EXR Doubles its Gas Resource on China's Doorstep

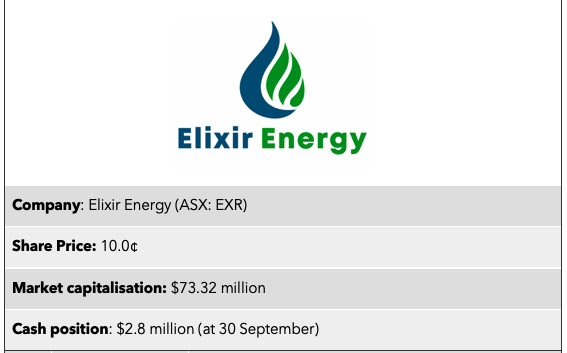

Elixir Energy Ltd (ASX:EXR) has almost doubled the size of its Nomgon IX prospective resource in Mongolia.

Nomgon IX is a large coal bed methane (CBM) production sharing contract (PSC), covering approximately 30,000 km2 (equivalent to the size of Belgium).

EXR owns 100% of this project, and is progressively developing this large gas resource right on the border of gas hungry China - around 400km north of China’s main gas transmission grid.

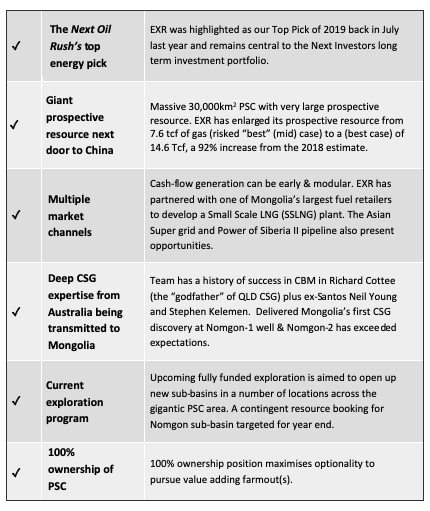

EXR is one of the few ways ASX investors can gain some exposure to the global thematic of a decarbonising and increasing energy security conscious China.

China is desperate to move away from burning dirty coal for energy, and that directive is coming from the top down. This all feeds into the demand of what EXR is uncovering just across the border.

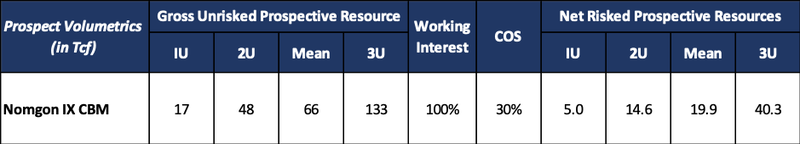

Today’s prospective resource update delivered by independent reserve auditor ERCE Equipoise (ERCE), shows the resource best case has nearly doubled.

EXR has enlarged its prospective resource from 7.6 tcf of gas (risked “best” (mid) case) to a (best case) of 14.6 Tcf, a 92% increase from the 2018 estimate.

The resource stretches across multiple sub basins, and over the course of 2021, EXR intend to continue growing and de-risking the resource via exploration. Click here for a detailed explanation of what a prospective resource is.

In the soundbite below, EXR MD Neil Young speaks exclusively to Next Oil Rush about the significance of this Resource update:

EXR intends to re-commence drilling in February, with the drilling of a fully tested corehole to follow up on the recent highly promising Yangir-1 strat hole.

All 7 wells drilled in 2020 intersected coal, and 2021 drilling will expand on this work.

Today’s substantial resource increase not only goes a long way to de-risking the asset with what in oil and gas terms has been a very modest outlay over a short period of time, but also makes a significant statement about how readily the enormous potential of the PSC can be realised.

Wood Mackenzie, the world’s premier oil and gas consultant, believes China is the engine of global gas growth, meaning EXR is in the right place at the right time.

