Surprise US $ 36M Deal Blindsides Market

Published 13-MAR-2014 19:36 P.M.

|

15 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

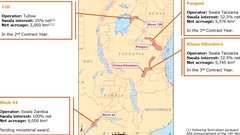

Surprise! Swala Energy (ASX:SWE) just announced US$36 million in funding – we didn’t even know they were trying... This surprise agreement was struck with an as yet unnamed party – covering all past costs plus a free carry through seismic and two optional wells. The unnamed party will receive a 25% working interest on SWE’s 12B Block in Kenya. On a per km2 basis, SWE’s farm out is the best farm out achieved on shore Africa to date . This milestone deal means investors are getting a free ride in Kenya – SWE just have to sit back and watch as their partners do all the exploration work. SWE is now fully funded for their 2014 Kenyan exploration program – this will allow SWE to focus their efforts in Tanzania and potentially securing other licences over Africa. Nobody saw that coming.... We love pleasant surprises. Both the $4.4M equity raise (at an 18% premium to the share price) in November 2013 and this recent US$36M farm-in deal came completely out of the blue. A testament to management keeping tight lipped about important developments. Meanwhile, potential in the Tanzanian acreage continues to grow – one Analyst now speculates a $2.75 share price rise – almost 900% from today’s price – should a drill prove successful. This may be as soon as 12 months away... Who knows what these guys are cooking up in the background, and what the next unexpected announcement might be...

As SWE investors ourselves, we have been very pleased with results thus far – SWE has been as high as 150% since we introduced the story to our readers last June :

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

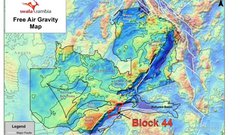

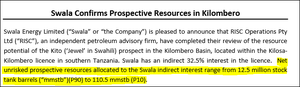

Multiple analysts are backing SWE early in 2014 predicting significant gains from where it is today. Last year, SWE started to register on the radar of many new investors following constant multiple giant oil discoveries by a similar company Africa Oil Corp (TSX:AOI) , right near SWE’s blocks in Kenya. SWE are exploring the same East African Rift System – one of the biggest oil field discoveries in recent times. A Canadian company called Africa Oil Corp (AOI) were first movers in this region and went from a junior on the TSX to a multi-billion dollar company in 2012. AOI’s stunning success was all down to one thing – continuously striking oil in the Lokichar Basin, Kenya. Now, The Next Oil Rush is hoping to repeat its gains with a much smaller company, operating in the same region, with the same JV partner, sitting on prospects close to AOI’s discoveries... SWE is in a similar position to AOI before the huge re-rate. One SWE prospect (the Kito Prospect) was recently independently assessed, indicating a potential unrisked resource of up to 110.5 million barrels net to SWE . This only one tiny prospect in a small area of a large basin that SWE have an interest in. Add to this the $36M farm in deal in Kenya, highlighting the strong potential of the 12B Block... And the recent acquisition of 200km of 2D seismic over their basins in Tanzania – generating extremely encouraging results , capped off by the discovery of another Neogene Basin... Could all of this pent up potential lead to an oil strike similar to the multiple hits of AOI? SWE are impressed by the Tanzanian results to date, moving steadily into Years 3 and 4 of exploration , on the back of very encouraging results on gravity, magnetic and seismic surveys. This will see SWE maintain their goal of drilling two exploration wells in Tanzania before the end of February 2016.

![]()

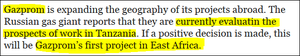

As SWE move forward with their exploration program and lock in multimillion dollar farm in deals, Russia’s US$100 billion energy giant GAZPROM , is currently evaluating the prospects of work in Tanzania. This would be the Russian giant’s first venture in to East Africa, raising the profile of Tanzania’s resources potential. We dare say this interest, along with interest from other state owned oil producers from ‘energy-hungry’ Asia, could see the Tanzanian government soften their proposed approach towards allowing international companies to obtain future licences.

US$36M = Tanzanian Assets for Free

SWE’s US$36M free carry on the 12B Kenya block is a stunning result – this value is close to the market cap of the company – and that value doesn’t include the Tanzanian assets or its cash....

![]()

At this price, SWE investors are essentially getting these Tanzanian assets for free!

![]()

This deal effectively ascribes a value to SWE’s acreage of $17,700 /km2 – it’s the highest paid per km2 for a block onshore Africa to date:

![]()

The new partner prefers to remain confidential until the final government sign off – all we know is that this mysterious company must have some serious cash and in all likelihood be fully integrated – meaning they explore, produce, refine and distribute. And given their request to stay anonymous we are guessing they are a pretty big player... In exchange for a 25% working interest in the 12B Block, the farmee will:

- Pay SWE’s past costs;

- Pay all of SWE’s costs associated with the planned 350 km 2D seismic survey up to a cap of US $2.7 million (net to SWE’s working interest)

- Pay all of SWE’s costs associated with the drilling of a first exploration well up to a cap of US$7.5 million (net to SWE’s working interest), subject to positive results from the seismic survey

- Pay all of SWE’s costs associated with the drilling of a second exploration well up to a cap of US$7.5 million, subject to positive results from the first exploration well;

- Pay all of SWE’s costs associated with any work programme agreed to by a majority vote under the Production Sharing Agreement (PSA) in excess of the work commitment under the PSA.

