International Feeding Frenzy in Australia’s Hottest Shale Gas Region Puts Undervalued Junior on M&A Radar

Published 14-MAY-2014 16:11 P.M.

|

26 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

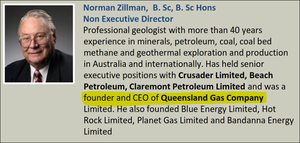

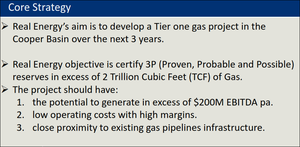

The tipping point for Australia’s shale gas boom is here. The yanks are coming and Queensland’s Cooper Basin is target number one. “It ticks most of the boxes for a successful unconventional gas development,” says Houston-based energy investment firm Tudor Pickering Holt . “One of the most likely, near term, commercial shale/tight gas developments outside of North America.” Here’s why: The US shale gas industry is set to top $90 billion by 2017 – all driven by high-tech methods like fracking which have unlocked a bounty of domestic energy. Those same techniques are coming Down Under where both shale and coal seam gas plays are multiplying across the land as demand for LNG soars both in Australia and throughout the world. Australia is the new frontier. Majors and private equity are already moving in . US energy giant Chevron just invested $350 million with Beach Energy to hunt for shale gas in the Cooper Basin’s vast unconventional prospects. And it’s not just the Americans stuffing money into the Cooper Basin. Hong Kong based conglomerate Cheung Kong Group just made a $2.7 billion takeover bid for natural gas distributor Envestra, upping the stakes in an ongoing bidding war against APA Group. Britain’s BG Group inked a $19.6 million deal to acquire nearly a 10% stake in Drillsearch Energy – a junior explorer with gas rich prospects close our latest portfolio addition’s holdings. Which brings us neatly to the point. BG Group is spending up to $20 billion to develop an LNG export facility on Curtis Island on Australia’s east coast so it can fulfil mega contracts to supply LNG made with coal seam gas to the Asian markets. Origin Energy and Santos are also building LNG trains on Curtis Island. All this activity is making it one of the biggest gas projects in Australia’s history and could unlock billions and billions of dollars for the country. But all three gas giants have a problem. They don’t have enough gas coming in from their coal seam projects. The Cooper Basin can fulfil this demand – its massive shale deposits, basin centred gas and conventional gas are close to pipelines to get the gas to market. So a frenzy of M&A activity is underway in the Cooper by the gas giants to secure their LNG supply. There are so many farm-outs, farm-ins and takeovers it’s hard to keep track of them all. But we’ve been alerted to the very last junior explorer in the Cooper Basin with 100% control of its holdings – the very last one... All the other juniors have done deals. But this company is yet untouched, undervalued and surrounded by major players, who are probably licking their lips in anticipation, ready to pounce on our little company. This company boasts Norm Zillman as a Director – the founder and former CEO of the Queensland Gas Company (QGC) – QGC started with a tiny $20 million market cap and was later taken out for a colossal $5.6 billion . Norm is so keen on this little company’s acreage he has come out of retirement to take another swing. This is a company right in the Cooper’s sweet spot with three potentially resource rich holdings of a region everyone is scrambling to take a piece of. Infrastructure is in place – pipelines, railways, roads – plus the mega LNG trains coming on stream on the Queensland coast . All it has to do is prove up the resources and the rest can fall into place. The price per acre is low now but with so much M&A action in the vicinity we doubt this will last long. Introducing the last Cooper Basin junior with 100% of their acreage:

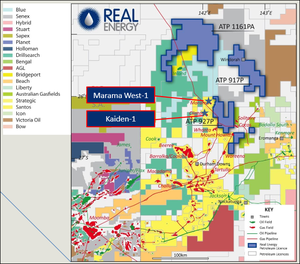

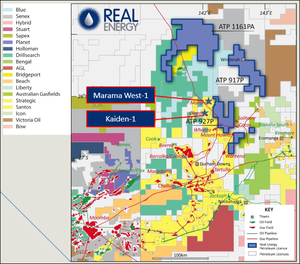

Real Energy Corporation Limited (ASX:RLE) is a $33.5 M market cap junior with assets in the Cooper Basin – the next hot spot for unconventional oil and gas. RLE’s stated goal is to develop a shale gas asset of 2 tcf and bring oil and gas plays on its three vast holdings in Queensland’s Cooper and Eromanga Basins into production. With over $13 million cash in the bank, this year should see them move fast in efforts to prove up resources in their vast holdings. Their holdings are marked in blue on the map below, and the calibre of their neighbours also bears listing – names like Santos, Beach and Origin are literally next door, and have made 3 discoveries in the last quarter:

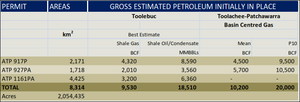

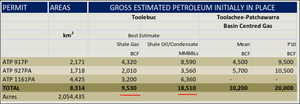

RLE has 100% ownership of three blocks – the last junior to claim this – comprising more than 2 million acres and is targeting independently estimated reserves of:

- 18.5 billion barrels (best estimate initially in place) of unconventional oil in shallow formations

- 20 tcf of P10 gas initially in place in deeper formations

- 21 million barrels of conventional oil (best estimate of prospective resource).

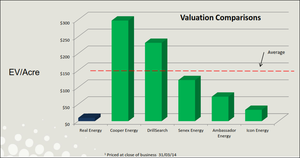

RLE have just selected 3 drill locations and are preparing to drill now. In the coming months the action will really heat up as they kick off the 3 well drilling campaign. The Next Oil Rush considers RLE a long term strategic play – each of RLE’s blocks are surrounded by proven resources drilled by the other junior explorers in the area with a high success rate. The upside potential in RLE is stark when compared to their peers:

Source: Real Energy

The above chart shows how severly undervalued RLE are compared to their peers in the Cooper Basin – all it may take is a few wells to be drilled by RLE in the coming months for that little blue pillar to grow and grow.... along with the size of RLE investors wallets... If you’d like to hear RLE’s potential straight from the MD himself, check out this interview on Sky News:

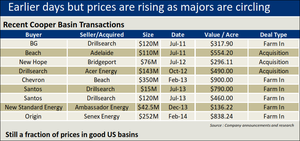

As well as the potential in RLE, Scott gives a good lesson on the Cooper Basin to Switzer in that one! The Cooper Basin is being divided and conquered by big gas players like BG and Chevron that want to secure as much gas as they can to satisfy the massive contracts they have in export markets across the world. RLE owns 100% of its holdings but its neighbours are rapidly being picked off. The table below summarises recent deals over the last few years – just a few months ago Origin farmed in to the Senex acreage for a whopping $838/acre!

Source: Real Energy

RLE is the last man standing. The spinster at the ball. For how much longer? RLE plan to drill three wells in the coming months – once they announce flow rates to the market things should really get interesting for RLE investors. Depending on the results, it’s possible that RLE could strike a big farm-in agreement. Or just a good old fashioned takeover. Getting the best takeover deal requires a ‘certified’ resource – this is RLE’s aim – to certify and prove up reserves to a specified size. RLE are currently cashed up and set to drill. As RLE progress, the next few months will reveal a lot more of what exactly RLE are sitting on – and may allow justification for a take-over or farm in. Bigger companies would rather pay big cash premiums to buy certified resources rather than take on exploration risk. With a huge balance sheet and chasing 30 year assets, putting big dollars on the table is no problem for global energy players. Given the calibre of their neighbours, cheap valuation (per acre), rising gas demand, plus the fact they are the last junior in the Cooper Basin owning 100% of their acreage, we consider RLE to be seriously undervalued – we have added to our portfolio now, before the great unwashed masses cotton on.

Our Track Record

Did you receive The Next Small Cap report on Core Exploration (ASX:CXO)? Since this report was released, CXO has traded up to 85% higher.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The yanks are coming!

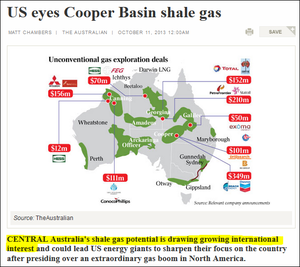

A leading Houston-based energy investment bank called Tudor Pickering Holt says the Cooper Basin in central Australia – where RLA has three 100% owned plays – is one of the best shale prospects outside of America. The map below gives a great summary of all the recent unconventional gas exploration deals – there is the Cooper Basin, straddling Queensland and South Australia:

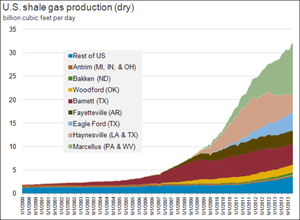

That’s a big call – and one that’s been heard around the world. Shale oil and gas is an ever growing industry in the USA right now – the country is well on its way to achieving energy independence as new technologies like fracking and horizontal drilling fuel an unprecedented flow of home grown energy. US gas production from shale formations has risen 12 fold in the last decade and is expected to account for up to 45% of US production by 2030:

Source: Real Energy

So after presiding over so much success, America’s shale whales are looking for new hunting grounds. The Cooper Basin is high on their hit list.

