IVZ Commits to Farm in Deal with British Tycoons - But Maintains Open Relationship

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 6,110,000 IVZ shares at the time of publication. S3 Consortium Pty Ltd has been engaged by IVZ to share our commentary on the progress of our investment in IVZ over time.

Last year we announced Invictus Energy Ltd (ASX:IVZ) as our 2020 Energy Pick of the Year.

IVZ is gearing up to drill one of the last un-drilled oil and gas basins in Africa.

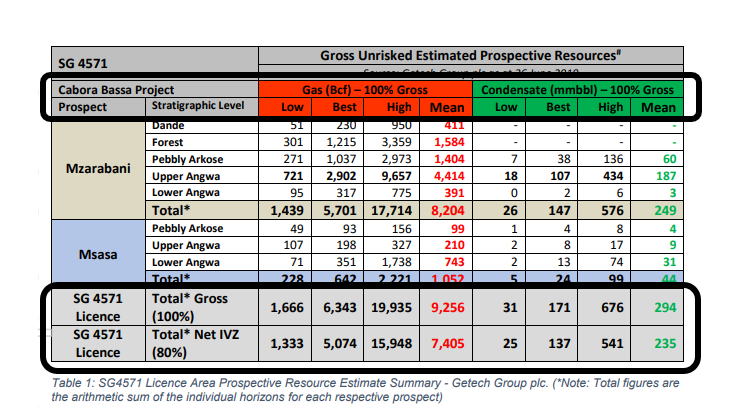

This is an ‘elephant scale’ prospective resource (on a 100% basis) of 9.25 TcF gas and 294 million barrels of gas condensate.

It is the largest conventional oil and gas prospect on the African continent.

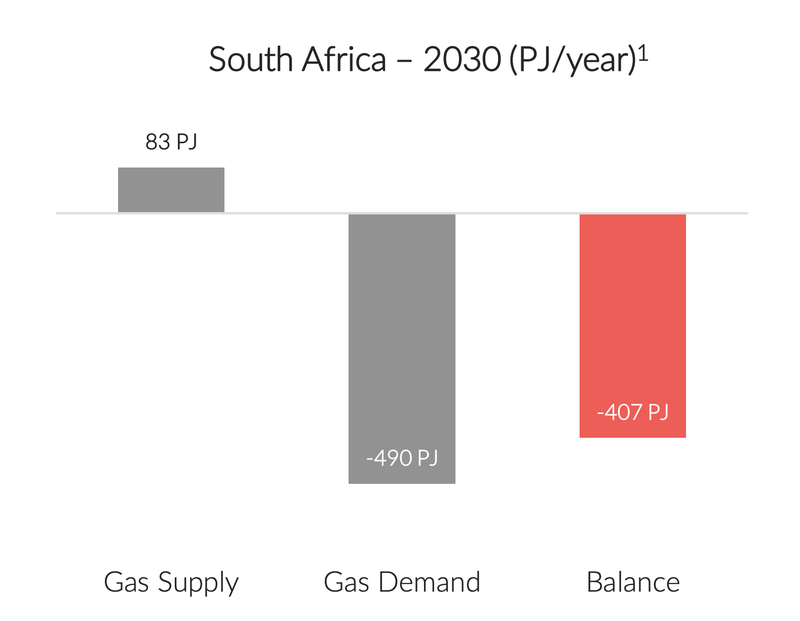

To put the size of the prize into perspective, the third largest economy on the African continent, South Africa, is forecasted to have 490PJ (Petajoule) of gas demand by 2030.

9.25 TCF (Trillion Cubic Feet) of gas is enough to power South Africa’s 2030 forecast demand figures 20x over.

Prospects this big generally take a long time to get ready for drilling.

Drilling has in fact been years in the making, and IVZ has spent the last 14 months securing all of the pieces necessary to maximise its chances of a successful drilling outcome.

IVZ is aiming to drill two wells in H1 of 2022 to test the size of the resource - two high impact drilling events to look forward to.