The deal further highlights the industry rush in the region, with big companies clamouring over themselves to get in. Hats off to SWE as they secured acreage well ahead of the pack – the rewards are deals like these.

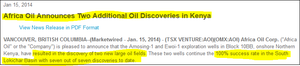

AOI just keep finding more oil – SWE sitting in an analogous basin

Africa Oil Corp (TSX:AOI) just discovered a further two new large oil fields – which continue their 100% success rate in the South Lokichar Basin. That’s 7 out of 7 successful wells to date!

Just in case you haven’t seen AOI before, our Next Oil Rush report called AOI as the ‘ Hot Tip of the Decade’ – before AOI struck oil.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. AOI were first movers in the East African Rift Basin system – one of the last great rift basins to be explored. AOI, with JV partner Tullow first struck oil in Kenya in 2012 – transforming AOI into a multibillion dollar company as the share price shot from under $2 to over $9 in the same year. AOI’s oil field discoveries are in the exact same region and geological system as SWE’s prospective blocks. Not to mention that SWE have the exact same JV partner as AOI – Tullow Oil. The Next Oil Rush believes SWE might just be the next AOI, and accordingly SWE is currently one of the largest holdings in our stock portfolio.

One prospect of many: 110.5 M barrels of oil independently assessed

SWE’s blocks sit in the Kilombero Basin in Tanzania, considered analogous to the Lokichar Basin – the home of all of AOI’s recent multibillion barrel oil discoveries. SWE’s Kilombero Basin has the same age rocks, has a similar depth to basement and the presence of the same trapping mechanisms as AOI’s Lokichar Basin. Recent seismic results indicate a number of leads in SWE’s Kilombero Basin that indicate a possible ‘string of pearls’ – yet another similarity with AOI’s Lokichar Basin. An independent assessment of SWE’s Kito Prospect estimates a net unrisked prospective resource allocated directly to SWE of up to 110.5 million barrels of oil .

That’s one tiny area in a very large basin – and potentially only the beginning for SWE. SWE’s seismic results have generated a pile of other additional leads, potentially larger in size than Kito . According to Analyst Dave Wall, these leads look are looking more and more like a ‘ String of Pearls ’ configuration – similar to that identified in the analogous Lokichar Basin – the home to AOI’s stunning success. Could this lead SWE to an oil strike similar to AOI’s multiple hits? The similarities between our favourite AOI and SWE continue to gather strength and it’s all too easy to connect the dots. In Mr Wall’s recent report, he goes on to comment on what might happen if a drill was successful at Kito – a potential price gain of $2.75 per share – from today’s levels, that’s almost a 900% gain:

![]()

Whilst SWE’s only obligations are to shoot more seismic, this prospect may be drilled within 12 months. We believe 2014 is set to be a cracker for SWE, and the work programme for Kilombero will continue to unveil the potential in the unexplored larger basins.

Multiple analysts continue to predict gains for SWE

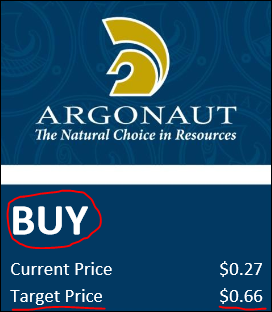

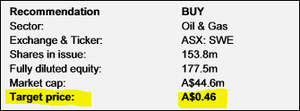

Multiple analysts continue to back SWE with impressive price targets in the near term. Argonaut’s Dave Wall has placed a price target of well over twice as much as where SWE is today.

Old Park Lane Analyst, Barney Gray has also predicted a significant gain from where SWE is today:

That’s comes on top of the past performance of SWE, which has been up over 150% since we first called it, almost a year ago:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Recent prospecting in Tanzania by Gazprom

Russia’s gas and energy giant, Gazprom , one of the world’s largest companies, capped at US$100 billion, is currently looking to Tanzania and evaluating prospects in the country – a sure sign that the region is heating up.

When big players like Gazprom show up on the scene, targeting the region as a high potential investment, it indicates Tanzania is looking more and more like a multi-billion dollar investment destination. Energy-pedia has reported that Gazprom International’s specialists will soon complete the examination of geologic and geophysical and other information to determine the prospects of further operation in Tanzania.

A positive result will see Gazprom’s first expansion in to East Africa, and with the increased demand from ‘energy-hungry’ Asia, the heavy-weight company will be in a perfect position to cosy-up to and export to the Indian market. SWE can enjoy the eyes of one of the world’s heavyweight producers in the region – reaping any benefits of Gazprom’s potential investment in infrastructure, which has the potential to de-risk SWE’s developments. And in what seems like icing on the cake, recent commentary in The Voice of Russia notes that “China alone intends to invest up to $10 billion in the Tanzanian economy in the next few years”.

