How 88 Energy Defied the Odds

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Amidst a cyclical downturn in the oil market, one dual listed oil explorer 88 Energy (ASX:88E; AIM:88E) has managed to stand out amongst the crowd, and steadily grow its valuation over the past year – defying the odds and expectations for a junior.

Recent drilling success at its onshore Alaskan Project Icewine has swung the spotlight firmly on this company, as it transitions from small explorer with an unproven project, to a company that has acquired, developed and de-risked a project of size large enough to attract a major.

With majors tending to take a longer term view of the development of oil projects, and less of a focus on short term fluctuations in the oil price, 88E’s Project Icewine may well be on their radar for a farm in or take out in the near term.

88E have a unique understanding of the shale oil play it is targeting, and this coupled with the downturn in oil price creates an opportunity in one of the world’s remaining frontier regions, with no effective competition.

So what’s in it for the majors?

And just why has 88E performed so well over the past 12 months?

88E’s Project Icewine could prove compelling to a major when the following factors are considered:

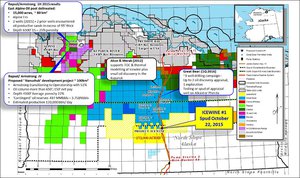

- 88E have a large, continuous acreage position comprising of over 272,000 acres on the North Slope of Alaska, and hold a 78% working interest – this is a scale which ‘moves the needle’ for major oil companies;

- The Project has a clear infrastructure advantage when it comes to this remote region – the Dalton Highway runs through the project, as well as the Trans Alaskan Pipeline System (TAPS) – the main pipeline through which oil can be sent to market;

- The State of Alaska strongly encourages oil exploration, and has developed attractive fiscal terms for oil explorers, highlighted by the a tax rebate of over 75% on exploration costs up to June 30 th 2016;

- The recent Icewine-1 well de-risked the project significantly, exceeding the project teams expectations – with indications this could be a resource of world class potential;

- 88E have previously received an independent resource size of 492.5 million barrels of oil and a risked mean (assuming 41% change of geologic success) of 200.3 million barrels of oil. However this was based on just 36% of the acreage 88E hold today, and it was prior to the successful Icewine-1 well.

Near term catalysts for this stock are the remainder of Icewine-1 results, the acquisition and interpretation of seismic, and a revised independent resource report – likely to be much bigger that the above figures given the progress 88E has made on the project.

However it should be noted that this is a speculative oil exploration stock – caution is recommended when considering 88E as an investment opportunity.

Longer term, catalysts for 88E would include attracting a farm in partner or take-over offer, and the drilling of Icewine-2.

Read on, and we will explain how 88E got to where it is today, and what the future may hold for this emerging energy company.

AIM : 88E

88E’s goal is to repeat the Eagle Ford shale success

The recent downturn in the oil market created an environment where risk taking juniors could be bidding for otherwise unattainable assets in ‘up market’ post codes – a perfect storm for 88E to take advantage.

So how did a small explorer like 88E come to be in possession of Project Icewine, sitting in the North Slope of Alaska, home to the 15 billion barrel Prudhoe Bay oilfield complex, the largest conventional pool in North America?

It all comes down to 88E Managing Director Dave Wall, and his extensive industry connections.

It also necessary to understand how the Eagle Ford shale was discovered, as it’s in a similar way that 88E are looking to prove up its Alaskan acreage.

Mr Wall is an ex oil and gas analyst with significant corporate experience, and a large network of associates in the space. Through his networks, Mr Wall met a man by the name of Paul Basinski.

Basinski is credited as one of the minds behind the early entry into the Eagle Ford shale, which is now the largest onshore oil discovery in North America.

Basinski had been working on unconventional plays since the 1980s, well before they became en- vogue in recent times – and even up until 2008, the focus had been on gas rather than oil. Extracting oil from shale was thought to be impossible.

Yet, Basinski was studying the data from wells drilled into the Eagle Ford shale and had a theory.

He thought Texas could host a sweet spot for liquids hosted in shale where the key differentiator was the existence of a vapour phase – when the liquids exist in a gaseous form in the reservoir. This means that they should flow more easily through the rock and at higher rates.

Basinski then spearheaded the acquisition of over 300,000 prime acres in the Eagle Ford, which are now considered the best part of the play. This was all done prior to the “discovery” well almost one year later.

The rest is history.

Fast forward to recent times, and Basinski started running his own private company, Burgundy Xploration. He was interested in seeing if he could pull off the same feat in an area he dubbed Project Icewine in the Alaskan North Slope.

The North Slope is renowned for its conventional oilfields, but only in and around the waters on the north shore.

To the south, onshore, there have been relatively few explorers.

However, the onshore areas hosts what is known as the ‘HRZ Shale’, which was thought to be in the same vapour phase that proved so prolific in the Eagle Ford.

When Burgundy wanted to increase the stakes and acquire more acreage, an opportune introduction resulted in a partnership with 88E, which entered a joint venture with Burgundy in 2015.

88E took a 78% operating stake in the venture, and swiftly progressed the exploration work programme.

88E now has a majority stake Project Icewine

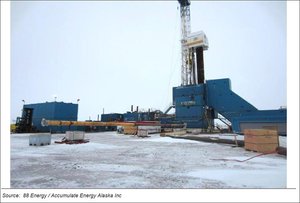

The joint venture originally had an acreage position of almost 100,000 acres at Icewine, and soon got to work financing the project through a mixture of equity and a $50 million facility with the Bank of America getting to the drilling of the Icewine-1 well in short order.

That alone was a remarkable achievement given the current market climate.

