More Shots on Goal Ahead: 88E ASX Reveals Next Multi-Billion Barrel Oil Opportunity

88 Energy Ltd (AIM:88E | ASX:88E) is continuing its high reward strategy towards making a multi billion barrel oil discovery in Alaska.

EDITOR'S NOTE:

We are long term investors in 88E, and are looking for outsized returns of a similar scale to our other recent oil and gas pick, Elixir Energy (ASX: EXR).

We doubled our position in EXR in May 2020 when the stock was trading at 2.4c. Since then, the stock has been a high as 18c — that's a 650% gain.

We still see similar long term potential in 88E. This article will outline all the reasons why we invested in the company and continue to hold.

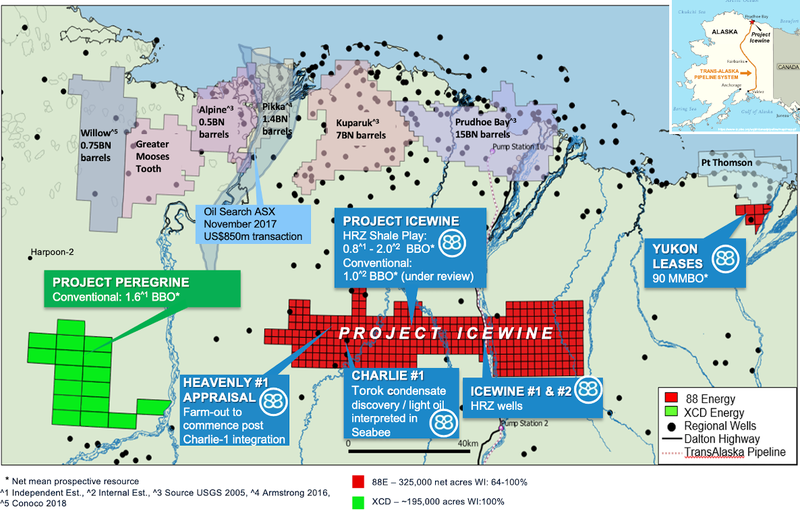

88E recently doubled down on its North Slope ambitions by acquiring the previously ASX listed XCD Energy in an off market takeover.

XCD held Project Peregrine, which spans 195,000 acres of prime exploration ground on the Alaskan North Slope and it’s now 100% owned by 88E.

The project adds to 88E’s existing asset portfolio of net 325,000 acres of ground at Project Icewine and the Yukon Leases, giving 88E a dominant and enviable land position in one of the oiliest places on Earth.

88E now has net half a million acres of exploration ground across multiple world class assets with multi-billion barrel discovery potential on the North Slope.

88E’s latest addition Project Peregrine packs a punch, with an independent conventional mean prospective resource of 1.6 billion barrels of oil.

To the north and south of Project Peregrine sit major oil discoveries.

Willow, located to the north of Peregrine, is a 0.75 billion barrel discovery made by ConocoPhillips (NYSE: COP) — the $44 billion goliath on the North Slope.

A recent well drilled by Conoco, a mere 15 kilometres from Project Peregrine, encountered hydrocarbons at its Harpoon prospect - which is interpreted to be directly on trend and analogous to the Harrier prospect at Peregrine.

To the South of Project Peregrine sits Umiat, a recent Brookian oil discovery with over a billion barrels of oil in place.

88E has just revealed that it intends to drill two, low cost wells to explore Project Peregrine in early 2021.

These wells will be testing the resource potential of Peregrine, with the aim of unlocking the next major oil discovery on the North Slope.

To that end, it won’t be funding it on its own.

As 88E currently holds 100% of the project, it intends to do a farm out deal with other partners that want exposure to near term upside.

Given the 1 billion barrel plus potential on offer, the upside here is substantial, especially given both wells combined are expected to cost just ~US$15 million.

88E’s Project Peregrine would clearly be an attractive, low cost opportunity to a farminee looking for immediate leverage to a large oil discovery.

We have run the maths on similar recent deals in the energy space – and a quick scan of the ASX shows a recent deal for A$6 million on an opportunity that has 100x less in ground value than 88E’s billion barrel+ opportunity.

