Can 88E Unlock the World’s Next Multi-Billion Barrel Oil Play?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Can the multi-billion barrel ‘potential’ at Project Icewine be transformed into commercial flow rates over the coming months?

That is the question on 88 Energy (LSE | ASX:88E) investors’ minds now that the company has begun drilling what could be a truly transformational well – the Icewine #2 production test well.

We already know there is plenty of oil in the ground in the HRZ formation from the success of the Icewine #1 well; and the size of 88E’s prize here is in the order of billions of barrels, depending on the assumptions you make.

In any case, it’s difficult to find an undeveloped oil resource anywhere in the western world of this magnitude.

If 88E can maximise the flow rate from the HRZ at Icewine #2, the company can unlock a serious amount of value in a very short space of time.

Of course, at the same time, this is a speculative oil stock, so there is no guarantee of success here. Invest with caution and seek professional financial advice before making an investment.

We have been tracking the 88E story for years now, and we haven’t been the only ones. Since we first wrote about the company’s Alaskan play, the stock has gone up over 1,085%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

But this is by no means the end of it for 88E investors – it actually starts now.

With a production well being drilled right now, and flow testing mere weeks away...

We are now staring down the barrel of the next major uplift moment for 88E.

So it’s high time we took another look at this emerging junior oil company, as the industry watches and waits for those all-important flow rate results to be released.

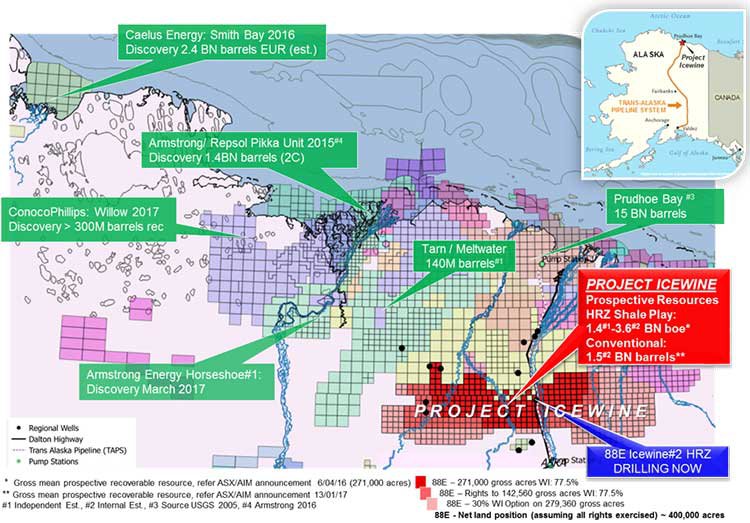

Regular Next Oil Rush readers and 88E investors would be no doubt familiar with the below map of the North Slope of Alaska. This place is one of the “oiliest” places in the world, and has been a happy hunting ground for oil explorers, especially over the past few years – Caelus Energy, Armstrong, Repsol and CononcoPhillips have all tasted success on conventional plays.

Source: 88 Energy

The green labels show where significant conventional oil discoveries were made – including the monster Prudhoe Bay – 15 billion barrels were discovered there in the 1960s, the largest conventional oil pool in North America.

That discovery was the reason for the development of the Trans Alaskan Pipeline (TAPS), which carries oil south and carves 88E’s Project Icewine (marked in red) down the middle.

Significantly, over 4 billion barrels have been discovered in a new conventional play in the last two years.

The most recent discovery was 1.2 billion barrels of recoverable light oil by Armstrong and Repsol, at Horseshoe, just 27 miles at its closest point to Project Icewine.

Recent seismic shows 88E has similar conventional play types to other North Slope discoveries on its acreage, and a new discovery of its own is something the company is not discounting – but more on that later...

