Reinvigorated Pilot Plots Course for New Oil & Gas Heights

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pilot Energy (ASX:PGY) has a counter-cyclical investment philosophy that might just pay off.

Recently, oil prices have been unable to put smiles on oilers’ faces for over a year, falling as low as $40 a barrel.

How is an oiler supposed to put food on the table at such rates?

This doesn’t mean there aren’t intriguing opportunities that have escaped mainstream attention.

PGY is one such opportunity.

Currently capped at just $3M, PGY has multiple West Australian assets with high value farm-out potential in the near term.

PGY’s management team have decades of combined experience in companies like Chevron and Woodside.

The Board of PGY has invested over $300,000 of their own hard earned cash into the company, and currently hold 16% of shares on offer – these guys are determined to see this Pilot take off.

Recently PGY announced an independent audit by Gaffney, Cline & Associates (GCA) of prospective oil resources for its WA-507-P exploration permit, which confirms the potential for multi-million barrel oil discoveries.

This is further to the announcement earlier in the year which confirmed the potential for multi-tcf gas discoveries within the same permit.

With PGY’s tiny current market cap, this is a ground floor entry investment and a speculative stock – investors should seek professional advice before choosing to make an investment.

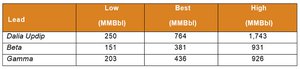

Here are the leads and Gaffney Cline’s estimate of gross prospective oil resources...of which PGY has an 80% interest:

Source: Pilot Energy

PGY is definitely getting in on the regional action as these three leads each have a High Case potential for finding 900MM barrels, with the largest lead potentially holding 1.7Bn barrels.

PGY has rapidly developed a compelling early stage exploration portfolio offshore and onshore Western Australia, and intends to add value to its assets through low cost desktop studies, before farming out to industry partners in order to fund exploration.

Oil exploration isn’t simple or cheap at the best of times, so today’s market environment means collaboration trumps monopolisation when it comes to exploring for substantial oil reserves offshore Australia.

As it stands, PGY is sufficiently funded to progress its near to mid-term work program, and has zero debt on its balance sheet.

The good news is that there are no outstanding issues or roadblocks for PGY to strike a deal to further explore its most prime assets.

With the oil market going through tough times, and prices remaining weak, now could be a good time to look ahead in terms of investing in attractive oil and gas assets for cents on the dollar – with a view of maximising the acquired value of those assets when the market recovers and prices realign with historic averages.

PGY is thinking along the same lines, and so without further ado, we continue our coverage of:

A change of focus

Pilot Energy (ASX:PGY) is a junior explorer with a portfolio of four prime Western Australian oil and gas assets.

The Next Oil Rush brought the Pilot Energy (ASX:PGY) story to you last month in our article, ‘ Tiny ASX Oil Explorer Next Door to $50BN Eni and $45BN Statoil ’.

The main focus of the article was its two assets in the Carnarvon Basin, offshore Western Australia. It is the country’s most prolific hydrocarbon-producing area, having produced over 2.7 billion barrels of oil and 472 billion cubic metres of gas to date.

It’s important to note that PGY has recently been reinvigorated into an emerging oil and gas explorer after a complete overhaul of its board and management team.

After acquiring no less than four exploration permits since November 2014, PGY is gradually progressing operations and has the right management experience to attract farm-in partners.

The (entirely new) management team has disposed of the company’s previous Alaskan quagmire, with commercial nous and a potential US$500,000 payoff.

So let’s review in more detail where PGY is operating, what its intentions are, and most importantly how much value it can offer investors looking for the next oil rush.

PGY’s operations

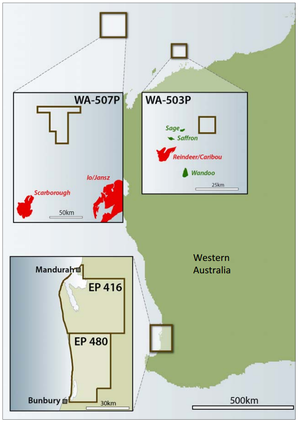

Courtesy of tidy joint-venture agreements, PGY now has varying stakes in 4 exploration permits dotted around Western Australia.

Here’s a summary:

Internally produced

The company has a new name, new management, new projects and a clear strategy – which is to create a leading junior exploration/production company on the back of a balanced portfolio that is focused on a counter-cyclical investment philosophy.

In other words, obtain optimal assets within a downturn in order to be best positioned in case of an upturn, maintaining a low cost base in the meantime.

PGY has significant percentage ownership in four exploration permits located in West Australia; respectively in deep-water, shallow-water, and onshore (two permits) – essentially three projects in total.

