Why did the Steve Jobs of Shale Choose to Partner with this ASX Stock?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hydrocarbon-savvy ASX investors take note.

A $6m capped onshore oil and gas producer with over 2,000 active US wells producing around 600 Bbl/d and 6,100 Mcf/d, sporting a US$200MN Macquarie-sponsored credit facility is beginning to emerge.

While its wells in the US involve low risk development plays that produce oil and gas from conventional, long lived assets, and generate continuous cash flow, the more interesting play here is in our own backyard.

This ambitious against-the-grain hydrocarbon extractor intends to pick up the baton from the ‘Steve Jobs of Shale’ aka Aubrey McClendon — one of the founding fathers of the US shale gale — to finish what the visionary oiler began back in 2010:

To successfully explore and commercialise what could be one of the most prolific shale deposits on Earth:

The McArthur Basin in Australia

The late Aubrey McClendon was the controversial co-founding pioneer of Chesapeake Energy. Chesapeake Energy was formed with a $50,000 initial investment and grew to become one of the US’s biggest oil and gas companies, capped at $37.5 billion at its peak in 2008. Then the GFC happened...

Before his death earlier this year, McClendon announced that his American Energy Partners (AEP) had completed four transactions in the McArthur Basin – and one deal was cut with this ASX stock.

McClendon sealed a Definitive Farmout Agreement with this company, to the value of US$75M, with an additional US$100M as part of a Stage 2 funding.

This covered our company’s 14.6 million net acres of property at its McArthur Basin Project, which holds a potential resource P(50) unrisked of 1,846 MMBoe (billion barrels of oil equivalent) or 11Tcfe, over a 3.5 million acre tract of the wider land parcel.

What did the man, commonly referred to as the “US shale king” see in this ASX stock’s onshore acreage across the Northern Territory of Australia?

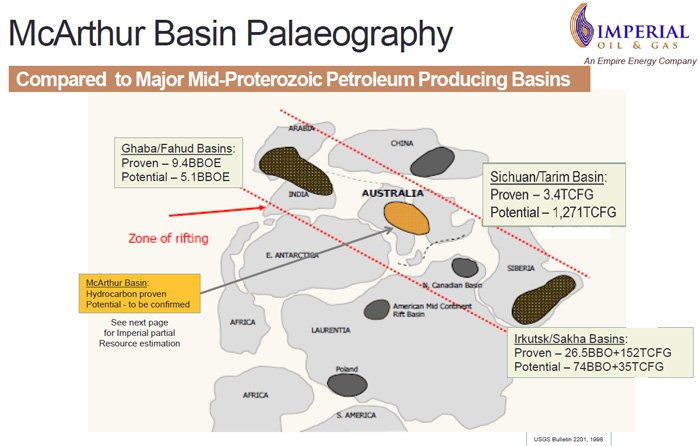

Aside from a massive tract of land, McClendon saw this region as potentially being one of the most prolific hydrocarbon-producers for the next 50-100 years...

With favourable geology that if expertly stimulated, could unleash a global scale shale gas project on par with some of the big US shale plays.

The untimely death of McClendon has seen a deferment of the closure of the farm out agreement as the results of the August NT election are awaited. With fracking a hot election issue, both companies are eagerly awaiting the result of this election.

The thing is – the geology of this ASX company’s ground has not changed amongst all this.

Like all oil stocks of this size, this is not for the feint hearted, and is a speculative investment. Cash appears quite tight right now. There is no guarantee of success here, so seek professional investment advice if considering an investment.

Today’s company has the location and is working with McClendon’s very experienced exploration and development team – whose members have drilled and completed thousands of unconventional wells throughout the major shale basins of the USA.

Despite the controversy that surrounded Mr. McClendon, this company also has the knowledge that before his passing, the shale king expected big things from outback Australia.

Unveiling:

The oil game is far from over — some may even suggest it is beginning again with recent rebounds in prices.

The emphatic slide in oil prices in recent years blew hundreds of operators, producers and explorers off the global oil chess board, and at the same time presented dozens of strong-assets at knock-down prices for savvy oil operators.

Enter Empire Energy (ASX:EEG).