Today IVZ signed a non-binding, Farm-in Option Agreement with Cluff Energy Africa, which goes some way to de-risk the funding of the 2022 drilling events.

We think Cluff Energy Africa is a great project partner for IVZ - the two major shareholders are deep pocketed oil and gas financiers. The Cluff team has significant Zimbabwe in-country experience - more on the Cluff team below.

Under the terms of the non binding option agreement, Cluff Energy Africa will be funding 33% of the two-well drilling program for a 25% interest in the project.

This will leave IVZ with 55% ownership going into the drill program, and IVZ would remain the operator of the project. On success, 55% ownership of a massive gas discovery in Zimbabwe is an excellent outcome for IVZ.

Today’s announcement reduces the funding risks related to the drilling program and provides IVZ with a strong commercial partner with a proven track record of resource discoveries to support its upcoming drilling campaign.

We like that today’s agreement covers two wells as it gives IVZ TWO ‘shots on goal’ to potentially make a massive discovery.

So what is a non-binding option agreement anyway?

One thing that stood out to us in today’s IVZ announcement was that the deal is a “non-binding option agreement”.

This means the deal is non exclusive - it can be terminated by EITHER party before the option expiry date of 31st March 2022.

Now as IVZ investors, in the next couple of months, we are expecting to get more 2D seismic processing data on the project, the results of which may demonstrate additional prospects and leads.

This could drive the value of IVZ’s project up higher.

If IVZ can attract a deal with improved terms, it always has the option to pull out of the Cluff Energy Africa deal.

So in this respect, today’s news could be likened to the first bid in an auction.

A first bid is generally never the last bid - but what the first bid does do is bring others to the table and could be seen as setting floor price levels, especially when it comes from a partner like Cluff.

So is today’s deal the floor price for any other interested parties wanting to get a piece of the massive 9.25Tcf + 294M barrel gas-condensate project?

Well, as we touched on above, 2D seismic interpretation is yet to be completed.

We expect that once the data is fully interpreted, and the highest priority drill targets are identified, the project could become even more attractive from a farm-out point of view.

Zimbabwe is facing crippling gas shortages and demand for new gas resources has never been higher - gas prices could also see the value of IVZ’s project rise.

However on the other hand, the IVZ share price could go down in the coming months - in which case the Cluff deal would not be viewed as the floor price.

What today’s deal does is preserve the optionality of funding for IVZ so it can drive the best value for IVZ shareholders.

Cluff Energy Africa’s experience and expertise should not be discounted here either - often a farm-in partner’s experience and capabilities are just as important as the financial dollar commitment.

So who is Cluff Energy Africa?

We think Cluff Energy Africa is a great fit for IVZ as a farm-in partner.

The key reason for this is the people behind it and their track records in the mining and oil and gas space.

Cluff Energy Africa is backed by two “larger than life” characters:

- UK based resources entrepreneur and oil tycoon Algy Cluff OBE, and;

- British billionaire Lord Michael Spencer.

Here's the back story of how this company came together:

Cluff Energy Africa is a private vehicle, and according to this article, we understand that Mr Cluff owns 60 percent and Lord Spencer, owns the remaining 40 per cent through his IPGL investment vehicle.

Both these men are the two principals of Cluff Energy Africa and leading its pursuits of new investment opportunities, like IVZ.

Mr Algy Cluff OBE - UK oil tycoon with decades of deal making experience in Africa

Mr Algy Cluff OBE founded Cluff Oil in 1972, leading to the consortium which discovered the Buchan Oil Field in the North Sea. At its peak, the field was producing 32,000 barrels of oil per day.

In the 1980s Cluff shifted its focus to the African mining industry where he led the team that discovered the largest producing gold mine in Zimbabwe, before exiting Zimbabwe in 1996 after being taken over by Ashanti Goldfields.

The UK press seem to follow most of his moves - you can read more about him here, here and here.

Cluff has been active in Africa in the resources space for over 40 years now and the Cluff Energy Africa venture is the latest vehicle for this.

Think of Cluff as the resources experience behind Cluff Energy Africa.