This means 88E can retain a substantial working interest whilst still providing excellent leverage to any incoming party, which should mean a deal is pretty likely.

Meanwhile, there remains significant opportunity and value at Project Icewine.

Despite a negative market overreaction to early results in April 2020, which were released amid ‘peak fear’ from COVID-19 and a freakishly low oil price, further investigations from the Charlie-1 well at Project Icewine have been promising.

The company has just released sidewall core analysis using two different techniques, and both are demonstrating that the primary targets – the Seabee and Torok Formations are full of oil.

Reservoir modelling of stimulation of the formations is now underway to understand flow potential.

Given that we know the reservoir is similar to Patheon Resources plc (AIM: PANR)’s Alkaid well, which flowed at 100 barrels per day from only a 6ft interval in a vertical well, confidence is high that a decent flow rate can be achieved.

So, expect more lab data and news to come from Charlie-1.

Armed with more data, 88E has identified a new preferred well location to test the conventional targets at Project Icewine — an ‘oilier’ location with better reservoir quality.

The company will be shopping the project around to farm in partners once again and have another crack at striking flowing hydrocarbons.

Yes, oil explorers are risky investments, and can be binary outcomes, but with multiple billion barrel oil discoveries made on the North Slope to date, 88E is intent on finding the next one. If it can do that, the outcome would be an outsized return.

All in all, major upcoming activity to watch out for includes the farm-out of Project Peregrine in the lead up to the drilling of two wells in early 2021, plus the integration of new results from the Charlie-1 well, and reinvigoration of the farm out process for Project Icewine.

The oil price has recovered, the market has returned, and 88E is ready for a highly active 6-12 months.

Look out for farm in partners with an appetite for exposure to near term upside.

Share price: 0.25 p / A$0.005

Market capitalisation: £24.4M / A$43.8M

Cash position: £4 million / A$7.2 million (at 30 June, includes XCD’s cash balance)

Alaska North Slope: Multiple world class assets

88 Energy is now the controlling owner / operator on multiple world class exploration/appraisal projects across ~520,000 net acres on the Alaska Central North Slope.

Before we dig into the details here’s a quick summary of the highlights of 88E’s asset package:

Project Peregrine: Recent addition from XCD – drilling planned early 2021

- Adds ~195,000 highly prospective exploration acres in the National Petroleum Reserve-Alaska (NPRA) region of the North Slope of Alaska.

- Large, 1.6 billion barrel prospective resource, located on trend to recent discoveries.

- Conoco’s Willow discovery to north, and Umiat to the south show the project is in the right region.

- Conoco’s Harpoon-1 well encountered hydrocarbons just 15km away from Project Peregrine.

- Permitting commenced and farm-out discussions underway for drilling of two wells in 1H2021.

- 88E to hunt for a farm in partner looking for exposure to near term discovery potential.

Project Icewine Conventional: Charlie-1 condensate discovery / further farm-out to commence

- Now de-risked by three wells: Icewine#1, Icewine#2 and Charlie#1.

- Charlie-1 - Condensate discovery in Torok formation as announced April 2020, oil pay interpreted in Seabee formation.

- Excellent oil saturations indicated by core analysis in Seabee and Torok in Charlie-1.

- Preferred drilling location away from Charlie-1 – more oily, with better reservoir quality.

- Results from Charlie-1 analysis of HRZ liquids rich resource play expected to facilitate farm-out process.

- Farm-out process to be relaunched and strengthened with integration of Charlie-1 data.

Yukon Leases: Existing Discovery – interpretation complete on 3D seismic (2018)

- ~90 million barrels mean prospective oil resource (100% 88E).

- Negotiations underway with nearby resource owners to aggregate and farm-out.

