Drilling Fast Tracked on 8 Billion Barrel Potential as Nearby Results Due in Weeks

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy Limited (ASX:88E / AIM:88E) has just moved into the Alaskan fast lane...

The company could be drilling for oil at its recently acquired 8 billion barrel potential (gross mean unrisked) Project Icewine in Alaska as early as this year.

The identification of an optimal drill location, requiring minimal preparation, means the company could be plunging a drill bit into Project Icewine acreage in just a few months’ time – as early as Q3– bringing forward the drilling programme by at least 6 months.

This is made all the more compelling by the fact 88E’s neighbour Great Bear is drilling its acreage right now – one of the two wells is only about four miles from 88E’s boundary...

We are just weeks away from Great Bear drill results – positive results so close to 88E’s acreage would transform its value almost overnight...

At the same time 88E is charging ahead to drill a different play that only they have.

The subdued current price of oil means that right now is the perfect time to drill for the black stuff on the North Slope.

It’s a bottom of the cycle entry point which could maximise returns on a discovery – and if the oil price rebounds as it is bound to do some time, then watch out for a multiplier effect...

Service contractors in Alaska are currently desperate for business – slashing their fees just to run their rigs – significantly dropping costs for fast moving explorers like 88E.

The Triple A credit rated sovereign fund of Alaska is budgeting another $700M in funding for cash rebates to energy explorers like 88E as part of a push to get the state’s production levels back up.

Through this sovereign slush fund, 88E stand to recoup up to 85% of the cost of drilling an oil well at Project Icewine.

Yes, you read correctly – 88E pay just 15 cents in the dollar for drilling for oil in Alaska.

So a $20M well in any other part of the world suddenly costs just $3M for 88E...

There are simply no better exploration incentives anywhere in the world.

This fact alone should be a strong catalyst for a potential farm-in partner for 88E’s Project.

The company is now perfectly placed to begin drilling this year – it’s just raised $7M to complete the acquisition of Project Icewine and push the schedule forward.

Given the above circumstances, we wouldn’t be surprised if a farm in partner were to come to the party with this company very soon...

AIM : 88E

88 Energy (ASX:88E, AIM:88E) is currently developing Project Icewine , a highly prospective oil acreage position on Alaska’s North slope – America’s most prolific oil producing region – and has a current market cap of around A$10M / £ 5M.

88E was the former Tangiers Petroleum and Project Icewine represents a new direction for the company that we first covered in December 2014 with the article Neighbour to Drill in Weeks: TANGIERS’ New Alaskan Play.

Well, that drilling is now underway and the first well should be hitting its target any day now. The rig will then move to the next location – 4 miles from 88E...

Our sources tell us that the results from both will most likely be released together prior to mid-year.

Source: 88 Energy

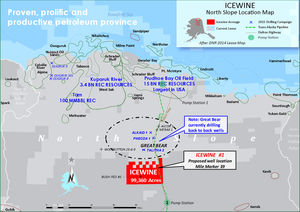

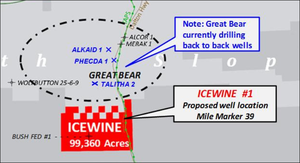

88E’s Project Icewine is surrounded by major producing oil fields and intense exploration activity – notably the 15 billion barrel (recoverable resources) oil field at Prudhoe Bay and the two to three wells being drilled next door right now by Great Bear.

Amongst a hive of exploration activity, 88E’s latest project is starting to quickly prove its worth.

In January we published 8 Billion Barrel Resource Potential Confirmed – confirming the significant potential Project Icewine has and foreshadowing the name change 88E has just gone through.

The new name – 88 Energy Limited – plays on the Chinese reverence for the number 8 as a lucky number, and we believe 88E’s number is due to come up trumps soon enough.

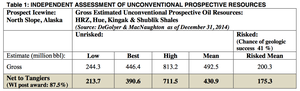

The Independent Reserve Report 88E was handed for Project Icewine identifies potential oil in place of 8 billion barrels (gross mean unrisked) and indicates recoverable oil potential of 492 million barrels (gross mean unrisked).

These figures were conservatively estimated by considering that just 44% of the project’s acreage will be productive for unconventional resources.

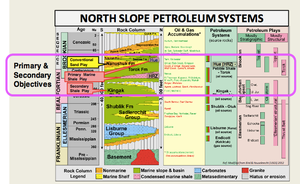

The report confirms the reasons why 88E partnered with the US group that generated the concept for Project Icewine, who are utilising the same toolbox used to identify the best part of the Eagle Ford.

88E believes the ‘HRZ Shale’ has the key ingredients that make the sweet spots of the best shale plays economic even at today’s prices.

