Will this junior oil explorer’s share price keep doubling?

Published 10-DEC-2013 18:37 P.M.

|

8 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

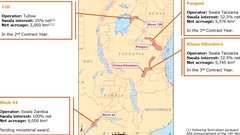

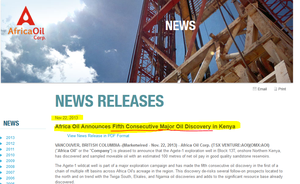

Swala Energy (ASX:SWE) is up over 150% since we introduced the story to our readers... and it is rising fast. SWE is starting to register on the radar of many new investors following constant multiple giant oil discoveries right near their blocks in Kenya and their extremely encouraging seismic results in Tanzania... ...not to mention recent huge investments into SWE by a private investment group out of the Middle East and a prominent Tanzanian industrialist. These strategic, high profile investors made an unsolicited approach and bought nearly 13% of SWE , and paid A SIGNIFICANT PREMIUM above market price to do so. Regular readers of The Next Oil Rush know that we take every chance to shamelessly brag about our early investment in a similar company called Africa Oil Corp (TSX:AOI) which is up over 600% since our initial report over 18 months ago, thanks to their stunning success finding oil in Kenya – five out of five successful wells to date with plenty more results on the way in the coming weeks... ...in the exact same region and geological system as SWE. We believe SWE could be the next AOI, and accordingly SWE is currently one of the largest holdings in our stock portfolio – needless to say we are very happy with over 150% gains to date. Just in case you haven’t seen AOI before:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. Looking to repeat the multi-bagger we had with AOI, a few months ago we uncovered SWE, which is a very similar company operating close by that had not drilled a well yet. We are pleased to report that SWE is up over 150% since our first report titled: The last junior oil explorer operating in this exciting region with this same JV partner went up 800% in a matter of months We also mentioned our holding in SWE a few months later after it had risen 50% in our update report titled: SWE up over 50% in the last few weeks, find out why is this only the beginning... Now that SWE is up over 150%, we STILL think this is just the beginning. Every huge drilling result for AOI (they are coming thick and fast) makes SWE look like an even more promising investment – we are invested in SWE for the long term, but are certainly expecting short term gains along the way.

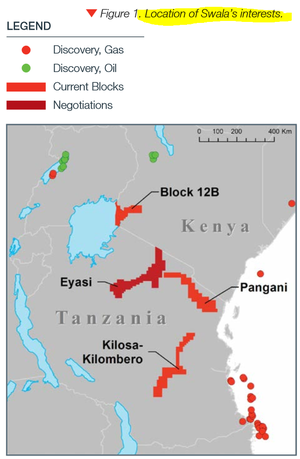

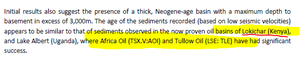

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. Doppelganger AOI keeps going from strength to strength, following their five massive discoveries in the Lokichar basin , which have proven to contain multi billion barrels of oil and passed the threshold for commercial development . SWE recently announced that seismic results on one of their blocks has shown that their block is similar to AOI’s Lokichar basin .

So what does this mean for SWE? A quick recap:

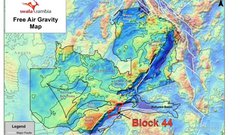

AOI has made five significant discoveries in the “East African Rift System”

The East African Rift System:

SWE has MULTIPLE blocks in the East African Rift System.

And THIS is why we are so bullish on SWE. In the last few weeks, several events have started to push the SWE share price north in a big way:

- A recent unsolicited investment AT A PREMIUM to the share price ... by not one, but TWO high profile investors

- The similarities to AOI just keep coming – 2D seismic results from SWE confirm this

- AOI making huge finds on 5 out of 5 of their Lokichar Basin wells

- Furious drilling activity by AOI should give more results any day now .

- Additional 2D seismic expected in Q1 2014

- SWE becomes a Supporting Company of the Extractive Industries Transparency Initiative

- SWE recently featured on Nihisa.com – a Tanzania based website that introduces East African companies to wealthy East African investors

- Three new analyst reports release by Argonaut , Fosters Stock Broking and Old Park Lane (click to each link to read the report)

Recent unsolicited investment in SWE at A PREMIUM – and wait till you hear by whom...

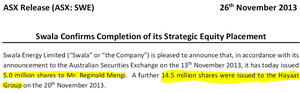

All eyes have been on SWE recently as two large placements were announced in late November, raising AUD $4.4 million for the company at an 18% premium to the share price at the time.

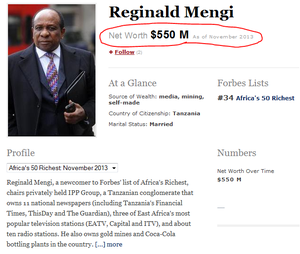

Tanzanian industrialist and media tycoon Dr Reginald Mengi, with a net worth of US $550 million, ranked 34 in the Forbes Africa Rich List recently came knocking, realising an excellent investment proposition in SWE. The good Doctor promptly requested 5 million shares and paid $1.1 million to SWE. This gives Dr Mengi a 3.3% stake in the company – nice investing Reginald.