The Cooper Basin is attractive to the big global energy plays for three reasons. Let’s go through them:

1. Resources abound in the ground

The Cooper Basin and the neighbouring Eromanga Basin are two of Australia’s biggest and best proven hydrocarbon provinces. The Cooper and Eromanga Basins straddle a huge area of the south-west bottom corner of Queensland and the north-west tip of South Australia – very remote country. That’s handy as less landowner and community issues need to be navigated. RLE’s acreage is entirely in Queensland. Since the Cooper was first tapped in the 1960s it’s produced over 6 tcf of gas and 300 million barrels of oil. Between them, Cooper and Eromanga have 160 gas fields with over 800 producing wells, plus 80 oil fields in production with over 350 wells pumping. Most of that is conventional oil and gas. Now, owing to all the technological advances in extracting unconventional shale and basin centred gas, the Cooper-Eromanga Basins are the next frontier. RLE has three large 100% owned permits totalling 8,314km 2 or 2 million acres straddling both basins – a big, controlling, land position for a $33.5M junior. RLE is cashed up with over $13 million in the bank and will be drilling in a few months’ time. Remember, RLE is the only junior in the basins to have full, 100% control of its holdings – all the others have been taken over by major players who are gobbling up real estate in the Cooper Basin as fast as they can process the paperwork. We don’t know for how much longer RLE can last like this... Remember this map ; RLE are surrounded by the big players!

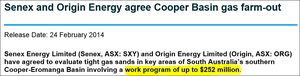

BG, Chevron, Santos, Beach – the list goes on. US energy giant Chevron inked a $350M deal with Beach Energy in 2013 to acquire a 60% interest in a two block area covering 810,000 acres – three times the size of Hong Kong – full of untested unconventional shale gas prospects. Add to this the new $252 million joint venture between Senex Energy and Origin Energy, and it was cause for The Australian to sit up and take notice:

![]()

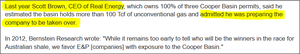

Beach is currently producing on their Cooper Basin acreage, as of March 2014 they had already extracted 7.3 million barrels of oil equivalent. But RLE’s exploration targets aren’t to be denied. Its 2 million acres are prospective for conventional oil, shale oil and gas and tight gas. The upcoming drilling program should further define RLE’s resource size. If RLE can emulate Beach’s success and attract a big player to farm in – or acquire it – then RLE investors will be sitting pretty – or if it decides to go into production for itself then those smiles will be just as wide if it can lands fat contracts with the gas giants. Like RLE’s MD Scott Brown told Sky Business , Australia’s oil and gas explorers have always known there are huge oil and gas reserves down under; it’s just a question of getting it out of the ground!

2. Quality infrastructure set to export to the world

High quality infrastructure is in place, its service industry makes it an attractive investment, plus the Santos GLNG project on Curtis Island in Queensland is now 80% complete and on track to start exporting gas next year:

It’s shiny, new, and almost ready to export gas from Queensland to the world. Builders have just received the final modules for installation.

![]()

This huge complex is one of three – yes three – LNG trains on Curtis Island being built to cool down and store the immense amount of coal seam gas for export. As well as coal seam gas this type of infrastructure is perfect for RLE to send any gas to – should they manage to find something extractable. As the LNG processing plant will come online next year, the timing is about right for RLE. Queensland is criss-crossed by high quality pipelines, roads, rail links and electrical grids that will allow RLE to maximise its return on investment if and when it enters production with its shale gas. The huge investments being made in infrastructure throughout Queensland are a very attractive sign and the Next Oil Rush’s views it as a key investment criteria.

