GLV announces details of historical gas discovery - and it has already flowed…

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 46,450,000 GLV shares and 8,500,000 GLV Options. The Company has been engaged by GLV to share our commentary on the progress of our Investment in GLV over time.

Our 2023 Energy Pick of the Year, $14M capped Global Oil & Gas (ASX: GLV) just announced details of an existing, historical DISCOVERY on their license.

Usually a gas discovery takes years of work and at least a few expensive drilling events.

This shallow offshore discovery has already flowed gas to surface for an extended period of time (60 days back in the 1980’s).

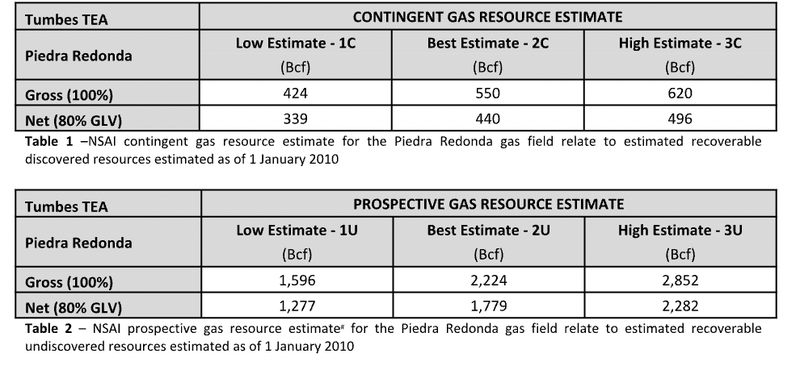

It has a “best estimate” 404 billion cubic feet of gas (Bcf) CONTINGENT resource (100% basis).

And a “best estimate” 2.2 trillion cubic feet (TCF) prospective resource (100% basis).

It sits fully within GLV’s licence area in offshore Peru.

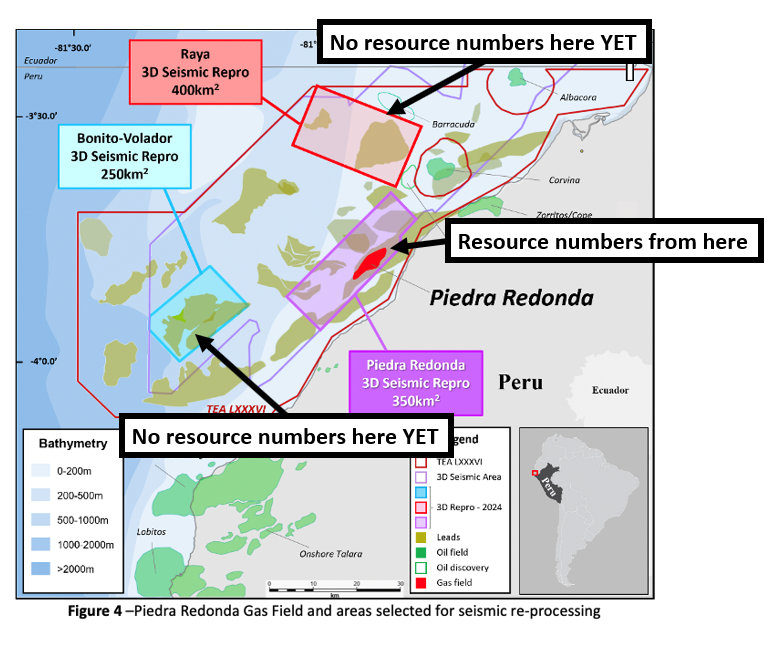

And it’s just ONE out of THREE of areas being evaluated within GLV’s license.

At last traded price, GLV has a $14M market cap.

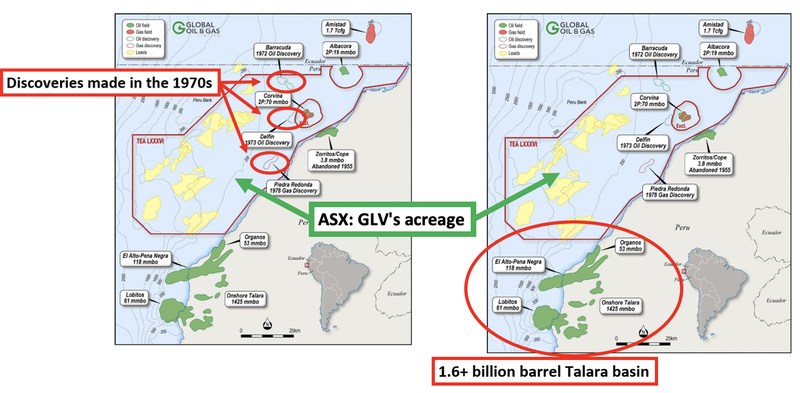

We already knew GLV’s project was big in terms of size.

