Is 88E About to Deliver a Game Changing Farm Out?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Oil explorer 88 Energy (AIM | ASX:88E) is back out of hibernation as the Alaskan winter comes to an end and has a forward work programme expected to unlock some serious value.

Here at the Next Oil Rush , we’ve been following this company’s Alaskan onshore oil story from the very beginning, when it was a tiny $5 million microcap stock.

Currently capped at $135 million – and given what’s to come over the next few months – the time seems right for an update given what is at stake here.

Firstly, 88E’s prime focus – the HRZ unconventional play.

After the success of the Icewine #1 well, we already have evidence that the play demonstrates the right characteristics conducive to evolve into a Tier 1 world class resource.

The Icewine #2 well was designed to test flow rates from the HRZ shale layer. After the success of Icewine#1 corehole and the successful stimulation of Icewine#2, the Company has shown it has all the ingredients required for a successful shale play.

Flow back clean-up is ongoing at Icewine#2 - and progress has been on hold all Alaskan winter, with preliminary results encouraging, but not definitive... yet.

With the weather improving, 88E will be finalising flow testing across April and May this year.

At that stage, and with the oil price on the up, 88E will most likely look to farmout to a partner – one that sees the upside in developing and commercialising Project Icewine into the next multi-billion barrel onshore oil discovery.

With a prospective resource of 1.4 to 3.6 billion barrels of oil equivalent, over only 270,000 of the now 475,000 contiguous acres, with TAPS running down the middle, Project Icewine must be on the radar of oil majors looking to bolster their portfolios.

If the unconventional potential at Icewine hasn’t already got oil majors hearts racing, 88E has a swag of conventional leads that it will soon have 500 square kilometres of 3D seismic run over them to delineate optimal drilling locations.

These leads are large scale prospects, there are multiple stacked plays to look at, and all in all 88E’s currently looking at a Net Mean Recoverable Resource of 1.05 billion barrels on the conventional alone.

It could be argued that 88E has the best exploration acreage of any other junior explorer on the ASX.

However, this is still a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

To further illustrate the conventional potential just next door to 88E, Armstrong Energy discovered 1.4 billion barrels in a play called the Brookian via wells drilled at Pikka in 2015 and Horseshoe in 2017.

This is the largest onshore oil discovery in North America in 40 years!

Additionally, ConocoPhilips discovered over 300 million barrels recoverable in 2017 at Willow in the same Brookian play that 88E is chasing on its acreage.

You only need to look at the Oil Search (ASX:OSH) transaction – that completed a US$850 million transaction (US$400 million in first tranche) with Armstrong to get a stake in the region, right next door to 88E.

The entire North Slope continues to be a hive of activity, with up to nine wells to be drilled on the Brookian formation this Alaskan summer alone.

With 3D seismic acquisition set to kick off in the coming weeks that is expected to firm up some of those enticing conventional leads, plus the results of the Icewine #2 work over – not to mention that the price of oil is up over 50% since June 2017 – it might just be the right time for a cashed up farm out partner to cut a deal with 88E.

While work at the Icewine #2 well was suspended, 88E didn’t stand still – the company identified another chunk of acreage on the North Slope featuring an existing oil discovery, which was acquired for next to nothing in a bidding process.

To add to its current stockpile of US$11 million in cash, the company is likely to bring in some US$6.9 million in cash through conversion of in the money options which expire 2 March (the options are exercisable at 2c). This includes ~US$0.5 million from Directors, which is a pretty strong endorsement by them. The company is more than funded for its planned forward work programme, which is forecast to cost between US$7-9 million.

With plenty of activity to come, let’s see what the next few months might hold for 88E investors.

For those of you that might be new to the 88 Energy (AIM | ASX:88E) story, here is a quick re-cap.

Setting is everything here.

Project Icewine is situated in a prolific, proven oil-rich province that hosts the largest oil field complex in the USA: the monolithic Prudhoe Bay Oil Field on the North Slope of Alaska.

The North Slope of Alaska is a veritable Mecca for oil explorers – in the past few years, Caelus Energy LLC, Armstrong, Repsol and ConocoPhillips (NYSE:COP) have all made good here on conventional plays.

