Cornerstone Investors Back PGY at a 100% Premium

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Oil may be temporarily downbeat, with some junior oil & gas explorers struggling to attract investor attention, however there are a small number of quality companies out there who are astutely gearing up for the inevitable market rebound.

A depressed market offers an opportunity for savvy operators to employ a counter-cyclical investment approach in order to acquire quality assets on the cheap, with the potential for a significant return when prices rebound.

This is exactly Pilot Energy (ASX:PGY)’s strategy.

To pick up strong assets in proven petroleum provinces – on the cheap.

Over the past 18 months PGY’s management team has turned the company around, and has quietly gone about acquiring interests in five West Australian exploration permits, across four projects.

They have done so with minimal cash outlay, and have been diligently adding value through low cost desktop work, so that the company is now poised to deliver significant gains during the next upturn in the oil and gas investment cycle.

This has not gone unnoticed, and PGY recently pulled off a coup by attracting major backing to the tune of $3.6 million from a group of sophisticated investors, at a premium of up to 100% to the 30 day VWAP.

Not only a strong endorsement of PGY’s management, assets and strategy, the investment enables the company to fund its firm commitments and provides significant working capital to pursue further growth opportunities.

The incoming investors will acquire a 45% shareholding in PGY, and the current management team, who have between them invested over $300,000 in PGY, will remain in place.

Managing Director Iain Smith will continue to steer PGY on a course to success, with seasoned Chairman Gavin Harper remaining at the helm.

When high net worth investors buy into a resources company in a big way, it often serves as a prelude for the company’s ascent.

PGY is ready for market traction after a long period at a bargain-basement level of 0.1 cents per share. Pending completion of the recently announced deal, the company’s market cap is currently right around cash backing – attributing basically zero value to PGY’s four projects, three of which should be regarded as offering ‘company making’ potential.

The $3.6 million placement allows PGY to fund all of its current work commitments on its asset portfolio in Western Australia, and provides working capital with which to progress farm-outs of its offshore projects.

Importantly the investment also provides scope for future funding with which to pick up additional quality assets in order to achieve the company’s stated aim of becoming a leading junior E&P company.

As the company is still in its early stages we do recommend a cautious approach when considering this stock for your portfolio.

This Pilot is taking all the necessary steps to ascend and is sitting pretty for when the broader oil and gas market enters its next upwards cycle.

Catching up with:

Oil exploration isn’t simple or cheap at the best of times, so today’s market environment means collaboration trumps monopolisation when it comes to exploring for substantial oil and gas reserves.

Pilot Energy (ASX:PGY) has been reinvigorated into an emerging oil and gas explorer over the past eighteen months, with the skilled and experienced new management team successfully resolving a number of legacy issues and acquiring no less than five exploration permits.

The company’s strategy is to acquire quality assets on the cheap, and add value through low-cost desktop studies before farming out to industry partners in order to fund the expensive business of exploration, be it seismic data acquisition or drilling an exploration well.

Let’s review where PGY is operating, what its intentions are, and most importantly how much potential it offers investors looking for the next oil rush.

Operating in one of Australia’s most prolific Oil & Gas regions

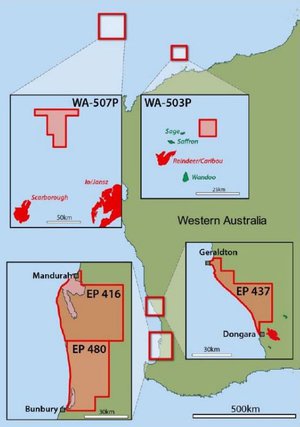

All of PGY’s current assets are located in Western Australia, with two projects offshore and two projects onshore.

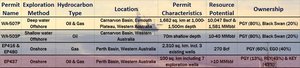

Here’s a summary of PGY’s asset portfolio:

To advance these projects through exploration, and hopefully onto production, requires significant funding. Importantly, the PGY management team has extensive experience of farming out projects to industry partners, with those partners earning an interest in the projects by funding 100% of big-ticket items such as seismic and drilling.

PGY a beacon for opportunistic investors

Just days ago, PGY announced a cornerstone investment from a group of four high-net-worth investors.

The deal allows PGY to meet all its current commitments on its WA portfolio, while providing ample working capital for the company to ride out the current industry downturn. Chances are some of that capital could be used to secure stakes in other attractive assets, whose current owners may be suffering from the oil glut.

In a raising arranged by Patersons Securities, four Australian and Hong Kong-based private companies will end up owning 45.4% of PGY.

The existing management team will remain in place.

Non-Executive directors Conrad Todd and Rory McGoldrick will step down from the board in order to make way for two new incoming directors, however importantly for PGY they will both remain as key members of the team, in the capacity of advisors to the board.

PGY runs a lean organisation in order to minimise corporate overheads, with Iain Smith as the only full-time employee.

Retaining the skills and experience of Mr Todd and Mr McGoldrick will enable the company to continue to grow as a fully-fledged operator, without incurring significant fixed costs.

