Israel’s Ministry of Health Approves ESE to Test Terpene Mix Against a Coronavirus Strain

Published 01-AUG-2021 15:21 P.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX micro cap, eSense-Lab Ltd (ASX: ESE) is aiming to commercialise technology that analyses and reverse engineers the exact terpene profiles of plants.

Terpenes are naturally occurring compounds which account for the flavour and fragrance of plants. Each plant has its own unique terpene profile and ESE is replicating these in the lab — something that typically only nature could deliver.

This technology has immense applications across a diverse range of market segments, but given the world is in the grip of a global pandemic, the anti-viral qualities of the terpenes that ESE can create have become especially important.

Funding is being poured into ridding the world of COVID-19 and reducing its impact, and terpenes are being increasingly viewed as having a role to play.

The company has signed a research agreement with the Israeli Ministry of Health to commence a research project at the Central Virology lab in the Chaim Sheba Medical Centre — the largest hospital in Israel — to test its proprietary TRP-ENVTM compounds.

The research will test TRP-ENV efficacy against a human coronavirus termed OC43, and will further investigate terpenes’ anti-viral qualities to reduce the ethanol content in sanitisers.

OC-43 is one of seven known coronaviruses to infect humans which includes the virus that causes SARS, SARS-CoV1, and the virus that causes COVID-19, SARS-CoV-2.

OC-43’s molecular structure is identical to SARS-CoV1/2 yet its virulence is not as aggressive. Therefore, ESE view OC43 as the best model to reflect TRP-ENV anti-viral activity against SARS-CoV2.

The testing will provide peer-reviewed scientific evidence of the efficacy and spectrum of influence of the combined technologies.

The contract covers testing of 16 formulations infused with TRP-ENV to determine efficacy over various virus incubation times and the effectiveness against coronavirus on a range of surfaces with varying incubation times.

ESE is able to generate its own proprietary terpene mixes, with anti-viral qualities for products such as essential oils, cosmetics, sanitisers and personal wipes.

Aside from efficacy against coronavirus, ethanol can be an irritant to the skin, so there is significant value in unlocking anti-viral products which facilitate the reduction of harsh ethanol in sanitisers.

This is a major coup for a micro cap ASX listed stock capped at less than $10M.

Beyond the R&D news coming out of Israel driven by the company’s new ex CEO Itzik Mizrahi (ex. Pfizer Israel, Actelion Pharmaceuticals), ESE is focused on delivering commercial outcomes and near term revenue generation.

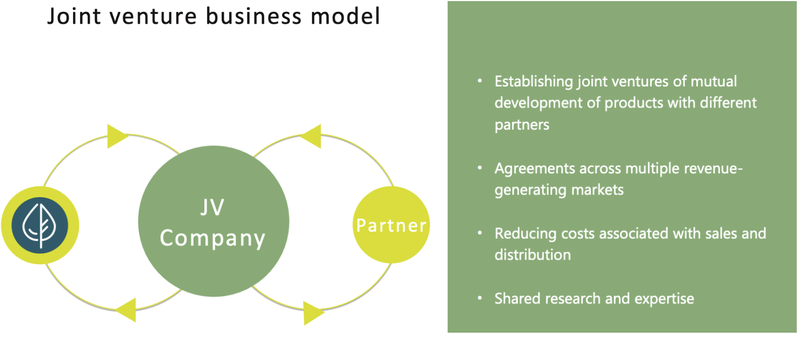

ESE’s new business model is to JV with sales and distribution partners across the globe, reducing costs for the company and boosting its revenue ambitions.

In just over six weeks, the company has established JV agreements with four different parties: Blue Science Solutions, Wise Winery, ANC Enterprises, and SeaLaria, all with significant revenue generating potential.

The largest to date was the Blue Science deal earlier this month.

Blue Science has agreed to exclusively distribute ESE’s products in the US. The pair have set a combined sales total of A$10 million over five years in order for Blue Science to maintain exclusivity, this includes a minimum sales commitment of A$3 million for the first 12 months.

Blue Science is an approved supplier to the IBM Rapid Supplier Connect initiative, which assists US buyers in the healthcare and government sectors find supplies and services with greater efficiency.

Like many speculative micro cap ASX stocks, ESE will need to address the funding question marks hanging over the company in the coming months.

The company raised $1.145M in April and the upcoming quarterly report will reveal how much was left at the end of Q2.

The slew of JV deals ESE has signed recently add up to potentially millions in dollars in revenue, and along with the recent R&D deal in Israel, it looks like the company is on the right track.

The new management team is executing on its revitalised strategy and expanding its reach, with a focus on lifting shareholder value in the process.

If ESE can get over near term funding requirements for the JVs signed to date and start seeing cash flow from its recent deals, there is no reason this company couldn’t be capped at multiples higher than current levels.

Share Price: 1.8¢

Market Capitalisation: $9.18 million

Cash Position: ~US$164,000 (at 31 March) + A$1,145,000 capital raising subsequent to the Q1 end. (An updated cash position is expected by 31 July in the Q2 quarterly report.)

