Is AOW the Best Kept Secret on the ASX?

Published 07-APR-2016 09:43 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

By this stage, you might well have heard about the little oil company that could – US-based American Patriot Oil & Gas (ASX:AOW).

We last featured this play in Bidding War Begins for ASX Oil Explorer .

At that stage, the company, capped at just a shade over AU$20 million had received takeover offers for $US20 million ($A26 million), and then bagged an offer which valued the company at $35 million.

In Australian dollar terms, this small company managed to generate offers with a combined value of $55 million.

We said it then and we’ll say it now – clearly there is something positive going on and AOW is shaping as one of the best kept secrets on the ASX.

There has to be a reason for US oil interest in AOW, particularly amid the current doom and gloom of the oil sector.

Who on the earth does multi-million dollar oil deals in this environment?

To do these deals, the target must have a pretty compelling story.

Now, as it ponders the latest takeover deal, AOW has revealed that it is in discussions with even more companies about a potential takeover bid.

We should warn that there is no guarantee that formal rival offers will eventuate and you should keep that in mind when deciding whether or not to invest in AOW. Seek professional advice before making any investment decision.

The fact that AOW is managing to get in a room with companies now perennially tightening their belts speaks volumes to the quality of offer the company is putting together.

Clearly there’s something about AOW’s business plan which has US oilers sitting up and taking notice – and if the oil price soon picks up – those bids could quickly escalate.

In this article we’ll take a look at the kind of play AOW is putting together and just why US oilers are eyeing off the company.

Re-introducing:

The latest deal

When we last left American Patriot (ASX:AOW), it was mulling over a takeover offer from Running Foxes Petroleum (RFP) which effectively valued the company at $35 million.

That deal was for 22c per share in the company – and with AOW’s shares currently riding at 17.0c (at the time of writing), the deal would represent a 30%-odd premium for anybody who bought in at current levels.

As we’ll get into later, RFP is a joint venture partner at just one of AOW’s five assets – which leads to speculate (and it’s just speculation) that the deal is really about one asset rather than five.

AOW is still mulling over the RFP offer and RFP is doing due diligence on AOW, but we can’t help but wonder what subsequent offers may look like if they took into account the whole suite of assets.

Anyhow, as this deal has rumbled on and the AOW management gave the stock-standard “take no action until further advised” spiel, it let loose with a very interesting statement...

The first line of that Finfeed story reads that AOW is now in discussions with “a number of other interested parties”.

That’s not “we are seeking potential bids”, that’s a rolled-gold “we are in discussions”.

The message here is that rival bids could be on the way.

Even if it’s all for show, RFP could catch wind of the talks (US oiler circles being what they are) and come back with an improved offer.

So at the moment it has an offer which is at a 30% odd premium of its current price, and there could be more on the way.

Again, this is no guarantee.

But, AOW has done this before, in more ways than one.

Earlier in the piece, AOW received a US$20 million bid from a private company headed up by legendary oiler ‘Tiger Mike’ Davis.

This bloke, who has a reputation of being an old-school, hard-nosed oiler put in the bid.

Now, you’ll remember that the entry price was AU$20 million, meaning that exiting on a US$20 million deal would basically be a waste of time, right?

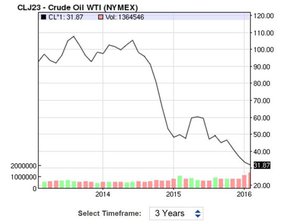

Well, AOW originally listed with a AU$20 million IPO back in 2014 – and as you can see below the oil price is rather different today than it was back in 2014.

In fact, it’s gone from around $100 per barrel to about $30/bbl, a 70% reduction on its 2014 price.

If you apply that to the offer price, Tiger Mike would have been right to offer something like US$6 million – but he didn’t.

He offered US$20 million.

It’s testament to the technical work AOW has done and the E&P gameplan it has put together, that it has managed to put together bids above the entry price in a time where the oil price has declined 70%.

But, then again, it’s a play key members of AOW have done before.

Ambassador 2.0?

If you’re looking for a stable long-term investment, go buy some blue-chips to put in the bottom draw.

AOW is not one of those plays.

Instead, AOW is geared towards working up its assets, selling out to the highest bidder and exiting the investment at multiples of the original investment price.

