LSE Stock to Rise as Helium Approaches Supply Cliff?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

You may not read about it often, but the gas that makes your voice go higher, delivering so many laughs at kids’ birthday parties, is actually part of a $6 billion global industry in revenue terms.

We are talking about helium.

Aside from party gags, helium is more importantly used in computer chip and optic fibre manufacture, sectors that are mushrooming with technological development.

The fibre optics market is estimated to be worth over $12 billion by 2020 and the global nanotechnology industry could grow to reach US$75.8 Billion by 2020 .

In fact there is massive potential for new use growth in the next 5-10 years for helium in emerging quantum computing and nano-manufacturing industries which require a low thermal noise environment created by liquid helium at -270°C.

If the LSE listed company we are covering today can impact just a fraction of those markets, given its new stake in a Tanzanian helium resource, it would be flying higher than a super Zeppelin.

Now, before we go too far, it’s worth noting that this is a very high risk stock for political and social reasons. Getting resource projects up and running in countries such as the Tanzania is no simple feat, and there may be challenges ahead.

There is a pending supply crunch coming for helium, but most investors haven’t caught onto it yet.

For years the US has held a huge sway over the helium market, after building up a large supply in the 1920s and ’30s when helium powered air craft were all the rage.

That all blew over, and since then the US has been gradually depleting its reserves by selling domestically, and to global markets.

But on 30 th September 2021 – the US helium supply will shut down, stripping 30% off the market over the coming years.

Add to that the fact that 40% of US demand needs replacing, and it all adds up to a heady time for the helium market.

Fast moving and forward thinking companies are now scrambling to take pole position in supplying the world’s markets amidst a new world order for helium.

Today’s LSE listed company has seen the writing on the wall, and taken a 10% (with option to increase to 20%) stake in a private company holding a world class helium resource in Tanzania.

This company is aiming to develop a world scale helium production facility in Tanzania, and make first transport by 2020 – just as the helium market is expected to tighten due to the US supply depleting.

The resource currently stands at 98.9 bcf (unrisked, prospective, recoverable helium volume, P50), and could be considered one of the biggest untapped resources going around.

Beyond its latest helium acquisition, this company has a cunning strategy to invest in and develop a diverse global portfolio of oil and gas assets.

Introducing:

Solo Oil plc (LSE:SOLO) is no ordinary oil and gas explorer.

Yes, this hydrocarbon ‘Lilliput’ already has a handful of natural gas prospects under its utility belt, any one of which could go on to add some commercial bulk to SOLO’s balance sheet further down the track.

However, what recently alerted us to this stock and what gives us cause to sit up and take notice of its latest levitational acquisition in the helium sector.

The acquisition looks like it has been timed well, as the helium price has done this over the last decade or so:

Source: VSA Capital

However at the same time commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on historical prices alone. Seek professional financial advice before choosing to invest.

The current strength of helium is one reason why SOLO has taken a 10% stake in Helium One – the other is what Helium One’s Tanzanian project has to offer.

Here is SOLO’s Chairman Neil Ritson going through the Helium One transaction with Proactive Investors:

Helium doesn’t just make your voice squeaky – it is critical to many things we take for granted, including MRI scanners in medicine, welding, industrial leak detection and nuclear energy, fibre optics and nanotechnology.

However, known helium reserves are quickly running out

Helium applications have mushroomed from around 2,000 metric tonnes per year to around 20,000 today. This number is expected to keep rising alongside greater use of modern equipment such as MRI machines, cryogenics and modern medicine in general.

In a nutshell, the answer to the above headline is that the most dominant producer in the world, the USGS, has mothballed its entire stockpile and will gradually extricate itself from US helium production.

This decision was made by US policymakers sometime in 2013, but only now are helium shortages being felt across several industries.

Before diving into more detail underpinning the case for a surging helium market in the years to come, let’s take a look at how SOLO is positioning itself.

SOLO has been operating in Tanzania since 2010; conducting work on two natural gas prospects — Kiliwani North and Ruvuma PSA. SOLO also holds an interest in UK onshore assets – including Horse Hill.