These same ingredients were used to lease over 320,000 acres at rock bottom prices in the Eagle Ford – before a well was even flow tested – and they turned out to be the best acres in the play by far.

88E is banking on a repeat of that unconventional oil finding success.

We could see a drilling programme at Project Icewine targeting the sweet spot on the North Slope as early as Q3 this year – more on that later.

So 88E has the potential resources, exploration team and all the fiscal conditions in its favour.

In this article we’re going to go through these advantages one by one to give you the clearest possible picture of why drilling for oil in Alaska offers the best bang for the buck on the planet for 88E right now...

Great Bear now drilling just over the fence from 88E

A compelling aspect of Project Icewine is its location on the North Slope – right in a pocket of prospective ground surrounded by oil producers and explorers.

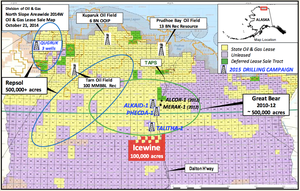

Repsol is drilling the first of three planned wells right now at its 500,000 plus acres to the north-west; there’s the 100 million barrel Tarn Oil Field, the six billion barrel Kaparuk Oil Field, and of course the Prudhoe Bay Oil field with its 13 billion barrel recoverable resource.

But by far the most important neighbour for 88E is Great Bear, a privately owned oiler with 500,000 acres under exploration right next door:

Great Bear has three wells planned for 2015 – Alkaid-1, Phecda-1 and Talitha-2 – that will explore both conventional and unconventional oil targets. This work is being done with the help oil services giant Halliburton .

Great Bear’s Alkaid-1 conventional well is being drilled right now and could be completed very soon, and then the Talitha-2 will be spudded:

Source: 88 Energy

The Talitha-2 well is just four or so miles from 88E’s boundary and may unlock some of the conventional potential that 88E is going after. In fact, one of Great Bear’s conventional prospects actually trends south toward 88E’s Project Icewine boundary...

So if Great Bear hits oil in any of these three wells, especially Talitha-2, it could illuminate 88E’s side of the fence and help work up targets for its own conventional drilling programme at Project Icewine.

Any success by Great Bear would see the conventional potential on 88E’s Project Icewine be upgraded and result in a likely large jump in market value.

Great Bear would also likely strike a farm-in deal or attract a takeover offer at a value metric that is many multiples the lookthrough of 88E’s current market cap.

And, if there is no success by Great Bear, 88E is likely to be drilling a completely different play before year end – for which there is an estimated 8 billion barrels of oil place (gross mean unrisked)...

So, importantly, these results cannot affect the 8 billion barrel unconventional potential, which is in a play type unique to Project Icewine.

Now, from what we understand, the results of Great Bear’s drilling will not be announced until both wells have been completed.

Given the lack of real estate available in this part of the North Slope, we anticipate Great Bear will promote the results far and wide for maximum impact – helping 88E along the way.

We expect Great Bear to release results in May / June so things could be about to move pretty fast for 88E and the value of its North Slope acreage.

The coming months could see a flurry of drilling news from the North Slope and things could change quickly for 88E – especially now it’s accelerating its own plans to sink drills into the Alaskan permafrost...

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks.

To note just a few:

- Following the Next Tech Stock article on Ziptel (ASX:ZIP), $1.7 Trillion Telco Market: ASX Tech Company Weeks Away From Global App Launch , , ZIP has risen as high as 160%;

- Since the Next Tech Stock article on Connexion Media (ASX:CXZ), Tiny ASX Company to Supply Tech to GM and Volkswagen: Potential $50BN Market by 2018? , CXZ has risen as high as 90%;

- We released the Next Tech Stock article on Big Un Limited (ASX:BIG), ASX Tech Company: 500 Bucks to $11M Market Cap , and since this release, BIG has risen as high as 88%;

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

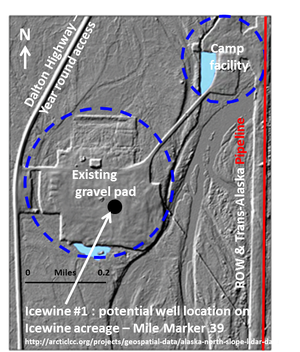

Existing Gravel Pad Likely to Result in Accelerated Program

A gravel pad that was originally used as a staging area for construction of the Trans Alaskan Pipeline in the 1970s provides an ideal location for 88E’s first well.

Initial analysis suggests that fast tracking of the permitting process may be possible, allowing a well to commence drilling before the end of CY2015 – six months ahead of schedule, with newsflow likely to be coming thick and fast from here to the end of the year:

Source: 88 Energy

With the 85% rebate on offer and the huge prize targeted, there’s every chance that this could catch the eye of a deep pocketed partner too.

