8 Billion Barrel Resource Potential Confirmed

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Eight is a very lucky number in China – and Tangiers Petroleum (ASX:TPT, AIM:TPET) is starting to come up with 8s all over the place.

It’s going to ask shareholders in the next few weeks to approve a name change to 88 Energy Ltd and it’s just been handed an Independent Resource Report identifying potential oil in place of 8 billion barrels at it’s Project Icewine (gross mean unrisked) in Alaska’s North Slope.

The same report also indicates recoverable oil potential of 492 million barrels (gross mean unrisked)...

These figures were conservatively evaluated by considering just 44% of the total project acreage for unconventional resources – appropriate given the early stage nature of the Project, however we see significant upside potential here if the entire project area is considered, the shale recovery factor is higher than first thought, or a shallower, conventional play works out.

Does the North Slope of Alaska have the right elements to become the next big thing in unconventional liquids-rich shale plays?

Tangier’s project partner, BURGUNDY Xploration, Inc., and it’s billion-barrel oil-finding principal, Paul Basinski, sure think so.

Basinski believes the “HRZ Shale” has the key ingredients that make the best shale plays “tic”. If anyone might know its Basinski – he spearheaded ConocoPhillips early mover advantage in Eagle Ford shale, and led them to acquiring ~320,000 acres in the sweet spot of the play at rock bottom prices.

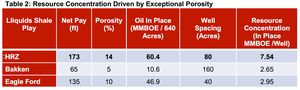

Unique geological circumstances appear to have led to the formation of a higher-than-normal porosity and net shale pay, leading to a resource concentration that appears to be higher than the Eagle Ford, Bakken, Marcellus and Utica plays...

Meanwhile various companies are pouring tens of millions of dollars of exploration investment into a shallow conventional target on the North Slope. Owing to the significant sums invested and the potential for multi-million barrel finds, it’s the hottest play on the North Slope right now.

Regional studies and offset wells strongly indicate that this play may be present on TANGIERS acreage...

TANGIERS’ immediate neighbour, Great Bear, is about to start drilling the first of up to three high impact wells for this conventional prize based on their latest 3D seismic survey results – one proposed well location is one and a half miles from TANGIERS’ boundary...

Positive results from Great Bear are likely to have an immediate impact on TANGIERS’ valuation – currently with a humble market cap of less than $6M AUD at last market close on the ASX (and less than £3M at last market close on the AIM).

With an 87.5% working interest on 99,360 continuous acres in the prolific North Slope – and a slew of nearby drilling events to come in 2015, surely the attention of potential farm-in partners is starting to focus on TANGIERS...

TANGIERS is building up to a phased coring and drilling event in 2015/16 and plans to initially spend $2.1M (£1.1M).

The company will need to raise funds to carry out this work – and at its upcoming Extraordinary General Meeting its going to set in motion plans to raise up to $6M AUD (£3.2M) of capital and hopefully put the company on a path back to good fortune.

Are lucky 8s in store for TANGIERS?

In 2014 TANGIERS were unsuccessful in a drilling event offshore Morocco – but now the company has turned its focus to onshore Alaska with its new oil play...

Project Icewine on Alaska’s prolific North Slope.

This new focus is covered in great detail in the Next Oil Rush article published in December 2014: Neighbour to Drill in Weeks: TANGIERS’ New Alaskan Play. It’s a great place to start your research.

Edison Investment Research has just released the following report on TANGIERS’, which is another useful source of information on the company:

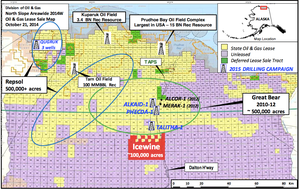

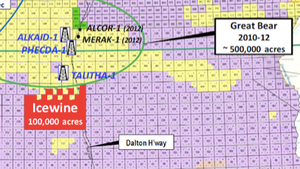

TANGIERS Project is marked in red on the map below, in a strategic location on Alaska’s North Slope:

Right at the top of the map above you can see Prudhoe Bay – the largest oil field in the USA at 15 billion barrels (recoverable resource) – and then straight down to the south you can see TANGIERS’ Project Icewine in red.

The five wells you can see just above Project Icewine are Great Bear’s (2 drilled in 2012, the other 3 to be drilled in the coming months).

As well as the Prudhoe Bay oil field, the Tarn (100 million barrels recoverable) and Kuparuk (3.4 billion barrels recoverable) oil fields feature on the North Slope.

Project Icewine has access all year round thanks the Dalton Highway, a key arterial road that passes through the acreage. Plus, the Trans Alaska Pipeline System (TAPS) also runs right through TANGIERS’ land:

![]()

So Project Icewine is in a prime location with easily accessible infrastructure – but TANGIERS are hoping the real prize is below ground...

Did TANGIERS’ HRZ shale member form just like an Aero chocolate bar?

TANGIERS’ interest in the North Slope was sparked by project partner and founder of Burgundy Xploration (Houston TX), Paul Basinski.