3. Location, location, location

The final piece of the pie attracting American interest into the Cooper Basin is its location – the middle of nowhere. Population density is minimal – there are very few towns and certainly no major cities. The most likely methods that will be used to extract the unconventional shale oil and gas in the Cooper Basin are fracking and horizontal drilling. These advanced methods have unlocked America’s energy potential but also ignited a big debate about their environmental impact. Flip to Down Under and the biggest environmental challenge is going to be getting enough water to the drill sites to allow fracking to take place – if at all. However, most of RLE’s shale gas prospects are high on sand content – so fracking may not even be needed, cutting costs down to the bone. So there you have it – the Cooper Basin – Australia’s shale gas and oil jewel. RLE is in a great position. It holds three large 100% owned permits totalling over 2 million acres straddling both the Copper and Eromanga basins – all of it prospective for conventional oil, shale oil and gas and tight gas. No wonder the oil and gas giants are sniffing around! We’ll drill down a bit further into RLE’s potential riches a little later but before we do that let’s see who’s running the show.

RLE’s brains trust

When we look at a new portfolio addition at The Next Oil Rush one of the first things we look at is the company’s leadership. The first name that caught our eye at RLE is Non-Executive Director Norman Zillman.

Mr Zillman is a legend in the Australian gas industry. He was one of the founders and the CEO of Queensland Gas Company (QGC) which had an eight year ride from a tiny $20 million market cap to a take-over price of $5.6 BILLION.

![]()

The ultimate rags to riches story – and Norm was one of the principal authors!

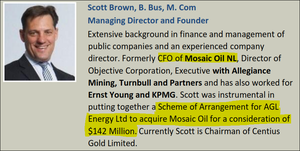

And now he is on the board of RLE. BG’s $5.6 billion take-over of QGC secured enough resources to help justify building a gigantic LNG processing facility on Queensland’s Curtis Island with the capacity to send 8.5 billion tonnes of gas a year into the world’s hungry export markets. And the rest is history. When it comes time to negotiate off-take agreements for RLE’s gas or even set up another takeover with BG, Norm’s experience will be invaluable. Norm actually doesn’t need to work anymore – but he couldn’t resist RLE’s acreage . He is responsible for around 50 discoveries in the Cooper Basin so his expertise there and experience in taking QGC from $20 million to $5.8 billion will be invaluable to RLE. Norm has over 40 years’ experience in the Australian energy industry and knows all the ins and outs of operating in the Cooper Basin. A great man to have overseeing RLE. The next man at bat is Scott Brown , RLE’s Chief Executive Officer and founder.

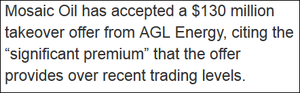

It’s an indication of his sterling reputation that he was able to convince Norm Zillman to put down his gold-plated golf clubs and get involved with RLE! But there’s a lot more to Scott than the ability to attract top talent to his team. Scott was the Chief Financial Officer of Mosaic Oil when they were taken over by AGL Energy for $130 million back in 2010 – a famous deal that allowed AGL to use Mosaic’s tapped out Silver Springs fields in southern Queensland to store gas for the coal seam industry.

Scott was instrumental in securing that very lucrative deal but he didn’t just come on board at Mosaic to sell it off. Prior to the deal he helped Mosaic acquire a slew of production properties that grew its bottom line. This is especially good to know while Scott works like mad to get RLE into the strong position it’s in today. Gas producers in the Cooper Basin are being gobbled up by major producers either through farm-in deals or plain old fashioned takeovers. RLE’s could be the next cab off the rank:

As a dilligent CFO, Scott Brown has been through the take-over process before and it seems he is hoping to repeat it as CEO with RLE. For the right price, RLE investors shouldn’t mind at all. With men like Norm Zillman and Scott Brown leading the charge for RLE, either way is an excellent option. Both Norm Zillman, Scott Brown, and the rest of the highly experienced RLE team are well versed in getting large resource projects off the ground AND selling them for a top price.

Our Track Record

Did you receive The Next Small Cap report on Segue Resources (ASX:SEG)? Since this report was released, SEG has been up as high as 130%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

RLE’s 2 trillion cubic feet sized ambition

RLE’s aim is to find proven, probable and possible reserves of gas on its Cooper Basin prospects and develop an asset in excess of 2 tcf.