Building an Empire

Already an active E&P (exploration and production) company operating over 2,000 wells in its possession, and with revenues of almost $US4 million in Q1 2016, and an EBITDA of US$2.1 million, EEG is one US-based oil company that’s actually making money (albeit paying back debt) in current conditions.

With 216,000 gross barrels of oil and 2,222,000Mcf of gross gas produced and sold in 2015 from EEG’s US operations, you would have thought this company would be worth more than AU$6 million. It’s likely that the market may be discounting this stock due to the debt it has been studiously paying off, a weak oil price, and waiting for political events to run their course.

The worm however looks like it may be in a position to turn. Maybe the McClendon factor associated with this stock will help...

EEG is on course to pick up the fracking-baton from one of the most famous personalities in the hydrocarbon industry, to finish what he started — cracking the code of the McArthur Basin shale in the Northern Territory of Australia.

This company has a growing production portfolio in the US, a potential company making asset to explore in the McArthur Basin, so it may not be long before its current valuation starts an upward ascent.

The oil game is not over, it’s repositioning for a new cycle

Prime factors for sorting the wheat from the chaff amongst onshore oil producers is production cost, production location and production capacity.

EEG is already an oil producer, but wants to take its game to the next level...

...by expanding its onshore shale ambitions into Australia’s Northern Territory — a region with highly prospective shale plays, but which remains behind the curve with little onshore exploration activity to date.

Should the Labour Party win the Northern Territory election in August, they will review fracking regulations . The Party says it supports fracking, but will call a moratorium due to environmental concerns. The ruling Country Liberals view is that the method is safe and economically vital.

It is a hot election issue and does pose some risk to an industry that will now need to show that the risk of environmental damage is “as low as reasonably practicable”.

Given the technical exploration team behind EEG has proven its mettle on hundreds of wells in the US, as part of the highly acclaimed US shale gale, and McClendon’s AEP was willing to invest hundreds of millions into NT shale, via EEG, then perhaps the NT political issues may not be insurmountable.

EEG’s on-ground team, led by CEO Bruce McLeod is one of the USA’s most experienced and talented unconventional exploration and development teams – put together by McClendon and AEP to undertake large scale shale projects both in the USA and internationally. The team includes:

- Dr John Warburton who has over 30 years’ experience in leading E&P companies including BP and LASMO

- Exploration and geoscientist specialist Denise Cox who has worked throughout the Mid-Con and Gulf regions and received 13 Marathon Oil Company Excellence awards during her 20 years with Marathon between 1984 and 2004;

- Allen Boyer SVP Operations whose experience spans the entire oil and gas industry with companies including US Energy Exploration and the Fortune 500 Rochester & Pittsburgh Coal Company;

- Jim Farthing who was Operations Manager with Conoco Philips in North America (Central Region/Gulf Coast) between 1979 and 2012;

- Tim Hull who was District Manager for Range Resources and responsible for the day-to-day management of all New York State oil and gas operations;

- Geologist and physicist David Hale, who from 2005 was the lead geologist and manager for geosciences for Kansas Assets held by Empire Energy;

- Geoff Hokin who has 12 years’ experience as a geologist in the unconventional coal and gas sectors in Australia.

As you can see this is an experienced team with invaluable on-ground experience, all housed in a micro-cap $6 million ASX stock.

Now could be a good time to back these fracking-connoisseurs at rather bargain-basement valuations and with the neat bonus of this company having a bulky US$200M (AU$268M) capital line on offer from Macquarie Bank, currently drawn to US$40M.

This means future asset acquisitions, exploration changes and project logistics could all be handled quickly.

At the same time, there is no guarantee that the company will draw on the credit line only to fund expansion, and like all small oilers, EEG may need to raise capital at some stage to fund its expansion – this is a speculative investment. Investors should seek professional investment advice if considering an investment.

Taking stock of the Oil & Gas Industry

Oil prices have fallen from their lofty peaks around $120/Bbl in mid-2014, to as low as $31/Bbl in January 2016. That equates to a hard to stomach 75% decline in less than 2 years – but as you can see, it looks like the floor has been well and truly bounced off since the start of 2016:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The people who are struggling the most are inefficient oilers producing oil at $60+ per barrel. As the tide of the 2010-2014 oil boom receded, dozens of US-based oil companies were left naked, with inefficiencies cruelly exposed.