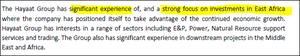

The Hayatt Group in Abu Dhabi also wanted a piece of the action, taking 14.5 million shares in SWE. The Hayatt Group now hold 9.4% of SWE, after putting in $3.3 million. From the SWE announcement – Swala Confirms Strategic Equity Placement :

These big investments from two highly sophisticated investors will allow SWE to accelerate their work programmes in their existing licenses, and continue business development in the region. The team at The Next Oil Rush are betting that these two new investors will be adding to their investments by buying up on market over the next few months.

More and More similarities to AOI

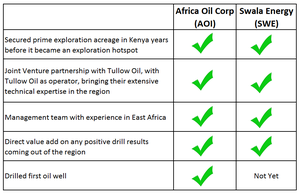

Our June Report titled: “ The last junior oil explorer operating in this exciting region with this same JV partner went up 800% in a matter of months ” outlined in detail why SWE provides such an exciting value proposition, detailing the striking similarities between SWE and the early days of the wildly successful Africa Oil Corp (TSX:AOI). Here is a summary of the similarities from that report:

A recent announcement of commercial oil by AOI, attention in the region from super majors and a few other factors are pointing to SWE and their concentrated East African asset portfolio being a very attractive take-over target... See AOI’s the announcement here: Africa Oil Announces Additional Pay at Etuko-1 and an Update on Development Plans

In March 2012, AOI was in the same position as SWE is right now – they had acquired a lot of prospective blocks in East Africa but had yet to drill a well. If we compare the value of the two companies when they were in similar positions, SWE’s market cap needs to increase FIVE TIMES OVER to be at the same level as AOI was back when they had not drilled yet, let alone increase 60 times over to match AOI’s market cap after their first oil strike.

Yet ANOTHER discovery by AOI in the Lokichar Basin

As well as the two big strategic investors announced by SWE in November, SWE also announced interpretation results from a 2D seismic campaign over its licence in the Kilosa-Kiombero Basin . SWE found large structures and sediment ages analogous to the Lokichar Basin in Kenya, where AOI struck their oil (5 out of 5 times)

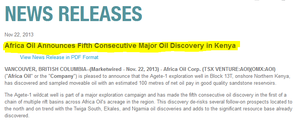

AOI just keep finding more and more oil in the Lokichar Basin . Last month, yet again, they announced a major oil discovery , now up to their fifth consecutive discovery! That’s a 100% success rate to date in this Basin.

It won’t end there for AOI, with no less than 9 prospects left to drill in the Lokichar Basin in the NEAR TERM. With SWE’s acreage bearing strong similarities, SWE can ride on the back of these discoveries, as investors search for the next AOI.

AOI are stepping up the drilling capacity over the coming months and you can expect some early results any day now .

This is news flow should prove very catalytic for SWE given they have just announced that some of their blocks have the same geological characteristics as the Lokichar Basin .

Recent analyst predictions of significant gains for SWE

David Wall from at Argonaut has rated SWE as a speculative buy, with a target price of 61 cents in their recent report:

Haris Khaliqi from Fosters Stock Broking has predicted 40c in his report

Barney Gray from Old Park Lane reckons that SWE was heading to 29c in his report – well its well and truly breached 29c now. We wonder what their updated price target will be?

SWE becomes a Supporting Company of the Extractive Industries Transparency Initiative

The team at The Next Oil Rush has always had a keen interest around investing in East Africa, one of our members has even travelled to Kenya. We are very conscious of the “ resource curse ” that can affect some emerging countries if their newly discovered oil wealth is not managed properly or is stolen by those in power for the benefit of a few... much like what has happened in Nigeria . We were thrilled when SWE recently announced they have become a Supporting Company of the Extractive Industries Transparency Initiative

This is an important step to ensure that the new found oil wealth will benefit not only SWE investors and government coffers, but most importantly the local population.

Conclusion

This is why we are so bullish on SWE. In the last few weeks, several events have started to push the SWE share price north in a big way:

- Recent unsolicited investments AT A PREMIUM to the share price ... not one, but TWO

- The similarities to AOI just keep coming – 2D seismic results from SWE confirm this

- AOI making huge finds on 5 out of 5 of their Lokichar Basin wells

- Furious drilling activity by AOI should give more results any day now

- Additional 2D seismic expected in Q1 2014

- SWE becomes a Supporting Company of the Extractive Industries Transparency Initiative

- SWE recently featured on Nihisa.com a Tanzania based website that introduces East African companies to wealthy East African investors

- Three new analyst reports release by Argonaut , Fosters Stock Broking and Old Park Lane (click to each link to read the report)

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.