The project is huge, sitting on ~4,858km2 of ground.

The project has tens of thousands of km’s of 2D/3D seismic data.

And has existing discoveries sitting inside the acreage.

We like GLV for its relatively low market cap for an early stage oil & gas explorer,

We ALSO like that Scott Macmillian from IVZ joined the GLV board late last year.

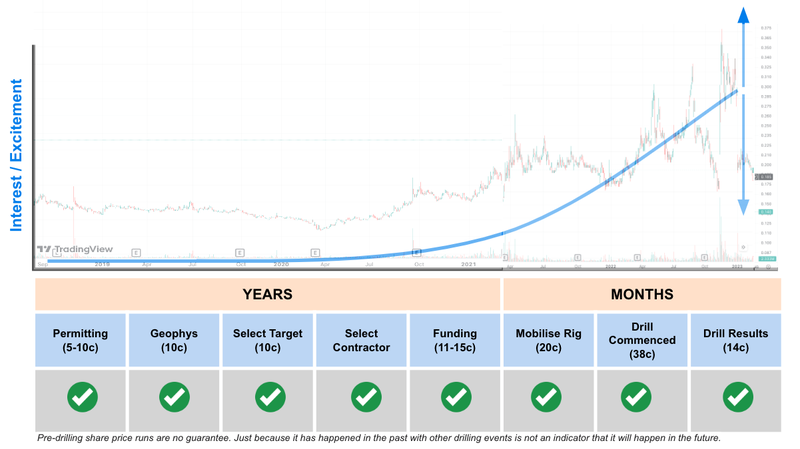

We Invested in IVZ back in 2020, when it had a $20M market cap (3.5c)

At the time, IVZ had a lot of work to do before their drilling event - IVZ’s first drill event was still a couple of years away.

But the early Investment and patient wait saw the IVZ share price gradually rerate from $20M to $134M BEFORE their first drill rig was mobilised.

IVZ’s share price during their first drill went as high as ~41c per share - more than 11x our Initial Entry Price.

During the first drill program IVZ’s market cap hit ~$360M.

Here is the list of work IVZ completed from when we Invested at $20M market cap, to just before its first drill rig was mobilised at $134M market cap:

- Field operations

- Historical seismic analysis and reprocessing (the old Mobil data)

- Government engagement

- Community engagement

- New seismic acquisition

- Increased land holding

- Identify prospects and targets

- Release initial prospective resource

- More analysis

- Upgrade prospective resource

- Environmental and other approvals

- Order long lead items

- Drill rig mobilised

(the above is what we expect to see GLV do in the medium term before its first drill)

And then we finally got to watch IVZ’s first big drilling event, which is a whole different experience to the gradual pre-drill work rise.

GLV is in a similar stage to where we first invested in IVZ.

(and IVZ Managing Director Scott Macmillan has just joined the GLV board, he has “been there” and “done that” when it comes to all the prep work required to get to a big drill event)

Note: We are not saying GLV will do the same as IVZ or any other early stage explorers, lots can go wrong and small cap investing is high risk. Past performance of other companies is not an indicator of the future performance of GLV

Today GLV announced one of the pre-drill steps we are hoping will create value in the company.

Until now the unknown was how much oil/gas GLV is working with.

Now we know what GLV has at just ONE of its THREE main targets:

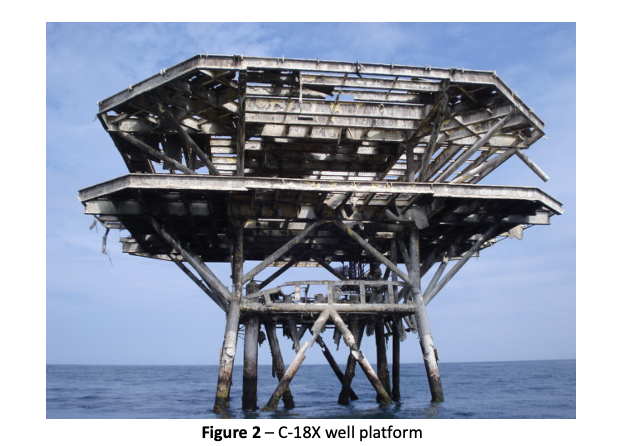

1. 404 billion cubic feet of gas CONTINGENT resource (100% basis) - Contingent means the resource is already “discovered”.The contingent resource comes from two old wells, one of which flowed gas at 8.2 million standard cubic feet of gas per day - below is a picture of one of the well platforms:

2. 2.2 trillion cubic feet prospective resource (100% basis) - a “prospective resource” is what hasn't been discovered yet and is less certain - the exploration upside.

