AVD Secure Farm Out: Drilling Soon on 100M Barrel Target

Published 09-NOV-2015 10:46 A.M.

|

17 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Investing in oil exploration companies is inherently speculative in nature – but the fact that oil prices are currently hovering below $50 per barrel has sent some oilers the world over screaming for mercy.

However if you can identity a smart oil explorer, also one with a bit of luck, and that company makes a large commercial discovery, there can be swift, large uplifts in value – let’s face it, that’s why we invest.

The thing about low oil prices and tiny explorers is that they are often misunderstood to mean a lack of opportunity.

If anything, however, tough market conditions make the best opportunities more visible and tangible.

Let’s face it – any discovery made today at a cyclically low oil price won’t be commercialised until a few years down the track – by that time the oil price would have likely recovered, leveraging the value of the discovery further still.

What this means is that...

Swinging for the fences may be a great strategy in the heady uptimes, but in today’s oil markets, bunting could be a better bet.

So imagine a company that has found a sweet spot that reconciles the best of both worlds...

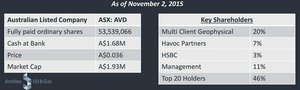

Antilles Oil & Gas (ASX:AVD) is it.

Partnering with other companies to reduce marginal costs and collaborating to share in both the risk and potential reward, AVD stands a better chance of success compared to if it went out to capture all the blue sky for itself.

At the same time, success is no guarantee for AVD, and it is recommended that professional advice is sought before investing.

AVD has just farmed out 50% of its onshore Peruvian Block 105 to Uruguayan oil and gas fund Union Group, a multi-billion dollar resource fund operating globally.

Union will fund 75% of an onshore well to be drilled by AVD in the coming months for up to US$3M.

To put this in perspective, AVD is currently trading at a market cap of around $2M...

The exploration well will target a mean 29.6 million barrel shallow target and a deeper mean 100 barrel target.

Furthermore AVD has announced qualification of the Company to bid with partner Polarcus DMCC for an acreage position in offshore Barbados...

That’s a long term play that sits nicely with its near term ambitions.

With well-funded drilling to commence in the coming months and a top notch management team that has worked for majors such as Woodside and BHP, this could be an opportune time to take a look at this small $2M market capped company before the inevitable rise in investor interest occurs in the coming months.

Which is why AVD has once again piqued our interest.

With that mind, we revisit:

Here at The Next Oil Rush we don’t just put away our periscope when oil prices fall.

Instead, we look for companies implementing smart strategies that take into account broader market conditions before taking advantage.

In this case, we have identified a company that is targeting assets that remain profitable at low oil prices, but also, have the tangible capability of outperforming investor expectations if and when oil prices recover.

AVD is doing just that – implementing a meticulous, well-thought out countercyclical strategy devised by a team of industry veterans with a proven track record.

AVD isn’t gung-ho about its intentions.

The strategy here is to get other bigger players to farm-in to strong assets with oil potential, within a region already boasting heavyweights such as Shell and BP.

With a clear strategy in place, most of the near term funding secured, and the drill bit expected to hit ground in the next 6 months, AVD is ticking all the right boxes to have a good chance of pulling off its counter-cyclical market strategy.

The cherry on the cake is a bid for acreage in Barbados that should it come to fruition will provide a long-term offshore play that could lead to a multi-million barrel resource.

That particular cherry is some way off, but today’s bread and butter could already be enough to lift AVD’s paltry $2M market cap in the near term.

We would expect to hear the result of AVD’s Barbados bid soon – likely in the coming weeks...

On Location

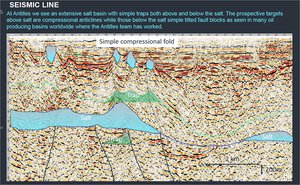

First and foremost AVD is exploring two assets onshore in Peru, South America.

Peru was selected due to its potential for oil discoveries that will facilitate cheap and quick production – having a technical team experienced in this part of the world also helps...

The assets AVD have selected, assuming commercial quantities of oil are discovered, are likely profitable even with the oil price around $50 a barrel.

Aside from these, there are other options on the table but we’ll get to them later.

Peru is currently one of the fast growing economies in Latin America and already exports around 200,000 barrels per day (around 75 million barrels of oil per year).

In total, AVD has secured over 4,000 km 2 of prime onshore acreage in Peru and is making progress towards commercialising it a priority.

