Takeover Trigger? RLE Hits Gas in its 2nd Cooper Basin Well

Published 07-NOV-2014 15:33 P.M.

|

9 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

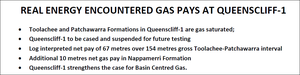

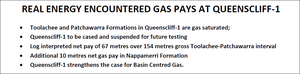

Cooper Basin explorer Real Energy (ASX:RLE) just struck major gas zones in its most recent appraisal well. That’s now two successful wells from two attempts. The Cooper Basin is Australia’s hottest gas province where a frenzy of M&A activity over the past years has left RLE as the sole remaining junior with 100% control of its tenements. The M&A activity has not let up, a few weeks ago Santos farmed into New Standard Energy’s acreage in the Cooper in a deal valued at $49.15M – implying an acreage value of $224/acre... RLE is currently valued by the market at under $30/acre... RLE’s follow up well Queenscliff-1 was just drilled to its final depth and has hit a net material gas pay of 67m in the same gas saturated Toolachee and Patchawarra formations as that RLE encountered on their first well. That first well was the Tamarama-1 well which hit 87m of net gas pay... Queenscliff-1 also hit a new gas saturated layer – the Nappameri formation – with 10m of net sandstone gas pay (from gross 30m). Flow testing will be conducted next year, and RLE will engage an independent engineering firm to prepare a report on the gas resources. RLE’s internal estimate of the proven, probable and possible (3C) contingent resources of both wells is now in excess of 1 Tcf of recoverable gas – that is more than three times what RLE were originally targeting (300 Bcf of 3C) as part of the original three well program. Gross sandstone reservoir pay thickness, average effective porosity, and gas saturation are significantly higher than pre drilled estimates... RLE is getting some serious momentum now, especially after it successfully raised $5M through a placement to funds, professional and sophisticated investors to continue its exploration work. RLE is making all of the right moves to make the Cooper Basin’s next big discovery AND making itself an extremely attractive takeover target.

When The Next Oil Rush first invested in RLE back in May of 2014 we wrote up its plans with this article – International Feeding Frenzy in Australia’s Hottest Shale Gas Region Puts Undervalued Junior on M&A Radar . Since this time, RLE has risen as high as 120%:

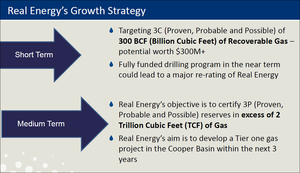

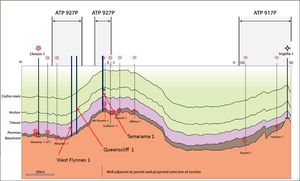

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. By August, RLE was accelerating its drilling plans and we covered this quick work in Maiden Well Spudding Imminent for RLE’s Red Hot Cooper Basin Gas Play. That maiden well, Tamarama-1, struck gas saturated formations and all the details on that well can be found in this article: Success for RLE on First Exploration Well – Follow up Drilling Coming Soon . The follow up drilling has now been completed, and the Queenscliff-1 well was again successful. A geologists report prepared for RLE says the ATP927P and ATP917P tenements these wells are testing could hold a mean gross estimated petroleum in place resource of 10.2TCF of gas. RLE is targeting big resources in the short term – its goal is to prove up a 3C (Proven, Probable and Possible) 300 bcf of recoverable gas – that has the potential to be worth over $300M. Internal RLE estimates are in excess of 1 tcf now that the first two wells have been drilled – an independent report will verify this figure next year. Over the coming three years, RLE’s goal is to certify 3P (Proven, Probable and Possible) reserves in excess of 2 tcf of gas:

Tamarama-1 on RLE’s ATP 927P tenement was a proof of concept well that tested for the presence of a Basin Centred Gas (BCG) play in the company’s 2 million acre land bank in the Cooper. It hit significant quantities of gas and has now been capped:

![]()

Tamarama-1 encountered 21m of net sandstone gas pay (from gross 44m) in the Toolachee formation and 66m of net sandstone gas pay (from gross 121m) in the Patchawarra formation. Queenscliff-1 was a follow up well that was designed to test the extent and strength of the gas in the Toolachee and Patchawarra formations that Tamarama-1 encountered. And encounter it did, once again this well hit the Toolachee and Patchwarra Formations – both were gas saturated:

Think of this as an enormous game of join the dots, where RLE sinks wells in enough locations to draw a big picture – a Basin Centred Gas Play.

Basin Centred Gas refer to gas in a continuous formation outside of a structural closure – typically holding large gas resources.

Remember, RLE is the very last ASX-listed Cooper Basin junior with 100% ownership of all of its tenements.

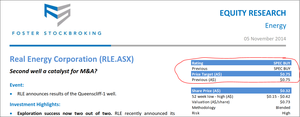

It doesn’t have a JV or an earn-in deal...yet... and all the other Cooper juniors have been snapped up by majors or are in the process of it. Hot on the heels of RLE’s gas pay hits at Queenscliff-1, Fosters Stockbroking Analyst Haris Khaliqi issued a $0.75 price target for RLE – that would be a 130% gain from today’s levels:

We don’t take analyst price targets as gospel – they can get things wrong. It’s just another tool we use to assess our investments. With the success of this second well, Mr Khaliqi outlines the potential for the following events for RLE:

- A farm in by a much larger company – this could see RLE free carried on drill costs but retain exposure to the upside on any discoveries;

- Continuation and expansion of drilling the acreage, with RLE commercialising the discoveries relatively quickly and generating its own cash flow, or;

- A complete take-over by a large corporate energy company – with burgeoning east coast demand for gas, any new production could be highly sought after.

