Is RLE Getting Ready to Supply Much Needed Gas to the East Coast?

Published 19-SEP-2017 09:30 A.M.

|

8 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As a threat to small businesses, and the wider economy, Australia’s gas crisis has been well publicised.

One aspiring producer, Real Energy (ASX:RLE), holds two large exploration permits in Queensland and is positioned to take advantage of increasing demand from East Coast gas users.

It’s been a few months since we updated you on this cashed-up, debt free gas explorer, which now looks to have a significantly-improved chance of moving into gas production.

RLE wants to bring forth a new gas resource in Queensland, and ultimately, commercialise its Windorah Gas Project to help meet the demand from east coast energy users. RLE’s permits in Queensland are, at least initially, focusing on the Toolachee and Patchawarra formations — well known throughout the basin for holding and producing gas.

The company looks to have its hands on one of the largest gas resources uncontracted on the east coast, with Independent Estimated Total mean Gas in place of 13.76tcf in APT927P, which we’ll look at in more detail shortly.

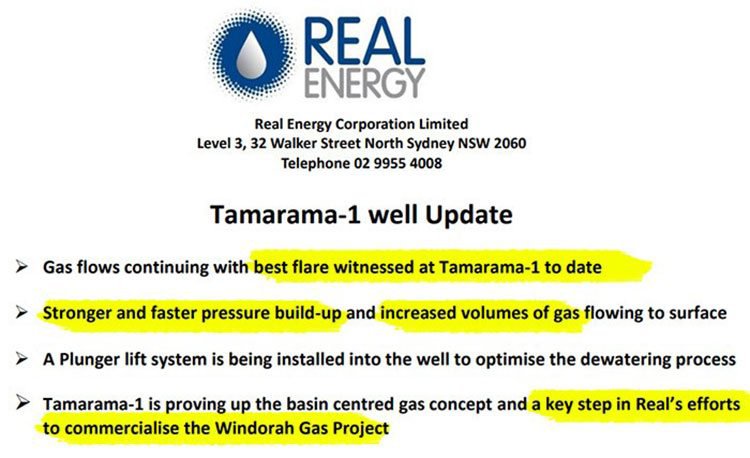

RLE has demonstrated consistent improvement in its flow and pressure rates at Windorah’s Tamarama-1 well, with gradual improvement in well performance. The Company installed a plunger lift into the well which has clearly improved performance.

The following video recently released by RLE of the Tamarama-1 well clearly shows strong gas flows:

This is the kind of strategic result we like to see coming from our Next Oil Rush picks.

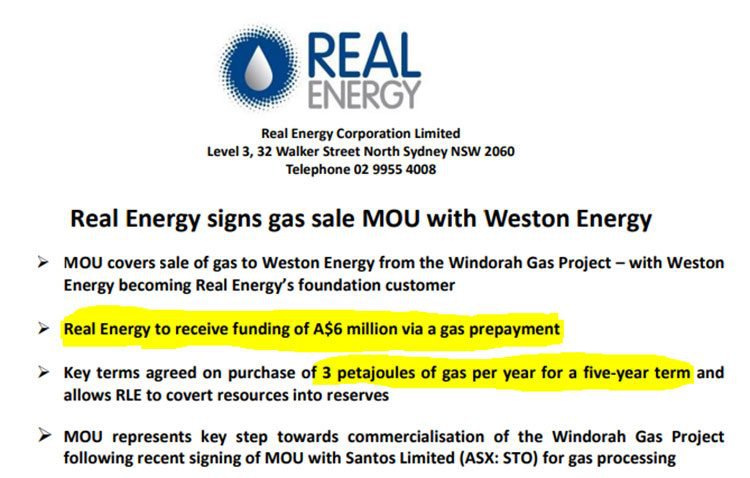

As is its executed non-binding Memorandum of Understanding (MOU) with Weston Energy Pty Ltd to sell gas from the company’s Windorah Gas Project in the Cooper Basin, Queensland.

The MoU represents a significant step towards signing a binding gas sales agreement (GSA) between the two parties, covering the purchasing by Weston Energy of 3 petajoules (“PJ”) of gas per year for a period of five years.

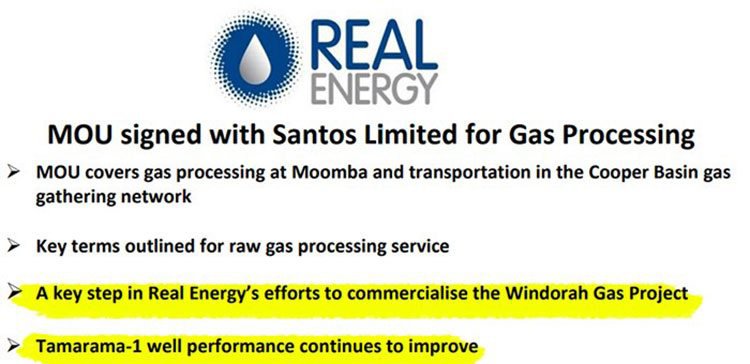

This agreement follows the cornerstone MoU deal with ASX-listed Santos for gas processing, which we reported to you when we last updated you on RLE back in May .