All of that in just one of the three target areas GLV is targeting with its 1,000km^2 seismic reprocessing work.

To put all of that into context - the Bass Strait (offshore Victoria) which has been supplying most of east coast Australia’s gas for ~60 years has produced a total of ~8 trillion cubic of gas.

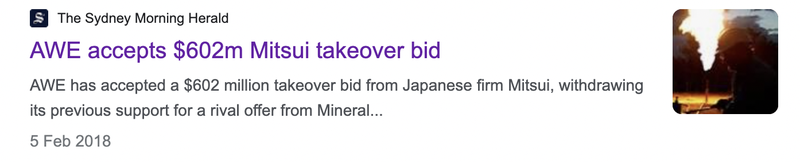

AND, AWE’s 50% ownership in the giant onshore Perth Basin discoveries (~1Tcf) was bought by the Japanese (Mitsui) for $602M back in 2018.

(Source)

So GLV is working with some serious numbers now...

At the same time, there is still all the upside from the two other targets GLV is working on.

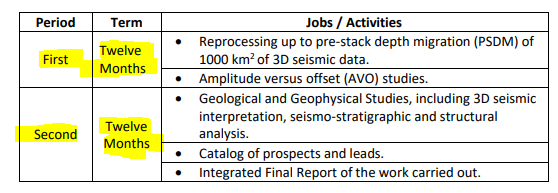

GLV is currently working under a Technical Evaluation Agreement (TEA) which means that for the next 24 months GLV will be doing low cost desktop studies.

So for the first 24 month period, GLV will be refining drill targets at three key prospects, putting together similar announcements like today’s. We will be looking out for things like:

- Contingent resource numbers

- Prospective resource numbers

- Drill targets to work out the lowest risk, highest reward target.

It should be a relatively low cost exercise, with what we think is a lot of upside for the fundamentals of GLV’s project.

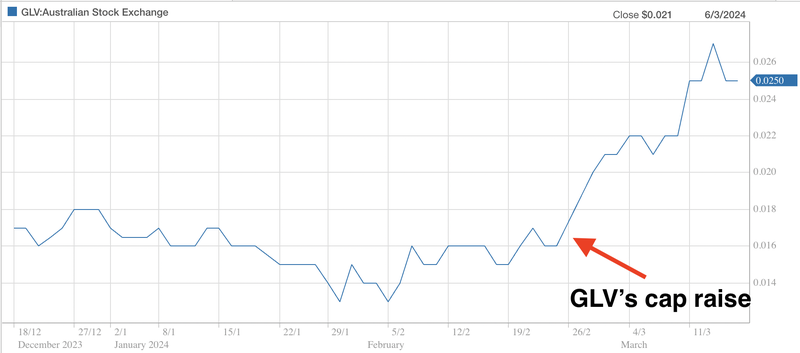

That’s why we decided to increase our Investment in the most recent capital raise on 28th February this year.

Last month GLV raised $1.365M at 1.5c per share, a raise we participated in.

GLV is already up 33% from our Initial Entry Price and 66% on the placement.

Why we took a decent swing in the GLV capital raise 3 weeks ago.

The main reason is that we think under GLV’s TEA, a small amount of cash gets the company relatively far and delivers multiple major catalysts that will hopefully build and maintain a higher company valuation.

We think GLV can now start building up momentum for four reasons:

1. GLV is no longer in a position where the market is anticipating a capital raise in the near term

This one we are seeing all over the market right now, companies that clearly need to raise capital are being sold down in anticipation of a capital raise.

Compounding the selling, investors also stop buying on market - preferring to wait for a discounted capital raise where they can buy in.

GLV did have cash in the bank prior to this raise, so when a company raises cash and wrong foots the market, we often see the share price react by moving higher as investors realise they may have missed the boat and the only way to get onboard in the near term is by buying on market.

This is what we think is happening with GLV’s share price post the capital raise:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

2. The market is just realising GLV’s valuation relative to the potential of its project

GLV owns 80% of its giant oil and gas project (4,858km^2).

