AOW makes company transforming acquisition

Published 19-OCT-2016 16:41 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in American Patriot Oil (ASX: AOW) have responded positively to full details regarding the group’s acquisition of JMD/Entrada Energy (Westworld) which has 22,600 acres in Utah and 356 acres in Texas.

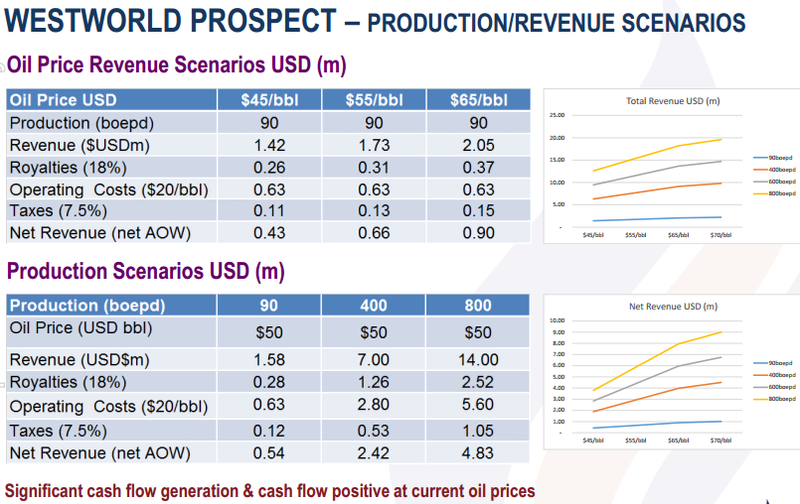

The group has existing production of 90 barrels of oil equivalent per day (boepd), but AOW is of the view that this could grow to more than 800 boepd by mid-2017, and 2000 boepd by the end of 2018.

When this transaction was originally flagged on October 5 AOW’s shares spiked 50%, and the release of further details regarding the transaction on Wednesday has attracted added interest.

Importantly, the group has 4.3 million barrels of oil equivalent in oil and gas reserves based on a fully independent reserves report.

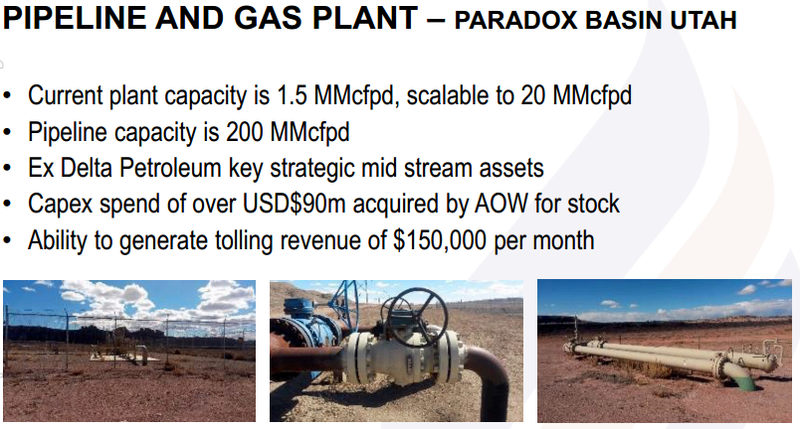

There is also valuable infrastructure included in the deal including a gas plant and a 25 mile pipeline. This effectively equates to the inclusion of sunk capital of US$90 million in the purchase price.

Not only does this make the value of the transaction appear attractive, but it also provides IOW with the potential to generate recurring tolling revenue of $150,000 per month.

IOW has identified more than 400 drill sites with the ability to significant grow production as well as the potential to restart production at shut-in wells.

Consideration for the acquisition is an all-stock transaction with 139 million shares issued to JMG/Entrada. These are escrowed for 18 months and JMG/Entrada shareholders will control 40% of the combined entity.

Strengthened board to provide access to capital

U.S.-based board members will be appointed to the combined entity, providing the company with experience in that region, including improved access to capital, as well as potentially assisting in listing the group on the US OTC.

Board appointments include the ex-governor of Nevada and US based oil and gas executives with access to stockbrokers, investors and capital markets.

The Westworld prospect provides the following production/revenue scenarios.

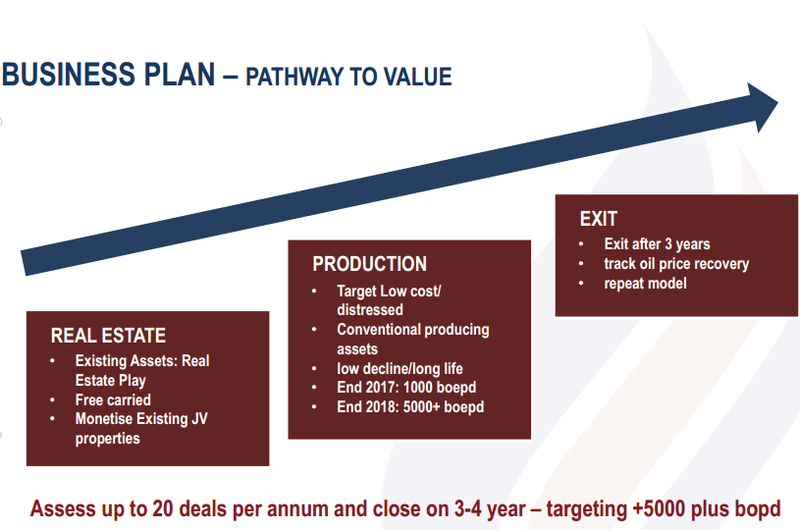

AOW executes on its private equity style of investment

This transaction fits with the group’s strategy of acquiring distressed producing opportunities in US mid-continent regions where it can conduct free carried infill drilling and monetise existing properties. AOW has also stated its intention to target assets that produce in a range between 100 and 1500 barrels of oil per day.

Consequently, the Westworld deal meets those parameters. The all shares consideration means the company will maintain its debt free position in terms of current borrowings.

The group is being managed in a similar fashion to a private equity firm with clear parameters regarding asset identification and valuations, as well as a stated exit strategy as listed below.

The next six months should see closure of the JMG/Entrada transaction, growth in production, cash flow and reserves, results from infill drilling of existing projects and the prospect of another conventional production acquisition by the fourth quarter of 2016.

Any one of these developments is a potential share price catalysts, making AOW one of those ‘watch this space’ stocks.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.