Let’s take a detailed look at the cards AVD is holding.

Block 105 – Onshore Peru

AVD’s first prong of attack is in Peru at its 50% owned Block 105. As discussed above, the other 50% has been farmed out to Union Group, who will fund 75% of the well to be drilled in 2016.

This asset represents AVD’s near-term commercial potential, located in the heartland of Peru’s established oil producing region – the Titicaca Basin.

According to AVD, Block 105 holds a prospective resource of 29.6MMBO (at shallow depth) with a 100MMBO resource estimated deeper below the surface.

See the table below:

The key to unlocking and realising this potential is either by taking the asset through to production alone or attracting a ‘farm-in’ partner to assist in exploration and cost.

Currently, the global oil market is in the doldrums from a pricing perspective, which means it’s a far better strategy to split the costs with other companies for a smaller share of something – as opposed to a greater share of nothing.

This would explain AVD’s cornerstone deal with Union Group who have been busy securing blocks in on-shore Peru elsewhere and funding hydropower infrastructure projects in Peru , thereby underlining its commitment to the region.

What has impressed AVD (and us) about Block 105 is the project economics.

Peru has a royalty tax regime of 5%-20% and a corporate tax rate of 32% — these stats are comparatively generous to other oil exploration regions such as Australia and North America.

Furthermore as we mentioned above Union Group has agreed to cover 75% of the cost of drilling a new well next year, in exchange for 50% of Block 105.

Just by doing smart deals, AVD can effectively obtain multiple prospective assets and see them through to drilling without significant capital expenditure.

It’s similar to having a free bet on several horses in a race – the more free bets you have, the more likely one of them will win.

At the same time this a speculative investment and due diligence into the Company should be undertaken before investing.

It’s tie up with Union Group means AVD has mitigated a large portion of its exploration risk in onshore Peru and relieved its capex burden considerably.

The Bigger Picture Off-Shore

As AVD pushes forward with its onshore exploration, its blue sky offshore plan is also full of optimism given the recent natural gas discovery off the coast of Columbia by ‘Petrobas’.

The gas discovery was made at the Orca-1 well, drilled in the Tayrona Block about 40 km offshore La Guajira province, bordering neighbouring Venezuela.

The deep-water discovery shows the presence of an active hydrocarbon system below the ocean floor and is likely to add confidence to AVD’s long-term approach of conducting high value deep water Atlantic Margin type exploration with moderate risk.

Meanwhile, as major BHP goes about a cost cutting exercise in most areas of the business – there is one region they are prepared to invest large sums into exploration – Trinidad & Tobago – the same region AVD are looking very closely at.

BHP are ploughing $1.2 billion into offshore Trinidad & Tobago –betting on this region to have similar quantities of oil to huge oil regions such as the Gulf of Mexico:

The latest in BHP’s oil hunt in these parts is that a first deepwater well is slated for 2016:

![]()

This region is vastly underexplored, and BHP are prepared to spend big sums here.

Little AVD will be watching all this activity this closely, and similarly, the Company is going for big and bold assets here, with play opening potential that may result in discoveries for years to come.

Contradicting its tiny $2M market cap, AVD has secured pivotal partnerships with much bigger players

Defying its tiny size, AVD is working smarter, not just harder in its exploration.

To boost its exploration success, AVD has agreed deals with offshore marine explorer Polarcus and offshore driller AGR FJ Brown. More on these guys later.

As and when its offshore ambitions become a reality, AVD will be well positioned to activate its previously arranged agreements and obtain cost-effective seismic work as well as higher integrity amongst authorities.

Bear in mind that AVD is operating in a region that’s highly prospective for oil and gas , yet little offshore development has happened to date.

Venezuela has around 135BBO while Trinidad has around 13TCF of gas and 1BBO. Further afield, Colombia is estimated to have resources of 2.4BBO and Peru 15.4TCF of gas and 663MMBO.

That’s more than enough to go round to keep explorers like AVD happy.

Sechura Basin

In addition to Block 105, AVD’s other play in onshore Peru is in the Sechura Basin.

AVD has signed a Technical Evaluation Agreement here, with Peruvian oil and gas regulator Perupetro.

The fiscal terms of the area are highly attractive with low costs due to the ease of access for onshore drilling activity and seismic acquisition. Following evaluation, AVD will move to obtain an exploration license.