The oil slide has erased $1 Trillion from the valuations of US energy companies, (according to the Dow Jones US Oil & Gas Index ) which surpasses the $883BN peak-to-trough loss in market capitalisation seen after the dotcom bust in the early 2000’s.

In such staggering market conditions, how is an oiler supposed to put bread on the table?

The simple answer is efficiency.

When oil prices are under $100/barrel, even the less efficient players are able to succeed.

When oil prices are <$50/barrel, it tends to be only those with belts tightened, that survive.

For EEG, the current oil market is therefore abound with opportunity because its own cost-structure remains well-below current market prices.

So with EEG revealed in broad strokes, let’s take a detailed look with focused spectacles

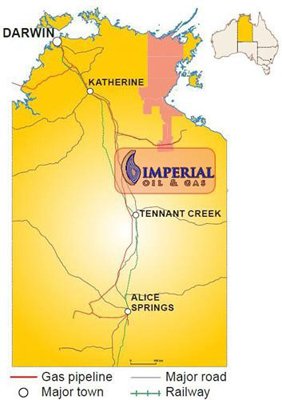

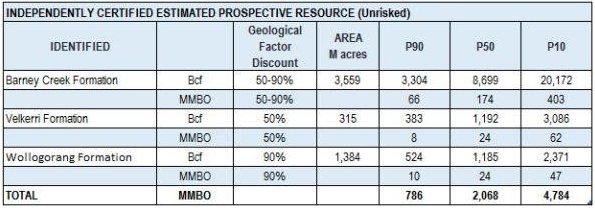

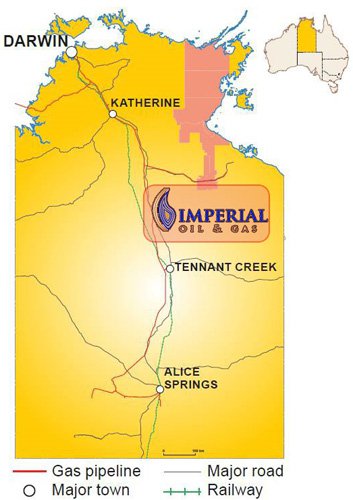

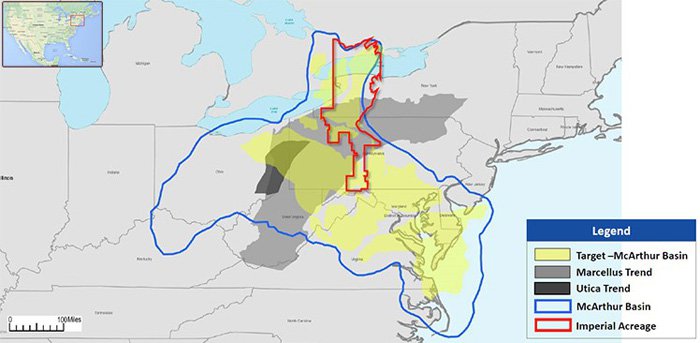

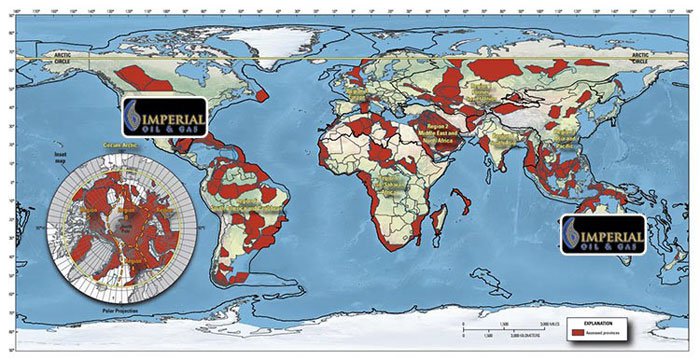

EEG operates in two different countries, with assets scattered across the US (over 2,000 wells in 3 states) and the rather large McArthur Project in Australia.

