The Race for East African Oil has well and truly begun

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Three events in the last few weeks have signalled the start of the great global oil and gas rush to East Africa.

2nd February 2012 - Tullow oil signed a deal with France’s Total and China’s CNOOC to sell two thirds of its East African assets in Uganda for $2.9 Billion:

Tullow Oil, Uganda sign asset sale deal

22nd February 2012 – Super Major Shell attempts a $1.6 billion takeover offer of Cove energy and its acreage in Mozambique and offshore Kenya, only to be blown out of the water by a $1.8 billion bid from Thai-PPT 48 hours later – The next move in this bidding war will be of great interest.

Thai PTT trumps Shell with $1.8 bln bid for Cove

23rd February 2012 – A conference is held in London to discuss Somalia - where “senior representatives from over 40 governments and multi-lateral organisations will come together with the aim of delivering a new international approach to Somalia” . Speakers include David Cameron and Hilary Clinton. The Guardian newspaper’s “man on the ground” at the conference subsequently publishes the following articles:

(25th February) Britain leads dash to explore for oil in war-torn Somalia

These three events have certainly been noticed by the market, with the stock prices of all small and medium sized players holding any exposure to O&G in East Africa bubbling upwards as investors rush to the party. We’ll look at a few of them a bit later in this article

I’ll also explain why East Africa in particular is fast becoming such a hot spot for oil and gas.

It has been an incredible start to 2012 for Oil & Gas in the East Africa, and promises to be <!--more--> a huge decade, seeing consolidation of positions, bidding wars between majors and billions of barrel oil finds.

I have chosen one stock in particular that I believe will be an absolute standout over the next 3 years. I have a very large portion of my portfolio allocated to this stock, and am expecting returns of well over 1000%. I have written a detailed post explaining the story and potential of this stock.

Why East Africa? Proximity to Demand.

So why is East Africa of such sudden interest? Although many investors and companies have been aware of the potential of East Africa for some time now, the rest of the world is just starting to realise why the region is so important.

East Africa’s geographical proximity to Asia and the two massive developing countries of our generation, China and India, makes East Africa an ideal trading partner and potential oil exporter. China and India’s oil demand is still in its infancy, around 1.3 barrels per person per year, compared to about 4.4 in the developed world. China’s population is ~1.34 billion with India tracking closely behind at ~1.21 billion. To put things in perspective, Europe has a population of 500 million... the United States just over 300 million...

You can imagine the magnitude of increase in oil demand that is just around the corner as the combined ~2.5 billion people (read: consumers) of China and India start increasing from using 1.3 barrels of oil each per year, as they aspire to enjoy things like heating, electricity, cars, travel and all the other luxuries found in developed countries that us 4.4 barrel per year oil guzzlers take for granted.

So once this demand really starts ramping up, major oil companies will want to be well placed to deliver easily extracted oil and gas, across the shortest possible distance, to these massive markets.

Leasing the super tankers required to transport oil is not cheap, and these tankers are charged by the day. The costs of shipping oil from where it is extracted to its final destination is passed on to the buyer, so it is in the buyer’s interest to purchase oil from as close as possible. Shaving days off a cargo’s journey can mean significant savings to the buyer. This is why the Panama canal was built, for example.

Let’s look at China as an example, I have chosen China as they are a little further along than India in their development, and their demand will be ramping up faster in the near term.

“Saudi Arabia, Angola and Iran remained the three largest oil sources for China in 2009, with the three supplying 47.7 percent of China's total imports, according data released Wednesday by the General Administration of Customs (GAC).”