In AOW’s case, the play was IPO at $20 million.

Remember it currently has an offer of $35 million on the table – with potentially more offers waiting in the wings.

These offers haven’t been announced yet, so do not base your investment decision on what may happen in future – invest with caution.

AOW is pulling of this play to a T so far, and this may have to do with the fact that its management team have tread the same boards before.

Several members of the AOW team were at an Australian company going by ‘Ambassador Oil & Gas’.

The gameplan was quite similar to what it’s attempting in the US right now which is mainly: enter cheaply, farm out to a partner for free carries and sell out at multiples of the entry price.

Back in 2011 it entered the Cooper Basin region of Australia (on the border of South Australia and Queensland) at PEL 570.

Back then, The Cooper Basin was the hottest of hot properties for merger and acquisition action, and AOW’s entry into the basin was made toward that goal.

It acquired the permit for low cost, worked it up on the technical side (including seismic etc.), and then brought in cashed-up joint venture partner New Standard Energy (ASX:NSE) to drill.

The terms of the deal basically apportioned NSE a controlling stake in the permit and Ambassador was basically able to step back while the drilling was done and relax.

It turns out that a combination of the technical work and the drilling turned up something pretty good, because pretty soon a bidding war broke out.

Companies called Drillsearch (ASX:DLS) and US-based Magnum Resources were the primary players here.

First this happened:

And then this happened:

DLS eventually won the shooting match, putting in a deal which valued Ambassador at $48 million.

Again, this was for a company which did some technical work on one asset and then basically lay back and let its joint venture partner do all the heavy lifting.

Key members of Ambassador have played a role at AOW including head of business development Kleo Hatziladas and non-executive chairman David Shaw.

So the play here is pretty simple – pull off another Ambassador play.

This time though, instead of being just one asset, AOW is going on a hole other scale by applying its business model to five assets.

The famous five

The million dollar question (or, rather, the $35 million question) is why the likes of Running Foxes and Tiger Mike are circling AOW.

AOW is a company which isn’t actually producing any oil. It isn’t going after billion barrel targets, nor does it have a massive amount of acreage.

Instead, it has a tight five projects and has worked relationships with joint venture partners to make sure that during the drilling phase, it doesn’t need to pay a cent.

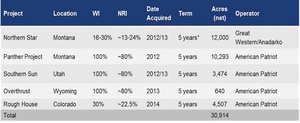

The five projects are spread over four states in the western United States, and are located in some of the hottest oil provinces in recent years.

The way AOW works is by working up the asset from a technical perspective, putting enough information together on what could be under its feet to attract a joint venture party.

Once that JV party is in, AOW assigns the JV partner a majority stake on the proviso that it pays for drilling (the most expensive but potentially most rewarding part of the process).

So, AOW gets to sit back and wait for the drilling to take place. If the drilling is a bust, it’s a shame but AOW didn’t actually pay anything for it.

If it’s a success, then AOW retains an exposure to that and funds further work on the project according to its working interest.

This is how things stand after RFP farmed into AOW’s Rough House project:

The main action at the moment is at the Northern Star and the Rough House projects, but when AOW takes a break from takeover talks, it is in dialogue with other operators to tie up similar deals at the Panther, Southern Sun, and Overthrust projects.

Northern Star

Northern Star is a unique case, because AOW managed to attract not one but two joint venture partners to the party.

The first joint venture is with a company called Great Western Oil and Gas .

The company is essentially a private group overseen by billionaire Pat Broe, and currently produces over 2200 barrels of oil per day and have over 250 operating wells.

These guys know how to get wells into production and generating cash.

The deal with Great Western involved AOW giving it a 70% stake, but in return it got...

- Cash

- Free carry on two horizontal wells with no cash cap at play

- An option to drill two more wells

At rough calculations, that’s almost $20 million worth of value without AOW needing to spend a single cent.

So, why did Great Western go for the deal?

Well, the technical work done by AOW plus drilling in surrounding areas painted them a pretty picture.

Over 40 wells were drilled in the area by none other than ExxonMobil in the past, which were all pretty successful – but didn’t offer Exxon the kind of scale a supermajor works on.

They’ve got bigger fish to fry, and these wells were drilled before the advent of affordable horizontal drilling, so Exxon pulled up stumps and moved on.