Like the MoU with Weston, the agreement with Santos provides a clear pathway to commercialisation, allowing for raw gas from RLE’s Windorah Gas Project to be processed into sales gas to supply the east Australian gas market.

It is early days in the life of these deals, so investors should remain cautious about the investment decision in this stock and seek professional financial advice for further information.

RLE has a simple, straightforward shot at establishing what could be large shale resource in Australia and represents a solid opportunity to take a calculated risk of striking a huge billion-cubic-feet gas resource onshore Australia. We’re here to guide you through the RLE story and update you regarding its rapid progress.

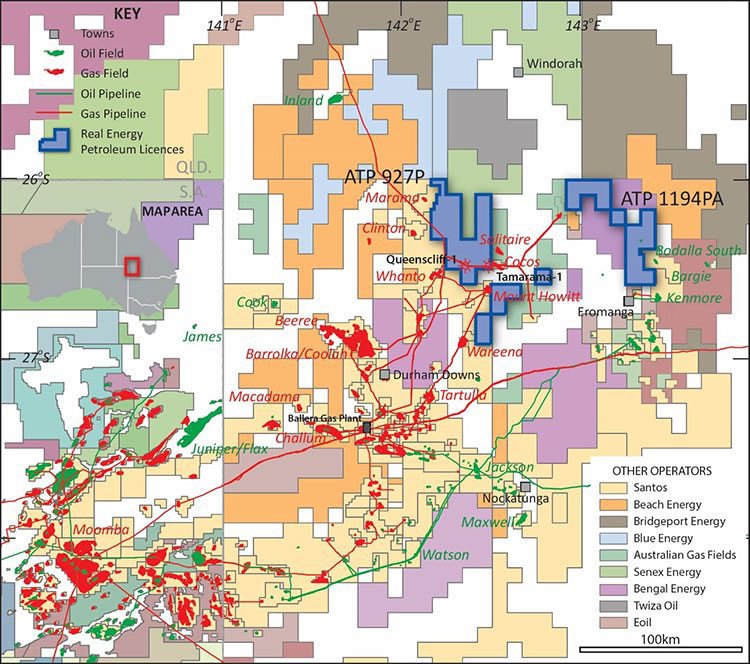

Real Energy (ASX:RLE), is focused on exploration and development of oil and gas acreage in the Cooper Eromanga Basin in South West Queensland — an area that’s synonymous with successful onshore oil and gas projects.

RLE’s focus is on itsTamarama-1 well at its Windorah Gas Project, which since June this year has produced results that have been key steps in RLE’s efforts to commercialise the project.

Going by the latest videos and updates from the company since June, progress is tracking well with gradual improvement in well performance.

In June, RLE made the following announcement:

At this time the company reported its ‘best flare to date’.

Here was the active gas flow at Tamarama-1:

Now, here again is a look at the latest video from Tamarama 1:

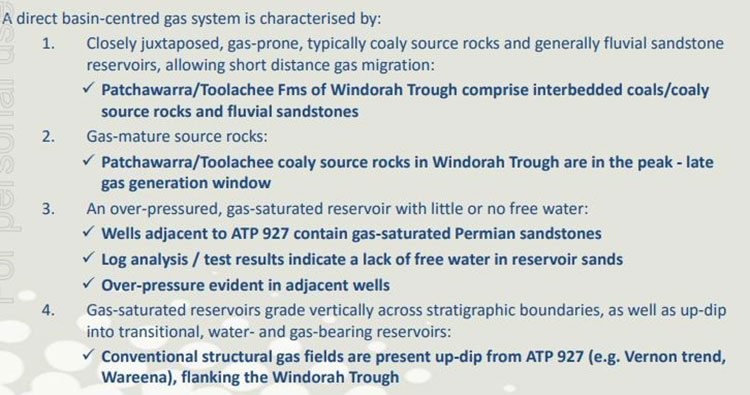

RLE’s Tamarama-1 well was drilled as an exploration well and has proved up the concept of Basin Centred Gas for the company.

Here’s why this is important:

As you can see, RLE’s assets meet all the criteria of a direct basin-centred gas system. Most notably, a 5 stage frac has been completed at Tamarama-1, with gas flowing to the surface. The company has successfully installed the plunger lift into Tamarama and water recovered appears to still be from the original frac fluid from the Toolachee zone coal seams.

Later this year RLE could move up the valuation stakes...