The project has existing discoveries inside it and sits inside a basin that has produced over 1.6BN barrels of oil in the past.

The project also has existing seismic data that is likely worth tens of millions of dollars and years of time if the seismic were to be shot from scratch.

After today, GLV has already defined a 404 bcf contingent resource and a 2.2 trillion cubic feet prospective resource.

3. ...Not to mention GLV’s team...

Led by Scott Macmillan from IVZ...

We first Invested in IVZ at 3.5c per share back in 2020.

This was years before IVZ drilled their first well.

IVZ did a lot of necessary project de-risking work before their first drill - like seismic reprocessing, new seismic collection (this alone took ages), target generation, and prospective resource definition.

The pre drill work saw the share price consistently trade in the 15c to 25c range pre drill, and touch a high of ~40c pre drill result.

At its peak before its first drill result, IVZ hit a market cap of ~$320M.

At current market prices (2.5c per share), GLV’s market cap is just $14M.

(the low market cap is one of the key reasons we like GLV)

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

4. Market might be pricing in GLV being funded through to major catalysts

No matter how valuable a project a company could be, it always takes a few catalysts being delivered to get the market interested and for the market to re-rate the company’s valuation and truly believe in the story.

Typically delivering these major catalysts costs a lot of money, especially in the oil and gas space.

In GLV’s case, things are a little bit different.

GLV is working under a Technical Evaluation Agreement (TEA) that sees them spend very little money doing exploration for a two year period.

For the first 24 months, the focus is on reprocessing seismic data and ranking drill targets.

This means GLV can deliver major catalysts, rank drill targets and bring its project to a position where it has multiple high impact drilling opportunities for a relatively low cost.

Especially considering most of the work is going over historic data.

The market could now be pricing in a scenario where GLV is funded through some (or all) of these major catalysts and is trying to get ahead of it...

(but even in this case, small cap companies will still usually raise equity as a buffer or as a back up plan if things go wrong with the project.)

What could the next major catalysts be for GLV?

News from Target #1 (Bonito prospect) 🔄

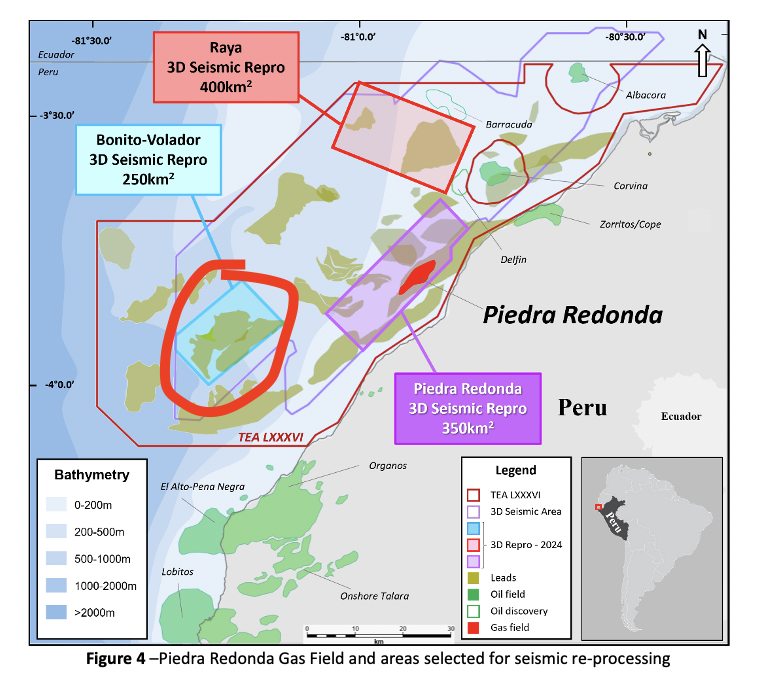

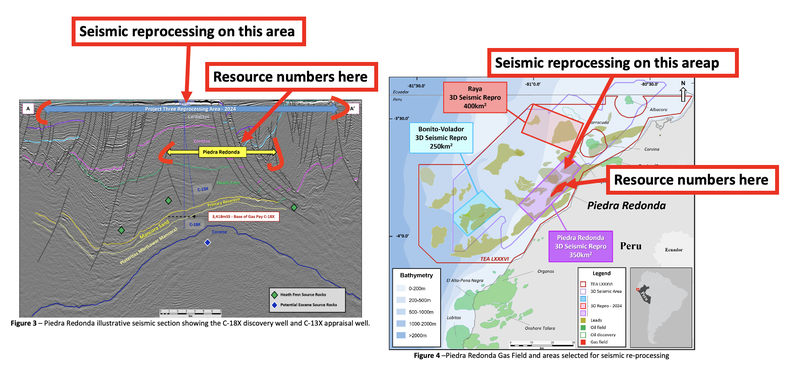

GLV has already started reprocessing ~250km^2 of 3D seismic data at its first prospect.