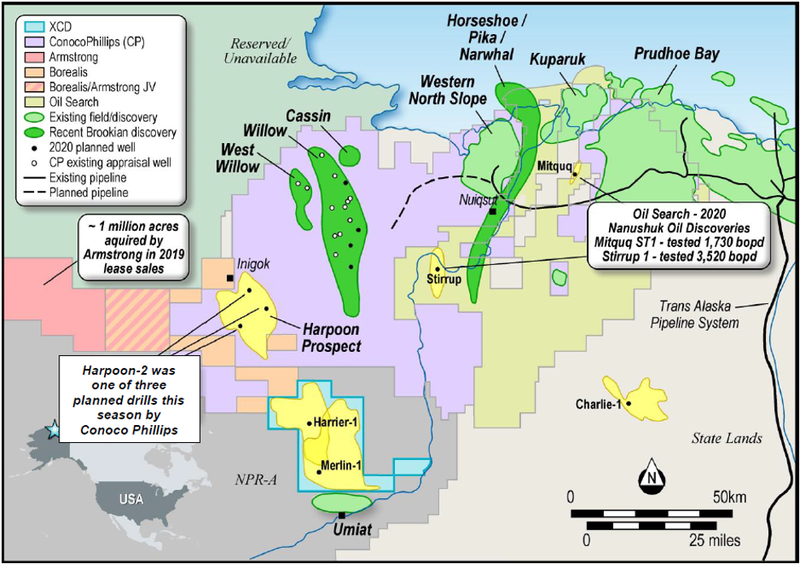

Project Peregrine – 88E’s latest acquisition

There are three onshore prospects already identified at Peregrine — Merlin (Nanushuk), Harrier (Nanushuk), Harrier Deep (Torok).

Combined, these prospects have a mean unrisked recoverable prospective resource of 1.6 billion barrels of oil, as per an independent report generated by ERC Equipoise (you can read further detailed coverage of Project Peregrine from our January 2020 coverage of XCD here).

The Peregrine Project lies directly to the north of the Umiat oil accumulation that’s estimated to have greater than 1.0 billion barrels of oil in place.

The leases are also just 35 kilometres south of ConocoPhillips’ 450–800 MMBOE Willow discovery.

The Willow oil discovery (0.75BN barrels) is considered a direct analogy to the Merlin prospect.

Meanwhile in its first quarter earnings call for 2020, Conoco confirmed that it encountered hydrocarbons at its Harpoon prospect, which is interpreted to be directly on trend and analogous to the Harrier prospect at Peregrine.

The Harpoon prospect sits just 15km north west of 88E’s Project Peregrine lease position.

88E has identified two primary prospects — Merlin and Harrier that total over 1 billion barrels, that it is intent on drilling in early 2021.

We reiterate here that both prospects are located on trend to existing recent discoveries, with Harrier recently being de-risked by evidence of hydrocarbons at Conoco’s Harpoon-2 well.

88E will be undertaking low cost options for well drilling, estimating that two wells are expected to cost US$15M.

The Harrier 1 and Merlin 1 exploration wells will be drilled into the shallow Nanushuk reservoir using a lightweight workover rig that can be transported off-road in pieces by tundra-safe track vehicles, versus a heavier rotary rig which would require an ice road.

Existing gravel roads and snow trails will be used to conduct the entire exploration program.

Given both prospects are in the Nanushuk formation, the wells will only require drilling to about 5,000 feet to fully test, whereas a third prospect in the Peregrine block, Harrier Deep, has a Torok objective at about 10,000 feet.

As a comparison, Project Icewine’s primary targets are deeper (more on Icewine further down the page), and consequently more expensive to drill test.

Leverage to near term discovery – 100x more than recent ASX deal highlights upside

Now we have established the size of the prize at Peregrine, let’s look at how 88E are going to be able to attract farm in partners.

Some simple maths presents what we think is a very compelling opportunity on the 1 billion barrel plus opportunity presented at Peregrine.

Running the numbers, we think 88E’s farm in potential should be highly attractive to a listed entity with cash to invest in near term upside.

A scan of recent ASX deals shows that companies are prepared to invest similar amounts of cash for much less upside.

Take for example Talon Petroleum (ASX: TPD)’s recent entry into the Perth Basin via a transaction with Strike Energy (ASX: STX).

STX farmed out 45% of its Walyering (EP447) project to TPD for A$6 million.

In effect, TPD is paying A$6 million for 45% of the project.

Walyering is a discovered conventional gas resource of ~100 bcf of gas.

Applying a US$4/bcf gas price, implies a value of US$400 million in the ground.