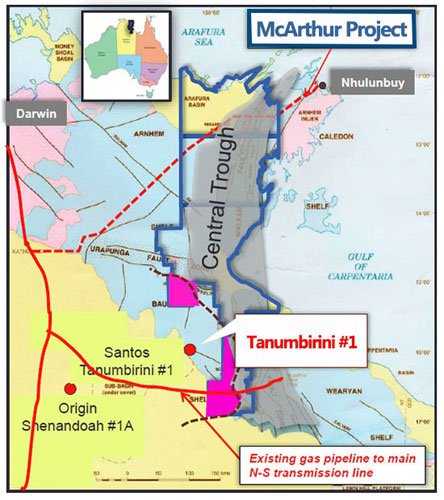

In total, EEG owns almost 15 million acres of exploration ground, with the vast majority in the Northern Territory of Australia, as part of the McArthur Basin, which is thought to hold at least 240Tcf of potentially recoverable gas resources overall.

The area shaded red, indicates the entirety of EEG’s tenements, stretching to 14.6 million acres. That’s about the same size as Norway.

Just as a quick comparison, here is how those 14.6 million acres look like if superimposed on to a map of the Marcellus shale formation (dark grey) in the USA:

As you can see, EEG’s Australian acreage rivals the size of several US states and is around 20% of the total Marcellus play.

Given the size of the McArthur Project, EEG was always in the market for a joint-venture (JV) deal with a major to achieve explorative progress.

A rather neat $75 million farmout deal was signed in a Definitive Agreement with American Energy Partners (AEP) in December 2015 for settlement on April 22, 2016, that would have seen Imperial Oil & Gas (a 100% owned subsidiary of EEG) receive an upfront cash payment of AU$10.3M with a further $10.3M in cash payments should it achieve its benchmarks...

...until tragedy struck, and put the EEG/AEP deal on hold:

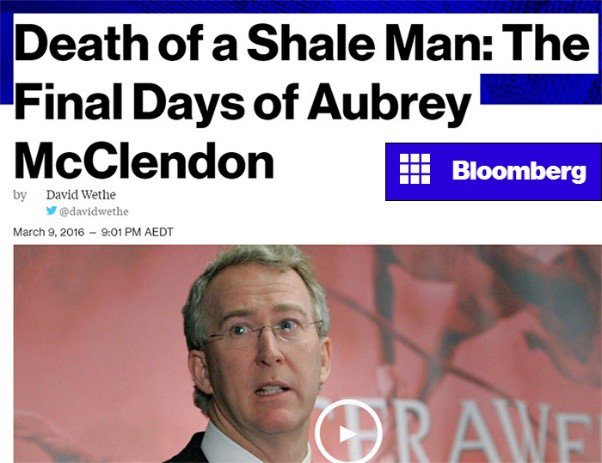

Aubrey McClendon was a visionary who today’s non-conventional oilers should be profusely thanking.

It was Mr. McClendon whose push into shale drilling revolutionised the global energy business — and made himself a billionaire in the process, in tandem with crowning Chesapeake Energy (NYSE:CHK) as the 2 nd largest gas producer and 7 th largest oil producer in the US.

His rise was the stuff of legend.

His entire oil strategy was not only to champion controversial hydraulic fracturing — but to go one step further by making it work with a high degree of probability.

Mr. McClendon grew to become a towering figure by building Chesapeake into a US$37.5BN powerhouse (after co-founding it in 1989). He then founded American Energy Partners (AEP) in 2013, raised over US$10BN, and amassed an arsenal of oil & gas assets across the US, Australia and Argentina.

Aubrey McClendon’s untimely death was a massive shock to the entire US oil industry, because of his illustrious past and broad involvement with the local community.

For nearly a week following his death, flags flew at half-mast at banks, churches and energy businesses across Oklahoma. Stores near the Chesapeake campus closed so employees could attend the funeral, which was held in a mega-church and drew a standing-room crowd of more than 3000.

If there is such a thing as a celebrity oiler with gravitational chutzpah, Mr. McClendon was it.