This move will be supplemented by incoming directors Mr Benson Wong and Mr Wilson Xue, with oil industry expert Mr Xingjin Wang joining as a third Advisor.

Commenting on the group’s investment in Pilot Energy, Mr Wong said: “ Our investor group has reviewed a large number of oil and gas investment opportunities over the past 12 months, and regards Pilot Energy’s management team, asset portfolio, and approach to business as offering a unique opportunity to create a leading Australian E&P company.

“My colleagues and I look forward to joining the Pilot Energy team, and are excited about the opportunities for growth that present themselves to a well-funded and well-managed oil and gas company such as Pilot Energy. ”

As we said earlier, if high-net worth individuals are banding together to cherry-pick interests in quality companies, it could mean that cherry has ripened.

The investment will proceed in two tranches. Tranche 1 will be an investment of $800,000 to acquire 400 million shares at 0.2c per share, a 35% premium on PGY’s 30-day VWAP.

The second tranche, which needs to be signed off by shareholders at a meeting in June, will result in a further $2.8 million coming in to PGY’s coffers, via a placement of 933.3 million shares at 0.3c each –a 100% premium to PGY’s 30-day VWAP.

Newly restructured and now well-funded, PGY is poised for significant success

With its current asset portfolio there is plenty of potential for PGY to get its teeth stuck into. Let’s look at those assets in more detail.

WA-507-P

Exploration permit WA-507-P is the jewel in the crown of PGY’s portfolio, with PGY holding an 80% working interest as Operator.

The permit is located within the prolific Northern Carnarvon Basin, home of numerous giant gas fields. The block is covered by an existing, high quality 3D seismic dataset, which reveals the presence three large structures, ranging from 27 km 2 to 121 km 2 in area.

These structures have the potential to contain significant quantities of oil and/or gas within the Triassic Mungaroo reservoir, which contains much of the gas/condensate discovered to date on the Northwest Shelf.

Independent expert Gaffney Cline & Associates has assessed the permit’s potential for both oil and gas discoveries, and here’s a snapshot of the prospective resources avalable at WA-507-P according to them:

![]()

GCA’s report says that three leads each have a high case potential for finding over 900MMbbls oil, with the largest lead potentially holding 1.7 Billion barrels...

The Statoil Factor

One thing that should not be overlooked is what’s happening with one of PGY’s next door neighbours at WA-507-P.

US$52BN-capped Norwegian oil juggernaut Statoil, together with other industry majors, has recently acquired a very large seismic survey across its WA-506-P, immediately to the north of PGY.

Statoil is currently preparing for an extensive geochemical surveying, targeting the same oil and gas play that PGY is pursuing.

Statoil has made a massive commitment to this area, being required to spend some $50 million over the next few years, and importantly for PGY they would be required to drill an exploration well before PGY

If Statoil proves up something substantial, it would almost certainly mean some form of ‘valuation overspill’ for PGY given the close proximity of their permits.

PGY is currently worth a tiddly $3 million (not including the recent funding deal), while Statoil is spending $50 million just on surveying its WA-506-P prospect over the coming three years.

Here’s a map to clarify how all this looks in practice:

The plots bordered in red have recently undergone detailed 3D seismic surveying and modelling...

...while PGY’s area, bordered in blue, sits right in the middle of the exploration peloton.

This is the proverbial David operating under the shadow of Goliath, operating on different planets when it comes to size and scope.

PGY would rather not spend valuable cash on developing WA-507-P by itself, and is in discussion with a number of potential farm-in partners in order to cover its relatively small seismic license fee commitment, having licensed a high quality 3D seismic dataset across its permit when it acquired the asset.

Adjacent activity by Statoil and other majors has the potential to propel PGY’s share price valuation in to the stratosphere, having been bobbing along the sea floor at 0.1 cents per share until very recently.

At the same time though, any rise in share price is speculative at this stage, so seek professional advice when considering this stock for your portfolio.

WA-503-P

Exploration permit WA-503-P is located offshore Western Australia within the Dampier sub-basin, inboard of the giant Northwest Shelf complex and on trend with numerous oil and gas discoveries, including the Legendre and Hurricane fields.

The shallow water depth across the block (maximum 70 metres) allows for drilling by lower cost ‘jack up’ drilling rigs. PGY holds an 80% working interest, as operator.

Here PGY is chasing oil, with the exploration focus being the Lower Cretaceous to Upper Jurassic sandstone reservoirs within the oil rich Legendre Trend. Existing exploration wells within and adjacent to the block confirm the presence of a working oil system and with the aid of existing 3D seismic data PGY has identified three prospects.

GCA have independently assessed the potential prospective resources of these prospects, as follows:

Source: Pilot Energy

Three leads each offer multiple reservoir targets and on aggregate, gross Prospective Resources vary in the High Case from 14.0 MMBbl to 72.8 MMBbl

There is ample scope for a commercial oil discovery within this block, and PGY believes that a ‘broadband’ 3D seismic survey will help to de-risk the known prospects so that one may be selected for drilling.

