Next Door to Santos: RLE is Cashed Up and Ready to Frac

Published 16-NOV-2015 10:35 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Cooper Basin is home to some serious oil and gas players.

Think Senex, AGL, Drillsearch and the big one... the $4.5BN market capped Santos.

Next door to Santos’s majority owned and operated Cooper Basin joint venture is a much smaller onshore player, but one with significant upside potential.

We’re talking about Real Energy (ASX:RLE) and its four petroleum exploration permits covering a total area of 9,523km 2 in its Windorah gas project in ATP 927P.

That’s a lot of ground in a region next to where east coast gas prices have doubled since 2011.

RLE’s first two exploration wells identified a tight gas resource underlying one third of its license holdings, with upcoming appraisal programmes set to define its commercial viability.

This includes a well stimulation programme encompassing staged fracturing at its Windorah Gas Project.

It is a project that will be undertaken by the $33.47BN Haliburton after RLE recently signed a contract with them.

Haliburton has already performed the fracture stimulation services in the wells located in the area next door to RLE, so it makes sense for RLE to also use the oil and gas giant as a contractor for the fracturing work.

The expectations of this stimulation programme are high given the location and could be a catalyst for a major re-rate.

Of course this is no guarantee – RLE is a junior, speculative energy stock and there is also a chance the programme does not encounter what RLE are hoping for.

As well as the work undertaken to date and Cooper Basin nearology, further supporting RLE’s plans is a nice government rebate.

It’s always a bonus when you receive money from the government.

For most people it’s a few hundred bucks, for some a few thousand, but when you’re a small gas explorer in the Cooper Basin and you receive an approximate amount of $5.9M, the sun is certainly shining down on you.

That’s what happened to RLE recently, when the Australian Taxation Office delivered a $5.9M tax incentive for the year ending June 2015.

Add this money to the recent share placement of $2.6M and RLE is in a significantly strengthened cash balance position to progress the commercialisation programme of its Windorah Gas Project, which is right next door to a majority owned Santos operated joint venture and close to RLE’s wells targeting the same formations.

RLE is aiming to achieve a commercial flow that underpins its gas development and in light of that we continue our coverage of...

For those unfamiliar with Real Energy (ASX:RLE), the Company has come a long way in a short time.

When they first caught our attention in the article International Feeding Frenzy in Australia’s Hottest Shale Gas Region Puts Undervalued Junior on M&A Radar , its goal was to develop a shale gas asset of 2 tcf and bring oil and gas plays on its three vast holdings in Queensland’s Cooper and Eromanga Basins into production.

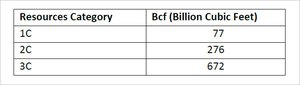

Today, whilst certified reserves remain to be defined, contingent resources of 276 Billion Cubic Feet (BCF) gas classified as 2C and 672BCF classified as 3C have been identified .

See the table below for a snapshot of what RLE has under its control right now:

The licenses are estimated to potentially host undiscovered ‘prospective’ resources of 18,261BCF gas.

Here’s a summary of where RLE is at now:

- RLE has made two discoveries in the Windorah Trough;

- RLE is pursuing a basin-centred gas play – a lower-risk and higher return style resource compared to a shale play;

- RLE recently upgraded its gas resources – Independently Estimated Total Mean Gas in place increased more than 141% to 13.76 TCF and maiden 3C Contingent Gas Resources of 672BcF;

- RLE recently signed LOI with Incitec Pivot for 10-year 110Pj Gas Sale agreement and $35M in project funding.

As you can see RLE has made great strides and is firming its position amongst bigger players in the basin.

Wise Owl Analyst Tim Morris, recently ran the ruler over RLE in a Research Report . Morris placed a price target of $0.52 on the company – that would be a gain of over 350% from today’s levels:

At the same time, it would be unwise to make investments based only on these kinds of reports alone – professional advice should be sought if considering RLE for your portfolio.

Morris went on to say that RLE offers speculative exposure to east coast gas demand (see below for more information) and reiterated that its planned well stimulation activities could be a major catalyst.

From this, RLE management estimates that initial flow rates of 2-3mmcf/day are to be the threshold required to expedite further commercial development of the field. This would allow the company to execute its gas sales agreement, which it is currently set up to do with Incitec (more on that later).

Howdy neighbour

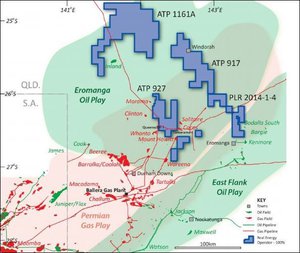

We mentioned earlier that RLE’s Windorah Gas Project was right next door to the majority owned Santos JV with Beach Energy and Origin, which is targeting the same formations.