Along with its joint venture partner, Burgundy Xploration LLC, 88E controls some 475,000 gross acres of this oil-rich landscape (that’s 301,000 net acres for 88E).

88E has what you might call a strategic vantage point, situated in close proximity to existing infrastructure, near an all-year access road and the Trans Alaska Pipeline (TAPS). This will make for easy access and reduced costs, should 88E prove up the viability of the resource and a development partner comes on board.

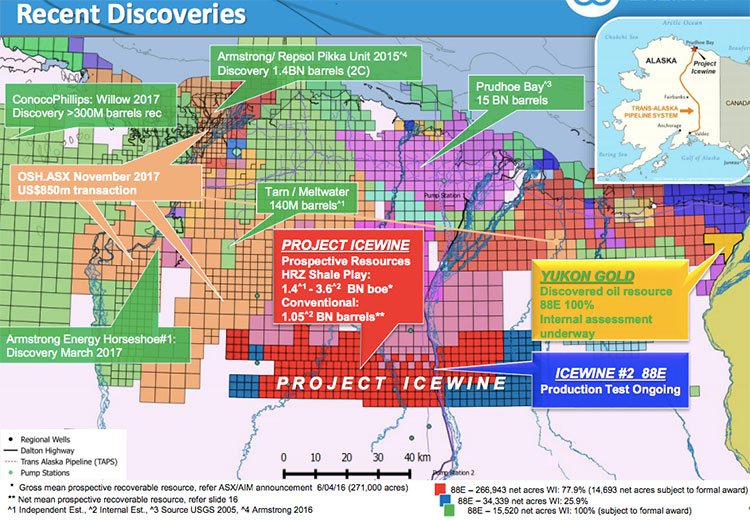

In the map below, you can see this strategic position in red and blue (Yukon Gold is gold:

Marked out in green are the locations where significant conventional oil discoveries were made, including the epic Prudhoe Bay – 15 billion barrels were discovered here in the 1960s, amounting to the largest conventional oil pool in North America.

In fact, that discovery was the reason for the development of the TAPS in the first place – that’s the pipeline which carries oil south and carves 88E’s Project Icewine (marked in red) down the middle.

Nearby, marked in orange, is also the $12 billion Oil Search (ASX:OSH), which agreed in November to spend $US400 million on a minority stake in two blocks in the Northern Slope region...

The field is estimated to hold at least 500 million barrels of recoverable oil, but likely much more, with venture partner Repsol putting the figure at around 1.2 billion barrels, and vendor Armstrong suggesting a potential ultimate 3 billion barrel size.

Given that 88E has some 1.0–2.6 billion barrels (gross mean prospective recoverable resource) on its HRZ unconventional play, as well as a further 1.05 billion barrels (net mean prospective recoverable resource) combined on its conventional leads, the OSH acquisition price per barrel of US$1.3 - $3.1 provides a nice starting point for trying to get a sense of the value that could be unlocked at the Project.

It also speaks to the level of interest in Alaskan oil opportunities by larger companies.

Returning to the cluster of discoveries that surround 88E, the neighbouring Horseshoe discovery is the largest US onshore conventional discovery in some 30 years. And it’s a mere 43 kilometres away from Project Icewine.

Not far from Project Icewine are also the Tarn and Meltwater oil fields – a 140 million barrel discovery – and ConocoPhillips’ Willow discovery, a potential multi-billion-dollar project which could hold some 300 million barrels of oil on a conservative basis.

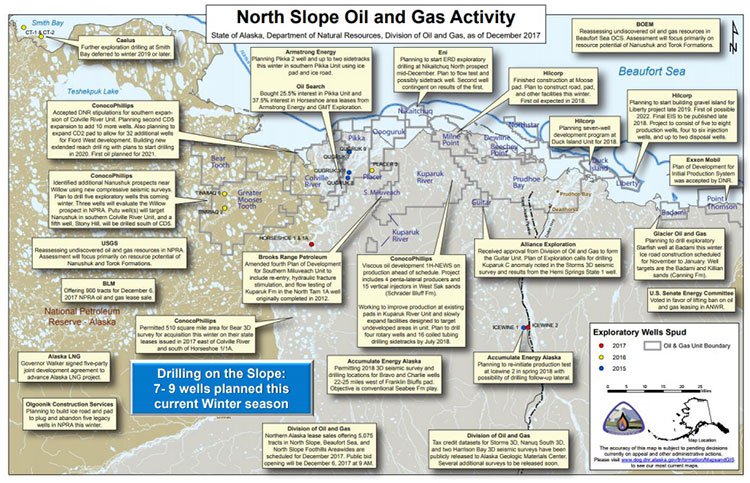

In short, this area is a bustling hub of exploration activity, with no less than nine conventional wells planned by other operators in the area for early 2018.

