Drilling Just Weeks Away for Tiny Explorer Targeting 1.6 Billion Barrels of Oil

A 20% chance to make 100 times our money? Even by oil exploration standards that is pretty impressive – This kind of opportunity suited our investment strategy, you need to decide whether it suits yours. We have done all the reading, crunched the numbers and made an investment in this tiny oil exploration company, and will explain why in this comprehensive article. Now it’s just a matter of sitting back and waiting a few weeks to see what happens with our investment... and the imminent drilling of a 1.6 billion barrel target. This tiny market cap oil explorer we have invested in was a first mover in one of the most exciting new oil exploration hotspots in the world – Morocco, North West Africa. Offshore Morocco has huge reserves of oil on par with North and South America – but it’s almost totally unexplored and unexploited. Huge potential exists in offshore Morocco for billion barrel oil discoveries, which is why oil super-majors are scrambling for a foothold in the region, recently snapping up any available acreage. The company we have invested in scooped up one of the best blocks in offshore Morocco way back in 2009 and is drilling a high impact well in a matter of weeks. A recently drilled well by two oil majors right next door to our tiny explorer discovered heavy oil, proved a quality reservoir AND flowed at a decent rate... But those two oil majors are now fuming as analysis of their results has revealed that the highest quality part of this offshore hydrocarbon system extends right into our little explorers block... The analysis shows our explorers’ acreage holds bigger targets, a higher quality reservoir AND lighter oil... and way more of it too – in fact our plucky little explorer has THE LARGEST prospect in the area. Light oil has a low viscosity and flows easily at room temperature – and fetches a higher price on market.... We are talking 1.6 billion barrels of the stuff here. That’s what you get for being an early mover, and having your pick of the blocks before the scramble began. Everyone knows that the best time to invest in an oil explorer is the lead up to a drilling event – just before market hype, excitement and anticipation of a positive result pushes up the value of the stock. For example, a similar sized oil explorer operating to the south saw their market cap increase 3-fold in the lead up to drilling. ...but with our investment, we have identified a unique and fascinating situation that has forced pre-drill uplift to be compressed into a “coiled spring” that we expect to be released when the market is made aware of our little known explorer – more on this later. And aside from their upcoming drill, 2014 is set to be the busiest year of drilling in offshore Morocco in the past 14 years. TEN wells alone are planned this year. Any discovery nearby this explorer’s acreage will have a positive flow on effect. Not to mention Morocco’s extremely attractive fiscal terms and political stability. This oil explorer is targeting over 1.6 billion barrels of oil and its market cap is miniscule. Oil is trading at over US $100 per barrel. For such a company defining event, a mere few weeks away, it’s trading completely under the radar. But all that is going to change. The great unwashed masses haven’t woken up to our company’s potential and near term drilling yet – when they finally do it may be too late... This company has a stake in an area of more than 11,000km2 with multiple prospects showing hydrocarbons. Now this tiny oil explorer is getting set to push the start button and stab a big, fat drill bit into this monster target. We did some digging through public company filings and discovered that the managing director of this company recently stumped up 200k of his own hard earned cash to invest before drilling. Let’s just add up the potential in clear terms – you’ll see immediately why we invested and are now counting down the days to drilling.... The company is about to drill into three stacked targets for a total potential of around 1.6 billion barrels + The company has an undervalued market – way below its peers + The company scored land ahead of its competitors and had its pick of acreage + Morocco is seeing oil activity it hasn’t witnessed in decades, proving the region’s promise = An oil explorer that could be about to re-rate in a matter of weeks. We are pleased to present the latest addition to our investment portfolio:

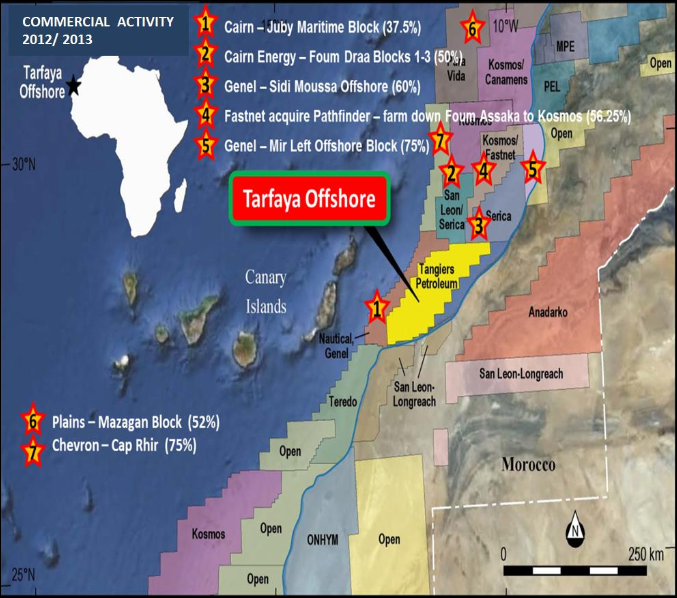

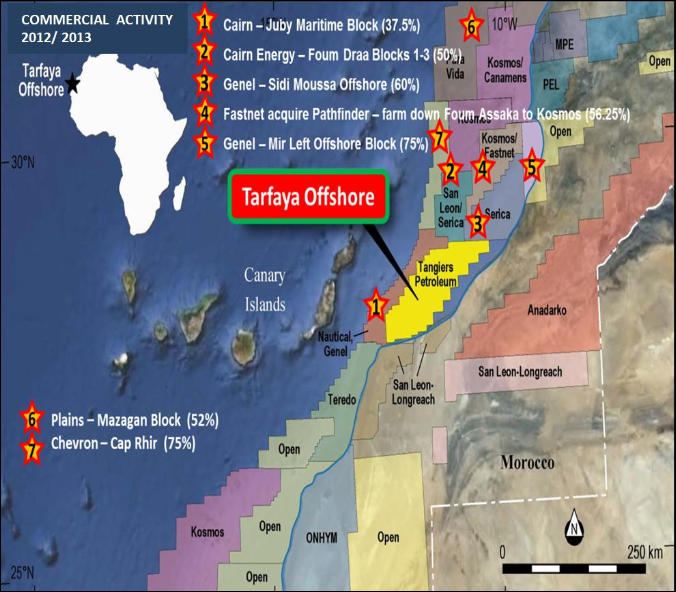

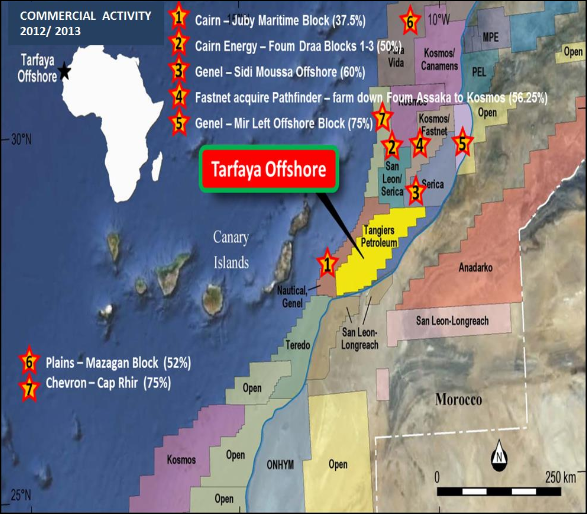

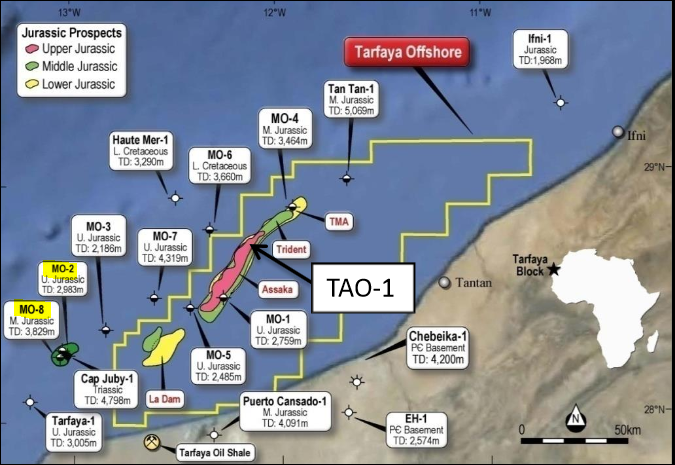

TANGIERS PETROLEUM (ASX:TPT, AIM:TPET) is a $32M AUD / £ 18 M market cap oil explorer with ambitions to develop an offshore oil field in Morocco. Morocco is one of the most underexplored oil regions in the world, yet it has great potential of which energy companies are just beginning to scratch the surface – there are 10 wells planned for drilling offshore this year, the most since 2000. You can see in this map the sea of activity, TANGIERS are operating in the block shown in yellow (the furious super-majors who already drilled next door and found oil are in block are to the west shown by the number “1”):