Compare that to 88E’s offer:

At the Harrier and Merlin prospects: 1.06 billion barrels — let’s ascribe a value of US$45 / barrel of oil, gets you to $48 billion of potential in ground value.

That’s >100x more leverage to play with.

Whilst these are not “apples for apples” comparisons and a number of general assumptions have been made, it is clear that the leverage on offer on 88E’s project is far superior.

Given this sheer upside on offer, coupled with 88E’s years of expertise in Alaska, we would think the offer would be highly attractive to a partner with capital to deploy on the generation of near term shareholder returns.

Project Icewine de-risked – more results to come

At the company’s existing Project Icewine, you may recall that the Charlie-1 well didn’t get the oil flows anticipated, as announced earlier this year.

Charlie-1 initial results were released at the worst possible time, with the COVID-19 pandemic generating peak fear in the market. Add to that an oil price crash (it has since recovered), plus a slightly confusing initial result. The combination of the above spooked the market, with 88E’s share price being the victim.

In a brutal response, the stock was heavily sold off by investors. In light of subsequent results from the well, this now looks to us to have been a severe overreaction.

Charlie-1 was not a failure — it did encounter hydrocarbons — but the market priced it as such.

The Charlie-1 exploration well at Project Icewine confirmed a large condensate discovery in the Torok formation, in both the Middle Stellar and Lower Stellar targets.

Initial petrophysical interpretation indicated hydrocarbon pay in both the Torok and Seabee formations, with additional confirmatory work underway.

Post well analysis is ongoing to confirm the composition and gas to liquid ratio of the Torok discovery, with excellent Vertical Seismic Profile data obtained from the well that will be used in conjunction with other log data and the existing 3D seismic to remap targets, and conduct other post well analysis.

Detailed logs and sidewall cores were also acquired in the HRZ formation, which are currently being analysed.

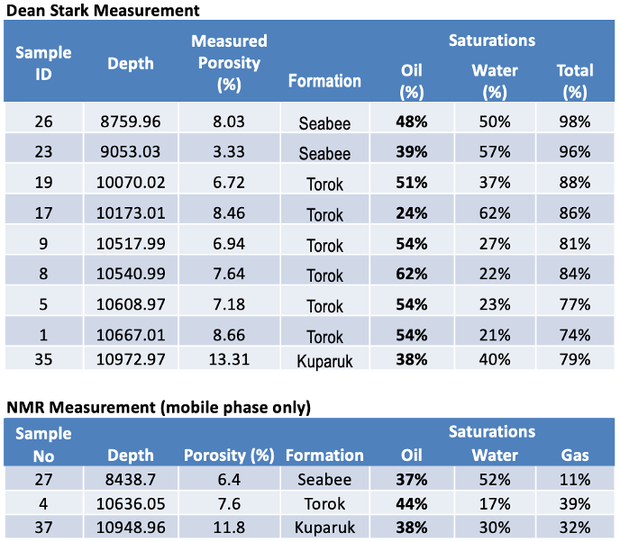

88E confirming excellent oil saturations in prime target formations – the Seabee and Torok

Based on recent lab results, excellent oil saturations are evident in Seabee, Torok and Kuparuk formations with saturations measured in two separate labs using different techniques – Dean Stark and NMR measurements:

The high gas / oil ratio on test in the Torok is under investigation and is possibly the result of preferential flow of more mobile gas.

The reservoir at this location is relatively tight, as expected, but comparable to other wells that have achieved good flow on stimulation.

For example, Patheon Resource (AIM: PANR, market cap of £95M) flowed 100bopd from a 6ft perforated interval in a vertical well in 2018 that had lower permeability and oil saturations.