Here’s a glance at the oil and gas activity underway on the North Slope, as of December last year – a good indicator of the strong industry interest that 88E could leverage:

So the region is clearly one of the greatest frontiers for oil exploration in the world right now, with plenty happening, and it’s one of the reasons 88E set up shop here in the first place.

Let’s look closer now at Project Icewine and what investors can look forward to in 2018.

As we’ve mentioned, Project Icewine really has two sides – the unconventional and conventional.

Firstly, theirs is 88E’s primary target: the unconventional multi-billion-barrel liquids rich HRZ play, which is what the Icewine#2 production test is all about.

The second of these is the conventional resource potential – and this is what 88E’s 3D seismic in March will investigate, aiming to deliver some conventional drilling targets.

Let’s take a detailed look at what’s happening at both of these plays, starting with the former...

The HRZ unconventional

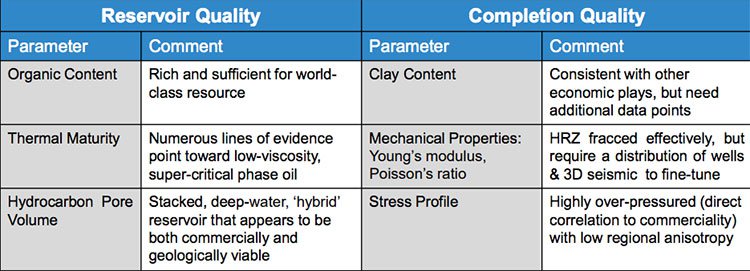

88E selected its HRZ unconventional play by making sure it hit the key technical parameters laid out in what Burgundy Xploration founder Paul Basinski calls his resource “toolbox” for de-risking and identifying the vital elements for success.

As the Bloomberg article below explains, Basinski is the geologist who helped discover the highly productive Eagle Ford shale basin in Texas, which lead the industry in terms of lowest cost of supply, highest oil rates per well, and highest NPV per acre: 88E is in very capable hands.

Based on Icewine#1, Icewine#2 and regional well data, the table below gives you an idea of the kinds of parameters Basinski has been looking for that culminate in an HRZ “sweet spot”.

For those of you who aren’t geologists, the take home here is that Project Icewine has all the ingredients to make a commercial shale play – and that conclusion has been arrived at by an industry legend.

Of course, 88E still has much work to do, so investors should take all publicly available information into account and a cautious approach to any investment decisjon made with regard to this stock.

Phase I was completed back in 2015-2016, with the project de-risked by core/log analysis from Icewine#1.

Preliminary results from Phase II so far are encouraging but not definitive, with only 20% frac fluid recovered (of a 30% target to achieve connectivity to the reservoir). This is promising, but merits further investigation.

Subsequently, ongoing flow-back clean-up activities are needed to provide more clarity.

88E is looking to finalise flow testing with optimised completion and artificial lift in April/May this year.

This is expected to cost around US$2 million (US$1.5 million net), and 88E’s aforementioned strong financial position make that very manageable.

Remember that its current cash position is expected to be strengthened further via US$6.9 million in the money options to come in. Further to that, the company will be receiving US$21 million from the State of Alaska, which could more than wipe out its US$16.5 million debt.

Some of the factors 88E is hoping to resolve with Icewine#2 in the coming months:

-

The need to access formation by

removing an additional 20% to 30% of loadwater from Icewine#2

-

Understanding the wettability of rock

and its relationship to Icewine#2 stimulation chemicals

-

Resolution of petrophysical

interpretation issues caused by high pyrite levels

-

The need for 3D to incorporate Icewine

results into regional context and to locate the “sweetest” spots for

investigation

-

The need to further delineate variability

of resource within fairway

A cashed up farm

in partner would be able to fast-track the ongoing series of works required, and

develop Project Icewine into a world-class commercial resource.