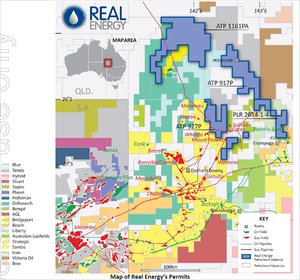

If you have a look at the map below, you can see that RLE is represented by the blue shading and Santos by the yellow.

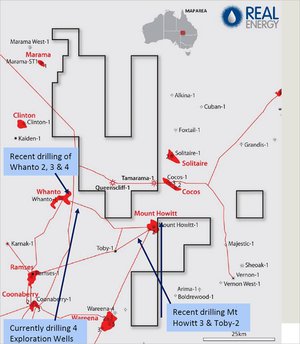

Santos has already drilled 16 wells in the adjoining blocks and every well has been cased as a producer or future gas producer.

Santos is now undertaking drilling in its third well of its current campaign and has another two to go.

In fact this third well to be drilled by Santos will be cased and suspended following intersection of gas pay which exceeded pre-drill estimates.

This outcome represents the third new field discovery by Santos from their Windorah near‐field exploration programme.

And by its very position it has positive ramifications for RLE.

RLE believes that given the location of its wells which it intends to develop into a major gas project in 2016, and its proximity to Santos’s Windorah play, it could be in line for a major re-rate.

At the same time, oil and gas exploration can be risky – and just because RLE is next door to Santos does not guarantee RLE’s success, so caution should be applied if considering RLE for your portfolio.

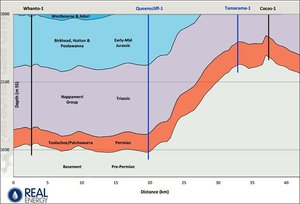

Here’s the cross section between Santos and RLE just to give you an indication of what RLE is looking at – Whanto-1 and Cocos-1 (the black lines) are Santos wells, and the blue lines are RLE’s previous successful well locations:

You can see this from a bird’s eye view perspective here – it’s almost as if Santos are circling in on RLE’s ground by the looks of Santos’ well locations:

Time will tell if RLE is playing in a friendly neighbourhood and we’ll be watching closely as the drill stimulation programmes in Tamarama take further shape.

But what we can deduce is that Santos seems to like the area judging by its drilling so far.

Time for Tamarama

RLE’s two gas discoveries so far are from the Tamarama-1 and Queenscliff-1 wells.

They are the first wells drilled to test the basin-centred gas play in Windorah Trough outside any mapped structural closure.

It has opened up the Windorah Trough to the significant potential of a continuous basin-centred gas play.

Tamarama and Queenscliff have been kind to RLE.

As proof of concept Wells, both have tested free flows of gas to surface and successfully de-risked RLE’s basin centred gas play in the 927P area.

Initially, exploration uncovered unstimulated flow rates in the order of 0.4mmcf/day and 0.2mmcf/day for Tamarama-1 and Queenscliff-1 respectively.

Based on intelligence from the 300-400 wells fracture stimulated in the Cooper Basin to date, RLE is targeting flow rate benefits in the order of tenfold.

Interestingly, despite its location, this area is considered to be underexplored even though there are a number of gas and oil fields and discoveries in close proximity to this permit.

Seismic coverage is sparse and there have been no wells drilled within the permit area – RLE are looking to change this dramatically. Queenscliff-1 and Tamarama-1 reversed this trend, and RLE are planning on more.

According to RLE managing director Scott Brown, the initial results at Tamarama and Queenscliff indicate that Real Energy has significant gas accumulation in its ATP 927P acreage in the form of continuous basin centred gas and these discoveries helped to open up the Eastern side of ATP927P Main block, which is now interpreted to also feature the play.

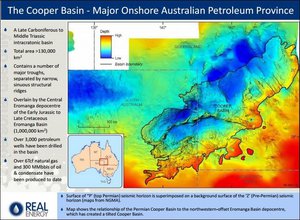

It seems the Cooper Basin in general is a pretty good place to be, and it’s no wonder so many large companies are actively exploring the basin for resources – it is a major onshore Australian Petroleum Province:

Now take a look at the next map, which indicates RLE’s Permits, surrounding fields and infrastructure.

That’s a fair slice of the pie in what is known as a region with some of the most important on-shore petroleum and natural gas deposits in Australia.

8.1 million reasons to smile

In late October RLE announced that it had successfully raised $2.6M in new capital via a private placement to investment funds, professional and sophisticated investors.

In what was great news for RLE, the placement was significantly oversubscribed.

Drilling down to the details of the deal, RLE issued 20,800,000 ordinary class shares at $0.125 per share, raising $2.6M (before costs) to allow the company to continue its exploration and evaluation activities.