Here they are mapped out:

As you can see, PGY’s three projects are spread out across Western Australia – with two in the Carnarvon Basin and one (comprising of 2 permits) in the Perth Basin.

The Carnarvon Basin is Australia’s largest natural resource development with an LNG export capacity of 16.9 million tonnes a year. Oil production from the Carnarvon Basin accounts for around 70% of Australia’s total oil production.

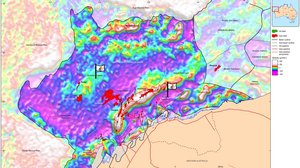

When we overlay PGY’s positioning onto existing satellite gravity data and Geoscience Australia data, take a look at the number of oil and gas discoveries that have been made in the region near to PGY:

Both PGY licenses are opportunistically located, close to existing huge gas and oil reserves – the WA-507-P license gives PGY a deepwater option while its WA-503-P license is a shallow water venture.

WA-503P

Previous exploration wells within the permit area confirm the presence of a working petroleum system, including oil shows and a 4 metre oil column.

It is thought that modern day “Broadband” 3D seismic data will help greatly to de-risk the known prospects, in order to proceed with drilling.

The decommissioned Legendre field is situated 20km to the northeast of the block, and produced over 40 MMbbl of oil from excellent quality sandstone reservoirs.

WA-507P

This permit is located close to the mammoth Scarborough, Io/Jansz, Thebe and Gorgon fields currently being developed by large companies such as Chevron.

It is here where all the action is and where GCA sees the most potential for multi million barrel oil finds.

PGY Managing Director, Iain Smith said, “ GCA’s findings clearly confirm the potential for the very large and previously quantified exploration leads within WA-507-P to be oil-bearing. We look forward to progressing our geological understanding of the permit in order to further de-risk the exploration leads, as we work towards attracting a suitable industry partner to fund the future exploration program .”

Statoil has just recently acquired a huge new permit in the Carnarvon Basin, and it just so happens to be PGY’s neighbour...

Statoil has committed to spending over $50M on seismic and technical work, and has a commitment to drill in 2018.

That’s great news for PGY because Statoil’s close proximity means its exploration work could attract farm-in partners looking for a quick entry into an established large gas play and a compelling emerging oil play that offers major potential.

And who knows... maybe even Statoil itself could come looking for a piece of PGY’s WA-507-P permit – it just depends on what its own exploration team finds first.

For now, Statoil has committed to undertake geochemical and geophysical surveys with a value of $50 million – a pretty sure sign that Statoil is keen to find out what is really down there.

Having acquired the WA-506-P permit in October 2014, Statoil has committed to collect 2,000 line km. of 2D seismic and 3,500 km 2 of 3D seismic data within three years.

Statoil are at present undertaking a larger 3D seismic survey over their whole permit as part of a 15,000 km 2 joint industry survey over WA-506-P, WA-3620P and WA-386-P, which runs to the west, north and east of permit WA-507-P.

And it’s all happening over the fence from PGY’s permit.

Will Statoil decide to pop round for a cup of sugar?

Only time will tell.

While it’s all very interesting having such a large neighbour spending so much cash next door to little PGY, the company is still a tiny exploration stock, it is very early days , and success is by no means a guarantee.

Meanwhile the regional well data and various studies support the case for an oil play in WA-507-P. The marine environment of deposition in the area has positive implications for extensive deposition of oil-prone source rocks and good quality sandstone reservoirs.

Gas has historically been the primary target of outer North West Shelf exploration. The high success rate there has largely been due to drilling prospects that exhibit Direct Hydrocarbon Indicators (DHIs) on seismic data. DHIs are not readily apparent when it comes to oil, and this has resulted in a large number of structures remaining undrilled, but which may be oil bearing.

That fact is not lost on the big players such as Shell, Statoil and Eni, who are pursuing the oil play in their own permits surrounding WA-507-P.

Taking a birdseye view

Before we look at PGY’s remaining permits in the Perth Basin, around 1,500 km to the south of the Carnarvon basin, taking a look at the broader picture as seen from a satellite, helps to put PGY’s assets in perspective.

Here is a map where we’ve overlaid the previous location map on to gravity data taken from a satellite by Geoscience Australia:

As you can see, PGY’s licenses are in amongst a very hydrocarbon-rich area, and its shallow water license is also conveniently close to existing oil pipelines and important infrastructure.

The key for PGY is to conduct as much technical work as possible, for the lowest possible cost in order to attract collaborators to progress development.