As highlighted earlier, Burgundy’s principal spearheaded ConocoPhillip’s entry into Eagle Ford shale in Texas, where it’s just raised its estimated resource base to 2.5 billion barrels of oil in place.

Whilst working at ConocoPhillips, Basinksi and his team developed a toolbox to help them predict the Eagle Ford sweet spot. Today, he has spotted something similar up in Alaska at Project Icewine – similar in many ways to the Eagle Ford sweet spot, Project Icewine appears to be in a high-liquids, vapour phase shale sweet spot.

TANGIERS are banking on him to repeat his success and hit the sweet spot on the North Slope.

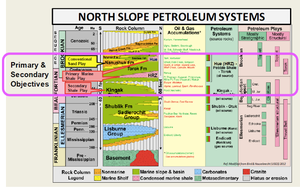

The primary objective for TANGIERS and Burgundy is to confirm an unconventional liquids-rich play in the HRZ shale. The HRZ shale has the very same source rocks as the 15 billion barrel Prudhoe Bay – that’s a strong sign first up.

But what makes the HRZ shale so compelling is the unique set of circumstances that lead to its development over the millennia...

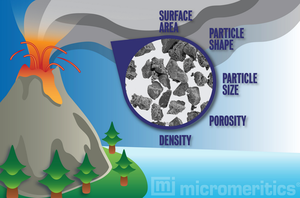

Geologic models suggest that Project Icewine was subjected to volcanic activity millions of years ago while the objective shale play was being formed. This volcanic activity resulted in the eruption of volcanic glass and ash, which formed clouds that floated over the ocean. This very fine material then slowly fell and settled to the bottom of the deep ocean where the shale was being formed.

The theory at TANGIERS’ Project Icewine goes on to suggest that this very abundant volcanic material provided early support to slow the compaction of the compressible organic matter and shale rock matrix as it was accumulating.

A ‘short time’ later, the idea is that the glass dissolved because of the pressure from the overlying sediment. The by-products then strengthened the shale rock matrix, thereby reducing the porosity loss.

Think of it like an Aero chocolate bar – the volcanic glass helped strengthen the framework of the shale to have more pores in it than it would have otherwise, just like the chocolate walls surrounding air here:

Now instead of air in an Aero chocolate bar, it is hoped that these voids are full of oil at Project Icewine, just waiting for TANGIERS to extract...

The presence of high porosity shale (or lots of big holes) is one of the most influential characteristics for well performance in unconventional plays.

And when you compare the HRZ shale to the Eagle Ford and Bakken, the differences in porosity are stark:

Mixing high porosity with a large net pay leads to a very high resource concentration – and based on likely well spacing, TANGIERS appear to be sitting on acreage that could have a resource concentration multiples better than the next best shale play in the USA.

That’s potentially more oil from less wells – much more economic...

Couple that with the underutilised Trans Alaskan Pipeline System that runs through Project Icewine, plus strong Alaskan tax incentives, and commercialising any discoveries starts to look markedly easier than in other regions.

So that’s what we like about TANGIERS unconventional play.

But there is also secondary conventional oil potential within Project Icewine.

According to the US Geological Society, there are some 3.98 billion barrels of potential on the Central North Slope – and TANGIERS are betting there may be some on their 99,360 acres.

In particular, TANGIERS is looking closely at a shallow conventional play in a high porosity, deepwater sand complex.

This is the play that Great Bear are testing via the three imminent wells next to TANGIERS. The hottest play on the North Slope, success rates for drilling informed by 3D seismic are greater than 60% here – and yes, Great Bear has the 3D seismic. We should hopefully get some news on what they can find with a drill bit over the coming months.

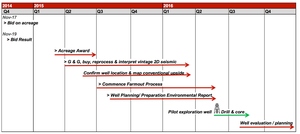

TANGIERS current strategy is to build up to a drilling event by spending $2.1M AUD (£1M) in 2015 reprocessing and re-interpreting existing 2D seismic data and kicking off the permitting process.

Ultimately this may allow TANGIERS to select a target for pilot hole drilling in late 2015 / early 2016, possibly testing a conventional target at the same time.

Imminent drilling by TANGIERS neighbours...

You can see private explorer Great Bear’s 2015 work programme of three wells just to the north of Project Icewine – Alkaid-1, Phecda-1 and Talitha-1. The first well is due for drilling any week now.

Talitha-1 is just one and a half miles from TANGIERS’ acreage...

All three well locations trend southward toward Project Icewine, and what Great Bear finds in the coming weeks and months could materially transform the value of TANGIERS’ acreage, and considerably improve TANGIERS’ attractiveness to potential farm in partners.

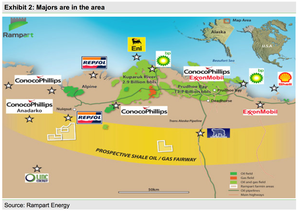

The North Slope is filled with majors and the other big project that could impact TANGIERS is the 500,000 acres being explored by Repsol and Armstrong to the North-West:

Repsol has committed to carry its partner Armstrong through a minimum work programme of US$750M (plus US$18M back costs), which granted Repsol 70% of the acreage – that gives an implied value of US$2,194/acre.