British billionaire Lord Michael Spencer

Lord Michael Spencer, Cluff Energy Africa’s other major shareholder, founded NEX Group, a London-based fintech company which he sold in 2018 for £3.9 billion.

He briefly served as a Treasurer for the Tory party in the UK between 2006-2010 and now sits in the House of Lords.

He is also the principal of a private equity group which has over £1BN in assets under management.

These two highly successful British investment tycoons are now seeking to partner with IVZ on its drilling event next year.

Cluff Energy Africa is currently assembling a portfolio of African oil and gas exploration assets, and is seeking to raise further capital next year to fund its exploration programmes.

Cluff views IVZ’s asset as a “rare high quality but low cost opportunity that has world class scale”.

Given Cluff’s track record of high impact resource discoveries, we can assume the Cluff team would have done a lot of due diligence on IVZ and the prospect before entering into this agreement.

Overall, Cluff Energy Africa has the experience, a proven track-record of building resource companies AND the financial backing to follow-up any drilling success with serious capital investment.

We think that this makes Cluff Energy Africa the ideal farm-in partner for IVZ.

We have been investing in early stage oil and gas exploration for many years, and some of our most successful investments have been in "swing for the fence" style of high impact drilling like what IVZ is about to undertake next year.

We like the high-risk, high-reward profile of these drilling events. Indeed successful, company-making wells can result in large returns for investors, but they are never easy to come by.

We should be clear here, this type of investing suits our risk profile as investors - it may not suit yours.

We encourage all readers only to invest what they can afford to lose in small cap speculative stocks, and to seek professional advice before investing.

Farm-In Agreements - a Refresher

If you are new to oil and gas investing, you might be unfamiliar with what a farm-in agreement is.

A farm-in agreement is a partial sell-down in ownership of a project in exchange for exploration funding.

Whilst the rewards are high, oil and gas exploration can be expensive, so companies don’t always want to tap the public markets for dilutive funding.

Often, they will look to sophisticated financing partners looking to ‘farm-in’ to the project so that exploration activities can be supported.

It is important to find the right farm-in partner, with expertise and track-record of success in a particular area. Financing can always be secured through debt or capital raising, expertise and experience on the other hand is unique and hard to find.

With Cluff Energy Africa, we think IVZ has found an excellent partner.

The Fine Details of the IVZ and Cluff Energy Africa agreement

IVZ’s agreement has been structured so that Cluff Energy Africa has an option to farm-in by 31st March 2022 and a deadline to sign a Joint Operating Agreement by 30th April 2022.

If the option is exercised and an operating agreement is signed by both parties, it would give Cluff Energy Africa the right to acquire a 25% interest in the project by funding 33% of a two well exploration program.

With IVZ owning 80% of the project, and Cluff Energy Africa taking 25% subject to the farm-in being finalised, this would leave IVZ with a 55% ownership.

On success, 55% ownership of a massive gas discovery in Zimbabwe is an excellent outcome for IVZ.

IVZ intends to remain as the operator of the project going into the two well drilling program at the ‘elephant scale’ prospective resource (on a 100% basis) is 9.25 TcF gas and 294m barrels of gas condensate.

Details of the drilling program are as follows:

- First Well “Muzarabani-1”: Planned minimum depth of 3,000m or basement (~US$12M).

- Second Well: To be identified following completion of seismic interpretation to a planned minimum depth of 1,500m or basement.

A 33% commitment by Cluff Energy Africa means the first well is funded for at least US$4M, leaving IVZ with US$8M to fund the remaining cost of the first well.

In our opinion a US$8M commitment to try and unlock 55% of a 9.25Tcf gas + 294M barrel gas-condensate discovery is a no-brainer and some of the best risk/reward drilling programs we have seen.

At the end of the last quarter IVZ had a cash balance of AU$7.3M - which could mean IVZ may need to do a small capital raise at some stage in the coming months to finance the shortfall for the first well. That’s only assuming IVZ dont get a better deal in the meantime, and may come after IVZ gets its hands on the final seismic data that reveals additional drillable prospects.