$7M placement to fuel Project Icewine

88E has successfully completed a strongly oversubscribed book build for a placement to institutional and sophisticated investors to raise $7M.

Investors in Australia and overseas took part in the placement – showing the advantage of 88E’s listing on both the ASX and the AIM of the London Stock Exchange for access to capital.

88E’s placement saw 700 million shares issued at 1 cent per share with one free attaching option for every two Placement shares. The options are exercisable at 2 cents and expire on the 1 st of March, 2018.

88E will use the $7M to complete its acquisition of Project Icewine and is set up to accelerate its exploration and drilling programmes there.

With this money in the bank, 88E is well placed to make Project Icewine live up to its 8 billion barrel potential, and as you’re about to see, the company is in the right place at the right time...

Alaska offers world-beating bang for the buck

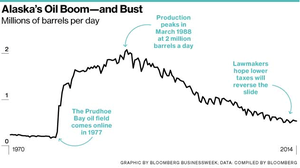

The state of Alaska is facing a tough time right now – there’s a $3.5 billion dollar deficit in its oil dependent budget, mostly caused by the fact that Alaska’s daily production has halved over the least 15 years.

To reverse this slide, Alaska needs new oil discoveries.

So the state government is seeking ways to get the major oil producers drilling and developing again and make it easier for new entrants like 88E to set up shop and thrive.

The first benefits oilers are getting from Alaska are tax breaks to make it cheaper to operate in the state – and it’s working.

A host of major oil companies are actively exploring the North Slope of Alaska, including BP, Respol, Shell, eni and ConocoPhillips.

There’s now even talk of Alaska building a state owned gas pipeline to connect shale gas fields in the North Slope – 88E’s backyard – to Alaska’s south coast.

Alaska looks set for an energy renaissance, and 88E is on the ground floor with Project Icewine accelerating toward a possible oil drilling event this year.

The state also runs a system of cash rebates of up to 85% for any money spent on exploration. For example, a $20M oil well could end up costing 88E just $3M – this discount rate should make the search for a farm in partner much easier for 88E.

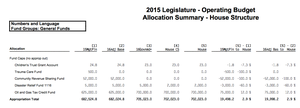

And that cash rebate system was recently reinvigorated – State Governor Bill Walker has drawn up a budget bill that provides $700M for oil and gas exploration rebates – Alaska is putting their money where their mouth is:

Let’s zoom in a little...

![]()

The Alaskan budget bill has passed the state’s House of Representatives and now just needs to be approved by the state’s Congress to become law.

That’s $700M in cash rebates that will soon be available to oil explorers like 88E who are gearing up to drill in Alaska.

Remember, up to 85% of the costs of exploration can be recovered – that’s extremely generous and you won’t find better conditions anywhere else in the world.

The beauty of these rebates is that they are backed by Alaska’s AAA-rated GO Bonds , and can be borrowed against or transferred AS CASH – another potential source of funding for 88E or a partner that wants to invest in the exploration and drilling at Project Icewine.

This is why Alaska is offering the best bang for the buck for oil exploration on the planet.

And low taxes and cash rebates are just the beginning of the advantages 88E has by operating in Alaska.

The falling price of oil means US and Canadian oil producers are cutting back their workforces, laying down rigs and negotiating cheaper rates from their contractors.

It’s a tough time for the oil industry – but for 88E it represents an opportunity.

As 88E accelerates Project Icewine amid this temporary slump, the cost of getting things done is going down. Cheaper contractor rates mean it could do all of its development for much cheaper price – delivering greater value for current shareholders.

And remember, the Dalton Highway and the Trans Alaskan Pipeline System goes right through 88E’s acreage – so nothing, not even winter, can stop Project Icewine.

Luck favours the prepared

The new name – 88 Energy Limited – is hoped to bring more luck to the company, with two auspicious numbers in the title.

Luck you can’t control, but hard work has its own rewards, and 88E has set itself up brilliantly to capitalise on the opportunities coming its way.

It’s got an Independent Resource Report in its hands that estimates potential oil in place at Project Icewine of 8 billion barrels (gross mean unrisked) and estimated recoverable oil potential of 492 million barrels.

That’s showing a compelling case to drill – and discoveries or results from Great Bear’s drilling effort on the neighbouring tenement underway right now could impact positively on 88E.

The company’s drilling could happen even earlier than expected now that 88E has identified an existing well pad that may allow a well to be spudded in Q3 or Q4 this financial year.

And when that well spuds, 88E will be eligible for an 85% rebate on the costs from Alaska’s government, at the same time taking advantage of cheaper service costs due to contractors slashing their prices to ride out the falling oil price.

Luck favours the prepared, and 88E is positioning itself to take the fullest advantage of all the breaks going its way. We can’t wait to see what the coming months bring...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.