Progress at these prospects is ongoing with news flow expected to continue over the coming months. In the meantime, SOLO’s shares have already started to make a move:

Looking through the details of the proposed Helium One deal; SOLO is in-line to earn-in up to 20% of Helium One’s Rukwa Helium Project , in exchange for around £2.55 million for 10% (split cash/scrip) and an option for a further 10% for an additional £4 million.

The great thing for SOLO, is that it has an option that allows it to progressively earn-in to Rukwa if it’s deemed economic to do so.

SOLO is an early first mover in Tanzania, joining Helium One to develop the Rukwa Project and the surrounding 4,000km2 exploration ground.

Here is their operational space, mapped out below:

Companies already operational in the region include Acacia Mining, Anglogold Ashanti, BG Group, BR Petrobras, Eni, ExxonMobil, Halliburton, Ophir Energy, Shell and Statoil — however, these juggernauts are drilling for oil and gas, not helium.

It’s also worth noting that SOLO’s deal with Helium One provides the company with access to proven dividend payer and ex Polo Resources Chairman Neil Herbert. Over his 4 years as Managing Director, Polo paid $185 million in special dividends.

It is fair to say then, that SOLO expects big things and the funds from this deal will go towards developing the Rukwa project alongside Helium One.

So, let’s take a detailed look at Rukwa, to see if there are any favourable market aromas that could potentially grow small-cap resource portfolios.

Rukwa in detail

Independent experts, Netherland Sewell and Associates Incorporated (NSAI), have estimated an Unrisked Prospective Recoverable Helium Volume (P50) of 98.9 billion standard cubic feet, using the O&G industry standard SPE PRMS methodology.

This resource occurs in 28 leads, defined by 2D seismic and is supported by data from two legacy exploration wells.

Furthermore, Oxford University’s Department of Earth Sciences have confirmed helium migration within the basin through their recent geochemical analysis of surface gas emanations.

Helium One remains the operator at Rukwa, and has commenced an extensive work program to convert Rukwa’s potential into reserves and define additional prospects.

Alternative exploration approach

Working within a collaborative talent pool that includes Oxford and Durham universities, Helium One has developed an alternative approach to helium exploration.

The first use of these methods have resulted in helium anomalies detected over mapped exploration targets.

Their research shows that volcanic activity provides the intense heat necessary to release the gas from ancient, helium-bearing rocks. Within the Tanzanian East African Rift Valley, volcanoes have released helium from ancient deep rocks and have trapped this helium in shallower gas fields.

And its this helium that SOLO is keen to unlock alongside Helium One.

So let’s return to the macro market, to see exactly how SOLO plans on commercialising its helium

Currently, the largest reserve of crude helium is owned and managed by the US Bureau of Land Management (BLM). In 2013, it announced that it would begin to auction off an increasing percentage of its Reserve, until it declined to 3 billion cubic feet (estimated to occur in 2022). After that, the BLM will only supply helium to public-sector market in the US.

There’s even a book about it:

It’s probably the last book Donald Trump would ever want to read, but nevertheless, this de-facto privatisation of US helium assets is serving up a huge boon for the likes of Tanzania and opportunists such as SOLO and Helium One.

BLM’s exit from being the prime supplier is forecast to remove a very significant portion of existing capacity from the market...

...and that means opportunity.

Current helium market

Helium is the second-most abundant element on Earth, making up 24% of the total mass of the universe. Helium is in rocks everywhere, so it’s not a question of exploration, but rather, looking for the optimal extraction conditions to obtain a high-grade product.

SOLO thinks it can produce high-purity 99.99% helium.

The current global market is thought to be worth £4.8 billion, with the price of bulk liquid helium rising consistently over the past ten years.

Helium Markets have been quite volatile in recent years with 3 years of global shortage during the period 2011-2013, followed by 2 years of oversupply caused by Qatar commencing production in 2014-2015.