Compare that figure to TANGIERS’ deal – who are acquiring Project Icewine for around US$30/acre – a ground floor entry price in the North Slope...

There is therefore a lot of room for growth in the value of TANGIERS’ project – which they can progressively de-risk through exploration activities, and a little help from neighbouring drilling events.

Repsol drilled three wells in 2012 and 2013, with two (Qugruk-1 and Qugruk-6) producing hydrocarbon shows and Qugruk-3 finding multiple shows. It’s planning to drill three wells this northern winter and test two of them – once again this is work that could have a material effect on TANGIERS acreage at Project Icewine.

So Great Bear, Repsol and Armstrong will be spending tens of millions of dollars in North Slope exploration in the coming months – this is essentially free exploration for TANGIERS – a handy position to be in as TANGIERS starts to negotiate with potential farm in partners.

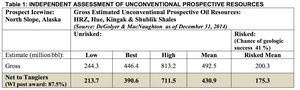

TANGIERS’ 8 billion barrels of potential oil in place

TANGIERS recently appointed leading petroleum consulting firm DeGolyer and MacNaughton (D&M) to put together an Independent Resource Report on the Project.

D&M identified potential oil in place at TANGIERS’ Project Icewine of 8 billion barrels (gross mean unrisked). The recoverable oil potential from across the project is 492 million barrels (gross mean unrisked) and D&M estimates the geologic probability of success at 40.7%.

This was calculated based on just 44% of the total Icewine acreage, with a recovery factor of 6.1%, which we expect TANGIERS may be able to get up to 10%.

These preliminary numbers are encouraging and show the potential of the Project – something that potential farm in partners would likely also be taking notice of.

Of course, the best way to find out how much oil is really down there is by drilling, and TANGIERS still has a bit of work to do before this happens, including some housekeeping...

New name, new direction and new money

The number 8 is an auspicious number in Chinese culture – the opening ceremony of the Beijing Summer Olympics began on 08/08/08 at 8 seconds and 8 minutes past 8 o’clock.

Eight is considered to mean “prosper” in Chinese and depending on who you ask, if you put two eights together you can double your luck – exactly what TANGIERS is hoping to do with a name change to 88 Energy Ltd .

After the duster in Morocco, will this name change bring a change in fortune?

The name change will be voted on at TANGIER’s upcoming Extraordinary General Meeting in Perth, Western Australia on the 12 th of February:

Not that TANGIERS is leaving everything to luck.

As we mentioned earlier, Project Icewine is supported by compelling geological models and an Independent Reserves Estimate showing potential oil in place of up to 8 billion barrels (gross mean unrisked).

Still, this acquisition needs to be approved by shareholders and that will done toward the top of the agenda. First and foremost will be the disposal of TANGIER’s 25% stake in the offshore Morocco Tarfaya Project, and then the completion of the acquisition of Project Icewine will be voted on:

Above and beyond all of this, TANGIERS will be asking its shareholders to support a capital raising of between $3.5M AUD (£1.9M) and $6M AUD (£3.2M) through the issue of new shares.

This money will be used to wrap up the US$3.5M acquisition, support TANGIERS’ exploration effort out at Project Icewine and underpin its goal to drill in 2016 and beyond.

So that’s a full dance card for TANGIERS and at The Next Oil Rush we expect these resolutions will be met with support from shareholders.

TANGIERS to turn up the volume?

A new name, a new project and an injection of new money – this could be just the start to 2015 that TANGIERS needs as it seeks to turn its fortunes around.

In less than six months TANGIERS has picked itself up off the canvas and is ready for another crack at it – switching from Morocco to Project Icewine on Alaska’s prolific North Slope oil region.

The newly released Independent Resource Report identifying potential oil in place of 8 billion barrels at Project Icewine (gross mean unrisked) and recoverable oil potential of 492 million barrels (gross mean unrisked) from just 44% of the total acreage is a cracking start, and over the coming months TANGIERS will seek to progressively de-risk the Project, seek a farm-in partner, and eventually drill a pilot exploration well around 2016:

The Independent Reserves Estimate and the upcoming capital raise will go hand in hand to help TANGIERS set things in motion at Project Icewine with vintage 2D seismic reprocessing and mapping to help identify targets.

All of the activity surrounding TANGIERS in Alaska, such as the imminent drilling events for Great Bear, could add value to the Icewine acreage and help TANGIERS select targets in more likely locations.

More and more, TANGIERS shareholders are being shown compelling reasons to get behind Project Icewine and at the upcoming Annual General Meeting they will have a chance to approve all of the moves Dave Wall and the TANGIERS team are making.

So, fingers crossed, the next time we mention TANGIERS on The Next Oil Rush , it will have the new name – 88 Energy Ltd.

Are good luck and good fortune just around the corner for TANGIERS in 2015?

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.