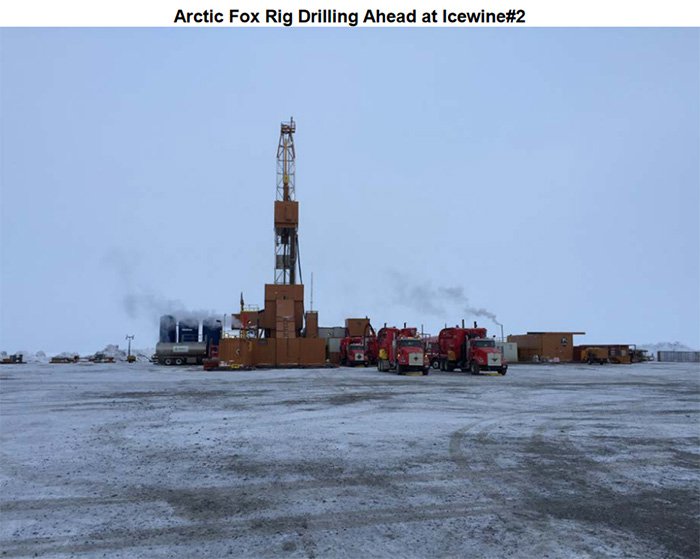

It’s also worth noting that the same drill rig, the Arctic Fox, used to make the Horseshoe discovery is being used by 88E right now – here is a photo of that drill rig at Icewine #2:

Back to the short term prize – the HRZ shale:

88E has taken a position in what its technical team, after years of research and work, has identified as the sweet spot for the HRZ shale play – a prolific source rock that generated about 30% of the oil in Prudhoe Bay.

88E believe that most of the oil remains in the HRZ and is just waiting to be extracted.

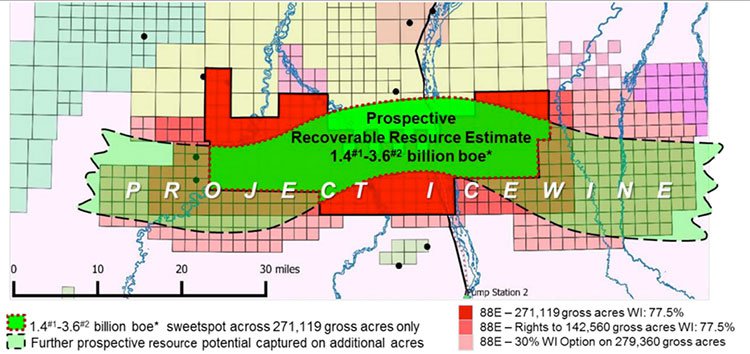

Zooming in on the Project, you can see roughly the acreage that this sweet spot covers below:

You can also see that 88E has taken up the vast majority of that acreage, meaning if successful, its destiny will be in its own hands, and it will be the “go to” company for all others wanting a piece of the play.

There is a prospective recoverable resource of between 1.4 and 3.6 billion barrels of oil (equivalent) sitting there.

The Icewine #1 well was drilled in 2016 to test a theory – that the HRZ shale layer has all the characteristics of what could be an unconventional oil play on par with the big ones in the lower 48 states – such as the Eagle Ford and Permian – both multibillion barrel plays that netted those that successfully identified and commercialised the plays a lot of money along the way.

It turned out that Icewine #1 was a raging success – and saw 88E’s share price shoot up by over 1,000%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

On the back of that success, we are keenly interested in how this is going to play out over the coming months as Icewine #2 work steps up a notch.

88E is currently capped at £123M (A$213M), and recently raised A$17M via a placement, with A$39.7M in hand at the end of last quarter – so is well funded to execute on its forward work plans over the coming months.

Back in February, 88E’s Managing Director Dave Wall gave the full update on where the company is currently placed to a room of existing 88E investors. If you are considering making an investment in this company, it is definitely worth take the time to watch:

The unconventional oil resource in the ground... how many billions?

Well that depends on which technical expert you ask.

Back in 2015, independent estimators, De Golyer, came up with a gross prospective resource figure of 1 billion barrels of oil, based on the Project’s acreage at the time, of 271,000 acres.

88E has other ideas though, and given the team’s technical experience on unlocking unconventional plays, including the Eagle Ford; a type of experience that very few have, including the independent estimators, the company calculated a gross prospective resource of 2.6 billion barrels.

Now, during the drilling of Icewine #1 well, the company took a calculated punt, and decided to double down on the project, by leasing a further 2.5 x the acreage, before the results of Icewine #1 were in...

If you do some simple maths, what that means is that there is now an extraordinary resource in the ground, compared to the numbers calculated at the time of the first resource calculation.

The Project Icewine Joint Venture now has the largest contiguous land holding on the North Slope, controlling the entire sweet spot of the play – and success would now deliver a much bigger prize compared to earlier.

Of course, like all speculative oil stocks, success is no guarantee, and it depends on a number of factors, some of which are outside of the company’s control – so always invest with caution.