Source: Real Energy

For those new to gas resources, put it this way: 2 tcf of recoverable gas is a very big number. A 2 tcf gas asset will last a very long time. To give you an idea, in all of the Cooper Basin, 6 to7 tcf has only been extracted – ever. AWT International has independently estimated RLE’s total shale gas in place is around 9.53 tcf with mean basin-centered gas at around 10.2 tcf in other formations:

Source: Real Energy

The Next Oil Rush expects RLE to drill at least three wells in order to approach a 300 – 500 billion cubic feet resource. RLE will be doing this in the coming months. From there it’s likely RLE will need to drill up to 6 to 8 more wells, then link the resource together so it’s contiguous. After that RLE will need to get the resource certified. If RLE can get that far and prove up a decent sized, certified resource, the buyers should come knocking. If that sounds familiar it’s essentially the same strategy employed by Beach Energy who drilled a series of wells in the Cooper Basin to prove up their resources and promptly secured a $350M farm-in deal with Chevron.

Senex deal points the way for RLE

To give you an idea of the takeover game let’s have a look at the recent farm-out deal between Senex and the massive gas player Origin Energy in the Cooper-Eromanga Basin.

Senex has a tiny patch of land in the basins compared to RLE where it has worked up several promising tight gas sands prospects. Origin liked what it saw and free carried Senex to the tune of $185 million. Senex, Origin and Planet have the option to contribute a further $67 million on a participating interest basis – that’s a total of $252 million to be invested – right next door to RLE. The next few months RLE’s neighbours will be watching as RLE progress with their drilling campaign.

Our Track Record

Did you receive The Next Oil Rush report on WHL Energy (ASX:WHN)? Since this report was released, WHN has been as high as 80%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Big potential in RLE’s vast Cooper-Eromanga holdings

Now it’s time to drill down into RLE’s assets and why we think they are getting ripe for a buy out or a huge run of lucrative production. An independent assessment of its three main plays across RLE’s 2 million acres of the Cooper-Eromanga Basin by AWT International estimated there are:

- 18.5 billion barrels of shale and condensate oil (best estimate)

- 9.5 bcf of shale gas (best estimate)

Have a look at the figures for yourself:

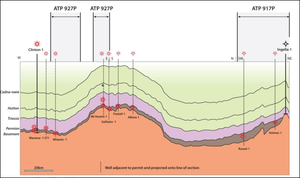

These numbers were calculated from the findings of over 124 historical wells and a raft of 2D seismic data. These are best estimates of resources in place – RLE will be drilling three wells in a few months’ time to further define their size. RLE’s three land holdings in the Cooper-Eromanga contain its three main plays in the region – all of them significant condensate-rich gas deposits. Here are RLE’s two permits in cross section view – ATP 927P and ATP 917P:

Both ATP 917P and ATP 927P are interpreted as being part of a continuous Permian sedimentary sequence while the Toolebuc shale oil and gas play in the Eromanga basin is part of a Cretaceous system present in all three permits.

![]()

Source: Real Energy

Every single well drilled around RLE’s ATP 927 permit has had gas charge within the exact same formations RLE are targeting – over 50% of the wells have had commercial gas production! RLE will focus on drilling this area first. The targets are shallower so will be cheaper to hit. RLE acreage is sitting on tight gas sands trapped in sandstone reservoirs in the Permian sedimentary section under the ground and RLE reckons they form part of a huge basin-centred gas play. The weight of the basin holds it in place.

Source: Real Energy

As it’s primarily made up of sand, not shale, it will be easier to get a flow rate compared to shale which needs a big fracking programme to squeeze gas from. In fact, all of the wells around ATP 927 flow naturally without the use of fracking so that’s a good sign – RLE may not have to pay much to get its resources out of the ground there. Soon RLE will drill in ATP 927 and will be hoping to add another to the long list of drilling success stories in the neighbourhood.

Our Track Record

Did you catch The Next Oil Rush ‘tip of the decade’ – TSX:AOI back in February 2012? The Next Oil Rush called it at around CAD$1.8 and has been as high as CAD$11.25 since – that’s over 600%!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We have the technology

The Holy Grail for every US president since Richard Nixon has been to make the country energy independent – free of reliance on the Middle East and elsewhere to keep things running.

