Oil Discovery? 88E’s Lab Results Reveal More...

Readers who have been with us for a few years will know we have been following 88 Energy (ASX:88E | OTC: EEENF) for all of its drill campaigns in Alaska (there have been five over 6 years).

Today 88E released an announcement on additional lab results from its most recent drilling campaign. This was definitely 88E’s best ever drilling outcome to date, despite the operational issues that occurred during drilling.

Today 88E also finalised the costs associated with drilling, with its net share coming in at US$9M - the vendors were willing to accept partial payment via 345M shares at $0.025, with the balance to be paid in cash.

This leaves 88E with a strong cash position ahead of another drilling event next Alaskan winter.

After we introduced our selective investment portfolio model in 2019, we wrote about our taking a position in 88E in July 2020 at 0.5c with a plan to hold for the Merlin-1 drilling campaign that was 9 months away.

We topped up again in September 2020 at 0.6c in anticipation of the drilling that was still 6 months away.

As always with early stage exploration investments, our plan was to invest very early, patiently hold until before the drill result and free carry, take some profit, then hold a decent sized position into the result.

We stuck to the plan. There was a good price run up to the drill result, including an outrageous two days where the share price traded in a range of 5.2c to 9.6c. While tempting to have sold out during the price spike, we always stick to our plan and held a decent position into the Merlin-1 result which had strong positives but also some very frustrating technical issues.

To anyone out there who was trading 88E in the couple of days before the drill result, congratulations to those who bought low and sold high, and condolences to those that bought high and sold low - we aren’t traders and buying and selling in the days before drill results is not for us... and we definitely wouldn’t buy days before drill to hold for the result (we will try to make this clearer to new readers in all of our future exploration commentary).

Despite the operational issues and not “officially” being called a “discovery” by the company, the market seems to have priced 88E with the Merlin-1 result at around 2.5c per share, which is over 200% up from the average price of 0.8c it was trading in the 9 months pre drill during when we invested.

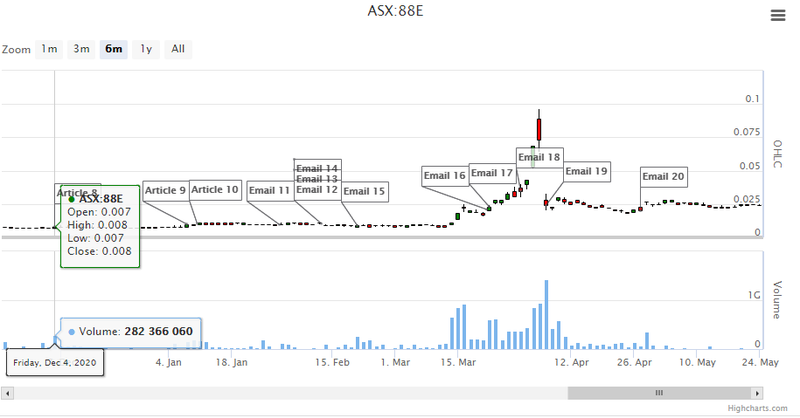

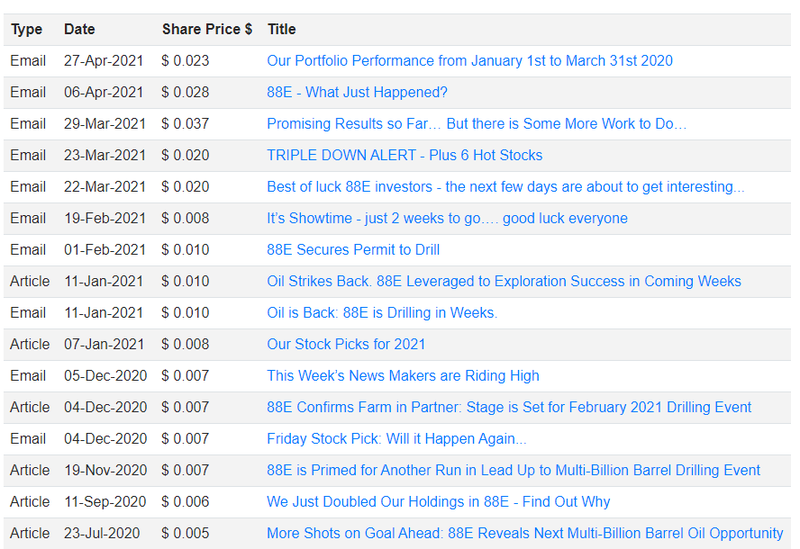

Here is the timeline of our commentary for 88E over the last 12 months:

Merlin-1 was “almost’ a discovery which was very encouraging - so close yet so far but us (and the market) are waiting for more investigation into what 88E actually has down there.

