RLE Discover Cooper Basin Gas: Primed to Address East Coast Shortfall

Published 10-JUL-2015 10:37 A.M.

|

9 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A picture is worth a thousand words...

But we think this bears some explaining!

The flames you see above are gas flows from a pipe connected to Tamarama-1, one of Real Energy (ASX:RLE)’s maiden gas wells in Queensland’s prolific Cooper Basin.

Tamarama-1 hit significant gas pays last year and now RLE has completed flow testing, confirming its viability as a commercial well.

The company also applied the same treatment to its Queenscliff-1 well nearby, proving that both wells can pump out gas and have the near term potential to put steady revenue onto the company’s books.

The stage is now set for RLE to frack these wells and improve gas flow rates significantly. To what extent RLE is able to do this will likely decide how the company performs in terms of valuation and share price.

RLE’s two Cooper Basin tenements could hold a mean gross estimated petroleum in place resource of 10.2TCF of gas in a Basin Centred Gas play – and these wells could just be the tip of a very large iceberg.

We’ll know more when results come in.

RLE is fast positioning itself at the head of a resources race to work up significant Cooper Basin resources to feed the growing hunger of Australia’s eastern states for LNG – and the insatiable thirst for the stuff from Asia and beyond.

Massive export terminals are being built on the coast right now, big companies like Beach and Santos are drilling feverishly – someone has to supply the gas. We reckon RLE is in the right place, at the right time, doing the right things.

With its gas exploration programme set for expansion, the company has just signed a letter of intent with a major Australian manufacturing group that could lead to a 10 year gas supply agreement – so the market is already lining up to get its hands on RLE’s gas.

And above all else, RLE is the very last ASX-listed Cooper Basin junior with 100% ownership of all of its tenements.

Currently trading at a significant discount per acre to its peers in the Cooper Basin, the more it proves the gas credentials of its Cooper Basin play, the more of a target we reckon RLE will become for a takeover or a farm in by a much larger company. That could see it free carried on drill costs, but retain exposure to the upside on any discoveries.

With $5M cash in the bank, $4M in R&D funding expected soon, plus gas and deals flowing for RLE right now, there looks to be much more to come...

The Next Oil Rush first took a detailed look into RLE back in May 2014 – International Feeding Frenzy in Australia’s Hottest Shale Gas Region Puts Undervalued Junior on M&A Radar .

That has the full story of RLE’s ambitions to develop its two large tenements in Queensland’s prolific Cooper Basin into powerhouse gas projects – the company has a 100% owned land bank of 2.3 million net acres:

A geologists report prepared for RLE says the ATP927P and ATP917P tenements could hold mean gross estimated petroleum in place resource of 10.2TCF of gas.

RLE is targeting big resources in the short term – its goal is to prove up 3P (Proven, Probable and Possible) reserves in two main gas formations – the Toolachee and the Patchawarra, big layers that dominate the Cooper.

Based on exploration drill results to date, RLE have made a preliminary internal estimated 3C resource for the Tamara 1 & Queenscliff 1 wells in excess of 1 Tcf – significantly more than their pre drill estimate of 300 Bcf for 3 wells.

Looking back at RLE’s progress to date, the company has wasted no time finding out the potential of its acreage and we covered this exploration ramp up in Maiden Well Spudding Imminent for RLE’s Red Hot Cooper Basin Gas Play.

That maiden well, Tamarama-1, struck gas saturated formations and all the details on that well can be found in this article: Success for RLE on First Exploration Well – Follow up Drilling Coming Soon .

RLE then hit up a second well, Queenscliff-1, and we covered that in Takeover Trigger? RLE Hits Gas in its 2nd Cooper Basin Well.

In this article, we’re going to run you through the fine detail of the flow-testing programmes on both wells that are proving its commercial viability.

We’ll also be taking a look at that possible long term off-take agreement for RLE’s Cooper Basin gas – but before we get stuck into that, let’s take a look at the big picture...

The race to serve east coast gas demand

One of the key drivers of RLE’s potential is the growing demand for gas on Australia’s east coast, predicted to jump from around 1.9Bcf per day now to over 5.2Bcf per day by 2018.

LNG export facilities are being constructed which will allow Australia to boost its gas trade and its own domestic consumption of LNG. The most prominent are the six LNG ‘trains’ being constructed off the Port of Gladstone in Queensland:

It’s this coming surge in demand that has the Cooper Basin in a frenzy – if viable gas projects can be brought online there, they can pump gas through pipelines to the coast and find ready and willing customers, both in Australia and overseas.

RLE’s neighbour in the Cooper Beach Energy seems to be spudding wells left, right and centre, while Santos has made its seventh discovery in the Cooper, targeting the same gas formations as RLE.

So with a prospective resource of 10.2Tcf of gas under rapid development, RLE looks to be in the right place at the right time – and the market is starting to catch on:

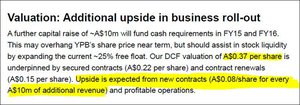

The report above is from Strachan Corporate, an Australian financial analysis firm that’s issued a report on RLE taking in all the latest developments.