Israel-based eSense-Lab (ASX: ESE) deconstruct plants’ chemical profiles and use alternate natural products to then re-engineer and create the virtual plant. The technology enables the creation of unique terpene profiles of rare and high value plants, providing sustainability and lower production costs.

The resulting line of plant-based products have wide reaching commercial and medicinal application, viable for multiple markets and mass consumer consumption.

One application of ESE’s unique terpenes is infusion in ethanol based liquid sanitisers.

Given the global shortage of surface and hand sanitisers, there is a clear demand for ESE’s technology.

eSense secures approval from the Israel Ministry of Health to commence a research project at the Central Virology lab in the Chaim Sheba Medical Center

To test the efficacy of its proprietary compounds against common influenza viruses and SARS viruses, including human coronaviruses, ESE has signed a research agreement with the Israeli Ministry of Health to commence a research project at the Chaim Sheba Medical Centre, the largest hospital in Israel.

The aim of the research project at the hospital’s Central Virology lab is to test ESE’S proprietary TRP-ENVTM compounds efficacy against a human coronavirus strain termed OC43.

The research will also provide further research into terpenes’ anti-viral qualities to reduce the ethanol content in sanitisers.

The contract covers the testing of 16 formulations infused with TRP-ENV to determine efficacy over various virus incubation times and the effectiveness against Coronavirus on a range of surfaces with varying incubation times.

ESE’s R&D team has already conducted an extensive literature search to collect established scientific data indicating the most effective anti-viral terpenes.

The research, combined with ESE’s strong terpene expertise, has enabled the development of a proprietary terpene mix aimed specifically for anti-viral activity.

According to the company’s R&D team, the compounds were determined based on a four criteria research model, which prioritised terpenes based on their unique properties and synergistic effects to create two formulations with different anti-viral focus.

The objective of TRP-ENVTM is to target SARS viruses (SARS, HSV1, HSV2), acting as penetration enhancers that diffuse the lipid membrane of these viruses. The objective of the research project is to target common influenza viruses, in addition to the other SARS viruses.

If the test trials are successful, both compounds ESE intends to use them in the creation of hand and surface sanitisers, which significantly reduce the sanitiser’s ethanol levels and may have enhanced anti-viral properties.

The effect of the disinfectants on the coronavirus viability will be examined by the decrease in the coronavirus infection of the Vero E6 cells, compared to the untreated virus with the disinfectant.

In the event a successful product is developed, it may require approval or registration with the relevant regulatory authorities (such as the TGA in Australia) before it can be imported and sold in a particular jurisdiction.

The direct cost to eSense of the contract and the trials is estimated to be approximately A$100,000 and the results of the trials are expected to be available in November 2020.

ESE expects that results providing strong scientific evidence of the TRP-ENV anti-viral activity, and its value in commercial sanitisers with previously announced joint-venture partners, Wise Wine and SeaLaria.

JV centred business model

Armed with its unique plant profiling technology, eSense is seeking out highly scalable, low cost / high volume market opportunities.

While it was previously focused only on developing terpene profiles of cannabis strains (without psychoactive ingredients), ESE is broadening its reach to wider markets, with a recently strengthened leadership team.

The team includes CEO Itzik Mizrahi, a highly experienced global big pharma executive and previous Head of Clinical at Pfizer Pharmaceuticals Israel, who brings over 20 years’ experience in commercial, medical and clinical management positions in global pharmaceutical companies.

New CFO, Moshe Hukaylo also has vast experience in public and private companies, having served as CFO of Pfizer Israel and at Merck-Serono Israel and InterPharm.

Under the new leadership team ESE has established an optimised business model and developed broader R&D plans.

Its team of expert scientists are focused on the creation of ‘virtual plants’ by applying cutting-edge technologies and disruptive techniques to reverse engineer rare or lucrative plants.

Under its new JV centred business model, eSense is seeking out highly scalable, low cost / high volume market opportunities which will greatly reduce costs associated with sales and distribution.

The company has already begun to deliver on its revised JV-centred business model under its new leadership team. It has secured five news deals since late-May. These commercial agreements open up new and expanded markets for the application of its terpenes.

They are:

- Five year deal with Blue Science Solutions for the US market for a combined total sales target of $10M, with $3M in the first 12 months to maintain US exclusivity.

- An exclusive 10-year deal with West Australian winemaker, Wise Wine (Sassey), to produce a new range of liquid sanitisers that will bring in an initial US$600,000 revenue for ESE in its first order of two million units.

- A JV with ANC Enterprises to produce a new range of skin care, hair care and hand sanitiser products with ESE’s proprietary terpene mix

- A letter of intent to enter a JV with private Marine Biotechnology company, SeaLaria, to develop new products based on the synergistic effect of ESE’s terpene strains, and SeaLaria’s unique gelatinised red algae.

Deals such as these only highlight the potential on offer in this emerging area of biotechnology.

The ongoing COVID-19 pandemic has significantly impacted consumer behaviour with people becoming more aware of hygiene. Government campaigns, advertisements and news are urging the use hand sanitiser, a shift that is anticipated to continually boost market growth.