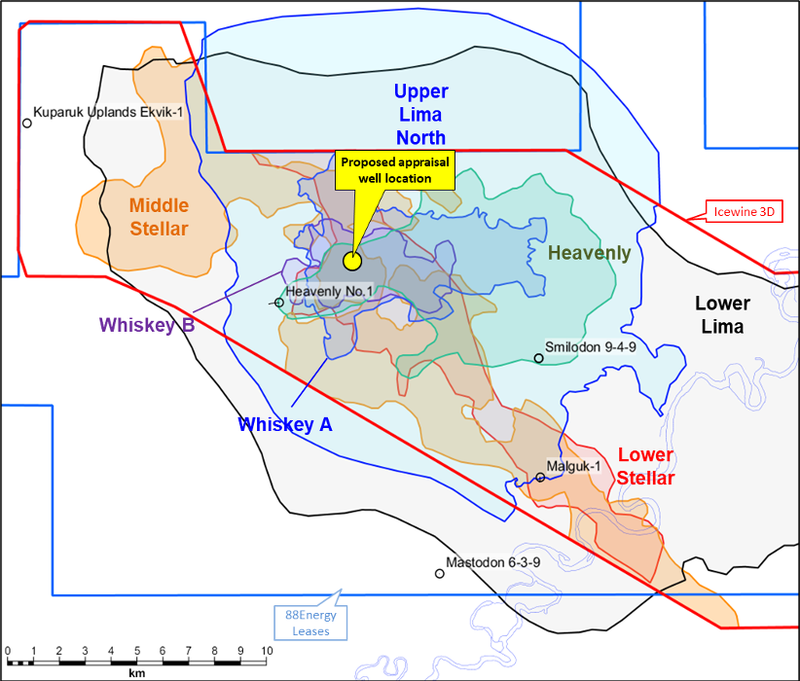

Following the integration of state-of-the-art modern log data from Charlie-1, oil saturated reservoir quality sands in the Seabee formation can now be resolved with high confidence on seismic. This was previously not possible.

The reservoir quality is clearly evident to be higher away from the Charlie-1 location, both updip and downdip.

Seabee hydrocarbons are proven in the historical Malguk-1 well by oil observed over the shakers at surface and in cores from Heavenly-1 and now Charlie-1.

Torok formation re-mapping also underway with several additional leads identified.

New Preferred drilling location for Project Icewine

The slew of data and analysis coming in from Charlie-1 lab results has de-risked the project immensely, resulting in 88E determining a preferred drilling location for a follow up well to Charlie-1.

Evidence for oil in the Seabee and Torok at this location is more compelling, based on well data and regional thermal maturity model. Better reservoir quality has also been interpreted using new seismic inversion from Charlie-1 data.

Eight separate Seabee and Torok targets are to be intersected in the next well, four of which have been demonstrated to contain hydrocarbons in Heavenly, Malguk or Charlie wells.

Furthermore, large additional potential has been identified in the Seabee — the Upper Lima North prospect. This was a prospect evident on seismic mapping and is coincidence with evidence for oil.

Armed with fully interpreted Charlie-1 data and a new well location planned, 88E is set to re-launch a farm out at Project Icewine.

Detailed logs and sidewall cores were also acquired in the HRZ unconventional formation, which will be analysed over the coming months.

The HRZ remains a viable target and options to commercialise this potentially large resource continue to be pursued. The Joint Venture plans to conduct a formal farm-out process to fund further appraisal.

Monetisation Strategy: farm-out, appraise, sell

88E’s board, management, and technical team have a proven track record for advancing projects and delivering on milestones, including operational capability and execution of farm-out transactions.

Going forward, the company has a low capex strategy, via farm-outs, targeted over 2-3 years to minimise dilution and maximise sale value per share.

Four farm-outs are currently active over three project areas with drilling of at least two wells intended in 2021.

Success in any project area will result in additional drilling of 2-3 wells in the following years to define the resource potential to the point of sale.

88E expect the majority of early stage, dilutive costs to be borne by the farminee in order to maximise return for 88E shareholders as the funding of large scale development capex is not part of the 88E strategy.

The company holds over A$7 million in cash right now, with no major expenditure items planned for the rest of 2020.

There is also potential to clear out US$15 million of debt from the balance sheet in 2020, with the company awaiting a State of Alaska court case decision to enable payback of credits owed to 88E.

With an expanded portfolio, we expect 88E to be highly active over the coming months, shopping around its assets in the lead up to the drilling of multiple wells in the first part of 2021.

We’ve seen 88E’s share price move upward in the lead up to drilling events before, and we expect to see something similar to unfold in the lead up to its early 2021 drilling.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.