Although today’s agreement didn’t cover the entire cost of the drilling - we would have loved to see IVZ free carried - we think that this option agreement from an esteemed farm-in partner like Cluff Energy Africa is only half of the story.

Without the right partner, even the best projects can remain stranded.

Given Cluff Energy Africa’s experience and track record within the region we think that they are the right partner to support IVZ into its drilling program, and given the size of the prize, there is still plenty of upside for IVZ if a discovery eventuates.

How did IVZ end up with this Elephant Scale Project?

IVZ holds one of the largest undrilled conventional oil and gas prospects in onshore Africa with a prospective resource (100% Gross basis) of 9.25Tcf gas + 294m barrels of oil.

When sitting on assets this large, the question is always, how did a micro cap exploration company listed on the ASX manage to pick these assets up?

The answer is relatively simple.

The prospective resource is almost all GAS, which up until the last five years was of no interest to companies looking for oil on the African continent.

Mobil, in the 1990’s, spent over US$30M doing fieldwork on this project, capturing 610km of seismic data and realised that the project was largely prospective for gas and not oil.

Back in the 90s, oil and gas exploration was almost exclusively focussed on identifying OIL reserves. Anything with a high-gas content was deemed un-economic and would often get overlooked.

That’s why Mobil walked away from the asset after realising the project was a large gas prospect - this was of no interest to anyone back in the 1990s.

The geopolitical conditions at the time were also undesirable, but just like in all facets of investing you want to pick up projects when no one else is interested in them.

These conditions provided the ideal opportunity for IVZ to secure this stranded gas project, which for the longest time would have been uninteresting to investors.

The world looks very different today than it did thirty years ago and a gas project like IVZ’s has gone from un-economic and uninvestable - to now critically important to Zimbabwe's development.

With energy crunches looming and supply issues putting upwards pressure on gas prices, IVZ is in the right place at the right time to be highly leveraged to an oil and gas discovery in the region.

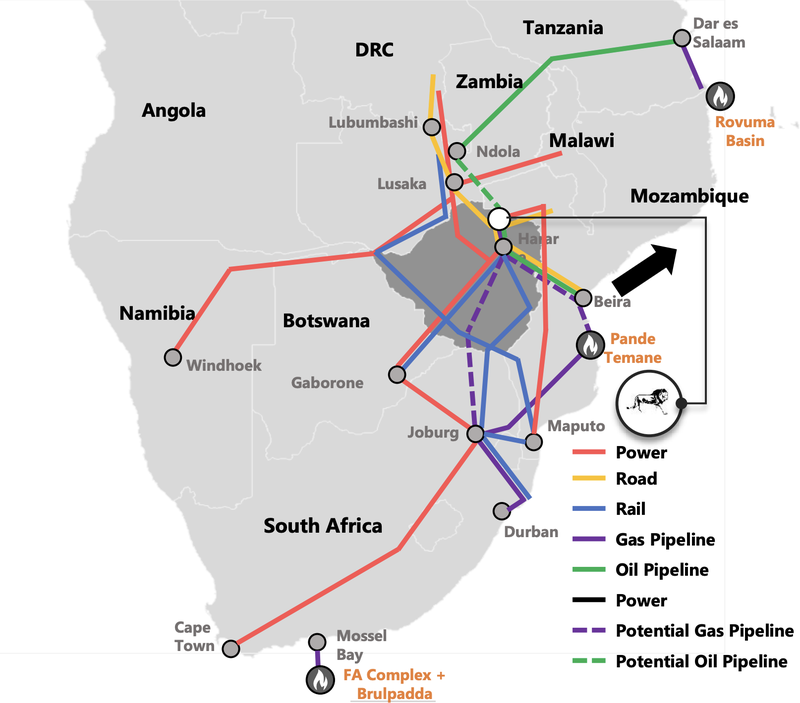

Strategic Location and Downstream Opportunities for IVZ

Over the past few months there has been a global energy crunch caused by gas supply issues.