Drilling has to stop while we wait for the Alaskan winter again (so the drill rigs can be shipped to drill site using ice roads) but in the meantime we will be watching for more news from the Merlin-1 lab results and the next moves 88E make in preparation for the next drilling season.

Here is what we have found out in recent weeks:

Since the drilling of Merlin-1, 88E has been running a bunch of lab tests on the samples it could collect, with the aim to get as much data as it can about what was found.

The interpretation of data collected indicates that Merlin-1 hit several potential pay zones - however operational issues prevented hydrocarbon samples from the two most prospective zones.

Lab results from April:

- Sidewall cores confirmed the presence of oil that was previously observed in drill cuttings.

- Initial mapping of additional prospective zones encountered in Merlin-1 is highly encouraging.

Here is what we know from today’s announcement:

Today 88E released two more batches of lab results:

‘Encouraging evidence’ of oil in down hole samples.

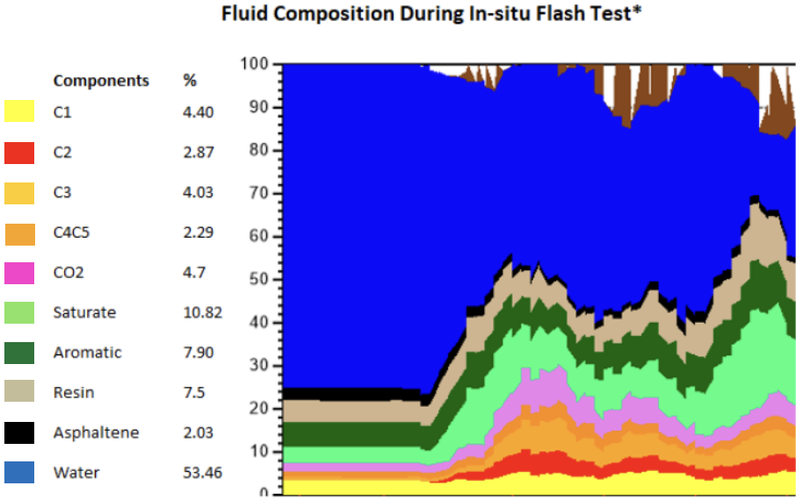

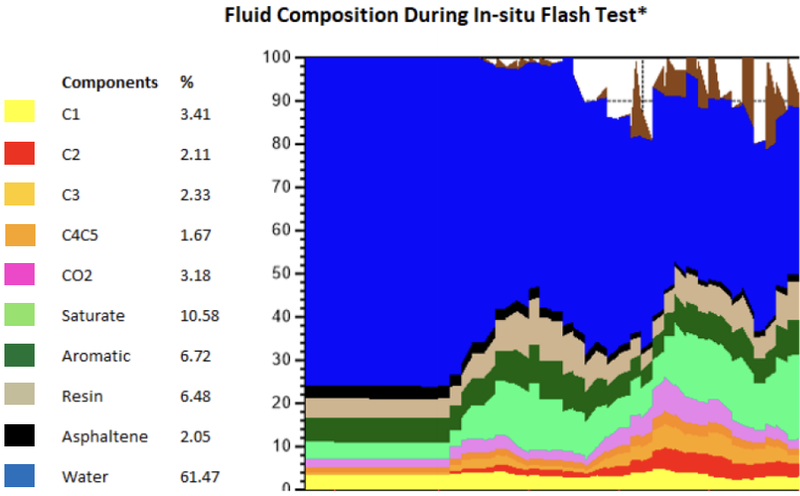

Today 88E released its ‘flash test’ results. A flash test is where you decrease the pressure in sample chambers to see changes to the quantum and composition of fluids at closer to normal surface conditions.

Here is what 88E found when it ran flash tests on Merlin-1 samples:

Percentages of hydrocarbon reach up to ~ 70%, which would be indicative of a discovery... but these are qualitative results, and the margin of error is uncertain.

So further investigation is required to validate actual % of hydrocarbon in samples.

In addition, the ratios of hydrocarbon indicated that the liquid present is highly likely to be oil rather than condensate - this is good from a thermal maturity perspective regionally.

The final percentages of hydrocarbon vs water in the samples will be known in the coming weeks.

What is clear is that the presence of oil is highly encouraging given the two most prospective horizons were not able to be sampled due to operational issues during drilling.