AVD has a 100% equity holding in the agreement, which carries a work program of evaluation of existing data. The total expenditure for the initial work program is US$400,000 over a work term of up to two years.

The Sechura Basin acreage is located within 50 kilometres of existing production and has a proven source rock for both gas and oil hydrocarbons in the Technical Evaluation Agreement area...

One asset to keep an eye on from AVD.

AVD’s Team Sheet Looks Set to Score

As we said before, AVD’s kicker is its Management team.

Lots of junior explorers have promising assets and lots of potential. But when it comes to realising that promise, an experienced team with a clear viable strategy is required.

For AVD this aspect is probably its strongest suit.

AVD Management Team Sheet

AVD’s Managing Director, David Ormerod was previously at Pura Vida Energy (ASX:PVD) – another Next Oil Rush stock we have on our radar.

Mr. Ormerod was part of the team that secured a $230M farm-out deal in offshore Morocco, before the big players started to flood in en masse.

Is he able to repeat the feat at AVD?

We certainly think he has a good chance.

Ormerod also spent time at BHP – yes the same major that is ploughing big sums into offshore Trinidad & Tobago...

For a tiny $2M-capped explorer, its Management team is second to none including years of experience at billion dollar-capped giants like Shell and BP.

In our view, AVD has ticked the ‘successful companies are all about quality Management’ box with some aplomb.

Successful oil exploration is about strong business partners...

One key element of successful oil exploration that produces results, is the help.

AVD has selected a specialised group of companies that will assist it in a variety of ways. Let’s take a closer look.

Perupetro is Peru’s national oil and gas regulator so it makes complete sense to see AVD in close quarters with this state giant. AVD has a strong relationship with Perupetro and currently has over $500,000 with the state company as a holding guarantee.

Polarcus (OSE: PLCS) is a Norwegian marine geophysics company. They are big players in oil exploration, offering their services to various oil explorers around the globe. AVD and Polarcus have joined forces in search (and bidding) for acreage in the Caribbean.

Polarcus’ forte is marine geophysical surveying, boasting a fleet of eight 3D seismic vessels

Having a high-calibre 3D seismic and drilling team strengthens AVD’s position upon bidding for acreage. Governments are more likely to offer acreage to well-backed entities that have all the bases covered and are ready to progress their allocated blocks.

AVD is currently reviewing acreage across the Caribbean offshore Colombia, Trinidad, Barbados and Panama. Having established a Joint Study and Bid Group (JSBG) with Polarcus, AVD has a strong geophysics arm that will analyse and process all the data that is collected.

This data will be used to identify acreage suitable for bidding and Polarcus may take a 25% stake in any joint bid with AVD as the operator. The Polarcus agreement enables AVD to source and acquire high quality offshore 3D seismic surveys thereby identifying strong prospects that can then be bid on with Polarcus’ backing.

By partnering with Polarcus, here again AVD is able to dilute its own risk and reduce the cost of exploration. When dealing with deep-water projects, even the larger explorers tend to farm-in other parties in order to reduce risk. As a result, only a 10%-20% stake in a good oil discovery is required for a huge revaluation – especially for a company that’s currently capped at a paltry $1.6M.

AGR Brown is a US-based drilling company that has completed over 500 well projects across the globe in the past 13 years. Its global reach spans every major oil hub globally where AGR provides Design Engineering, Well Construction, HSE and Project Management Services.

Its role within its partnership with AVD is to provide drilling support for any bids it makes in the Caribbean. Under the agreement AGR will provide drilling support to AVD on the acreage opportunities it identifies which again reinforces AVD’s bidding capability.

Specialising in 2D seismic surveying, MGC just recently became one of AVD’s most key partners. Instead of paying millions of dollars, AVD issued $517,107 worth of stock in exchange for a 20% stake in AVD.

Last but not least is Union Group. As we have already mentioned, Union group is a multibillion dollar fund that covers investment in Agriculture, Mining, Infrastructure, Energy including Oil and Gas production to exploration.

Union Group has farmed in to the AVD’s Peruvian Block 105 and will cover 75% of the expenditure for a new well, in exchange for a 50% stake in the block. With the successful farm out of the Block 105 drilling commitment AVD is now looking to fund the remaining 25% of the well cost (around US$3M).

