue.

In the long run a consolidation should make it easier for 88E to raise capital.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.