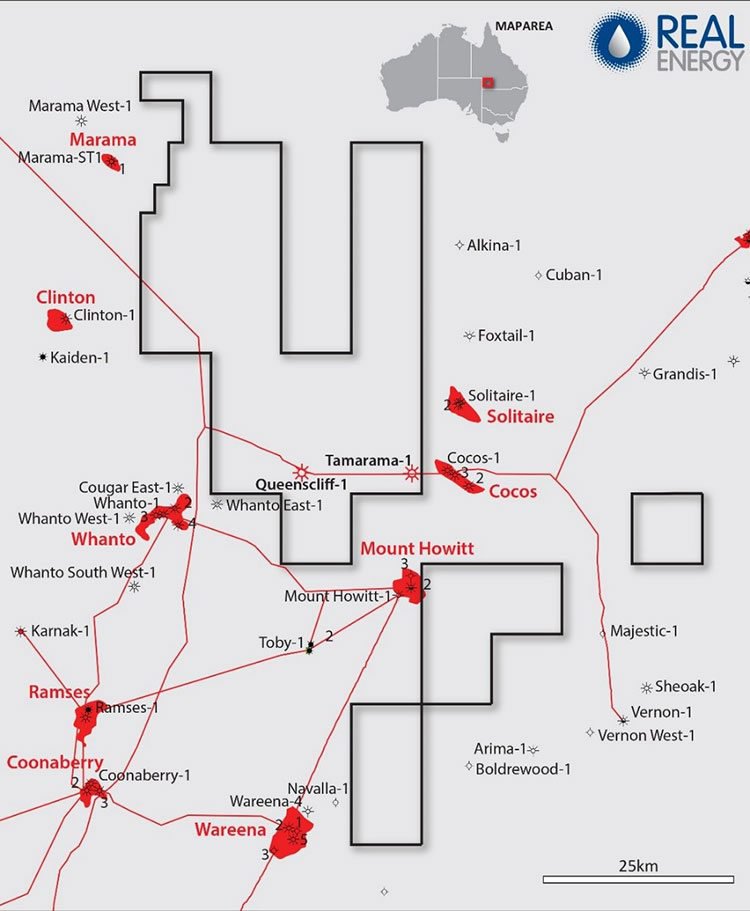

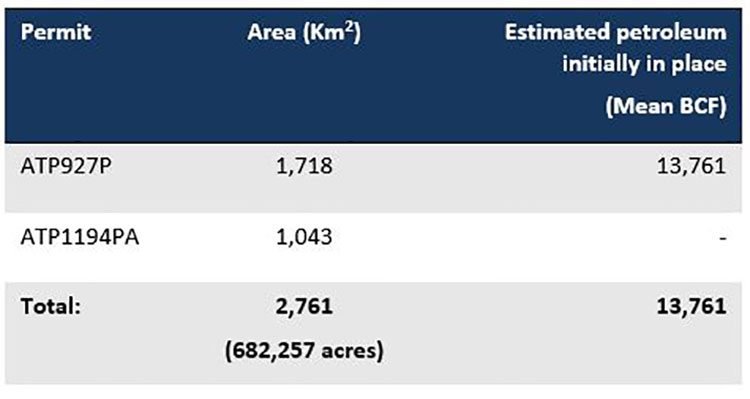

RLE has a large acreage position that’s 100% owned. Its overall position is as follows from each of its projects:

A total of 682,257 acres is a huge swathe of land for RLE to utilise. It could decide to vend in other partners or pursue its own exploration.

That’s what we like to see with our prospective oil and gas picks — lots of optionality and good chances of success when drilling.

There is a significant quantity of gas throughout RLE tenements — ATP927P and ATP 1194PA.

Mapped out below is RLE’s location and tenements together with the main players in the Cooper Basin.

The Windorah Gas Project (see map below) is focused on ATP927P. Significantly, RLE acreage is next door to Santos, Beach’s and Origin’s acreage and they are targeting the same formations being the Toolachee and Patchawarra.

Santos, the operator of the adjoining acreage has drilled over 10 gas wells in the last two years – all of them either being completed as gas producers or described as future producers. The most significant thing about basin centred gas is that it is laterally extensive over a wide area.

Attracting attention

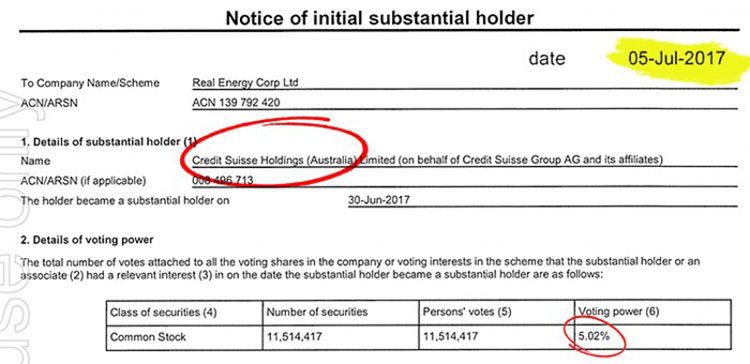

In a highly encouraging sign to shareholders, not long after the announcement in June regarding Tamarama-1 gas flow, Credit Suisse emerged as a major investor in the company with a 5% stake.