A recent article by S&P Global would back this up, stating China imported 9.18 million mt, or 12.65 Bcm, of natural gas, including LNG and piped gas, in November, up 21.8% on the month.

Could EXR be well placed to help China meet this demand, given the resource it is unlocking just across the border in Mongolia?

Time will tell, but looking at the here and now, there are several highlights to today’s resource upgrade, prepared by independent reserve auditor ERCE Equipoise (ERCE).

These include:

- Unrisked and Risked Prospective Resources have increased significantly in all cases from the 2018 estimates

- Risked 2U (best case) of 14.6 Tcf, a 92% increase from the 2018 estimate

- Chance of Geological Success now 30%, a 58% increase from the 2018 estimate

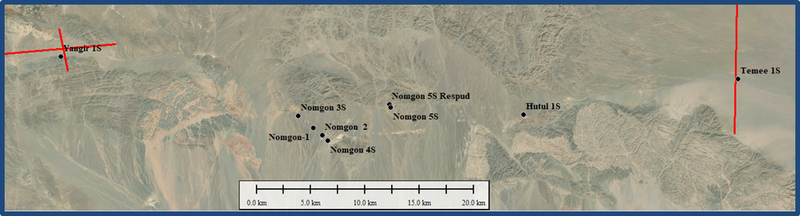

The resource was updated following the highly successful 2020 drilling campaign where 7 CBM exploration and appraisal wells (spanning a distance of 62km) all intersected coal.

An initial contingent resource estimate for the Nomgon sub-basin discovery area will be prepared and issued once all the data from the appraisal drilling program has been compiled, modelled and analysed.

A summary of the prospective resource range is outlined below:

It is important to note that the estimated quantities of petroleum that may be potentially recovered by the application of a future development project relate to undiscovered accumulations.

These estimates have both an associated risk of discovery and a risk of development.

Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially movable hydrocarbons.

EXR was our top energy pick of 2019 and we have invested three separate times and continue to hold a long term position, expecting big things in 2021.

We are long term holders in EXR, it is well funded into next year with a drilling program planned for 2021.

EXR’s management has been working hard to realise the potential of its prospective CSG (Coal Seam Gas - CSG is usually referred to as CBM outside of Australia) assets and the company has continued to deliver on its milestones.

If 2021 delivers similar results or similar milestones, there could be a chance EXR could attract potential suitors to its 100% owned assets sooner rather than later.

EXR certainly finished the year strongly and will start the new year with a bang.

EXR looking the goods for 2021 – drilling again in February

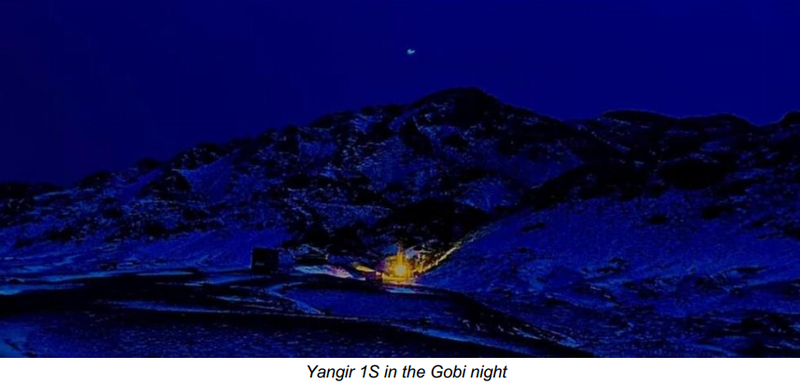

Elixir anticipates commencing its 2021 program in or around February, with the drilling of a fully tested core-hole to follow up on the highly promising Yangir 1S strat-hole.

The Yangar 1S strat-hole well (see map below), is a potential new sub-basin located some 24 kilometres to the north-west of Nomgon-1.

Importantly, drilling at Yangir intersected 27 metres of coal.