Mr. McClendon was also a key element in conjuring up the shale gale in the first place, via improved fracking and extraction techniques.

Many oil-sector executives and analysts dubbed him the ‘Steve Jobs of Energy’, for his foresight and early-market moves that led to consistent success in shale exploration.

The connection with EEG is that back in 2014/15, Mr. McClendon singled out the McArthur Basin as potentially the most prolific oil and gas producing region for the coming 50-100 years, based on initial geophysical data and current understanding of unconventional drilling techniques.

For some oilers, every well is a completely 50/50 affair, based simply on geological surveys. For others, wells are targeted based on specific understanding of the accompanying data such as porosity, the type of rock, compositions of shale formations and many others.

Aubrey McClendon had both a vision and a formula — for how to identify and access huge shale resources that were previously unreachable. In other words, he was able to figuratively ‘fingerprint’ various projects and improve the strike rate when spudding new wells — without the huge expenses typically associated with drilling.

Given the exploration work already done, EEG are determined to complete Mr. McClendon’s vision of tapping the McArthur shale

As a result of his passing, the Farmout deal between EEG and AEP is caught up in the McClendon Estate, which leaves EEG with both a challenge and an opportunity.

The challenge for EEG is to find a new JV partner that can assume AEP’s position if it doesn’t continue, and to do it as quickly as possible.

The opportunity is for EEG to take its stature to the next level, by securing a large oil and gas resource.

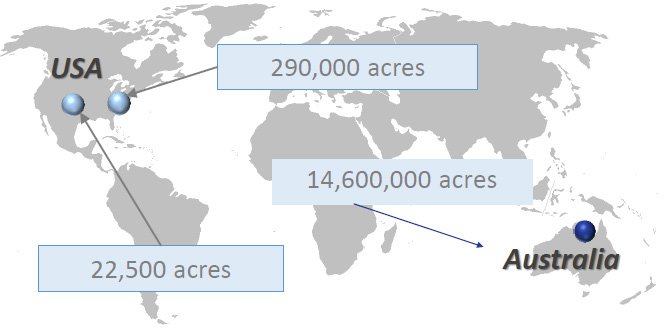

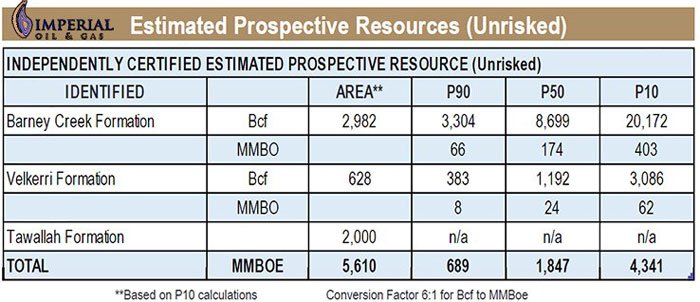

It’s still early days for resource estimates with high certainty, but from the available information provided, the potential is enormous:

The estimated Prospective Resource P(50) is 1.85 billion Boe or 4.3 billion Boe in the P(10) category.

Given the preliminary results, for early commercialisation EEG is focusing its attention on Velkerri Formation (shown in pink below), however the major resource target for EEG is the Barney Creek Formation — a formation in the McArthur Basin which has delivered commercial quantities of natural gas in wells drilled to date.

The likely epicentre of EEG’s exploration activities could be close to Santos (ASX:STO), just across EEG’s tenement border to the west:

The location wasn’t picked by chance — EEG has identified this lower portion of its 14.6 million acre McArthur Project plot, as having significant short term potential.

Aubrey McClendon was quoted as saying that, “The Tanumbirini #1 well is the best shale well I have ever seen”.

Coming from a veteran US oil man, that should inspire confidence amongst exploration crews in the region, and it’s no surprise Santos are concentrating a significant portion of their exploration close to Tanumbirini #1.

EEG’s McArthur Basin Project is also sitting on what’s known as a ‘depositional basin’, where the shales were originally formed, with EEG right on top the ‘depo-centre’ — considered as a likely ‘sweet-spot’ if compared and contrasted to other shale formations and their composition.