More than most countries, Zimbabwe has been affected by these issues, with the Zimbabwean government introducing energy consumption caps to quell energy demand.

Zimbabwe has no oil or gas resource of its own and is dependent on imports and a dwindling hydroelectricity supply for its energy.

For Zimbabwe, any successful oil and gas discovery can be transformative for the economy.

The issue isn't exclusive to Zimbabwe, Africa as a continent is severely impacted by energy supply problems.

IVZ’s project is strategically located in Zimbabwe which borders Africa’s third largest economy, South Africa.

South Africa is becoming increasingly desperate to secure its energy supply whilst also attempting to decarbonise its energy mix.

In the short-term, more than 10,000MW of coal fire powered energy is retiring in South Africa - which is ~20% of the country's total energy supply.

By 2030 South Africa is expected to have an energy supply deficit of 407Pj (Petajoules).

Basically, South Africa desperately needs energy.

And as we said above, the demand picture has also changed from the 1990’s, when coal and oil were seen as the only reliable energy sources to operate an economy.

With gas in the forefront of the energy mix in 2021, and infrastructure now in place in the region, any major discovery by IVZ should be able to quickly be commercialised.

We think that Africa as an emerging market has a lot of development to do, and energy is the most critical input to any developing economy let alone an entire continent.

IVZ Acquires 840KM of 2D Seismic Data

Over the past eight months IVZ has been busy acquiring 840km of 2D seismic data which adds to the already completed 610km in data captured by Mobil in the 1990s.

Geologists will use this data to get a better understanding of the rock formations below the surface and optimise the drilling location for a successful drilling outcome.

2D seismic data generates a map of the rock-structures beneath the surface by sending vibrations into the ground. The expectation is that the rock formations would then reflect the waves back to the surface where manual receivers do the recording.

Technical right?

Just like any other target generation work, collecting the data can be arduous, and companies will use large vibroseis trucks and hand-held devices to ‘map’ the intended area.

IVZ mapped 840km which took over 142,000 hours and is a very valuable dataset to support the drilling activities.

If you are interested in learning more, IVZ have put out a fantastic documentary of the 2D seismic program that puts into perspective what the company is trying to achieve:

Watch IVZ’s short documentary on the Cabora Bassa Project here

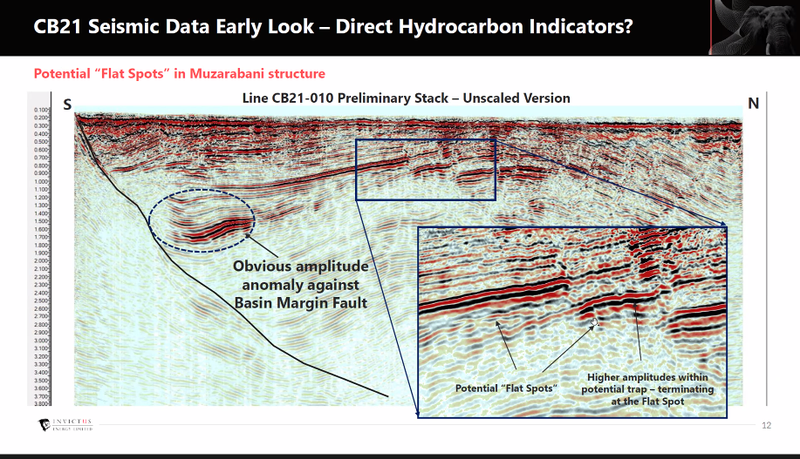

The ‘Armchair Geologist’ Seismic Interpretation

We are not geologists, but we have been investing in oil and gas exploration for a number of years so we think we have a basic understanding of seismic data.

IVZ’s 2D seismic data has delivered some very obvious “amplitude anomalies” across the entire area where data was gathered.

The most compelling of which are the ones found in the shallower sections of the Muazarabi Prospect, and the one found right up against the Basin Margin Fault (the area that runs up to the edge of the basin).