Over the coming months we could get multiple announcements from the project, whether it be an updated interpretation of the seismic data or a new approach to explore the project.

OR GLV could deliver an announcement like today’s from the prospect - a prospective/contingent resource number.

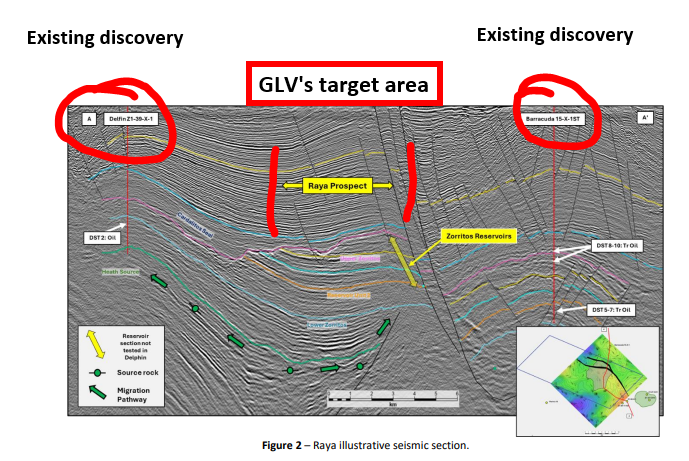

News from Target #2 (Raya prospect) 🔄

GLV is also reprocessing ~400km^2 of 3D seismic data from its second prospect.

GLV’s second target (Raya) sits right in the middle of two existing discoveries - Barracuda and Delfin which have both confirmed oil systems.

GLV said it picked this target area mainly because it had the potential to have similar “stratigraphic and structural traps” to the two nearby discoveries.

So GLV is looking at oil found in wells nearby AND a combination of potential structural/stratigraphic traps which are indicators of oil/gas systems.

Again, with this prospect we could see GLV deliver a major catalyst like a prospective resource number, new exploration theory or updated interpretation of the seismic data.

Given there are already two confirmed discoveries to either side of this prospect, we think there is a chance this one could surprise everyone to the upside.

GLV could upgrade the numbers from its third prospect (Piedra Redonda)?

GLV now has 404 billion cubic feet of gas (Bcf) contingent resource and a 2.2 trillion cubic feet (TCF) prospective resource on a 100% basis.

At the moment GLV’s resource numbers come from just a small section of its overall prospect area.

GLV is still going to reprocess ~350km^2 of seismic data across the broader prospect area which could mean the numbers increase further.

The image below shows how much of the project area the current resource numbers covers:

Any upgrades to these numbers could be a major catalyst for GLV.

Ultimately, we think that as GLV progresses its project from where it is at now to prospective resource numbers and onto high impact drill targets, the valuation hopefully re-rates to a level that is pricing in the potential upside from one of those targets.

All of that forms the basis for our GLV Big Bet which is as follows:

Our long term GLV Big Bet:

“GLV defines a multi-billion barrel prospective resource and sees its market cap re-rate by 20x prior to drilling”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GLV Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What could go wrong?

Given that GLV operates under a two-year “Technical Evaluation Agreement” the company faces no short-term exploration risk.

Given GLV just locked away a capital raise, funding risk is mitigated in the short term.

As a result, the key risk to our Investment Thesis in the short term is “market risk”.

There is always a chance that the current high interest rate environment impacts market sentiment and leads to a lower oil/gas price.

A low oil/gas price could mean sentiment turns negative and investment capital flows out of high risk explorers like GLV.

In the short term these factors could impact GLV’s share price negatively.

In the long term, exploration risk will be the main risk to our Investment Thesis.

We touch on more risks to our GLV Investment in our GLV Investment Memo here.

Our GLV Investment Memo

In our GLV Investment Memo, you can find:

- GLV’s macro thematic

- Why we Invested in GLV

- Our GLV “Big Bet” - what we think the upside Investment case for GLV is

- The key objectives we want to see GLV achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.