Further exploration should make this official, but the early signs are good.

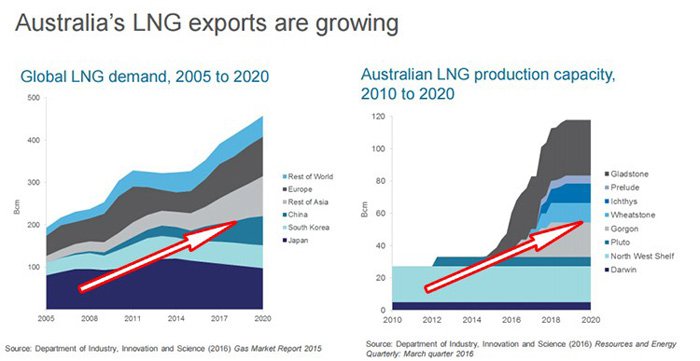

Assuming EEG can open its petroleum tap in the McArthur Basin, the existing pipeline towards the north (Darwin and its two LNG plants which require gas) and in the future to the east (Jemena pipeline approved, but to be built) could be supplying gas to the Gladstone LNG plants, at just the right time for an Asian peak in demand.

Australian exports of liquefied natural gas (LNG) are expected to pick up substantially as a number of large-scale LNG projects scale up production over the next few years.

LNG is expected to become Australia’s second largest commodity export (after iron ore) by 2018, with the bulk of these exports destined for Asian markets.

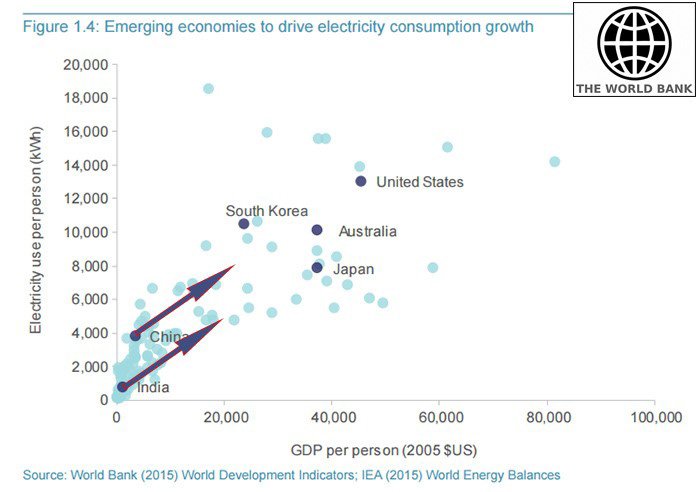

That’s exactly where EEG wants to be at some stage — supplying the next phase of Asia’s insatiable growth spurt, which clearly has a while to go if looking at electricity consumption as the barometer.

Shale gas constituted only 1% of total US natural gas supply in 2000, but today, it is almost 67% of total US production.

Having realised the American Dream, EEG is a proven oil operator

The American Dream is the famous adage that with grit and perseverance, anyone’s ambitions can become a reality— with creature comforts thrown in for good measure.

At EEG, its US operations have most certainly stood out with positive cash flow and EBITDA generated on the back of hyper-efficient production and intelligent hedging using financial derivatives.

In the US, EEG is an Operator of Mid-Con & Appalachia assets with current net production of around 1,300Boe/d.

EEG possesses over 2,000 wells scattered across the US, all of which have been kept in good working condition .

Here is an overarching snapshot of EEG’s performance since 2010.

As you can see, this plucky oiler has put forth positive cash flow, strong annual production, maintained a 2P Reserve above 12,000Mboe and positive NPV in every year since 2010.

If EEG can maintain positive traction in an oil market downturn, what could it do when the oil market reverts back to boom-mode?

Here at The Next Oil Rush , we’re more than keen to find out.

EEG is clearly a company that is bucking the trend of oilers falling like flies across the US.

And if we take a look at its US-based reserves, and added to the Australian-based blue sky potential, EEG could be one of the best onshore shale prospects over the coming years.