Amplitude anomalies are the red and black lines in the seismic images which can be an indication of oil and gas.

Encouragingly, the seismic data is showing potential “Flat Spots” which in oil and gas speak translates to a potential hydrocarbon contact (this is what IVZ will be looking for).

This sort of contact is usually between gas and oil, oil and water, or gas and water. All of which point to the presence of hydrocarbons.

Interestingly, the flat spots are all shut-off with “traps” which in the images looks like a blurred line that splits each coloured section.

These “traps” are what prevent the hydrocarbons from leaking out of the potential reservoirs. Think of this as a seal to a jar where the gas is continuously building up.

You will hear a lot about “traps” when investing in oil and gas stocks, as the traps are where the oil and gas resources can accumulate.

All very encouraging signs so far.

We will need to see IVZ fully interpret the seismic data but to us it looks like there are now two very obvious target areas for drilling - right beneath the shallow amplitude anomalies and right up against the Basin Margin Fault.

It goes without saying but these anomalies don't always mean an oil and gas discovery can be made.

There is a risk IVZ drill and find nothing, or even if there is gas, it needs to be able to be economically extracted.

At the end of the day, there is really only one way to find out - and that's by drilling.

Our Investment Strategy with IVZ

Our investment IVZ is chasing an elephant scale discovery in Zimbabwe.

With a prospective resource of 9.25Tcf Gas + 294m barrels of Conventional Gas-Condensate, this makes it the largest, seismically defined, undrilled structure in onshore Africa.

This type of frontier exploration is high-risk but often rewards the junior explorers who take these risks with transformational rewards if a discovery is made.

This is why we like to make investments in first movers who are able to secure the best acreage on the best terms.

We always like to make our investments early and hold as the company matures or nears a drilling event that could be a big catalyst for a re-rate.

We will then take out our initial investment as the share price increases on the speculation of positive drilling results and ‘free carry’ the majority of our investment into the drill.

With the drilling event now in the final stages of preparation we are looking forward to seeing if our investment in IVZ pays off the way we expect it to.

We want to reiterate again that investing in stocks like IVZ suits our investment strategy - but it might not be right for you - seek professional advice before investing in small cap speculative stocks like IVZ.

Recently we launched a project we called “Investment Memos'' which we have talked a bit about in recent articles. We wanted to launch these so we could track our investment thesis on all of our portfolio companies & see how they are progressing VS our expectations.

Check out our IVZ investment memo here.

✅ Initial Investment: 3.9c

✅ Increased Investment: 11c

✅ Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

What’s Next for IVZ?

With funding for the drilling program de-risked further, we want to see IVZ complete a full interpretation of its 2D seismic acquisition program and determine the final location for the 2-well drilling program.

In no particular order we want to see the following from IVZ leading upto the maiden drilling program:

- Final interpretation of 2D Seismic data.

- Drill rig secured and long lead items ordered

- Clear Funding plan outlined for the 1st-well (Farm-in or capital raise finalised)

- Drilling and environmental permitting completed.

- Financing the final of the project by a capital raise or with another farm-in partnership

Carrabosa Project Milestones

✅ Environmental Impact Assessment Approved

✅ Non-Binding Farm-In Offer1

✅ PEDPA Signed (Part 1 of the Production Sharing Agreement)

i️ Contract with Farm-In 1 Partner Terminated

✅ New Farm in Partner - Non Binding Option Agreement Signed

✅ Seismic Operations Commenced

✅ Seismic Data Collection

🔄 Seismic Data Results [End of 2021]

🔲 PPSA Signed (Part 2 of the Production Sharing Agreement)

🔲 Drill Targets Identified

🔲 Drill Rig Secured [2021]

🔲 Drill Permits Secured

🔲 Project Funding

🔲 Drilling Commenced [H1 2022]

🔲 Drilling Results

🔲 High Impact Basin Open Drilling Campaign

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 6,110,000 IVZ shares at the time of publication. S3 Consortium Pty Ltd has been engaged by IVZ to share our commentary on the progress of our investment in IVZ over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.