The conventional play

Aside from its HRZ unconventional oil play, 88E has also been busy progressing the conventional oil leads present on its acreage.

Here, there’s a conventional prospective resource potential of 1.96 billion barrels gross – that’s 1.05 billion net to 88E.

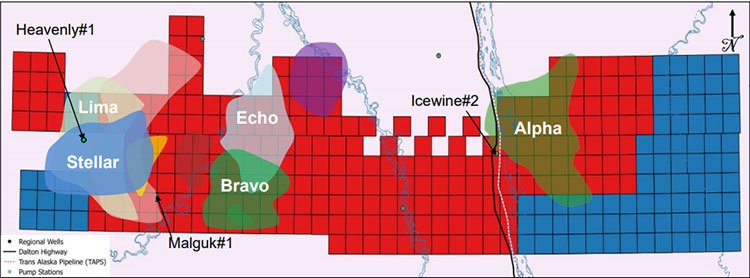

Final interpretations from 2,350 kilometres of modern and vintage 2D seismic have been completed, and these are highly encouraging, identifying multiple, stacked leads.

These leads are predominantly stratigraphic, coincident with reservoir and oil shows in regional wells. You can see them mapped out below:

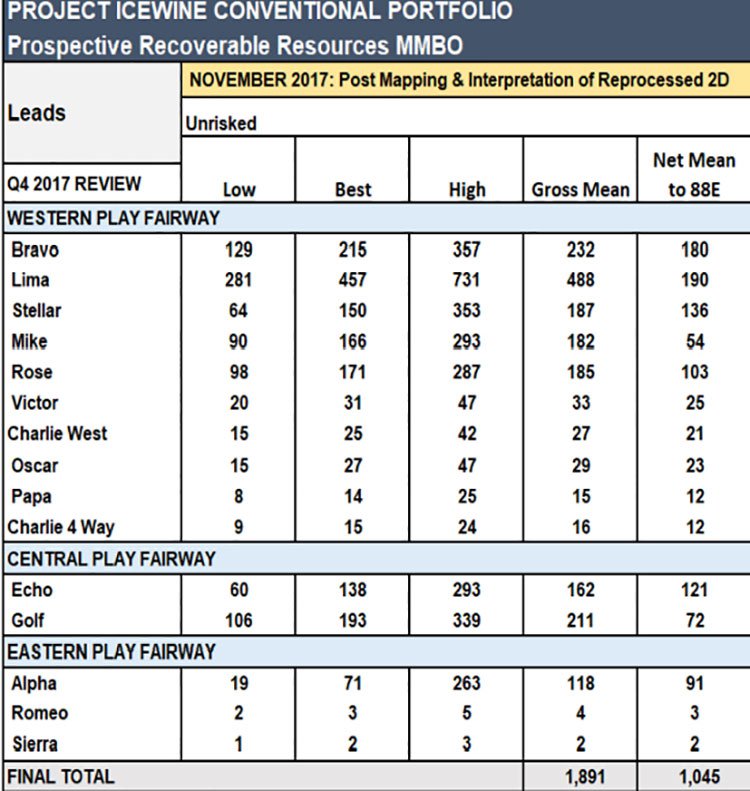

And here’s a resource breakdown, with a more comprehensive look at the leads identified so far via 2D seismic:

The Bravo and Alpha Leads were especially prominent on the modern 2D seismic.

Interestingly, the 2D seismic also showed a play type analogous to that seen in the Meltwater/Tarn field depositional system.

All in all, these are compelling leads, but are early stage and warrant further work.

Subsequently, 500 square kilometres of 3D seismic acquisition is set to kick off this month.

The aim is to firm up drilling candidates for a tightly focused program in early 2019, which in turn will pave the way for a farm-out.

With multiple stacked leads apparent, there is the opportunity to test multiple objectives with a single well.

To get to drilling though, 88E are going to need to partner up with someone to share the cost load.

Given the North Slope has seen considerable exploration drilling success over the past four years, a conventional drilling event at Project Icewine hitting those multiple stacked leads could really be a risk an oil major is willing to take given the size of the prize.