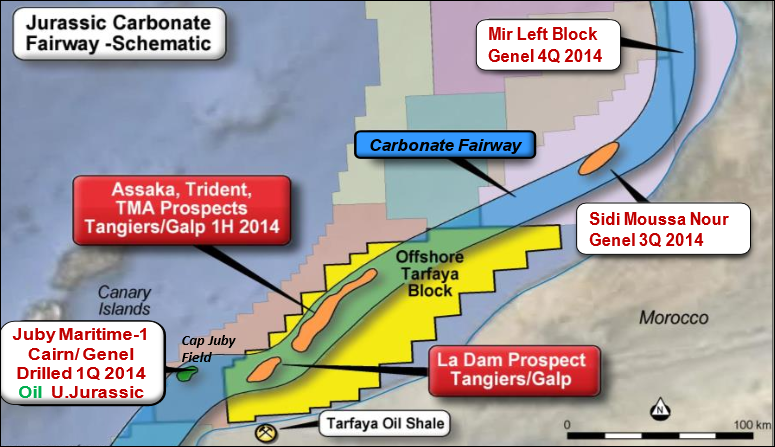

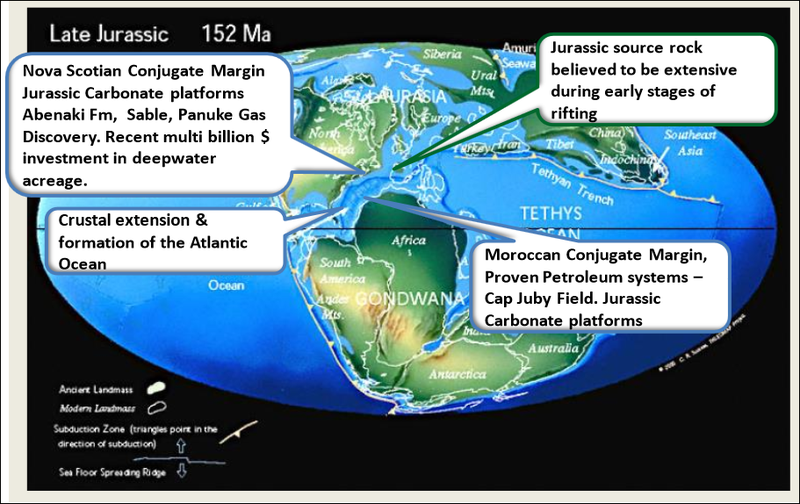

TANGIERS moved early in 2009 to secure their block, before exploring for oil in Morocco was cool, then in 2012 farmed out to Galp Energia for $33 million, plus $7.5 million in past costs. Should there be any additional costs, TANGIERS will need to cover 33% of them, so in order to account for this, TANGIERS recently raised $AUD 5 million (1 AUD currently buys about 0.55 GBP). We always like investing in companies that have recently raised capital and have cash in the bank. TANGIERS will be drilling into the Jurassic section offshore Morocco – into an area that was once a super-continent linked to North and South America. Its vast potential is thanks to underground activity that occurred millions of years ago. Texas, Brazil, Venezuela and even Canada have the Jurassic to thank for their vast oil fortunes in the modern age. Wait – what does Canada have to do with oil in Morocco? Just check out what’s happening in Nova Scotia, a maritime province in Canada. This Canadian land was once part of the super-continent and its Jurassic play fairway has been successfully explored. So far, 23 significant and eight commercial hydrocarbon discoveries have been made in offshore Nova Scotia ... Not only this, but additional wells have been found to contain numerous oil and gas shows. Although it contains the same Jurassic play and is considered analogous, offshore Morocco remains relatively unexplored and it is possible that drilling into this Jurassic carbonate section could bring flows on par or even higher than what’s being found in Nova Scotia. TANGIERS acquired what is known as the Tarfaya Block, which has a proven hydrocarbon system associated with the aforementioned Jurassic carbonate fairway. The Tarfaya block is yellow in the map below:

So what happened next door to Tarfaya block?

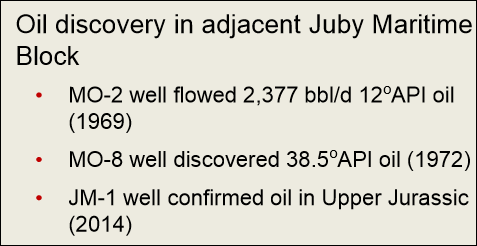

Oil Majors are scrambling to drill in Morocco, and two of the big boys have just drilled a well next door that confirmed the heavy oil discovery from the ‘60s which flowed at 2,400 bopd confirming both the regional presence of oil but also high quality reservoir. Cairn Energy (market cap of approximately GBP £1 billion) teamed up with Genel Energy (market cap of approximately GBP £2.5 billion) to drill the Juby Maritime-1 well to the east of TANGIERS’ upcoming TAO-1 prospect (you can see JM-1 in the image above, represented by a small green blob) Both wells are puncturing the same oil system, represented by the long blue squiggle. We’ll get into it in more detail later (featuring all sorts of technical oil & gas mumbo jumbo that will make your head spin), but essentially what the Genel & Cairn results have revealed to TANGIERS is that oil exists throughout the system, proven by shows in wells and the Cap Juby discovery in the adjacent block. Why is TANGIERS a “Coiled Spring”? When you do your basic research on TANGIERS, you will read about a recent proposed merger with another African focused oil & gas company. After months of negotiation – the merger did not go ahead. During the lengthy merger negotiations, TANGIERS went into voluntary suspension, meaning that its shares could not be bought or sold on the ASX. Why is this good news? Like we mentioned before, everyone knows that oil exploration stocks trend upwards in the lead up to drilling, and even more so in the lead up to reaching target drill depth and discover results. Due to the proposed merger, TANGIERS had been voluntarily suspended for a few months, hence all the usually expected uplift in lead up to drilling was not able to be realised. TANGIERS came out of suspension a few days ago, and with drilling only weeks away, we think this coiled spring effect will be impressive to watch. This forms part of our 20% chance at a 100-bagger theory. This opportunity has suited our investment strategy. Remember it’s up to you to decide whether this is part of yours. More details later on in the article.

Countdown to estimated start date of drilling by TANGIERS in TAO-1

Tangiers Petroleum (ASX:TPT, AIM:TPET)

To stay up to date will all the latest TANGIERS news, follow them on Twitter or like them on Facebook .

Our Track Record

Regular readers are well aware of The Next Oil Rush ‘tip of the decade’ – TSX:AOI – Back in February 2012 The Next Oil Rush called it at around CAD$1.8 and has been as high as CAD$11.25 since – that’s over 600%!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Have you heard about the Next Investors VIP Club?

Joining this Club will give you free access to opportunities not normally available to general retail investors – however you must qualify as a High Net Worth Individual These opportunities are as diverse as stock placements, seed capital raisings, IPOs, options underwritings. Plus a whole host of other high risk, high reward investment opportunities not available to the general public (careful – this stuff is high risk!). Just fill in the form and you will be alerted to the next opportunity.

The Results Next Door – What does it mean for TANGIERS?

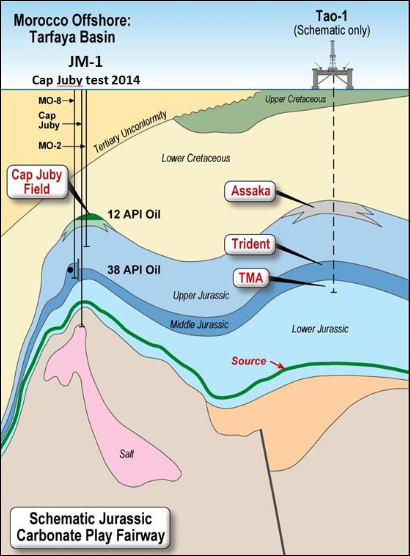

When we mentioned there is a scramble by oil majors to explore in offshore Morocco – we weren’t kidding. Any drilling action (and especially positive discoveries) in nearby blocks is always a bonus. Earlier this year, Cairn Energy and Genel Energy jointly drilled the Juby Maritime-1 (JM-1) well on the Cap Juby prospect – this is on the same hydrocarbon system as TANGIERS upcoming TAO-1 well, as shown in the graphic below:

What Cairn and Genel discovered in JM-1 was confirmation of a large heavy oil discovery in good quality reservoir in the Upper Jurassic and tight reservoir in the Middle Jurassic. We know that the way the carbonates were deposited at TANGIERS’ acreage is different and more likely to result in better quality reservoir. TANGIERS seismic inversion work confirmed this. Seismic inversion analysis predicts where good quality reservoir may exist based on previous well results. The Cairn & Genel joint venture confirmed a very large step out in the Cap Juby field in the Jurassics which is heavy oil – so Cap Juby is probably going to be a lot bigger than they think, which is good news. Remember, the original discovery well flowed at 2,400bpd, despite being 12 degree API (heavy!) Light oil argument is strong for TANGIERS Cap Juby was once very close to the land surface as indicated by tertiary unconformity – this allowed bacteria to contaminate and then eat the light oil. Bacteria eating oil? Yes – this actually happens. You can see in the diagram above that TAO-1 has thick cretaceous cover, so risk of contamination is very low – no erosional event as at Cap Juby, no oil / cash eating bacteria to spoil our investment. TANGIERS Reservoir risk has been mitigated The geological model gives encouragement for decent quality reservoir. This is backed up by amplitudes on the seismic as well as seismic inversion work. The seismic inversion work predicted that the middle Jurassic at Cap Juby would be a poor reservoir... and it was. This same work predicts that reservoir quality at TANGIERS’ location is better.

Tangiers Petroleum (ASX:TPT, AIM:TPET)

To stay up to date will all the latest TANGIERS news, follow them on Twitter or like them on Facebook .

A 20% chance at a 100-bagger? We aren’t making this up. Here’s why:

Look, we realise that this sounds like a pretty “blue sky” proposition – but have a look at our reasoning and calculations below, even if this investment achieves a fraction of this result we will be very happy. These calculations were part of our decision to invest in TANGIERS. You need to decide whether it’s part of your investment strategy too. For our newer readers, it’s important to note that we invest in every stock we write about as a long term hold – we take our positions in our stocks for at least 6 to 12 months – for more information please see our Financial Services Guide and Disclosure Policy . Here is our purchase contract for TANGIERS:

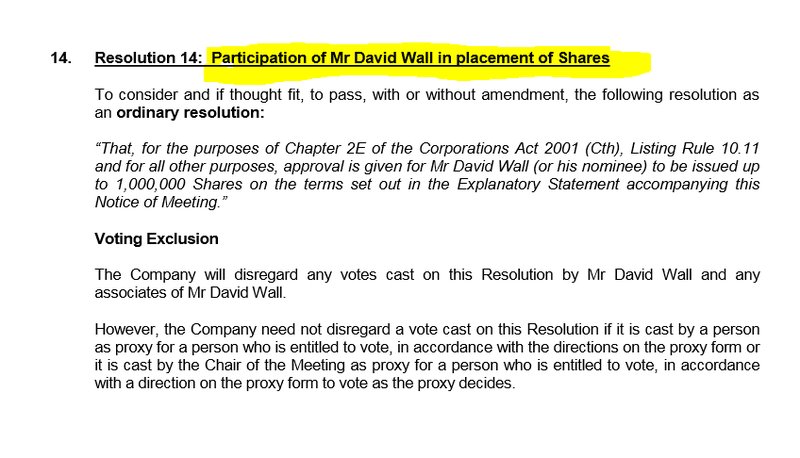

Aside from us investing, we also discovered that the Managing Director of TANGIERS (David Wall) recently stumped up around AUD $200k of his own cash to invest in the recent placement. We found this while we were digging through public company filings:

To demonstrate the upside potential inherent in TANGIERS, it’s necessary to look at another explorer, FAR Ltd , who are listed on the ASX. FAR are currently in the middle of a drilling campaign off the coast of Senegal. Not so long ago, FAR were capped at around AUD $50 million. (We’ll do the calculation in AUD. For our UK readers, remember that 1 AUD buys about 0.55 GBP, so just halve the numbers for an approximate indication) In the lead up to drilling, FAR reached a market cap of $150 million – a 200% gain. Now that drilling has actually commenced, FAR is hovering around a market cap of $100 million:

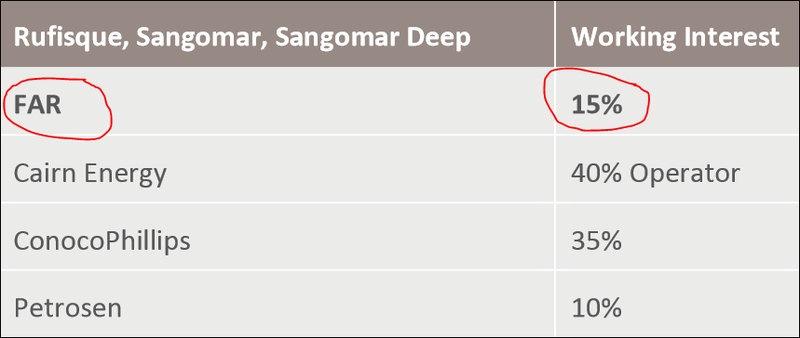

FAR’s share price climbed quickly in the lead up to their spudding – a phase TANGIERS has NOT been able to experience for the last few months due to its voluntary suspension. TANGIERS has just come back on to the market – and has all the potential to explode in value just like FAR has. But it gets better for TANGIERS investors. Like TANGIERS, FAR is also focused on African oil and is currently in the drilling phase in Senegal with its farm out partners Cairn, ConocoPhillips and Petrosen. This group will be drilling two exploration wells off the coast of Senegal, where FAR have a working interest of 15%:

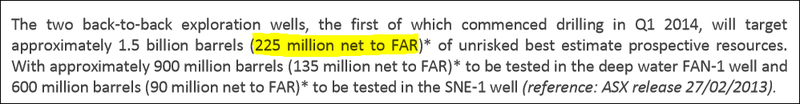

This group of companies are drilling two exploration wells, in total, FAR have a net target of 225 million barrels :