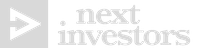

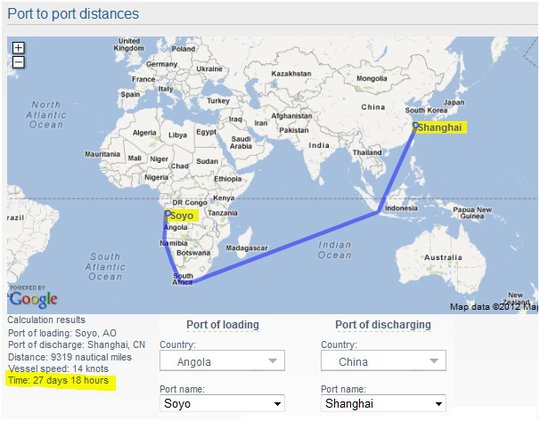

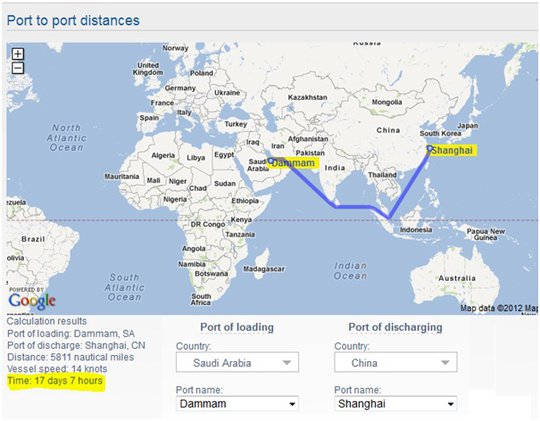

China has already made some good supplier choices (in terms of geographical proximity) with Iran and Saudi Arabia:

An easy 17 days to transport the cargo – the only problem is that Iran has been threatening to shut the strait of Hormuz recently as a response to the ban on buying Iranian oil imposed by the global community. Closing the strait would essentially block a third of the worlds oil supply. Given the instability in the region at the moment, It is no wonder that oil importing countries are trying to diversify their oil supplies.

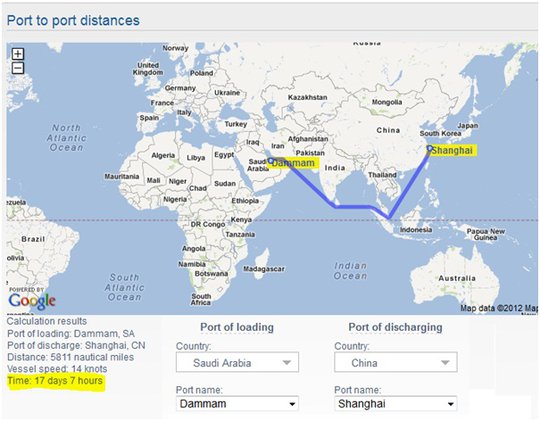

China’s other major supplier is Angola, in West Africa. Oil exploration off the coast of West Africa has surged since 2007 when Tullow Oil found the Jubilee field in Ghana, one of the African continent's biggest recent finds. West Africa produces over 3 million barrels of oil per day, much of this production from Nigeria. Shipping the oil cargo from West Africa to China in our example is going to add over 10 days to the journey, and that means more expensive oil for the buyer:

If you have the option of buying the essentially the same product from two different sources, but one is cheaper than the other, naturally you will go with the cheaper one – this is why the shipping distance (hence cost) are such an important factor in this situation.

East Africa offers the opportunity to develop supplies that are in close proximity to the demand, and will be preferable to the buyer as the extra shipping costs are not built in to the price. Also the shipping lanes used will have a lot less risk compared to other existing options as they do not pass through the Strait of Hormuz or Gulf of Aden. If we take the example of exporting oil from East Africa (Kenya), the journey is only 19 days:

Major oil companies are obviously well aware of this fact.

If we take Australia as another example, you can see the how close the resource rich boom states of Queensland and Western Australia are to the voracious demand in China. In Australia, the gas has been found, the lucrative fields have been purchased by the super majors and massive investment in extracting and exporting these resources is already underway:

This proximity to China and India is reason that the super majors like Chevron, Exxon Mobil and ConocoPhilips, Total and Shell are investing nearly $200 Billion in natural gas projects in Australia over the next few years. While East Africa is still at very early stages of exploration, Australia is already quite advanced in the development and production cycle. Projects are underway to build giant gas processing plants and export infrastructure. There are plenty of small cap ASX listed engineering companies in Australia making mountains of cash in this engineering and building boom, but I’ll talk about that in another article. You can see the all the companies I am currently invested in my speculative portfolio.

Still a little off-topic, there are many of reports about China’s preference for purchasing seaborne iron ore shipments out of Australia, as opposed to Brazil, given Australia’s closer proximity and hence significantly lower shipping costs. The same applies to all commodities, which is why the resource super majors have been investing heavily in Australian natural gas over the last few years, and plan in to start investing in East African oil right now, to be ready for the massive increase in Chinese and Indian demand over the next 20 years.

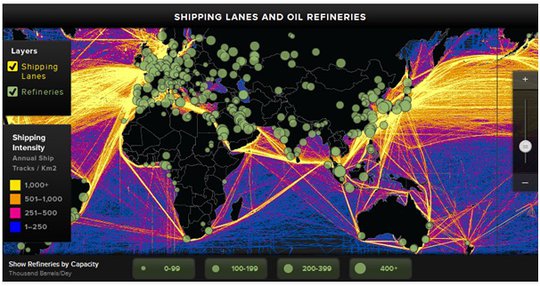

Note on shipping lanes and refinery locations:

For more information on shipping channels and refinery locations, check out this website, a very cool application:

http://www.energyrealities.org/global-markets

Which companies hold exploration acreage in East Africa?