The addition of terpenes in sanitisers could reduce the harmful effects on skin, without compromising effectiveness.

This presents significant opportunity for ESE — the global market value for hand sanitiser is expected to grow to reach US$8.09 billion at the end of 2025, up from US$1.2 billion in 2019.

While it’s still early days for ESE under its new strategy, getting these terpene profiles to market could deliver significant commercial value over the long term.

Blue Science Solutions

On 7 July, ESE entered into an exclusive sales agency agreement with Blue Science for the United States market. The deal marks the beginning of ESE’s expansion plans into the world’s largest consumer base for its future terpenes based sanitiser products.

Blue Science has agreed to minimum sales commitments in order to maintain exclusivity of A$3 million in the first 12 months of the agreement. Assuming the agreement is renewed after the initial 12 month term, the JV is targeting combined total of A$10 million of products through its network over the first five years of the agreement.

Blue Science is the exclusive holder/licensee and applicant of several patents for sanitisation and disinfection products for FDA and EPA regulated industries and will bring valuable knowledge for future product development and inclusion.

It is also an approved supplier to the IBM Rapid Supplier Connect initiative where Blue Science intends to introduce future Products for sale through its supply chains.

ANC Enterprises

On 15 June, ESE announced it had entered a joint venture agreement with ANC Enterprises Pty Ltd, a manufacturer and wholesaler of high quality Australian made cosmeceutical products.

Under the JV agreement the two companies intend to produce a new range of skin care, hair care and hand sanitiser products with eSense’s proprietary terpene mix.

Starting with a 700,000 unit initial order, ESE will provide specific terpenes uniquely developed for each product category, while ANC will formulate and manufacture the resulting products containing these proprietary terpene mixes.

The terpenes based skin care, hair care and hand sanitiser products are to be manufactured exclusively by ANC, with ESE to supply terpenes to the JV for an initial 10-year term on a cost plus arrangement.

The parties have agreed that on a minimum of 700,00 initial orders based on the anticipated initial production run for products to be undertaken by the JV.

Wise Wine (Sassey)

On 18 June, eSense announced a JV with family-owned West Australian wine maker and distiller, Sassey Pty Ltd — the owner of the Wise Winery.

To kick start the partnership, ESE will provide proprietary terpene mixes to the JV, specifically selected for their anti-viral qualities, and a cash contribution of up to $200,000 for operational expenses. Wise will contribute up to $200,000 of sanitiser ingredients (the base alcohol sanitiser and packaging).

The partnership is anticipated to generate US$600,000 revenue for ESE from the first two million unit order, which is to be partially funded upfront to an amount of $150,000 to $200,000 and the balance paid from sales proceeds.

The agreement will run for a 10-year period with initial orders of two million units. Manufacturing to be undertaken exclusively by Wise while eSense will provide its proprietary terpene mixes to the JV, specifically chosen for their anti-viral qualities.

Given that back in March the winery/distillery shifted into 24 hour production of hand sanitisers, this should hopefully take care of itself.

In fact, since the start of the COVID-19 outbreak, Wise has been supplying sanitiser to the WA state and federal governments, including hospitals, state and federal police, schools and aged care facilities.

You can read more about that deal and company’s technologies in my last article, here:

SeaLaria Ltd

In late May, ESE signed a Letter of Intent with SeaLaria Ltd, a private Marine Biotechnology company in Israel, for a JV to develop new products based on the synergistic effect of ESE’s terpene strains, and SeaLaria’s unique gelatinised red algae.

The initial focus of the JV will be on healthcare and consumer anti-viral hand sanitisers. The infusion of terpenes to enhance the anti-viral potency and reduce the existing high alcohol content present in hand sanitisers and related products will be tested and produced.

While it’s still early days for ESE under its new strategy, getting its terpene profiles to market and expanding its geological distribution could deliver significant commercial value over the long term.

Given that ESE’s technologies have such a variety of applications, we can expect to see further partnerships and expanded applications for the use of ESE’s terpenes.

eSense growth potential

Now armed with approval from the Israel Ministry of Health to commence the TRP-ENV research project at the Chaim Sheba Medical Center, ESE has high expectations for its terpenes based products.

The company anticipate that the results will provide strong scientific evidence of the TRP-ENV anti-viral activity and its value in commercial sanitisers, particularly with its previously announced JV partners, including Blue Science, Wise Wine and SeaLaria.

ESE’s laboratory is also continuing its research and testing of its gel-based, alcohol-free sanitiser with promising results of terpene’s anti-viral synergistic effects.

As is the case for most microcap stocks, securing funding is another factor that must be addressed — an updated cash position is expected to be released in the Q2 quarterly report before the end of July.

However, under its new JV business model, we can expect further opportunities to emerge as ESE continues to seek out innovative, evidence-based, commercial applications of terpenes in the multi-billion dollar medical, wellness, cosmetics and nutritional markets.

The company also anticipates further opportunities in evidence-based applications of terpenes in the medical arena, including application across cancer, virology, neurodegeneration, fibrosis, COPD, endometriosis and other diseases.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.