However whilst drilling Icewine-1 in November 2015, an opportunity arose to significantly increase 88E’s leverage to success on the Project.

Each November the Alaskan government leases out land for oil and gas drilling in return for a 20% deposit on the land. Last November 88E didn’t have the data from Icewine-1 yet, although the signs while drilling were promising.

But Wall and Basinski knew that by November 2016, the data would be well and truly in and the opportunity would no longer exist at the current ground floor price.

88E and Burgundy were announced winners at the government auction for 174,240 acres adjoining its existing Icewine acreage.

With the new acreage, the joint venture now has a majority stake on 272,242 contiguous acres, which is of a size large enough to attract a partner to the table.

At this stage 88E remains in talks and hopes to conduct a farm-out in the second half of 2016.

Any additional supportive data, on top of the positive results so far, should help with this plan.

Let’s find out more on what 88E found whilst drilling Icewine-1.

Icewine-1 – successful drilling leads to ‘Rosetta Stone’ moment

As 88E drilled Icewine-1 through to the end of 2015, it had several promising oil shows as it transitioned between conventional horizons and the HRZ.

Basinski had built a model which pegged the HRZ at Project Icewine as being in the thermal maturity sweetspot, as well as having some highly favourable attributes, such as exceptional porosity – but without the data from the cores it would just be a model.

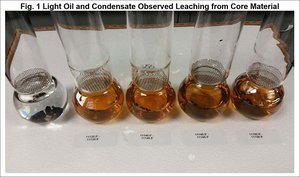

Early indications on thermal maturity were promising but the first results released by 88E were for permeability and porosity.

Of the 18 samples from the core, 16 came back on the higher side of expectations for permeability. The other two came back at levels too high for conventional testing.

Results for porosity came in at “at the upper end of expectations as per prognosis.”

Testing of the core for thermal maturity then confirmed that the shale at Icewine-1 is at the crossover between volatile oil and gas wet – which is exactly where the team wants it to be, with a higher oil than gas ratio present.

This means lower viscosity and potentially higher flow rates.

Testing has confirmed that 88E was onto something and the numbers simultaneously backed up and informed Basinki’s model.

Gross pay of 196’ with net pay of 180.5’ – an exceptional net to gross ratio of 92% was found.

The reservoir quality is in line with and above expectations.

Rock mechanics have been further de-risked along the way via additional analysis.

So as the weeks have passed, the data continues to stack up favourably for 88E – core and petrophysics data are indicating that Project Icewine has a Tier 1 liquids rich hydrocarbon concentration.

Pre drill estimates have been backed up by the growing realisation that Project Icewine has world class resource prize potential.

At the same time, it’s still early days here, and 88E is still a speculative investment. Caution is advised if considering for your portfolio.

So, with the scale achieved from the land auction and with a large part of its own ‘Rosetta Stone’ translated, 88 Energy is now in the box seat at Project Icewine.

Alaskan fiscal regime offers strong cash rebates for 88E’s exploration costs

With decades of oil production on large oil fields underpinning the development of the Alaskan state, and a heavy reliance on oil revenues to fill state coffers, the fiscal regime in Alaska is one of the best in the world for oil explorers.

Recent legislation passed in 2013 has put a progressive production tax on oil production of 35%.

88E, as well as other companies operating in the region, qualify for a combined cash rebate on exploration of 85% for all qualified expenditure until 31 st December 2015, reducing to 75% for the period ending 30 th June 2016, and 35% thereafter.

With the major TAPS oil pipeline significantly under capacity, and running directly through 88E’s Project Icewine, getting the oil out of the ground for a profitable return is made much easier – assuming 88E is able to make a commercial discovery and take this project into production with a major partner.

88E’s Capital Structure and Cash Position

88E is dual listed on the ASX and AIM, with 3.16 billion shares on issue.

The company has 413.7 million listed options with a strike price of $0.02/share, and an expiry date of 2 nd March 2018. 88E also has 151.6 million options at varying strike prices and expiry dates, with the majority at prices between A$0.014-0.021 expiring in 2018.

At the end of 2015, 88E had a cash position of A$9.6 million. The company has access to a US$50 million funding facility with the Bank of America, which had an available balance of US$42.1 million as at December 31 st , 2015.

88E has estimated cash outflows for the March quarter of A$3.3 million including A$2.5 million net equity contribution towards exploration and evaluation.

The approximate costs for seismic acquisition would be US$3 million and US$5 million net payment for the additional acreage recently acquired – both are due within the next six months.

Near term catalysts

There are a few more Icewine-1 results still to come in over the next few weeks, namely additional rock mechanical properties, which would be the basis for integrated well stimulation design; and characterisation of ‘super highway’ permeability zones.

An updated independent resource report should follow after Easter, incorporating the Icewine-1 results.

The acquisition and interpretation of seismic will lead to a clearer understanding of resource potential at Project Icewine over the coming months.

Mid term catalysts

With a large acreage position on an increasingly de-risked project, and seismic results in hand, 88E would likely have done enough to attract a joint venture partner to assist the company in doing the heavy project lifting in the coming months.

At the same time, nothing is certain, especially in the oil and gas game, so no one can guarantee a project partner is coming on board – this is dependent on a multitude of factors, some outside of the company’s control.

If successful in attracting a partner, this would culminate in the drilling of Icewine-2 – which would be a horizontal well and target a production test from the HRZ layer.

If scale and a world-class technical model isn’t enough for a major – maybe the sight of oil flowing from the shale will be.

But by that time, 88E could be valued much higher than today’s prices.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.