PGY plans to complete final interpretation of the existing 3D seismic data before hitting the farm-out market to fund further exploration.

This is part and parcel of the oil exploration industry and the good news is that PGY has some heavyweights of its own in its corner.

PGY management

PGY’s Managing Director is Mr. Iain Smith.

Mr. Smith has over 26 years’ experience having worked at Premier Oil and Australian offshore specialist Woodside Energy, in technical and commercial roles.

PGY also has non-executive directors on the Board with experience at companies such as Chevron, Cooper Energy, and Occidental.

During his career Mr. Smith has been responsible for overseeing numerous asset sales and farm-outs which to date have exceeded $300m in exploration expenditure.

But it’s not just working at majors that this team has on its resume...

Importantly for shareholders, PGY’s Board has significant experience in acquiring assets, adding value and farming them out to third parties in order to fund exploration.

PGY Chairman Gavin Harper was previously Chairman of Sino Gas & Energy Holdings (SEH), overseeing tremendous growth from 4 cents per share in 2011, to 24 cents per share in 2014 – a 500% gain – with the company joining the ASX 300 along the way.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Harper’s most recent role with Chevron was as Managing Director of Chevron’s gas business development company in Korea.

Most crucially for new investors, is that the current PGY Board has invested over $300,000 of their own money in recent capital raisings, and currently hold 16% of the shares.

There are also other remuneration and performance milestones to ensure PGY is steered diligently.

The PGY team is intimately tied to the success of the company – just what we like to see.

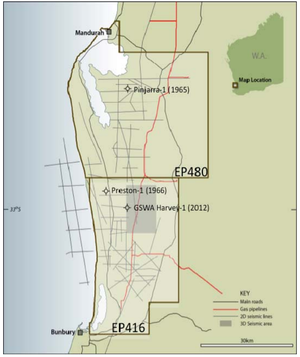

Perth Basin

PGY’s remaining assets (EP416 and EP480) are located in the Perth Basin close to the very south of Western Australia.

As always, here’s a map:

Just last month, PGY acquired a 60% operating stake in two separate licenses in the Perth Basin.

EP416 and EP480 were originally 100% owned by Empire Oil and Gas and the agreement between PGY and Empire effectively means PGY will pay the costs of Empire’s airborne geological survey ($150,000) with a further $300,000 payable subject to confirming the future work program.

In the Perth Basin, PGY is pushing forward at just the right time, hot on the heels of AWE’s hydrocarbon discovery – the largest onshore discovery in over 50 years. One of the reasons PGY went for these two licenses is that the basin is highly prospective for gas and has existing gas pipelines that run through PGY’s ground.

Previous exploration and survey work has been focused on EP416 and confirmed gas prospectivity.

The permits have had only limited exploration so far, so it’s still early days.

However, given the recent exploration success to the north, there is a good reason for investor anticipation with PGY’s latest acquisition.

EP416 & EP480 in more detail

The two permits neighbour each other between the towns of Bunbury and Mandurah, covering a total area of 2,310 km 2 . Three wells have already been drilled within the permits, one as recently as 2012 as part of a carbon geosequestration study.

2D seismic data confirms the presence of large structure spreading across both permits, with over 200km 2 of closure already mapped.

PGY is working towards obtaining formal, independent verification regarding resource size although initial internal estimates suggest that in the event of exploration success, PGY can expect to obtain between 90Bcf (low-end estimate) and 600Bcf (high-end estimate) from the two permits.

EP416 and EP480 offer the opportunity for low cost onshore gas exploration, with significant prospective resources already identified. The permits host existing gas infrastructure and are near to an area of demand for domestic gas by industrial customers.

On the other hand, the potential rewards are higher in correlation to the amount of risk taken, and PGY is not banking on only one project.

Pilot ready for take-off?

PGY has cleaned up its act and embarked on a new trajectory...one that might just deliver to shareholders what they’ve been waiting for – a company with tangible value and commercial success.

Now, there are no guarantees that PGY will define a large resource or that it will find anything at all. Investors should bear in mind that exploration stocks are inherently speculative.

With three discrete projects in the bag, PGY’s asset portfolio is diversified and open-ended. Deep water, shallow water, and onshore plays are all accounted for as part of PGY’s game plan.

Although the oil market is temporarily depressed, optimism should not be forgotten.

Eventually, oil prices will find their long-term equilibrium – and hopefully PGY will find its long-term commercial viability as part of a new, reinvigorated company.

Here at The Next Oil Rush , we feel it’s a great addition to our portfolio given PGY’s bargain basement value in proportion to the quality of assets it now has.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.