We here at The Next Oil Rush reckon this will put positive pressure on the Tanzanian government to resolve issues relating to their licencing legislation by May ’14, in time for the fourth licencing round. And all agree that any infrastructure investment in the country will be a huge benefit to SWE, along with confirmation of commercial oil near-by in Kenya greatly de-risking SWE developments.

2013 achievements for SWE

SWE had a great 2013, with share price rises as high 150% since The Next Oil Rush called it. No doubt this had plently to do with SWE’s acheivements in 2013 , which were carried out on budget and in a safe and timely manner – much to the satisfaction of the Tanzanian regulatory body TPDC.

- Listed on the ASX in April 2013, with a capital raise of $11M AUD

- Cut down the work programme of the 12B Block from 700 line kms to 350 line kms

- Fast-tracked Tanzanian work programme with below budget completion.

- Completed the seismic programme in Tanzania – Five basins were surveyed in total, four are considered viable.

- Continued non-dilutory cash management – Raised $4.4MM at an 18% premium in November 2013.

And some of the more challenging tasks will continue in to 2014...

- Secure additional licences in Zambia – Bidding round in June 2013 but the process has suffered delays – this is still porgressing.

- Re-enter the tender process for the Eyasi Licence in Tanzania...

Eyasi: The storm in the teacup

The positive relationship between SWE and the Tanzanian Petroleum Development Company (TPDC) was challenged slightly, as the ASX announcement from SWE issued on Feb 14 th notes. The TPDC terminated negotiations for the Eyasi licence, as SWE’s joint bidding partner withdrew from the process. SWE’s bidding partner wished to focus their exploration on their other African interests – of which they have a significant workload ahead of them. The TPDC deemed this JV break up to be a breach of the tender guidelines – despite the joint bidding agreement which allowed either party to withdraw at any stage, with the remaining party assuming the whole of the interests in the licence. The TPDC followed up with a rather unpleasant press release . Whilst on the face of it disappointing for SWE, the important part of the press release was the final line – confirmation that the licence would be re-tendered. The licence was not automatically handed to anyone else.

The TPDC stated that the Procurement Act in Tanzania does not cater for non-joint ventures – so when SWE’s bidding partner pulled out there was a legal grey area for the TPDC with no obvious answer... So the TPDC decided to terminate negotiations. Although the Eyasi negotiations have at this stage terminated, we suspect that the likely outcome is that the Tanzanian Minister will call a meeting with the two sides in order to smooth things over, ahead of the re-tendering announced by TPDC. After all, why rock the boat with the likes of Russia and China eying off the region?? So despite the tough press release, it’s our interpretation that the authorities at the TPDC just want to be seen as firm in their conduct and processes. From what we understand, the relationship between the Government of Tanzania and SWE remains strong, and engagement continues. The Next Oil Rush suspects that this is all likely a storm in a teacup. Especially given SWE’s strong performance on their other Tanzanian licences, their social responsibility and their previous excellent working relationship with the TPDC. And to remind SWE investors again, we remain confident, maintaining SWE in our portfolio, as the company continues its exploration of the existing Tanzanian licences, uninterrupted.

So what’s next for SWE?

The team here at The Next Oil Rush have enjoyed following the steady advancement of SWE since we first reported on them in June 2013. The recent US$36M farm in deal was a significant milestone for the company – the Tanzanian assets will be explored at no cost to SWE investors – freeing up SWE to further progress with Tanzanian and other new potential assets. Analysts continue with lofty price target predictions, the most bullish being Energy Analyst Dave Wall at Argonaut predicting a doubling in share price. With estimates of multi-million barrels of oil confirmed in the Kito prospect, and positive results coming out of the Pangani Basin, we’re monitoring SWE’s short-term movements very closely. SWE continue to follow in the path of another of our favourites, AOI, who have made another two huge discoveries of oil in a similar region and with analogous geometrics to SWE’s Kilombero Basin. The next logical move for SWE was to decide to extend their exploration into Years Three and Four, which they have just confirmed. Add to all of this, the news that big guns from Russia and China are sniffing around East Africa, and we have more than enough evidence to support our continued investment and interest in SWE. We are watching these multiple price catalysts very closely, and here’s a snapshot of SWE’s upcoming activities:

- IPO of SOGTL (a 65% owned SWE subsidiary) and listing on the DSE (Tanzanian Stock Exchange) – Set for March ’14 with a capital raise of US$2-3MM

- Secure additional licences in Zambia – Process is advancing.

- Advance understanding of Pangani and 12B – Predominately through seismic.

- Advance at least one new country entry – Several licencing rounds anticipated in EARS region.

- Secure the Eyasi licence in Tanzania – Once the tender process re-opens.

- Drill one well into the Kilombero and Pangani basins by February 2016.

The Next Oil Rush believes that SWE’s strategy of building a portfolio of highly prospective oil blocks concentrated in East Africa will make them a logical acquisition target for a major oil company who want exposure to the region. And with the eyes of the likes of Russia and China in the region, we expect interest in the region to heat up. Remember that companies like SWE and AOI snapped up all the exciting East African permits in the land grab of 2012 – The Next Oil Rush will be watching developments with interest in this exciting region.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.