As experienced oilers will tell you though, quite often where there’s conventional oil closer to the surface, there’s source rock down below.

This is what AOW was willing to bet on when it acquired data and carried out some seismic on the project.

That seismic data indicated that the deeper, tighter rocks may require some attention. So, it put together the data and the investment opportunity and shopped it around.

Great Western jumped at the opportunity, and here we are.

The best part of the deal is that there’s no cap on the cost of the two horizontal wells Great Western is paying for.

As part of this type of arrangement, it’s quite common for well costs to be capped, with the joint venture partners paying for anything above this according to their working interests in the well.

Not this time.

If for some reason Great Western runs into difficulties and needs to do more work on the wells, AOW can simply shrug its shoulders and let them do it.

The first well as part of the deal started in February last year, with drilling, completion and testing taking place last year.

News has been thin on the ground, but the initial analysis suggests that there could be a fair bit of oil within the target Ratcliff formation.

AOW has tipped the well to produce at about 250 to 500 barrels of oil per day, and it wouldn’t be unreasonable to suggest firmer numbers in the near-term, ahead of a second well being drilled at the project.

We know what Great Western is bringing to the table, but what about its second joint venture partner in the guise of Anadarko Minerals ?

The Anadarko deal

So it turns out that AOW’s work at Northern Star has been attracting industry attention in the area.

Anadarko had an adjoining project, nearly 12,000 acres – adding to Northern Star’s 50,000 acres.

The US company had been looking purely at the conventional side of things, but now wanted a bit of exposure to the unconventional as well.

Anadarko’s acreage features the Lustre and Midfork conventional fields, with 17 prospects to follow up on for a conventional program.

To date, Anadarko and AOW drilled one well targeting the conventional, and that well brought in production of 508 barrels of oil per day before settling back to 216bopd.

With 17 leads, you can imagine the sort of production the JV will be looking at – namely, something around the 3000bopd mark.

Please note thought that this is far from guaranteed, and oil exploration is a risky venture – investment caution is advised.

So with Great Western it has the unconventional covered off, and with Anadarko it has the conventional covered off.

AOW has the best of both worlds with minimum outlay and maximum return – and that’s just one project.

Rough House

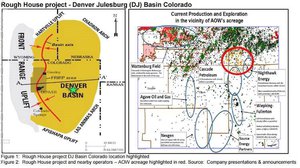

Down in Colorado, this project has been pegged as a conventional play rather than a more expensive unconventional play – not that it matters to AOW anyhow given it generally pays nothing on initial exploration.

Running Foxes has farmed into the project, and barely a month after doing so lobbed in a $35 million takeover offer.

Clearly there’s something here...

First off, AOW managed to snag a whole bunch of seismic data on the project for absolutely nada .

So it has a whole bunch of technical data on its hands, but the best part about this play is that it’s near a whole bunch of producing projects.

For example, Night Hawk Energy is producing around 2000 barrels of oil per day , while the Aloha Mula -1 well, on its own, had initial production of 1500bopd.

There’s nothing quite like production at nearby projects to make the industry take a look at your project right next door.

That’s exactly what RFP did, farming into the project.

RFP has put up for a five well commitment, with AOW to be free carried for two of those wells.

If it isn’t taken over in the near term, AOW will retain a 30% working interest in the remaining three wells – meaning that it will only need to pay for 30% of the cost of those wells.

The first well as part of that program is due to start drilling in the third quarter – but the fact RFP has lobbed in a takeover offer even before its drilled a well leads us to believe there’s something in the technical data which had RFP’s eyes lighting up...

The final word

We’ve called this perhaps the best kept secret on the ASX – but we don’t really mind telling you about it.

It currently has a takeover offer on the table which is above both AWO’s IPO price and its current share price – with potentially more on the way.

The way it’s managed to do that is pretty canny.

Instead of pouring investor time and money into drilling a whole bunch of wells – it’s gotten joint venture partners to do most of the heavy lifting.

We can only imagine the sort of offers which will come in if AOW manages to swing deals on its three other projects...

Remember, the RFP deal was essentially done on one project’s potential.

This is an oil company, so it does remain a speculative punt, but it’s definitely one worth watching over the next few months to see how the dance continues.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.