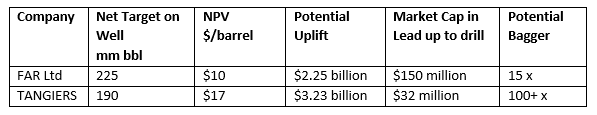

Based on the fiscal terms of Senegal, water depths, capital costs, operating costs and the price of oil, it’s reasonable to assume a net present value of $10 / barrel to FAR. Now if FAR are successful, that would be 225 million barrels x $10 a barrel = $2.25 billion. So the potential uplift from a $150 million pre-drill market cap to $2.25 billion would make it a 15 bagger. Pretty impressive stuff for FAR investors... but take a look at this: Let’s run the same calculations for TANGIERS. TANGIER’s net target is 190 million barrels in the upcoming drill, using the conservative P50 estimate of 758mmbbl for TAO-1 (most peers use the Pmean number – which for TANGIERS is a whopping 1.6b barrels!) As Morocco is an attractive place to invest and the drilling is in shallow water (that makes things a lot cheaper) it’s safe to assume a net present value of $17 / barrel to TANGIERS. If TANGIERS are successful, 190 million barrels x $17 a barrel = $3.23 Billion TANGIER’s current market cap is a measly $32 million. From these current low levels, if TANGIERS are successful, it would be better than a 100 bagger . The potential uplift is far greater with TANGIERS, than it is to the similar African oil and gas company, FAR. Here the figures are, side by side:

For both companies these are exploratory wells, and follow up wells will need to be completed, but the stark contrast in potential uplift remains. Plus, with a 20% chance of geological success , TANGIERS investors like us essentially are faced with a one in five bet on a potential 100 bagger from current trading levels. This suited our investment strategy – think about whether it suits yours. Like we said before – this is a blue sky calculation, we would be happy with even a FRACTION of this result. So, not only are we adding TANGIERS as a long term addition to our portfolio – we’re looking at it as a bloody good bet too. TANGIERS just came out of voluntary suspension – all that pent up energy in pre-drill buzz is now squashed into just a few weeks in the lead up to spudding.

Countdown to estimated start date of drilling by TANGIERS in TAO-1

To stay up to date will all the latest TANGIERS news, follow them on Twitter or like them on Facebook .

Our Track Record

Did you receive the Next Oil Rush article on WHL Energy (ASX:WHN)? Since this article was released, WHN has been as high as 80%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

TANGIERS stands out against the other African drills

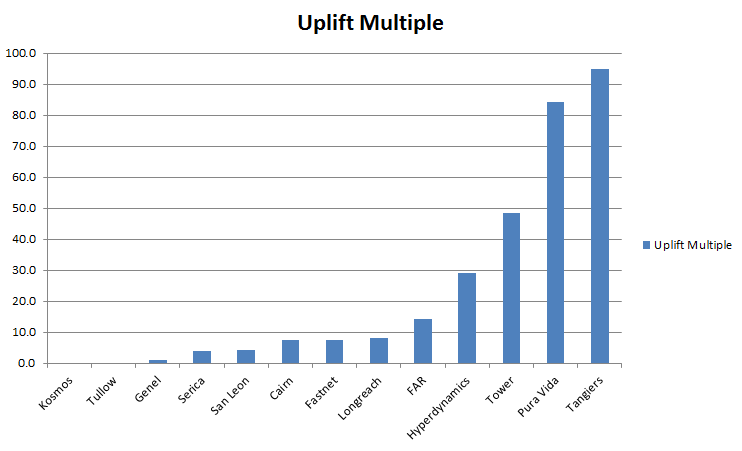

So now we’ve learnt what TANGIERS looks like in comparison to FAR, but what about other companies exploring offshore Africa? Our team of analysts loves getting into the nitty gritty of each of our investments – they ran the numbers on TANGIERS and we were pleasantly surprised. Once again, TANGIERS is looking like a stand out investment looking at the uplift multiple (note – these are internal calculations, remember to do your own calculations and research!):

Now do you see why TANGIERS’ voluntary suspension was a red rag to us rather than a red flag?

Tangiers Petroleum (ASX:TPT, AIM:TPET)

To stay up to date will all the latest TANGIERS news, follow them on Twitter or like them on Facebook .

A hole in one on the Jurassic carbonate fairway?

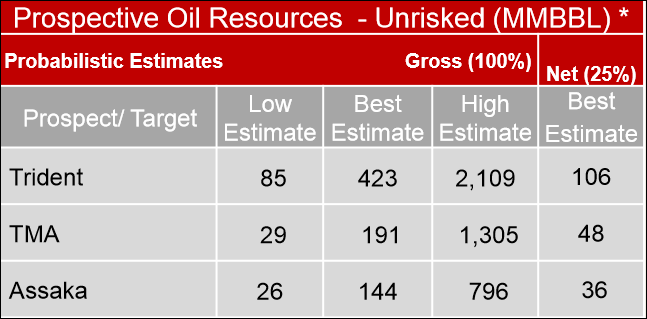

The biggest catalyst for TANGIERS is the spudding of its TAO-1 exploration well in just a few weeks’ time. TANGIERS chose the TAO-1 drill location in order to test 3 stacked targets within the Jurassic carbonate fairway. These plays are Trident, TMA and Assaka. Netherland Sewell and Associates independently assessed the primary Jurassic prospects from the 3D seismic data. You can see the prospect estimates listed in the table below:

Adding up all three targets in the Best Estimate column, the gross un-risked prospective resource is 758 million barrels. Net to TANGIERS is 25%, so that makes it 190 million barrels of targets all for TANGIERS. Remember this drilling event is just weeks away. TANGIERS will be drilling in very shallow water with a maximum depth of just 100m which significantly reduces costs. Previous tests of the area have shown overlying Cretaceous sediment and an absence of salt in the area, meaning it’s unlikely the drill results will produce heavy oil.