Santos recently farmed into New Standard Energy’s Cooper Basin acreage for a total consideration of $49.15M – in return for a 35% stake in Permit PEL 570:

![]()

Mr Khaliqi analysed the acquisition metrics for the above deal – applying this to RLE would imply a valuation of $1.54 / share – that would be a 380% gain from current levels:

![]()

Again, there is no guarantee RLE will hit this level, the share price is dependent on many factors – it’s a bit more complicated than a simple metric like this – however it does give a good indication of the potential in RLE. RLE is the last of the Cooper Basin juniors with 100% ownership of its tenements. It’s the wallflower at the ball, but maybe we’ll soon see a pack of majors lining up to ask it to dance...

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks. To note just a few:

- We recently released a Next Tech Stock article on Ziptel (ASX:ZIP), $1.7 Trillion Telco Market: ASX Tech Company Weeks Away From Global App Launch , since this release, ZIP has risen as high as 160%;

- Since the Next Small Cap article on Segue Resources (ASX:SEG), Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets , SEG has been up as high as 200%;

- Since the Next Small Cap article on Core Exploration (ASX:CXO), BHP Circling... Micro Cap Neighbour to Drill Mammoth Targets , CXO has been up as high as 140%.

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Queenscliff-1 hits gas pays – 2 out of 2 success rate for RLE

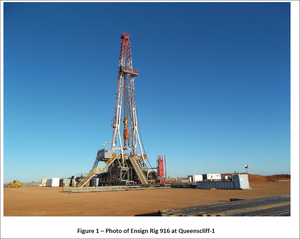

RLE’s Queensciff-1 well encountered continued elevated gas readings from both the Toolachee and Patchawarra formations as it drilled down to its total measured depth of 3,219 m.

Now that the drilling is complete, the results are in – and they are impressive:

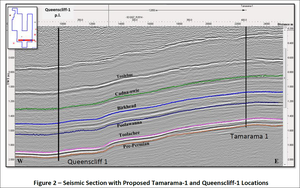

RLE has proved that gas saturated Toolachee and Patchawarra formations exist at Queenscliff-1. Both the Toolachee and Pathchawarra formations were penetrated by Queenscliff-1 early on in the drilling, with the top-most section of the Toolachee encountered at 3,024m – deeper than at Tamarama-1, which is 668m down dip. You can see the area in the seismic slide below – the Toolachee formation is second from the bottom, Tamarama-1’s location is to the east:

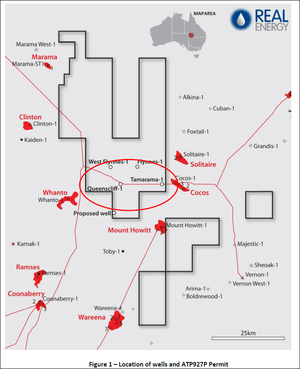

RLE’s Queenscliff-1 well hit 32.5m of net sandstone gas pay in the Toolachee formation (from gross 66. m) and 34.8m of net sandstone gas pay in the Patchawarra formation (from gross 87.5m). That’s a total of 67m net gas pay. Queenscliff-1 also hit a new gas saturated layer – the Nappameri formation – with 10m of net sandstone gas pay (from gross 30m). Queenscliff-1 was designed to test the extent of the Basin Centred Gas play RLE believes it has under its tenements, and after the strong gas shows at Tamarama-1 these new gas hits show it’s onto something – and presents a strong case for further exploration in the area. Here are the well locations laid out on a map:

These new results show that Tamarama-1 was not a fluke or was within a structural closure. Queenscliff-1’s gas saturated readings show the Toolachee and Patchawarra formations are spread across its tenements and that gas is accumulated throughout. There is now a very compelling case for RLE to drill more wells and map the extent of this – again bringing it back to confirming a BCG play. In the image above you can see West Flynnes-1 – that’s RLE’s planned next well and RLE will likely tackle this in 2015. Third-party geological analysis has assessed RLE’s land holdings to contain a mean gross estimated petroleum initially-in-place of 10.2 Tcf of gas in the Toolachee and Patchawarra formations. It now has two wells that show strong gas shows from these formations.

RLE’s $5M cash raise significantly oversubscribed

To support its rapidly accelerating exploration and drilling programme in the Cooper, RLE has negotiated a private placement to funds, professional and sophisticated investment – and raised $5M:

The placement was significantly oversubscribed, showing just how high demand is for Cooper Basin action – especially with a company like RLE that’s relatively early stage but steadily proving up its acreage. RLE will issue 16,129,033 ordinary class shares at $0.31 per share, raising $5M, which will be used to support its ongoing exploration activities.

Two wells with gas shows – what’s next?

After RLE’s maiden well in the Cooper – Tamarama-1 – struck gas zones, the company knew it was onto something – the Basin Centred Gas play it has long suspected is present within its lands was becoming even more clear. Now that its second well in the area – Queenscliff-1 – has hit strong gas shows from the same formations Tamarama-1 hit, the Toolachee and Patchawarra, the picture of a BCG is getting even clearer. Flow testing will occur on both wells next year, and from this data, an independent resource estimate will be completed. RLE’s internal estimate of a 3C contingent resource in excess of 1 Tcf is an excellent result from two wells to date. RLE’s medium term goal is to develop a world class Tier 1 gas project, and they seem to be well on their way. RLE are also planning to drill another well, West Flynnes-1, which looks like a goer in 2015. If RLE can prove it has BCG on its land then the major gas producers who surround it could soon be doing more than just sitting up and taking notice. There has been a frenzy of M&A activity this year in the Cooper Basin and RLE is the final junior remaining with 100% ownership of its tenements. How long can that last now that it has two gas-saturated wells? RLE is cashed up with $5M hitting its bank account. It has two wells with gas-saturated readings. This year has been about proving RLE’s concepts. Next year things should really heat up for RLE – if they don’t get taken over first...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.