Multinational oil companies like CNOOC and Total have snapped up oil fields in East Africa. Shell and Thai PPT are locked in a bidding war to acquire East African explorer Cove Energy. Large cap companies like Anadarko, Tullow BG Group, Apache, Dominion are already active in East Africa.

So who are the small players with acreage in the next great oil region? Which companies will be likely takeover targets once they have proven up resources (or even before!), and where can investors make the best returns on this oil rush. Take a look at my speculative investment portfolio, which is skewed towards small cap companies with oil and gas acreage in East Africa , and also few small oil and gas engineering companies in Australia as discussed earlier. The portfolio is designed to most effectively monetise the great resource rush of our generation.

I have cherry picked a few of the small East African explorers in my portfolio, basing my decision on the companies that best fit the Next Oil Rush 16 crucial speculative oil stock investment criteria.

I will mention again, I have chosen one stock in particular that I believe will be an absolute standout over the next 3 years. I have a very large portion of my portfolio allocated to this stock, and am expecting returns of well over 1000%.

Below is a list of a few of the companies with exposure to East Africa, this is not an exhaustive list, and if I have missed any please let me know in the comments section at the bottom of this article, or email me at [email protected].

Oil and Gas companies with exposure to East Africa:

Cove Energy (http://www.cove-energy.com/)

LON:COV – farmed in to exploration offshore and onshore acreage in Tanzania, Mozambique and Kenya, farm in blocks operated by bigger players such as Anadarko and Total. Cove is currently the subject of a takeover and bidding war between Shell and Thai PPT.

Afren PLC (http://www.afren.com/)

LON:AFR –a mid to large size producer-explorer with producing assets in West Africa and Kurdistan, and an extensive exploration portfolio in East Africa (Kenya, Ethiopia and Tanzania).

Ophir (http://www.ophirenergy.com/)

LON:OPHR –a mid to large cap explorer focused on Africa in general, holds East African acreage in Tanzania, Somaliland and Madagascar.

Aminex PLC (http://www.aminex-plc.com/)

LON:AEX –a small cap explorer focused on East Africa, specifically Tanzania and Mozambique. Aminex also has a few other second tier projects around the world

Africa Oil Corp (http://www.africaoilcorp.com/)

TSX:AOI, OMX:AOI –a small to mid cap explorer focused solely on East Africa, namely Ethiopia and Kenya

Horn Petroleum (http://hornpetroleum.com/)

TSX: HRN – Horn Petroleum is a small cap explorer currently drilling in Puntland, Somalia

PanContinental – (http://www.pancon.com.au/)

ASX:PCL – PanCon is a small cap explorer with assets in Australia, Kenya (offshore) and Namibia.

WHL Energy (www.whlenergy.com.au)

ASX:WHN – WHL Energy is a small cap explorer solely focused on east Africa with a 100% owned “flagship project” in the Seychelles (offshore)

Range Resources (http://www.rangeresources.com.au)

LON:RRL, ASX:RRS - small to mid cap explorer-producer with diversified portfolio of assets around the world – owns a 20% interest in a current exploration well in Somalia

Red Emperor (http://www.redemperorresources.com)

LON:RMP, ASX:RMP – small cap explorer that owns a 20% interest in a current exploration well in Somalia

Lion Petroleum Corp (http://www.lionpetroleumcorp.com)

(listing on TSX soon) - Small cap explorer with acreage in Kenya

CAMAC Energy (http://www.camacenergy.com)

NYSE:CAK – Mid cap globally diversified explorer-producer, recently awarded 3 exploration blocks in Kenya.

Simba Energy (http://www.simbaenergy.ca)

TSX:SMB, OTCQX:SMBZF – small cap explorer focused on Liberia, Mali, Ghana, Guinea, Kenya (onshore)

Orca Exploration (http://www.orcaexploration.com)

TSX:ORC.B – a mid to large cap globally diversified explorer-producer, with East African assets in Tanzania.

Beach Energy (www.beachenergy.com.au)

ASX:BPT – a mid to large cap diversified explorer-producer with some assets in East Africa (Tanzania)

Hopefully this list provides a nice starting point for your research into your investment in the East African oil rush. Make sure you have your ticket for the biggest land grab in decades.

Good Luck with your investments,

-Next Oil Rush

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.