The expanded land holding now gives so much more weight to the results at Icewine #2, which is being drilled to determine if that oil we know is in the ground can flow at commercial rates.

Over a billion barrels of conventional oil leads down there too...

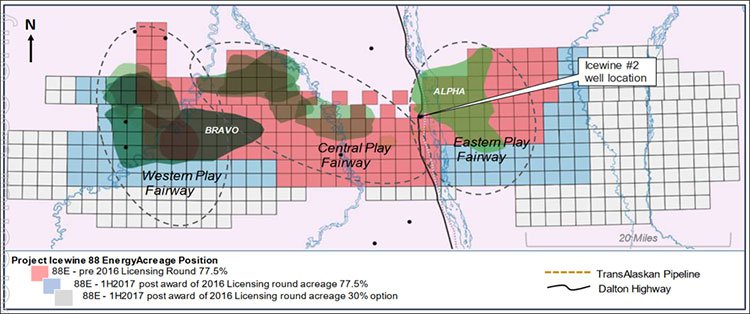

Aside from the HRZ unconventional oil play, 88E has also been investigating the potential for a conventional oil discovery on its acreage.

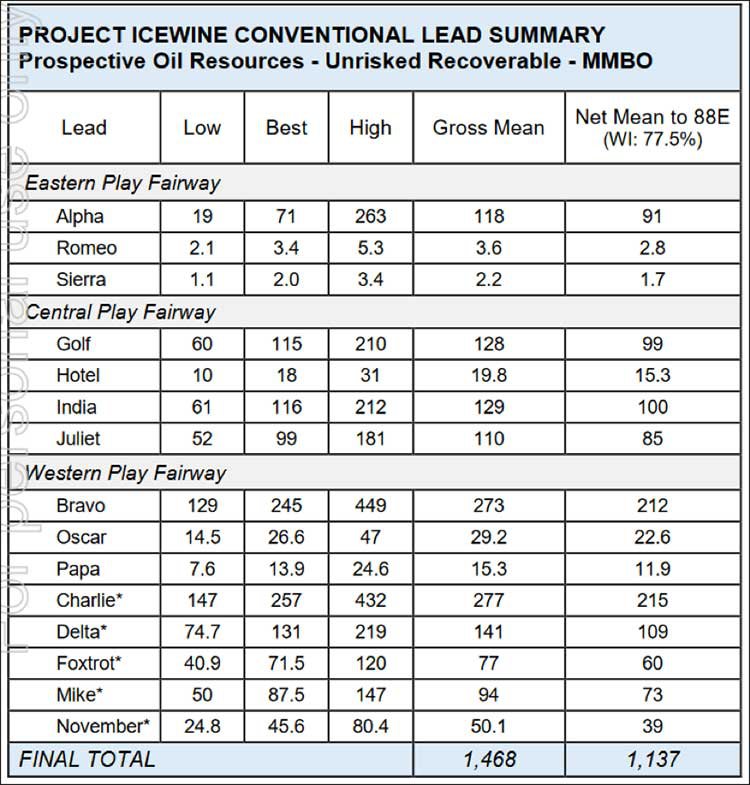

Based on 2D seismic acquisition, 88E has encountered 15 leads in total, for an unrisked recoverable prospective resource of 1.468 billion barrels.

Given the number of conventional discoveries made in recent years on the North Slope, this is quite a handy thing to have in the back pocket.

In the diagram below, you can see some of the larger conventional leads mapped out in green:

And here’s a table showing the resource figures for each lead:

Now, it’s important to note that these are just ‘leads’ at this stage, and more work needs to be done to convert them into drillable prospects.

What does look promising, in additional to the size of each lead, is the fact that some of the leads overlap each other – which means potentially one well could hit multiple stacked plays in one go, and perhaps even hit the HRZ on the way down.

In any case, the forward work programme on better defining these leads will be determined after the results of the Icewine #2 well are in.

Icewine #2 – timing of near term catalysts

There is going to be a lot of newsflow coming out of 88E over the next few weeks and months – so keep a close eye on the impact that news has on the share price.

The Icewine #2 well has now spudded, and it’s expected to take around 30 days to drill.

After the drilling is complete, over a 1-2 week period, 88E will fine tune the final stimulation plan via a series of micro stimulations, which will allow optimal placement of the entry points for the sand and water. This sand and water will be injected where the best hydrocarbon concentration is, to open up fractures so that the oil can flow.

