Friday Stock Pick: Will it Happen Again...

It’s Friday again and here is our portfolio stock that we think has a strong chance to rise in the near term.

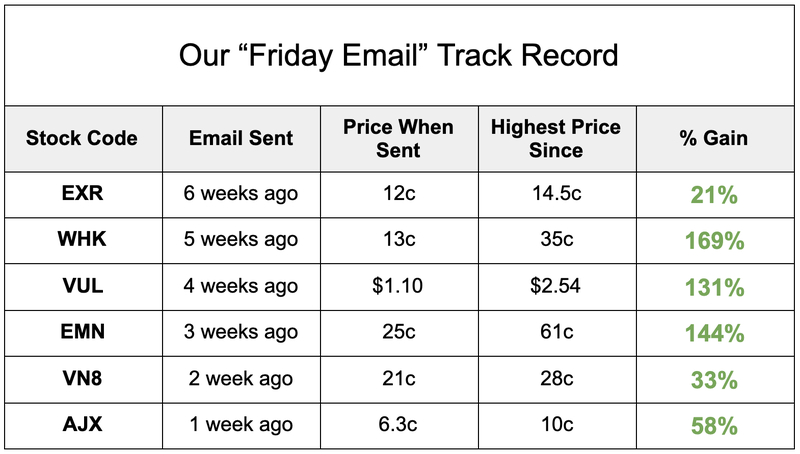

We continue to be delighted with the Friday results so far:

88 Energy (ASX:88E) is a junior oil explorer that is determined to hit the next multi-billion barrel oil discovery on the North Slope of Alaska.

88E has a major drilling event in February 2021, testing a 1.6 billion barrel mean unrisked recoverable prospective resource:

Today, 88E announced that a group of US oil investors have agreed to pay for almost the entire drilling cost of the next well (up to US$11.3M) - in return to earn 50% of the project.

This is a huge result for 88E investors, essentially giving 88E a "free hit" at this next drill target.

88E is drilling in the North Slope, what industry pundits call a “Super Basin”, and one of the oiliest places on Earth.

We have been long term backers of today’s company and its management team, and we currently hold a large position in the stock ahead of a few months of significant newsflow.

Will it happen again?

While past performance is not to be taken as an indicator of future performance, this company always seems to run up in the lead up to it’s drilling events.

Here is why we think 88E’s share price could rise in the near term

- Drilling in February: We expect a significant share price run in the coming months, on strong volumes in the lead up to this important drilling event.

- History: As news in the build up to drilling is released to market, the momentum builds. We are betting this will happen again.

What’s our plan?

- Hold for the near term and sell enough to recoup our initial investment in the lead up to drilling. We are aiming to “free carry” into spudding.

- If drilling is successful, it will be transformational for 88E and we would expect to make multiples on our investment.

Investing in oil explorers is a high risk / high reward style of investing, and not for the faint of heart. Only invest what you can afford to lose.

Oil stocks remain out of favour, albeit with early signs of recovery, so we think it's a great time to invest ... and we have been buying.

We invested in VUL at $0.20 when lithium stocks were out of favour.

This has delivered us a more than 10x return in less than 18 months.

Anything in oil right now is a counter cyclical investment – wait for the inevitable return to favour.

Bring on February 2021.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.