Trident is TANGIERS’ prime drilling target and this prospect was confirmed and further defined on the 3D seismic data from 3D seismic data recently acquired in 2012. They have been studying this data for some time and determined the drill location where they feel they are most likely to succeed. This location will also hit the other two targets at the same time. Unlike its peers, TANGIERS has not published a mean (or expected) prospective resource. We’re no mathematicians but a simple use of Swanson’s Mean calculation (which is conservative) gives us a mean of 1.6 billion barrels for TAO-1. Swanson’s mean? This is a calculation of 0.3P10 + 0.4P50 + 0.3P90 , and gives a conservative estimate of the mean values for modestly skewed distributions. That makes this well the biggest target to be drilled in offshore Morocco in the next two years . It also increases the net resource potential for TANGIERS from 190MMbbl to 400MMbbl and double the possible value on success to $8 Billion. The purpose of drilling at TAO-1 first, is that this well will allow investigation of the shallower Assaka prospect at the same time as the deeper prospects – they sit right on top of each other. Three stacked objectives, each section pierced one after the other and evaluated over the course of the drilling... this should provide a steady stream of news flow over the coming months...

Countdown to estimated start date of drilling by TANGIERS in TAO-1

Our Track Record:

Did you see The Next Oil Rush report on Swala Energy (ASX:SWE)? SWE has traded as high as 150% since:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

TANGIERS – Early movers in Morocco

TANGIERS has a 25% working interest in the Tarfaya Offshore Block, an area of more than 11,000km2 that it’s currently exploring in Morocco and the site on which it plans to spud within the coming weeks. This area has emerged as an exploration ‘hotspot’ lately and TANGIERS got in on the action early.

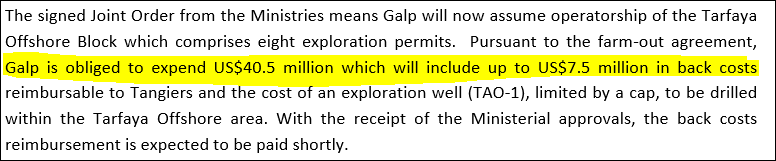

TANGIERS acquired its portion of the offshore block nearly five years ago, with Moroccan state controlled ONHYM owning 25% of the JV and €10 billion energy giant Galp Energia making up the final 50% as the operator. TANGIERS farmed out to Galp to the tune of US$33 million in carry plus another US$7.5 million in back costs. Under the deal, which was made at the end of last year, TANGIERS retains a 25% interest in the Tarfaya Offshore Block, Galp get 50% and the remaining 25% interest goes to ONHYM. So in total, Galp has to pay US$40.5M towards this deal which will go directly towards drilling the TAO-1 well in Morocco:

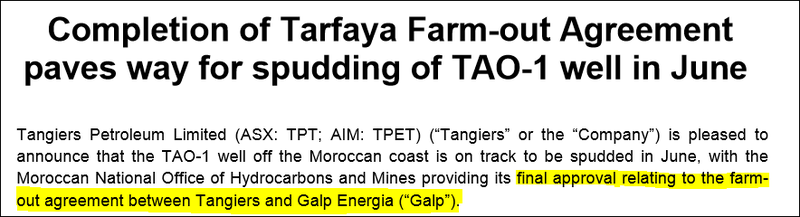

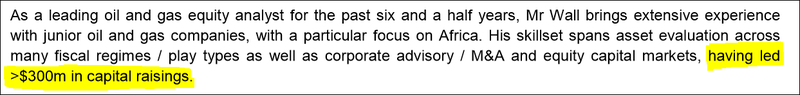

The Moroccan government has approved the deal and given the JV until February 2015 to evaluate TAO-1 well results to decide whether to extend drilling. So not only has TANGIERS got the potential to confirm some big resource targets in its first Moroccan well but it could potentially come back for more. The project is on track after the Moroccan National Office of Hydrocarbons and Mines gave its final approval relating to the farm-out agreement between TANGIERS and Galp . This final approval means Galp can now reimburse TANGIERS US$7.5M for back costs, which will help the company to make up its 33% share of costs for the TAO-1 well:

When this agreement was finalised, the director of TANGIERS commented “The TAO-1 well is a potential company-making opportunity so we are delighted that the final approval has been granted and that the well is on track to be spudded next month (June 2014).” The farm out deal has certainly helped fund the upcoming drill, however, if there are cost overruns, TANGIERS is obliged to pay 33% in excess of the US$33 million budget. In order to cover these costs, TANGIERS recently raised some extra cash:

Now all TANGIERS investors like us need do is sit back and watch as the drill hunts down those 190 million net barrels...

Countdown to estimated start date of drilling by TANGIERS in TAO-1

Moroccan farm-out activity has never been busier

Offshore Morocco is now an aquatic boom town. TANGIERS isn’t the only one involved in farm-outs – Morocco has been very popular for this type of activity as of late. There has been a farm-out frenzy along the Moroccan Atlantic margin over the past two years which has lead to multiple drills scheduled in offshore Morocco in 2014. Galp isn’t entering into a farm-in deal with only TANGIERS, it’s also got ties to Kosmos, Cairn Energy, Genel Energy and Freeport McMoRan that are all operating in this area. Galp is a huge oil major with deep pockets, it has enough cash to access a shared port, warehouse, storage and berthing facilities in Agadir, Morocco – and TANGIERS can get in on these benefits thanks to its deal with Galp. And these benefits include pushing operating costs lower because there are multiple companies in on the action, and ample infrastructure to support them. It’s win-win for all.

Our Track Record

Did you receive The Next Small Cap report on Core Exploration (ASX:CXO)? Since this report was released, CXO has traded up to 85% higher.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Investing in Morocco – North African’s oil hot spot

When you think of oil, we’re guessing the usual suspects spring to mind. America, Brazil, Saudi Arabia, Canada and Venezuela. So why add Morocco to the list? Easy. Because it has high potential and has been severely underexplored in the past decades. The offshore Cap Juby oil field was previously discovered in the 1960s but the area has been relatively unexplored. Geologists are confident there is more oil down below and just waiting to be tapped.