The placement shares represent circa 11.3% of the existing issue capital.

Add this to the R&D tax incentive of $5.9M and the money holds the company in good stead to further develop its well simulation and fracking programme at Tamarama.

It also provides 12 months of funding without necessarily having to worry about where the next dollar may come from.

For a junior player working next door to a few giants that’s big win.

In fact, the cash position of the company is quite strong. It has recorded a consolidated profit of $3,971,000 in the 2015 financial year , with $3.7 million cash at bank.

Speaking of fracking

RLE recently confirmed that it has found a drilling contractor for a long-awaited hydraulic fracturing campaign for a frac job that will take place early next year.

Upon release of its quarterly results in October, RLE said that it had completed a tender to a well stimulation services company, with it in the process of awarding the contract.

That company is Haliburton and it is seeking to get cracking on a well stimulation of the Queenscliff-1 and Tamarama-1 wells, which at this stage is being designed as a five-stage frac job.

Both the wells tap the prolific Toolachee and Patchawarra formations, which have been tapped and fracked by explorers in the past.

RLE is currently studying cuttings from both wells for permeability and porosity in order to further refine the frac program.

Looking forward

Tamarama-1 and Queenscliff-1 sit in the ATP927P permit, which is targeting the Windorah Trough in the Cooper Basin.

According to independent analysis, the contingent resource of the permit ranges from 77 billion cubic feet of gas on the more probable 1C category to 672Bcf on the 3C category.

Prospectively, the permit is thought to hold a recoverable resource of 5.4 trillion cubic feet of gas. The permit also has an in-place figure of 13.7Tcf, which was up 141% on previous estimates.

However, the estimates from DeGolyer and MacNaughton only take into account the current drilling on the permit.

The fracture stimulation of both Queenscliff-1 and Tamarama-1, and flow rates following the stimulation, will change this and should allow a firmer estimate of ultimate recoveries and flow rates.

This stimulation will also show potential gas offtake partner Incitec Pivot that gas can be reliably produced from the permit.

Chemical giant Incitec signed a non-binding Letter of Intent with RLE in May 2015 for an indicative 10-year gas sale agreement of approximately 110 PJ of gas worth about $800M.

Under the terms of the LOI, Incitec is to provide funding to the tune of $35M towards the development of the project.

The deal isn’t sealed as yet, but gives RLE something to aim for as it goes about firming up its resource.

Caution is advised here, as the sale agreement is not 100% locked in, and revenues are not guaranteed for the company – RLE is a speculative stock.

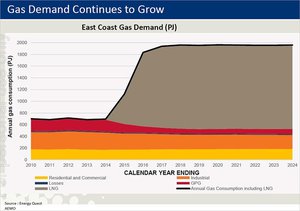

The LOI was signed by Incitec Pivot in a background where domestic gas supply on the east coast is expected to tighten considerably as a result of the ramp-up of LNG projects on the Queensland coast.

Energy Quest is forecasting a shortfall by 2019 of 133 petajoules of gas along Australia’s east coast.

In fact forecasts suggest that LNG gas demand will dramatically outstrip the domestic gas market, while LNG operators continue to struggle to meet contracted volumes.

In the face of this, gas prices are expected to increase substantially from current levels and the CAPEX reductions from the industry will make the domestic problem worse.

East coast gas demand profile

The Cooper Basin is thus well placed to meet the looming shortfall.

This is why industrial players like Incitec Pivot have sought to tie down deals with emerging oil and gas explorers – like RLE – in both proven and frontier basins for supply.

These deals will often be for a set price, giving the industrial player more comfort on the deal in an environment where gas prices are expected to rise despite a decline in oil prices.

For explorers like RLE, it provides a more immediate path to commercialisation before exploration work has been done, giving it certainty.

The final word

With money in the bank and 12 months of consolidated exploration to come, RLE remains focused on exploring its Cooper Basin permits, which have now been proven to host significant gas resources, following the successful drilling and testing of the Tamarama-1 and Queenscliff-1 wells.

Given its location and neighbours, RLE is well placed to take full advantage of anticipated continuing demand for gas in the east coast of Australia.

It is here that the Cooper Basin is well served by infrastructure including gas pipelines connecting to capital cities and LNG export facilities.

RLE’s priority is now the well stimulation activities, including the five stage frac program to confirm the commercial viability of the resources.

RLE is confident that this programme will further prove the gas saturated Patchawarra and Toolachee formations in ATP927P Main Block could be commercially produced and will push the Company towards commercialisation – and hopefully realising some significant unlocked value held in its substantial acreage...

Keep reading the Next Oil Rush to follow this one!

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.