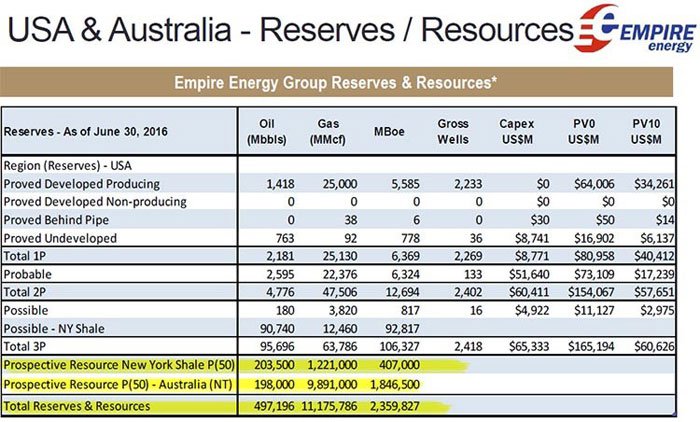

The total Proved Reserves and Prospective Resource for both EEG’s oil and gas prospects is 2,359,827Mboe.

That’s a pretty staggering figure which will require EEG to do further exploration, however, its past expertise and involvement with AEP, suggests to us that this potential has been somewhat de-risked in favour of EEG.

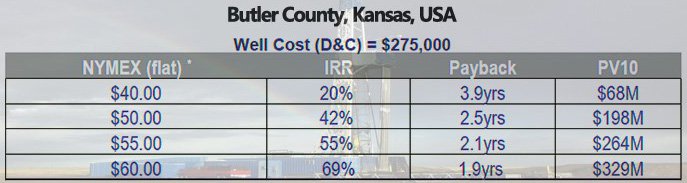

Butler County could be a standout asset, in which EEG has an option to acquire a stake

One particular US asset most definitely worthy of note that hasn’t been mentioned yet, is EEG’s Butler County asset located in Kansas.

EEG targeted this asset in mid-2015 and has initiated a buy-in schedule which could see EEG acquire up to a 60% stake in the short term.

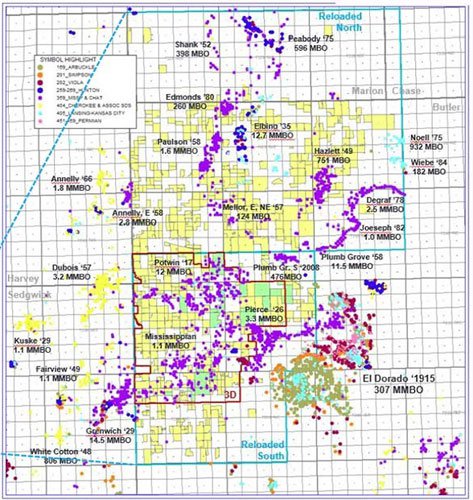

Butler County is a 70,500 acre asset with 30 new target fields identified from a recent 3D survey.

Butler County is important because it allows EEG to re-stock its US portfolio with prolific wells, in order to replace those with falling pressures and production rates. Drilling risk is low and if there are dry wells they are of negligible cost.

Going out hunting for multi Tcf gas resources in Australia is a great thing, but it also pays to butter the bread that fed you for over seven years too.

Here is a map of Butler County, showing busy-bee oiler activity:

EEG hopes to achieve gross reserves of 30MBbl/well and sees a substantial value increase over the short term, as the already defined targets sit within a hugely prolific oil producing area. Each target, if successful, will generate up to 20 or 30 drilling locations...

As the saying goes “the easiest way to find oil is to drill within a known oilfield”.

Butler County has produced over 625 million barrels of oil since productions records were started:

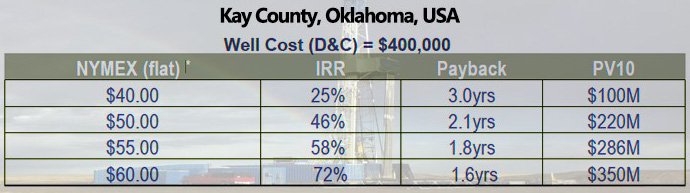

EEG’s other development is ongoing at Kay County in Oklahoma...

Kay County is a 10,000 acre asset where EEG has a 50% stake.