The global helium market appears to have found equilibrium in 2016, and is now growing on the back of additional applications that only helium can enable; these include computer chip and optic fibre manufacture, sectors that are mushrooming with technological development.

Let’s take a look at what else needs helium.

MRI machines

An MRI machine typically uses about 1,700 litres of liquid helium and requires refilling periodically. The use of MRI technology is predicted to grow in the next decade especially in developed countries, where healthcare services are having to tend to increasingly elderly populations.

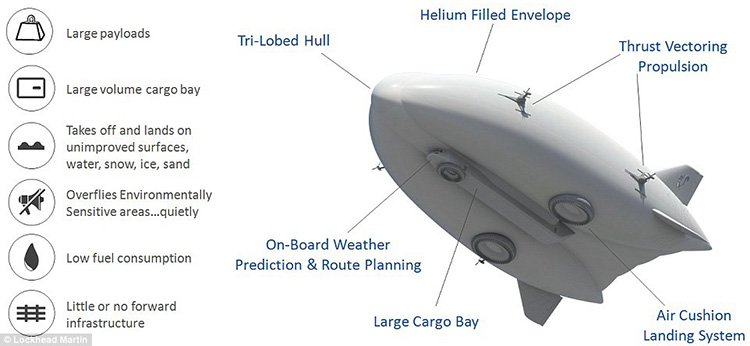

However possibly the most awe-inspiring application of helium, that could see it go to the heights of demand not too dissimilar to crude oil, is the long-forgotten air ship.

Airships

It is possibly the most forgotten mode of transportation, but this way of getting around used to be standard practise in the 19th and 20th centuries. Accidents and better alternatives steered global transportation away from hydrogen-filled airships...

...but now that helium can be used as a substitute, events like the Hindenburg disaster are simply a thing of the past.

Take a look at what’s happened to the lowly airship over the past 50 years — they’re coming back with a US defence-sector-sponsored bang:

With a slogan of ‘No Roads, No Problems’, and a vehicle that effectively blends helicopters and planes into one vehicle — we think Lockheed Martin’s airship is a sign of things to come.

With such airships already being built, the first customer was a mining company interested in cutting logistical expenses, operating in the remotest parts of Quebec, northern Canada.

Could you imagine the effect of such technology on disaster relief, city planning, government oversight, group-scanning, anti-terrorist monitoring functionality, and undoubtedly, more applications that have yet to be thought of yet.

Google likes to party too

In the spirit of innovation, Google wants to get in on the helium airship theme, to develop its own fantastical technology — introducing the Google Loon, so named because people thought it was too crazy to even be conceived:

Google plans to offer 100% global wi-fi coverage by launching up thousands of helium-filled balloons carrying 4G antennas. If you’re off the grid and trying to get on, don’t worry. The grid is coming to you.

So while we’ve looked in depth at the helium play, let’s now turn our attention to how SOLO intends to develop the Ruvuma Basin gas discovery over the coming years.

Existing interests – Ruvuma

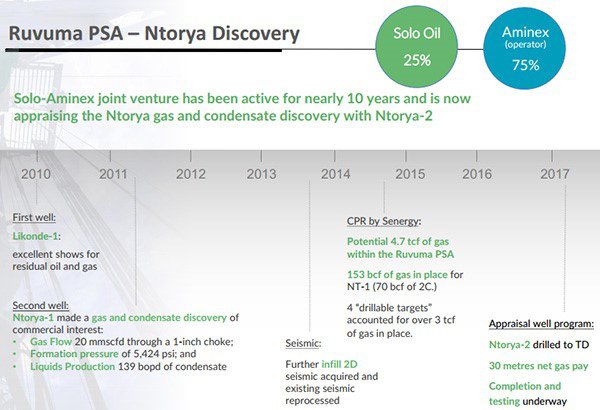

SOLO is a first mover in the energy sector in Tanzania, having invested in the country since 2010.

The company is only one of a handful of companies so far deriving revenue from gas in Tanzania, via its 7.175% stake in the Kiliwani North gas development.