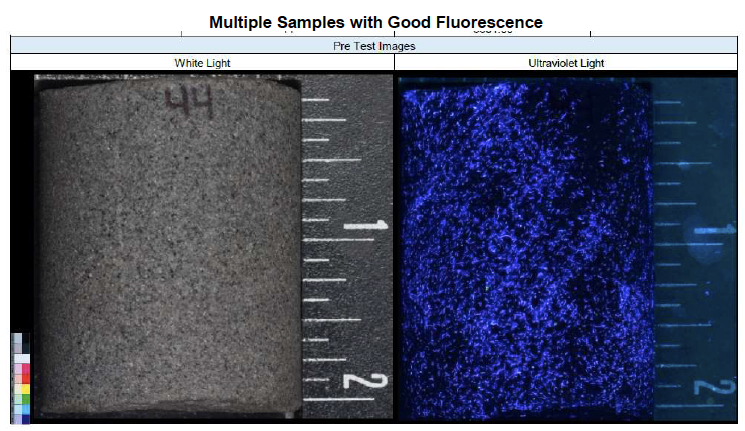

More fluorescence recorded at previously unidentified depths.

When analysing core samples, white light and UV photography is undertaken - if oil is present, then fluorescence will be evident under UV light.

We got an early look at the fluorescence observed during drilling on 29th March and wrote about it here.

Today 88E posted images of fluorescence observed in the lab - you can see them below.

But note that 18 of the most prospective samples were not included in those sent for analysis - as these have been set aside for special analysis related to any oil extracted.

Observations in the lab of sidewall cores confirms previous analyses, however there are several additional horizons that have shown the evidence of oil that were not previously identified. These horizons will be the focus of further work.

News still to come from Merlin-1:

There are a few more lab results still to come through from Merlin-1:

- Nuclear magnetic resonance imagery: to determine the ratios of free oil and water present, as well as porosity.

- Dean Stark tests: extracts the oil and the water from the sample to determine saturations.

- Final petrophysical interpretation: The results of all tests to date will then be integrated into a final petrophysical interpretation.

- Mapping of prospective pay zones: During Merlin-1 several prospective zones were encountered that had previously been unmapped.

The Merlin-1 prospective zones exhibited good shows with potential for pay - subject to the results from the testing above.

An initial mapping exercise has indicated that these zones may be of similar magnitude in terms of volumetric range as the originally targeted primary zones...

Further work is required to confirm this, but the early work so far is encouraging.

Here is our past commentary on 88E:

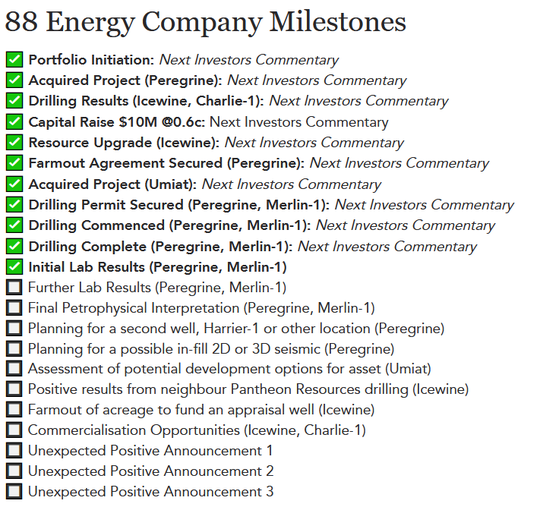

[NEW] Here are 88E’s company milestones as we see them

This is a new feature we are working on and will soon be rolled out to all portfolio companies, please reply to this email with any feedback/suggestions.

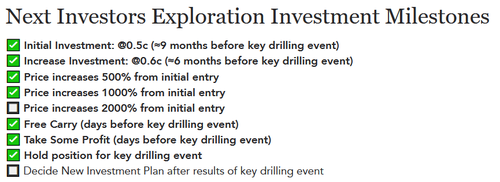

[NEW] Here is our 88E investment strategy

Another new feature we will soon be rolling out to all portfolio company pages. Again, please reply to this email with any feedback/suggestions.

These “exploration” investment milestones represent our general strategy for early exploration companies with key drilling events in the future (like PUR, BPM, IVZ, TMR)

"Expected Company Milestones" are based on the company's publicly available execution plan and some assumptions made by our team on potential announcements that should de-risk the investment. “Our investment milestones” show our current long-term investment plan. Early stage investments are risky and there is no guarantee that the expected events will occur. The lists are not in sequential order.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.