PGY has an agreement with a seismic contractor to acquire the data at very low cost, with acquisition planned for 2016.

While PGY now has the funds to carry out this work, consistent with the company strategy, the management team is planning to farm-out an interest in WA-503-P to an industry partner, in return for that partner covering the survey cost.

EP416 & EP480

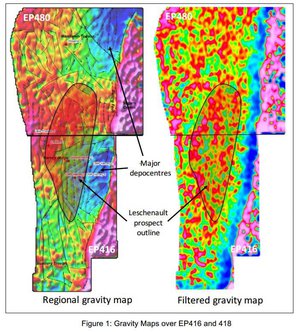

These two permits cover a combined area of 2,310km 2 across the southern Perth Basin, with sparse exploration done since the 1960s.

A recent well drilled in 2012 confirms the presence of good quality sandstone reservoir intervals within the area, and together with JV partner Empire Oil & Gas, PGY has identified a very large gas prospect, named Leschenault.

PGY holds a 60% interest in the permits, and recently took over operatorship from partner Empire Oil & Gas.

PGY’s internal assessment of the prospective resources for the Leschenault prospect is as follows, offering up to 600 Bcf in the high case; of a scale not dissimilar to AWE’s significant Waitsia discovery to the north of the basin.

![]()

Source: Pilot Energy

The Joint Venture recently released the results of airborne geophysical surveying stretching, with received results giving cause for cheer.

One of the key conclusions from the data gathered so far is that the “gravity data indicates the presence of large regional depocentres to the NE and SE of the Leschenault prospect, which represent potentially deep hydrocarbon kitchens from which gas is thought to have been generated”.

The way PGY sees it is that if the kitchen is well stocked, why not dip in for a bite.

PGY hopes to drill the Leschenault prospect, once further low cost surveying and desktop work is complete and a farm-in partner is identified to cover the cost of drilling.

Shown below are PGY’s most recent survey results received in late February.

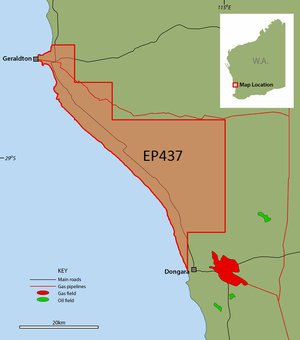

EP437

PGY’s most recently acquired asset covers around 100km 2 within the onshore Perth Basin, in an area where good oil shows have previously been encountered at several wells. PGY owns a 13% interest, and is in partnership with the operator, Key Petroleum (ASX:KEY) and Rey Resources (ASX:REY), a company we have previously covered at the Next Oil Rush .

EP437 is situated on the west of the northern Perth Basin, between the towns of Geraldton and Dongara; some 10km to the north of the Dongara gas field and Jingemia/Hovea oil fields, and 20km to the north of the Cliff Head oilfield.

PGY’s interpretation of existing well and seismic data suggests the presence of a number of shallow-depth prospects at the Bookara and Arranoo sandstone levels, located along a terrace structure and structurally updip from the Dongara gas field.

Three prospects have been identified to date, all located updip from the Dunnart-1 & 2 wells; both of which encountered good oil shows.

EP437 provides PGY with exposure to low cost onshore oil and gas exploration, along trend from existing discoveries.

The proximity to infrastructure in this part of the Perth Basin enables even small oil discoveries to be commercialised.

Having turned the corner over the past 12 months, finally this Pilot is on a concourse for growth

PGY holds an attractive and balanced portfolio of four conventional exploration projects offering the full range from low cost onshore gas and oil/gas exploration (EP416/480 and EP437 respectively), through high potential shallow water oil exploration (WA-503-P) to very high potential deepwater gas and oil exploration (WA-507-P).

Management has proven itself to be astute, nimble-footed and opportunistic. They keep a tight rein on the purse strings, and have successfully deferred a number of significant cost items through creative commercial structures with industry partners.

With the oil market temporarily going through tough times and prices remaining weak, now could be a good time to look ahead in terms of acquiring exposure to attractive oil and gas assets for cents in the dollar – with a view to maximising the acquired value of those assets when the market does eventually recover, and prices realign with historic averages.

For PGY, several potential catalysts are already on the horizon including survey results from EP416/EP480 and WA-503-P, independent assessment of the Leschenault prospect volumes, and further acquisitions.

Although on the table, these catalysts are yet to happen and thus investment caution is required – this a small company and a speculative stock.

The most substantial boost however, could come in the form of a farm-in agreement to progress the big kahuna targets at WA-507-P, an offshore play with billion-barrel potential.

When it comes to oil exploration in general (and even more so now in downbeat markets) it’s better to have a piece of something than all of nothing.

PGY is thinking along the same lines and now with substantial funding secured, this pilot light may be set to burn stronger than ever...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.