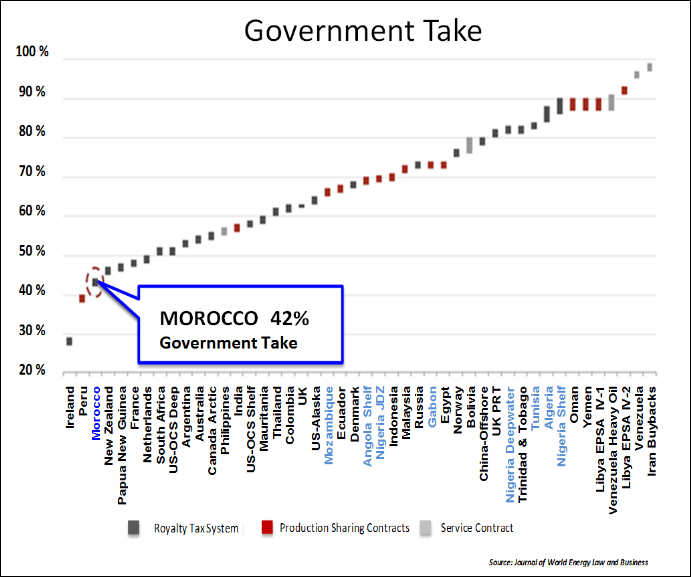

In fact, only one well has been drilled in the area for every 10,000km2 ... and when you compare this to the global average of 80 wells per 10,000 km 2 , you start to get the picture of just what kind of potential is sitting around and waiting to be discovered in Morocco. But that’s not all. Only eight wells have been drilled since 2000 and technology has advanced since then, furthermore you can’t even compare it to the technology that was around in the 1960s when oil was first tapped in the area. Now there’s modern 3D seismic mapping to greatly improve the accuracy of hitting drilling targets and far advanced drilling techniques to pump the stuff out. All these facts have got us interested in the wealth of potential there is to be found in Morocco. But what about the country’s stability? Before we invested, we certainly investigated the stability in the region. Thankfully, Morocco is one of the most stable countries in Africa. It was the only northern African country not affected by the Arab Spring – and this can only be seen as an added tick against Morocco’s continuous stability. Not only this, but according to advisory services firm KPMG , Morocco ‘actively seeks foreign investment’ so you can invest in Morocco knowing the government has got your back. Geoff Porter, the Founder of North Africa Risk Consulting, was even recently quoted as saying that ‘Morocco is a hive of activity’ while other northern countries like Libya and Algeria are looking ‘less appealing than they have done for five years’. In fiscal terms, Morocco is also being seen as a world-class country for oil. Damon Neaves, Managing Director of Pura Vida Energy, recently explained to OilPrice.com that “the fiscal terms in Morocco are as good as you’ll find anywhere in the world. If you compare a barrel of oil in the ground in Morocco, then it is worth more than it is just about anywhere in Africa.” So Morocco’s oil is not just good in relation to Africa, but it’s one of the best in the world. And it’s not simply oil that’s attracting smart-thinking investors – manufacturing in Morocco is booming too. Why? Investors are siting Morocco’s ‘ political stability, steady economic growth, its thriving port and a strategic geographic position ’. Of course, all of these positives aren’t just great for manufacturers – they’re perfect for oil investors too! For oil companies, its gets better... There’s a tiny 10% royalty on oil that’s discovered at less than a 200m water depth – that’s exactly what TANGIERS are going after. Tie this in with the fact that foreign oil companies are given a 10 year corporate tax holiday from the first production and 35% thereafter and you can see why Morocco is one of the most fiscally favourable countries in the world to explore.

Finally, when considering fiscal terms, capital and operating costs, the net present value of oil is US$17/bbl in Morocco. This means that any big oil discoveries found are going to be relatively cheap to get on to the market – a huge bonus for investors.

Tangiers Petroleum (ASX:TPT, AIM:TPET)

To stay up to date will all the latest TANGIERS news, follow them on Twitter or like them on Facebook .

Blast from the past brings riches to Moroccan oil companies

So what exactly is the Jurassic carbonate fairway? Good question, and get ready for the answer because it’ll knock your socks off. Basically, in the late Jurassic period Africa, South America and North America were all joined as one big super-continent. Over the millions of years that have since gone by, as we know, this super-continent has broken apart and slowly drifted away from the other pieces, with Africa moving the farthest. During this early stage of rifting, Jurassic source rock was created extensively underground and this produced carbonate platforms which make it the perfect underground source for oil. In Nova Scotia, Canada, this has already been proven with companies like Abenaki Pm, Sable and Panuke Gas discovering the riches the Jurassic Carbonate Fairway can bring.

In Nova Scotia so far 127 exploration wells have been constructed offshore in an area close to Sable Island and more than 8 billion barrels of oil have been discovered. Like in Morocco, this area is also shallow, creating small-scale traps that have great oil potential, according to the Nova Scotia government. Shell Canada has taken advantage of the potential and has invested more than $970M into its Nova Scotia project! But that’s not all – BP has also seized the opportunity to make big bucks there and signed a deal worth $1.05BN to explore the area. Yes, you read correctly – ONE BILLION DOLLARS. In total, more than $2BN has been invested in the area, showing there is a lot of faith in the promise of first-grade oil to be discovered on this Jurassic strip. Because all signs are pointing to the Jurassic gigaplatform as being the source for this oil. This is great for Morocco because it is a conjugate with Nova Scotia and is believed to share its Jurassic gold, hence the raft of majors piling in after TANGIERS in order to drill offshore in this region. Can the riches found off Nova Scotia also be discovered in Morocco? TANGIERS and Galp are convinced they can be – in a few weeks we should have a bit more knowledge.