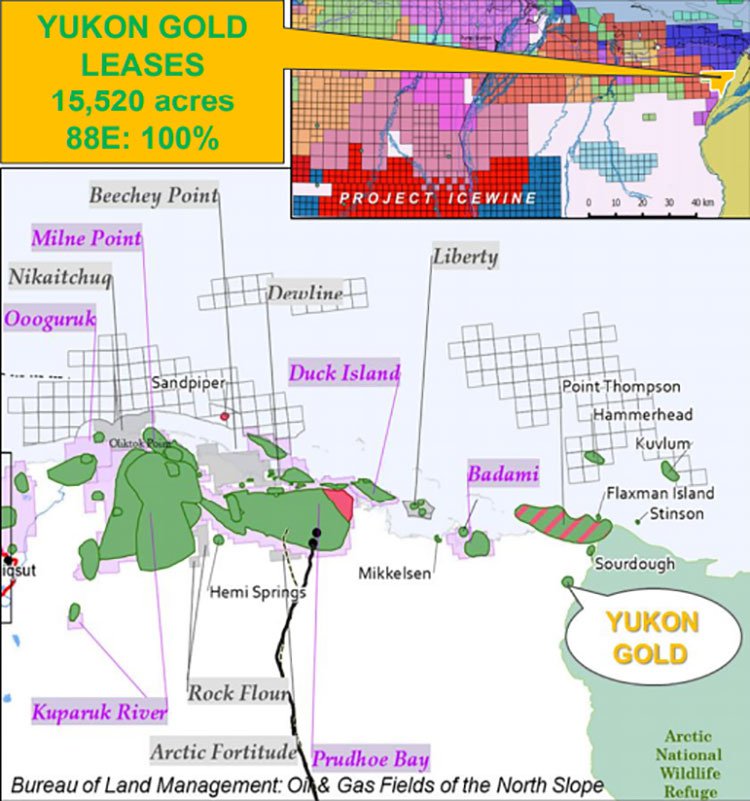

88E’s new acreage - Yukon Gold

While 88E is principally focused on progressing both unconventional and conventional plays at Project Icewine, its recently acquired, 100% owned Yukon Gold Project provides a pleasing layer of upside, and is worth looking at in a bit more detail.

Spanning 15,520 acres, Yukon Gold is situated on the eastern margin of the North Slope, some 50 miles east of Prudhoe Bay:

Yukon Gold has an existing oil discovery on it. The Yukon Gold #1 well was drilled by BP in 1993/1994, to a total depth of 12,800’ MD, and picked up oil saturations at multiple intervals below 8,800’.

It’s estimated to hold 120 million barrels of recoverable oil reserves, and the State of Alaska has reported it as a significant undeveloped oil resource – and now it’s 88E’s.

This acreage was opportunistically snapped up at very low cost (less than US$1 million), and it resides nearby recently commissioned infrastructure, which is always handy in Alaska.

An internal assessment is currently underway, making use of existing regional well logs and 2D seismic.

Moving forward, 88E’s plan is to work up this project’s prospectivity with minimal spend, and to then seek a partner for any major capital outlay.

Given that this project was bought for a mere song, and bearing in mind the improving oil price, 88E has a good chance of securing an attractive deal, providing technical merit can be demonstrated.

Breaking the ice: a look to the future

2018 is quickly shaping up to be a busy year of purposeful activity for 88E, with a number of share price catalysts set to play out in the not-so-distant future.

In April/May, the Icewine#2 ongoing production test will begin, and this could be a game-changer in terms of getting a handle on the commercial prospectivity of the play.

On top of that, 3D seismic is set to kick off this month, working towards identifying and refining conventional drilling candidates.

The company also plans to further assess the prospectivity of Yukon Gold, and an internal assessment is underway.

All of this translates into waves of news flow for 88E, and each of these are potential share price catalysts in their own right.

Yet any catalyst is speculative and investors should seek professional financial advice if considering this stock for their portfolio.

Successful results here could well attract a farm-in partner, which would be game-changing for the A$135.1 million-capped ASX junior.

Regardless, we’ll

be sure to keep a keen eye on all that transpires on the oil-rich North

Slope.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.