![]()

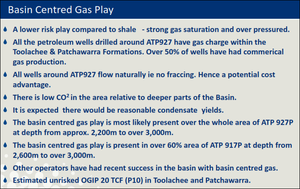

Two techniques are bringing the US even closer to that goal – horizontal drilling and multi-stage fracking. And now this technology is being used in the Cooper Basin AND on RLE’s acreage. These methods have allowed oil and gas companies in the States to bring up so much product that the International Energy Agency (IAE) thinks the US will be energy independent by 2035. You can see here how the US are importing less and less crude oil and natural gas:

It’s working in America. Now it’s moving quickly to Australia.

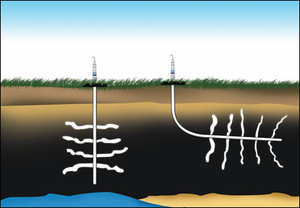

The Cooper Basin has thousands upon thousands of wells to catch up to the Texan Permian Basin. RLE is in the right place at the right time. Horizontal drilling and multi-stage fracking can be used in the Cooper-Eromanga Basins to unlock gargantuan deposits of unconventional oil and gas. For those new to unconventional oil and gas extraction, let’s have a quick run through these techniques. Horizontal drilling. If an oil deposit is shallow, as many are in the USA, you drill down to the level of the oil and then go sideways. This technique can open up oil resources previously though unreachable or even tapped out. Here you can see a vertical drill on the left and a horizontal drill on the right:

Multi-stage fracking. This method works by pumping water and sand into an oil deposit contained within rocks, such as the shale in the Cooper Basin. The pressure then fractures the rock (hence the name fracking) and the resources seep up through the new channels.

The rise of the use of these very effective extraction methods comes at a time when massive levels of investment are going into infrastructure in the region. When gas and oil is tapped from the Cooper Basin it can be quickly sent through numerous pipelines connecting to major east coast cities and export facilities like the ones being built on Curtis Island.

RLE discoveries can move quickly to market

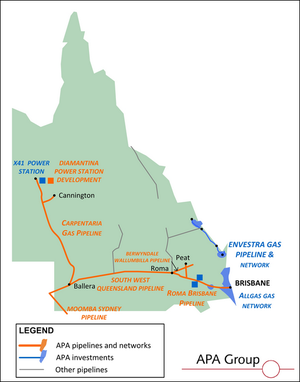

The APA group owns and operates four gas transmission pipeline facilities in Queensland.

Back in 2011, APA began upgrading its Roma Brisbane pipeline in anticipation of the current rapid expansion of Queensland’s gas industry. Smart move, because the three massive LNG plants being built on the coast of Queensland are near to completion and gas is going to flow through the state like the blood in your veins! Just think how easy it would be for RLE to get its gas to the markets through this ready-made infrastructure. Or better yet, think how attractive this makes the Cooper Basin and RLE’s holdings there look to a potential takeover or farm-in partner! All these elements are combining to support the sort of energy boom we’ve seen in the US. A gas boom for Australia is not some investor fantasy. It’s fast becoming a reality.

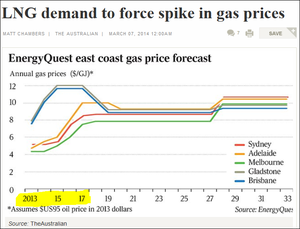

Strong gas price growth on the horizon

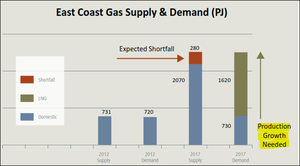

The market for Australia’s east coast natural gas is pretty big – about 750 PJ/year at the moment. But once the true potential of Queensland’s gas fields comes on stream the market could triple:

$70 billion worth of coal seam gas export projects are being built in Queensland right now – the three Curtin Island trains are the jewel in the crown – and most of the LNG that is going to be produced will be shipped off to more lucrative markets like Asia where gas is guzzled fast. There’s even talk of prices reaching $18 a gigajoule!

That’s being fuelled by the possibility of a shortfall between what the Queensland gas producers have signed up to deliver to markets like Asia and what they can actually deliver. The industry has not been able to roll out as many coal seam gas wells as they might have hoped and there is a possibility the gas giants could struggle to fill their orders in the first few years of operation.

That’s good news for RLE – as the Cooper Basin is a perfect place to find the extra gas to fill the demand.