Analyst Peter Strachan sums it all up here:

Strachan highlights that conventional gas flow rates recorded from zones within both the Tamarama and Queenscliff wells within ATP-927P demonstrate gas-in-place estimated by the company at of over 5.7Tcf, within a basin-centred accumulation.

Strachan also notes that RLE has $5M in the bank and $4M of R&D money due, so it’s well positioned to keep developing its Cooper Basin play and take the fullest advantage of the growing demand from Australia’s east coast for its resources.

Now, as we all know, analyst reports are just one piece of the puzzle and shouldn’t be relied on solely when making investment decisions.

But let’s dig into the detail a bit more, and see the things RLE is doing to turn so many heads...

Flow testing confirms Tamarama-1 gas

RLE has completed flow tests on both Tamarama-1 and Queenscliff-1 and found that both wells flow gas to surface.

The company says this gas flow proves the existence of Basin Centred Gas throughout the main block of ATP-927P.

At the Tamarama-1 well, the lower Toolachee Formation-upper Patchawarra Formation was perforated and flow tested. On the clean up, the well flowed gas at an unstimulated initial rate of approximately 0.46mmscfd through a 16/64” choke, with flowing pressure of 327psi.

In other words, gas flowed, and lots of it!

Gas samples were obtained from this the lower Toolachee Formation-upper Patchawarra Formation interval and laboratory analysis indicates the gas contains approximately 10% CO 2 and no H 2 S – so its clean stuff ripe for commercial use.

Tamarama-1’s upper Patchawarra Formation interval was perforated and flow tested and flowed at a relatively stable rate of approximately 0.33 mmscfd through a 12/64” choke, with flowing pressure of approximately 436 psi.

Gas samples were also obtained from this section and laboratory analysis of the gas sample indicates the gas contains approximately 12% CO 2 and no H 2 S.

Interestingly, the lower Patchawarra Formation interval was perforated, but no formation fluids or gas was recovered to surface. So it looks as though RLE may have to some fracking to do at a later date to get it moving – more on that in a minute...

Over at Queenscliff-1 it was a similar story.

The well was completed and perforated over the lower Toolachee Formation and upper Patchawarra Formation sections, with both flowing at good rates.

Gas samples were also obtained and laboratory analysis indicates approximately 14% CO 2 , which was in line with expectations.

RLE’s next steps in the Cooper

The flow testing at Tamarama-1 and Queenscliff-1 demonstrate that not only does RLE have a lot of gas, it also shows it could very well be sitting on a Basin Centred Gas play, extending across its acreage.

The next steps for the company are clear – keep developing these wells and drill more.

RLE is already noting that it may need to frack Tamarama-1 to get to the deep gases there, and from what we can gather, there may be a fracking programme announced soon to get the ball rolling.

It would make sense – RLE is on a roll, with gas flowing from two wells and a Basin Centred Gas play in the mix. If a fracking programme unlocks even more gas for RLE, then the company could get on even more of a roll. The more it proves up the quantity of gas on its acreage, the most attractive the company would look to a farm in partner.

Especially now that it’s got its first potential customer lined up...

10 years of gas supply in the works for RLE

Incitec Pivot, an Australian multinational manufacturing company, has signed a non-binding LOI with RLE to bag up to 110PJ of gas over a 10-year period for its operations.

Discussions are ongoing and working toward securing a binding gas supply agreement that will give RLE its first customer for Cooper Basin gas.

At The Next Oil Rush , we see this as the final piece of the puzzle for RLE’s current run. Although do bear in mind that nothing is guaranteed.

It’s done the hard yards by drilling two exploration wells that hit good gas shows. It’s now tested those wells and found they are commercially viable.

Now it’s got a customer.

Depending on the deal struck, RLE could receive a significant pre-payment for gas and possibly an equity tie-up to fund further development.

All of this makes RLE an even juicier target for takeovers and farm ins – remember, it’s the very last Cooper Basin junior to retain 100% control of its tenements.

That may not last...

Next for RLE

From what we’re hearing RLE is in the process of certifying its resources in the Cooper after its flow testing showed its wells are commercially viable. If that comes through soon, it could be a significant catalyst for the company.

And the timing would be sweet – it’s gearing up to embark on a fracking campaign to expand the two wells it’s already spudded, Tamarama-1 and Queenscliff-1, and there could be more drill bits turning the earth to expand its gas footprint soon.

There is surging demand for east coast gas in Australia and RLE finds itself in the right place at the right time, still with 100% control of its tenements – a takeover or a farm in could therefore be on the horizon.

RLE’s future success is far from guaranteed and significant challenges are always part and parcel of gas exploration, as most readers of The Next Oil Rush will know.

Regardless, up ahead we see a lot of big events for RLE as it develops its Cooper Basin tenements from promising leads to commercial revenue producers. We’ll be watching...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.