Unfortunately, the share price didn’t rally as much as one might expect on this news because it corresponded with a sharp fall in the oil price.

The below Nine Finance article discusses this in more detail:

However, the move by one of the world’s most highly renowned and well-capitalised investment banks joining RLE’s shareholder register is a welcome sight and shores up confidence in the company and its gas ambitions.

However, this remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Credit Swisse’s involvement is certainly an important sign for any partners that come on board.

Gas sales agreement signed with Weston Energy

On July 17, RLE announced that it had signed a non-binding Memorandum of Understanding with Weston Energy to sell gas from its Wendorah Gas Project. Weston Energy is a privately-owned gas retailer helping bring much needed energy security to Australian businesses.

This is a significant step for RLE towards signing a binding Gas Sales Agreement. It covers the purchase by Weston Energy of three petajoules gas per year for a period of five years.

The signing of Weston Energy as RLE’s foundation customer follows the signing of an MOU in May with Santos for Windorah’s gas processing — both are significant and impactful developments for the business.

We discussed this agreement in more detail in our last update on RLE in May — Amid the East Coast Gas Crisis, RLE Strike Deal with Santos .

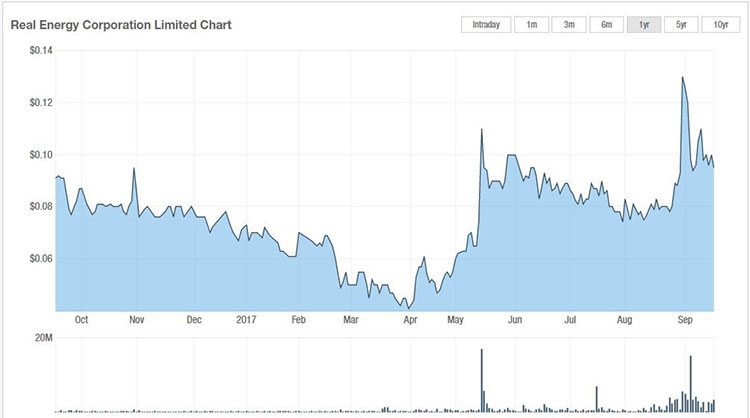

Optimistic news, like the above, has helped RLE’s share price begin to stage a recovery this year with some bursts of handy volume too. You can see the reaction to the Santos announcement in May and then the Weston Energy announcement in July on the chart below.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

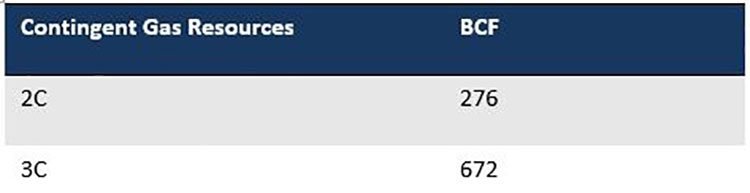

RLE’s ultimate goal is to prove up an estimated Total Mean Gas in place of 13.76 TCF

RLE’s permits cover over 2,761km 2 and cover every type of hydrocarbon there is. But it’s the unconventional gas seams that interests RLE most.

The main play RLE is chasing is the Toolachee and Patchawarra formations as these formations contain significant gas. Initially, RLE will focus on the Toolachee and Patchawarra, which have high organic content of up to 30% TOC.

RLE is definitely in the right place at the right time

RLE’s land is 100% owned with no other JV partners. In some ways, RLE has an entire cake to divvy up, as and when required.

This means that RLE can welcome potential JV partners from a position of strength, if it decides to do so.

Of course, these are just aspirations for now and investors should be cautious — this is a prospective gas stock and professional financial advice is advised.

The potential upside is that RLE records a huge resource and develops the Windorah Gas Project into a significant supplier to the Australian gas market, which is feeling demand pressures from both home and abroad.

Having reported improving flow rates, RLE is now standing on the verge of potentially becoming a producer.

The coming few months should see a push higher in RLE’s level of exploration activity, news flow, and hopefully, its valuation.

With a cash position of over $7 million, field operations moving along nicely, and showing improving flow rates at Tamarama-1, RLE is on track to turn its promising geology into commercial dollars.

This $21.5 million-capped hydrocarbon junior is hoping to reward patient investors with something very alluring later this year. We’ll keep an ear close to the ground for RLE’s drill-bit, because a strike of over 13 billion TCF could launch this featherweight oiler into the stratosphere.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.