Following that, armed with the data from the micro stimulations, 88E will execute the main stimulation.

After that, flow back and clean up gets underway, and by this point it would be around late June or early July.

Then, the flow testing proper begins – and this is where we will be keeping a keen eye on those flow rates.

What kind of flow rate is 88E looking for?

In short – a flow rate of somewhere between 100 to 150 bopd (barrels of oil per day) will spell success for 88E, along with a clear understanding of why the oil flows the way it did.

Armed with that information, along with an understanding of where the best sections of the HRZ interval are for locating future horizontal wells, would mean 88E can advance the project to the next stage.

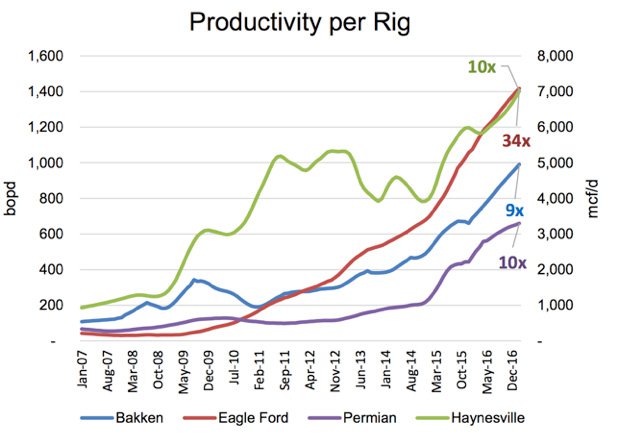

The reason 88E is looking at 100 to 150 bopd is somewhat based on the following chart:

The chart shows productivity per rig on the major unconventional oil plays in the Lower 48 US states, over time.

In the early days of these plays, it was all vertical wells, and the kind of flow rates were mostly sub 100 bopd. As the understanding of the plays evolved, and also as giant leaps in technological advances in unconventional oil extraction were made – particularly moving to horizontal wells – a major uplift in flow rate per rig is achieved by the time we get to today.

The Eagle Ford had a 34x uplift in flow rates between the first vertical wells and recent horizontal wells...

For 88E right now, given the level of understanding of the play thus far, it has a clear goal for a vertical flow rate of 100 to 150 bopd, which it can base future horizontal well design and location on, and start boosting those flows up to highly commercial volumes.

So once the company gets a clear handle of the nature of the play over the coming months, it can then plot out locations and design of additional horizontal wells...

And that leads us to what the next couple of years might hold for 88E.

How is the company going to extract the most value for shareholders?

88E has always been a company that has moved fast – seeking to extract the most value in the shortest amount of time, and it’s a strategy that has served it and its investors very well to date.

That strategy won’t change on success of Icewine #2.

In the background, 88E has started the process for applying for additional drill permits, which would facilitate additional wells being drilled as early as H1 next year.

The next well would likely be a horizontal well, which if the company can get a flow rate approaching 2,000 bopd, would essentially prove the team’s theory – that the relationship between vertical flow rate and horizontal flow rates, and all the characteristics of the play are very much real.

The next step would be to look out east and west, and drill out the rest of the sweet spot, and at the same time hit up some conventional leads on the way down.

Then the company would look to drill a few wells near the Dalton Highway, next to the TAPS, which would validate the idea that significant oil production can be achieved at the Project.

This would essentially be a test case for a starter kit unconventional shale play on the North Slope.

This would all take 2 to 3 years to be completed, but by that time, a delineated resource would have been obtained across the entire acreage, and 88E would be armed with proven flow rates from 4 to 5 horizontal wells.

At that point Project Icewine would be imminently saleable to an oil major – at many, many multiples of 88E’s current value.

Now, this is a best case scenario, and like all speculative oil investments, there is a chance it won’t be successful – so invest with caution, and keep in mind your own personal circumstances before investing.

88E’s goal over those 2 to 3 years would be to retain as much leverage to the project as possible without diluting the existing shareholder base, which is the best way for 88E investors to make money.

There are also the conventional leads that provide another path for the company to pursue, should production from the unconventional HRZ shale layer not be economically feasible at this point in time.

So it’s going to be some very heady times for 88E investors over the coming years, starting with the upcoming months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.