At Block 105, AVD will remain as the operator of the upcoming exploration well, with a spud date earmarked for early next year.

The Argentina Factor

One factor that could turn Latin America upside down from an oil exploration perspective is the Argentinian general elections scheduled for 22 November 2015.

A political shift away from the Kirchner government could change the landscape in Latin American oil exploration significantly.

Many oilers are expecting a sharp relaxation of sentiment towards foreign explorers in Argentina, and better operating conditions for private oil companies. This could have a material positive impact on several oil companies including AVD because the Kirchner administration renationalised Argentina’s largest petroleum company, YPF in 2012 . A new business-friendly administration could open multiple doors in the country and the wider region, suffering from sloppy government intervention .

With AVD now in close quarters with big players such as Union Group, Perupetro and MGC – Argentina could be a jewel in the making.

To See Barbados

AVD recently announced qualification of the Company to bid with Polarcus for an acreage position offshore Barbados in the Caribbean. This bid round is in the extension of the Trinidad/Tobago Basin within 50km of existing production.

A payment of US$517,107 in stock will be triggered to 2D Seismic provider Multi-Client Geophysical on qualification of this bid.

David Ormerod is looking forward to the bid round in what he believes is an attractive area for high impact exploration. Barbados has become an integral strategy for AVD and is believed to be an attractive investment environment .

Of course it is early days for AVD, and this is a speculative investment – so please do your own research before making an investment.

Two-pronged strategy addressing the short and long term

AVD has taken a pragmatic tract in its exploration.

This junior explorer has identified an oil project in Peru that has near term production potential, and is driving hard to bring it closer to production so it can generate cash flow to support its broader, deep-water ambitions.

One eye is on the immediate near-term where its Peruvian Block 105 holds a 29.6 million barrel shallow mean target and a deeper 100 million barrel target .

A farm-in partner in the form of Union Group has already committed up to $3M which takes care of 75% of projected well costs.

Considering AVD’s strategy, it’s on course to reach a point where Block 105 will bear almost zero expenditure risk for AVD, but AVD will retain a stake that will generate revenues if and when a resource is proved up.

That’s great business, and just the type of smart strategy today’s oil market craves.

Meanwhile, its deep-water strategy is walking a similar line, only with long-term ambitions

AVD plans to acquire highly prospective deep-water acreage and then entice larger project partners to share the brunt of the expensive exploration work and bring in farm-in partners for drilling.

At this stage, AVD will be a price-maker, rather than taker.

Once a resource is in the bag, there would likely be several companies bidding for AVD’s resource because larger oil companies now tend to wait for smaller explorers to reach maturity before swooping with a farm-in agreement or even a takeover.

Therefore, AVD will be able to command a strong sale price (if taken over) or preferential terms (if farmed out).

The Tortoise and the Hare

Peru is the hare, a deepwater play is the tortoise.

Instead of being seen as a flat market without a future, today’s low oil prices present a buying opportunity for small, well-run junior explorers that have strong assets in their portfolio.

The same, well-run junior explorers are likely to be negotiating takeover and farm-in deals with large players once the oil market has gone through its cycle.

The key barometer is how such junior explorers are run and who is running them. At AVD, a veteran Management team with over 100 years of experience between them has been meticulously assembled and is now gradually taking AVD to fruition – just like they did at Shell, Woodside, and BHP in previous positions.

To leverage its microscopic $2M market cap, AVD has secured vital partnerships with entities that supplement its own expertise including an offshore marine explorer (Polarcus), an offshore driller (AGR Brown).

Therefore, AVD represents a ground floor entry point for investors seeking a fine balance of having exposure to near term production but also have the potential to profit from AVD hitting a transformational billion barrel discovery.

This company is trading below most ASX shells floating around right now, even with a drilling event in the coming months that is for the most part funded.

With one eye on the blue sky and another on its bottom line, AVD is pursuing a dual strategy of developing near term onshore production while pursuing a longer-play, high impact onshore exploration in the background.

AVD’s competitive advantage is that it can bear low oil prices in the doldrums in order to catapult into healthy commercial viability when oil markets turn bullish.

Here at The Next Oil Rush , we think the oil market has opportunities at all stages of the economic cycle.

Therefore, we see AVD as a superb conduit to have a swing for the fences in deep-water whilst having the security of its bread and butter on shore.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.