Here too, EEG is pencilling in some strong project economics, with a 2P net reserve of around 5MMBoe and a net 2P PV10 of US$27MN.

Current Drill & Completion costs have decreased by close to 40%. EEG hopes to achieve gross reserves of 56MBoe/well, with a payback of under 3 years as long as crude prices stay above $50/Bbl:

The ability of oil prices to remain elevated has clear repercussions on oilers. However, there are ways to take price fluctuations largely out of the equation.

Through timely futures contracts taken out while oil prices were high, EEG has effectively insured itself against the sudden decline of oil prices, to the delight of its shareholders.

This smart move has helped EEG weather the oil price downturn, and continues to support financing to this day.

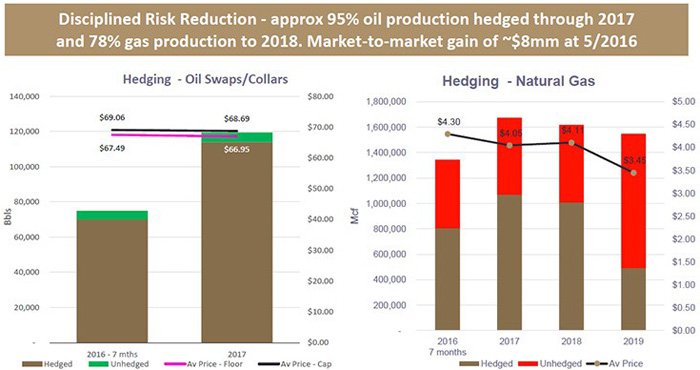

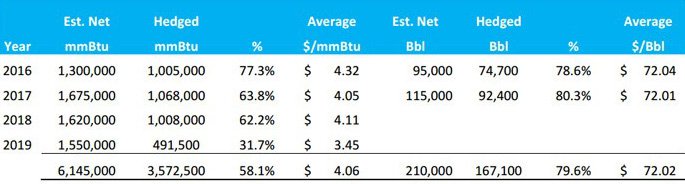

Here is EEG’s hedging summary going forward:

Last but not least on EEG’s asset list, is recently acquired 1bcf worth of operational wells spread across 30,000 acres in NY State. The payback on this asset is estimated to be around 9 months — an excellent timeline that’s below industry averages — with more news likely on the horizon over the coming weeks and months.

This brings EEG’s total landholding in New York State to around 300,000 acres. Most of this land covers potential Marcellus and Utica shale potential, which unfortunately is stuck in limbo due to Governor Cuomo’s fracking ban in New York State.

Marcellus and Utica acreage in Pennsylvania, to the south of New York State, sells for between US$2,000 to US$15,000/acre.

Hopefully, EEG will be able to cast some price catalysts in the direction of shareholders later this year.

The Empire Strikes Back

EEG is a conventional oil producer with the most unconventional of ambitions.

With the oil market summersaulting here, there and everywhere in recent years, EEG has stood out as a fixed bellwether representing what can be done with oil, when efficiency is at the heart of operations.

With its US turf assimilated, EEG is a small-but-growing fish that’s ready for the bigger oceans of unconventional onshore shale exploration.

It has the opportunity to become the world’s first E&P Company dedicated to commercialising the McArthur Basin – a mammoth unconventional resource, and with backing from both Macquarie and one of the original catalysts for the US shale gale, Aubrey McClendon.

All in all EEG could be considered as an oiler with alluring features given current market conditions:

- a low-cost producer,

- positive EBITDA,

- with an eye on growth and expansion into the larger oceans of unconventional onshore shale.

That’s more than could be said for some of the other US-based oilers, who’ve collectively seen bankruptcy rates skyrocket since 2014.

At the same time, EEG is a small oil company, and is a speculative investment. There is no guarantee of success, and caution should be applied if considering an investment.

The fact that EEG has remained resolute and productive — while so many have fallen by the wayside — suggests that we may have stumbled upon a needle in a haystack.

Aubrey McClendon’s dream could be realised even sooner than the foresight-blessed Mr. McClendon had hoped...

...and we think EEG may have everything in place to make it happen.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.