Rising demand from the east coast market

It’s shaping up to be a feeding frenzy of takeovers and supply contracts in the Cooper-Eromanga in the same way the coal seam gas market blew up a few years ago. The coal seam gas industry sprung up overnight, and now the east coast is dotted with wells:

The vast majority of Australian coal seam gas projects are on the east coast with by far the most on the shores of Queensland – with all the infrastructure like pipelines and export facilities raring to go for the rest of the state. Australia’s coal seam gas industry is massive – over 40,000 wells are projected for Queensland alone. US energy giant Exxon Mobil is investing in Australian coal seam gas. So are the Chinese and the British. The Hong Kong based Cheung Group just created a bidding war for gas distributor Envestra – with a $2.37 billion take-over offer that trumped APA Groups offer:

![]()

Billions of dollars are being spent finding, proving and exploiting mammoth deposits of coal seam gas and building colossal LNG facilities like the ones at Curtis Island to get it onto the hungry world energy markets. But demand is so great that coal seam gas may be unable to keep up with it. Coal seam gas production will need to grow by 500% just to keep up. The 3 LNG operators are still looking for more and more gas to process to get their return on investment... Enter the Cooper Basin and its unconventional shale and tight gas. The race is already on for gas suppliers to shore up their ability to meet contracts by picking up gas plays in the Cooper and Eromanga basins. The British energy company BG has claimed a 9.4% stake worth nearly $20 million in Drillsearch Energy, an outfit that has blocks right next to RLE’s. BG is one of the principal developers of the Curtis Island gas hub, having paid more than $5 billion for the Queensland Gas Company (the outfit RLE’s Norm Zilmann helped found) and used its resources as the base for the new export hub. That’s just one deal for a developer in a sea of gas where RLE has one of the best boats afloat. The coming years will be all about helping the big gas players fill their gas export demands. RLE could do it as a producer or it could also prove up an attractive resource and get bought out for a big price. Time will tell, but what RLE has in the ground will have a big say too.

All things considered...

Here are three items we think RLE ticks off with a gold plated pen: Management – What is the track record of management? This is number one for us with RLE. Norm Zillman, gas industry legend, the man who helped created Queensland Gas Company and sold it for more than $5 billion is the Non-Executive Director. He doesn’t need to work another day yet here he is, helping guide RLE. At his side is founder and CEO Scott Brown who helped sell Mosaic Oil for $130 million. This is a leadership team well versed in building a companies up to max potential then selling them for max profits. Safe hands are on the wheel at RLE. Takeover potential – Is there takeover potential? RLE’s business plan is to develop conventional and unconventional oil and gas plays at its 2 million acre holdings in the Cooper Basin. By proving up a resource, RLE would appear very attractive to a possible takeover or farm in. Multi-million and even billion dollar deals are on the cards across the Cooper Basin and RLE is right in the middle of it all with highly prospective assets over a huge land position. RLE could well prove irresistible for a cashed up major looking to expand its portfolio – and the bank accounts of RLE investors! Infrastructure – Is the company’s asset close to infrastructure? RLE’s land holdings in the Cooper-Eromanga are well within reach of several high quality pipelines that link to the east coast of Australia where billions of dollars is being spent to set up LNG processing facilities like the ones on Curtis Island. We see no problems getting product to market, in fact, the only problem will be sorting out whose product goes down the pipes when!

Next on the agenda

The key thing RLE needs to do to make any of its plans come to fruition is to develop a confirmed resource at its Cooper-Eromanga holdings. RLE will be kicking off their drilling programme in a few months’ time – it’s already in negotiations to contract the drill rigs. But it also needs to reach access agreements with landowners and undertake some cultural heritage surveys of the land to make sure they don’t disturb anything important. We expect to see all of this finalised soon and the drilling of three wells should begin by August 2014. From there, a steady stream of flow rate announcements should hit investors’ screens. Meanwhile, we’ll be keeping an eye on the developments out at Curtis Island where the gas giants are in the final phases of construction for the three LNG trains. These massive facilities are the key to everything. They are the doorway to the world for Australia’s and RLE’s gas. Their thirst for product is driving a buying frenzy in the Cooper Basin, so RLE’s upcoming drilling programme is crucial. If they get it right, the potential for farm in or takeover will only increase. The Next Oil Rush has added RLE to our portfolio as a long term play. RLE appears undervalued at this moment in time and has clear pathways to growth. Remember, RLE is the only junior left with 100% ownership of some of Australia’s most prospective shale oil and gas land right at the time when demand is going through the roof.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.