Some gas samples were obtained from the bubbling cores extracted in the Yangir well and these will be tested for gas composition shortly (gas content cannot be accurately measured given the absence of an on-site laboratory for what was only a low-cost strat-hole).

EXR has recently submitted its formal budget and plan for 2021 to the Mineral Resources and Petroleum Authority of Mongolia (MRPAM) as part of an annual regulatory process required under the terms of the Nomgon IX PSC, which will also involve procuring subsequent environmental approvals from the relevant Ministry.

Drilling in February comes after one of the busiest periods in the company’s history to finish off one of the world’s most challenging years.

With 7 out of 7 wells intersecting coal in 2020, as long term investors, we are looking forward to what 2021 can unlock for EXR.

Strong adsorption results

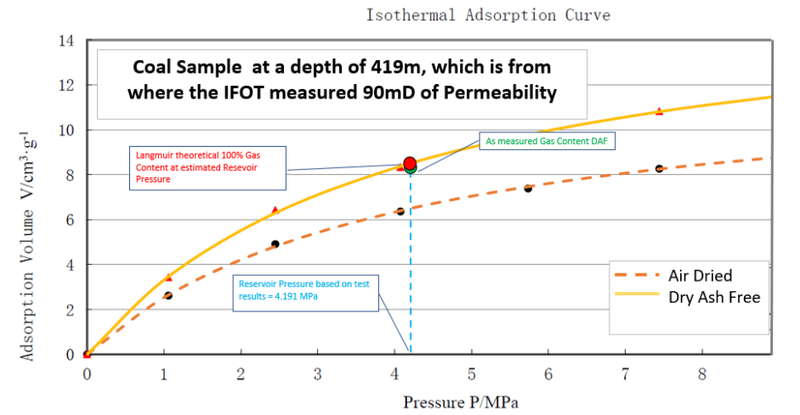

Just last week, EXR provided a promising update regarding adsorption results from the Nomgon 2 core-hole well.

Whilst COVID-related issues delayed the results, the news was worth waiting for as it demonstrated that the lower 100 series coals intersected at the Nomgon-2 well were fully gas saturated.

This is consistent with the Nomgon-1 well, representing a best-case scenario as it will greatly reduce the costs and other issues associated with water handling in future testing and production phases.

Proof of consistently strong adsorption results will positively impact the company’s production testing in 2021.

Commenting on recent developments, Elixir’s managing director Neil Young said, "The consistent adsorption result from Nomgon-2 indicates that the earlier high gas saturation levels from Nomgon-1 were not a one-off and this is already feeding into our production testing plans for next year.

"All 7 wells drilled this year intersected coal and we are already advancing the processes and plans required to hit the ground running in the New Year.

"Our planned technical program for 2021 will greatly expand upon 2020’s excellent work.”

The company’s outstanding progress has been reflected in its share price, up six-fold since January with the potential for further upside in 2021 given multiple catalysts are on the horizon.

Positive results put EXR a step closer to defining a large gas resource on China’s doorstep

With its large, 100% owned PSC located near to China, Elixir represents a compelling investment play for Australian investors.

As we stated above, EXR is one of only a few ASX-listed companies that offers exposure to China’s energy transition away from burning dirty coal.

With China being a leader in global energy policy given its size, President Xi Jinping’s statement in October in which he committed to net zero emissions by 2060 was embraced by those striving for a transition to carbon-neutral energy solutions.

The government has instigated a “5 year plan” that dramatically reduces its reliance on other global powers for key resources, especially its energy supply with the added advantage of transitioning from burning dirty coal for energy.

China currently generates more than half of its electricity from coal, but natural gas is increasingly being used in the country for heating and transport.

While a transition from less coal usage to natural gas is not a silver bullet, it would at least be a stepping stone to a carbon-neutral solution.

An uptick in demand for natural gas in China would be extremely positive for EXR as it would increase the value of the asset and investor interest.

As long term investors in EXR we are looking forward to seeing what 2021 can bring.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.