Yet, this is an early stage play for the company, so investors should take a cautious approach to their investment decision and take all publicly available information into account.

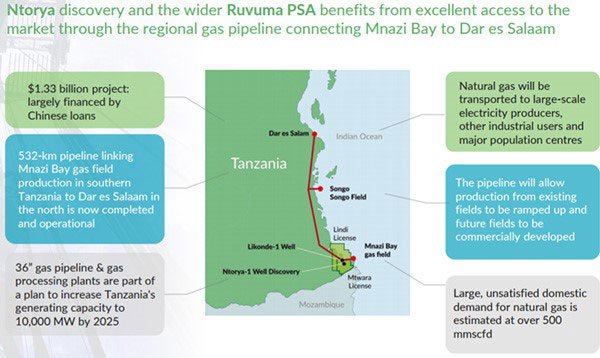

The following map gives you an idea of just how prolific this region is and why SOLO has entered.

With well-established relationships with regulatory bodies and an understanding of the processes that need to be addressed in terms of moving from exploration to production, SOLO stands in good stead with its assets.

Here’s a look at Chairman Neil Ritson explaining why SOLO has taken its stake in this region.

The Ruvuma outlook

Though only at exploration and appraisal stage, SOLO’s 25% interest in the Ruvuma Petroleum Sharing Agreement in the south-east of Tanzania, puts it in a region where substantial gas discoveries have been made offshore in recent years, and where gas has also been discovered onshore and along the coastal islands at Ntorya, Mnazi Bay and Songo Songo Island.

The discovery covers approximately 3,447 square kilometres, with SOLO’s ground lying approximately 90% onshore and the balance situated offshore.

The Ntorya gas-condensate discovery represents the most immediate commercialisation opportunity in the Ruvuma PSC.

For a more detailed explanation of why, check out this Finfeed.com article .

The well is currently suspended and a discovery for subsequent additional testing or production, and an early production scheme involving local use of the gas or its conversion to power is under consideration.

Based on an infill 2D seismic programme around Ntorya-1, a re-estimation of the discovered and prospective resources in the Likonde-Ntorya area was made and subsequently audited by Senergy (GB) Limited.

LR Senergy estimated that Ntorya contains a gross 158 bcf of proven gas in place, of which it attributes a gross 70 bcf as best estimate contingent resources.

Overall in the Ruvuma PSA, LR Senergy estimates gross 4.17 trillion cubic feet (tcf) of discovered and undiscovered gas in place.

So it seems there is much to like about SOLO’s gas play, which nicely complement its helium ambitions.

Contingent resources are expected to be converted to reserves once a commercial development and export scheme is approved.

Here’s a look at how the Ntyora discovery has progressed.

So with Ntyora progressing well and the helium market tied up, SOLO is...

Advancing towards tomorrow’s world with the lightest of steps

SOLO is a resources company that now has access to one of the largest helium gas deposits on Earth on top of its interest in onshore gas.

Helium provides a real point of difference.

In 20-30 years’ time, we could be seeing an entirely different ‘society’ altogether.

Pretty much every breakthrough in modern equipment and electronics (MRIs, cryogenics etc.) now requires high-grade helium to both build the equipment, and then many more cubic feet of helium to keep them operational.

Helium, although long forgotten as a high-margin commodity, is making a comeback made possible by highly-specialised end-uses, going mainstream faster than a helium balloon at a birthday party.

SOLO’s helium idea involves an age-old commodity being redeployed towards more efficient uses that command much higher sales prices.

As a commodity, helium is working up a strong business case to assume a far greater market position than ever before.

With Lockheed Martin building state-of-the-art airships, Google wrapping the world with 4G networks, nanotechnology becoming a thing of the present, fibre optics growing at a rate of knots, Helium One, and by extension, SOLO, is now stepping up to the plate to offer abundant helium at a time of escalating prices.

There is plenty to news to come out of SOLO’s offices in the next few months across its helium and gas assets, but it is helium that is capturing the most attention and we think there’s a reason for going SOLO right about now and appending this spearhead to your small-cap investment portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.