Our Track Record

Did you receive The Next Small Cap article on Segue Resources (ASX:SEG)? Since this article was released, SEG has been up as high as 130%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

TANGIERS has one of the best blocks of the lot

At TANGIER’s Tarfaya Block, four wells have so far been drilled and although none of the current targets were penetrated, three out of these four wells have oil shows. The great news is that the water depth here is shallow – less than 200m – and this means drilling shouldn’t be too expensive using a jack up rig, a bonus for TANGIERS investors. If we need any encouragement that TANGIERS is going to find success with its TAO-1 venture, we only have to look at what happened in the past in its neighbour’s backyard.

The oil discovery in the adjacent Juby Maritime Block in 1969, when drilling first began in the area, the MO-2 well (marked yellow in the map above) was gushing at over 2,000 barrels a day with 12°API oil. Then, three years later, its MO-8 well (in yellow also) discovered 38.5°API oil. And it doesn’t end there – this year the JM-1 well has been confirmed oil in the upper Jurassic too – right near where TAO-1 is located.

All these promising discoveries surrounding TAO-1... what will TANGIERS uncover?

Countdown to estimated start date of drilling by TANGIERS in TAO-1

TANGIER’S undervalued price may not be around for long

When an oil company is about to drill and potentially strike riches, there’s normally a buzz on the market with increased attention and liquidity on the company. Let’s face it, most people want exposure to the potential upside on a mind blowingly successful drill campaign. However, the TANGIERS buzz hasn’t come about thanks to its lengthy voluntary suspension, which began in February 2014. In the three months of lost trading, the company has been temporarily overlooked... but the high leverage to success remains. TANGIERS is now back on form after this suspension now that it’s hired two new Directors at the beginning of April and a Managing Director in mid-April. TANGIERS was extremely careful about selecting these new team members and the three have brought with them a wealth of experience.

The new Managing Director, David Wall , is a leading oil and gas equity analyst and has had vast experience working with oil and gas companies, focusing on Africa. A perfect match for company about to drill off the coast of Morocco then! Importantly, Wall has successfully led around $300M in capital raisings , which must have come in handy during the recent TANGIERS capital raising.

Also joining the team is Dr Stephen Staley, who is now a Director at TANGIERS . Staley brings with him more 30 years of management and technical experience from the European, African and Asian oil, gas and power sectors. He’s also an expert in geology, with a PhD in Petroleum Geology – we’re sure his expertise will come in handy as TANGIERS moves ahead with its African projects. And last, but certainly not least, comes Michael Evans , a Chartered Accountant and a newly appointed Director to the TANGIERS board . Evans has been working in the natural resources sector for the past 30 years, but most importantly he was formerly the founding Executive Chairman of ASX oil and gas explorer FAR Ltd (ASX: FAR). With the search for new management and associated suspension, TANGIERS has ended up being completely overlooked in the lead up to drilling. And with the company about to spud in a few weeks’ time, they remain completely undervalued on the eve of such a big company making event. TANGIERS is targeting 190M barrels and has a geological chance of success estimated at 20% – in a few weeks’ time spudding will occur and we will soon know a lot more about what secrets the Tarfaya Block holds...

TANGIERS ticks our boxes

The team at The Next Oil Rush has spent many years investing in stocks with the goal of achieving long term value. Our hard earned wisdom is your gain – we’ve written the book on how to make money from junior resource stocks and a big thing we rely on is our pre-investment checklist.

You’ll have to read the book to know them all, but here are a few from our list for TANGIERS: 1. Price Catalysts – This one is obvious – a drilling event that the eyes of African oil investors will be watching – a 1 in 5 bet on a 100 bagger... the potential uplift will soon be a lot clearer once the well spuds. We have invested in TANGIERS on the strength of this – you need to decide whether it’s the kind of invest-ment that is right for you. 2. Market Sector – Morocco is a hive of drilling activity, majors have bought up big in the area, determined to be the first to find commercial quantities of oil. Morocco is one of the hottest regions in the world right now for oil exploration. TANGIERS bought in early and will soon know what secrets their block holds... 3. Political Risk – Normally African countries can have high risk associated with them, but Morocco is relatively stable, has excellent fiscal terms, and welcomes business – these are all positive signs, and when combined with the offshore potential, make Morocco and attractive place to be investing in.

What’s next for TANGIERS?

All TANGIERS’s current focus is on its TAO-1 drill which will spud within the coming weeks. This has the potential to unlock significant value if it’s successful and we are watching what happens in Morocco carefully. Should the TAO-1 well be deemed successful, TANGIERS will plan an appraisal well in order to move toward commercialisation of any big discoveries. As well as the TAO-1 work, TANGIERS will continue their investigations into the Tarfaya Block – there may be more to find.

TANGIERS are back trading again, completely undervalued due to the past few months in voluntary suspension, recently raised $5 million AUD, and have all the potential of 190 million barrels net. At a $32 M AUD / £ 18 M market cap this is difficult to fathom. But TANGIERS won’t just sit back quietly and watch all the action take place in Morocco. It plans to continue to search for new ventures for potential acquisitions so it can continue to grow its portfolio. The low market cap may not last forever, especially if the TAO-1 well can prove up any oil down there...

Tangiers Petroleum (ASX:TPT, AIM:TPET)

To stay up to date will all the latest TANGIERS news, follow them on Twitter or like them on Facebook .

Countdown to estimated start date of drilling by TANGIERS in TAO-1

Have you heard about the Next Investors VIP Club?

Joining this Club will give you free access to opportunities not normally available to general retail investors – however you must qualify as a High Net Worth Individual These opportunities are as diverse as stock placements, seed capital raisings, IPOs, options underwritings. Plus a whole host of other high risk, high reward investment opportunities not available to the general public (careful – this stuff is high risk!). Just fill in the form and you will be alerted to the next opportunity.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.